This year in March, Apple Inc. introduced Apple Pay Later. Users were already using Apple Pay, which is a secure mobile payment service compatible with iPhones, iPads, Apple Watchs, and Macs. Whether you would like to pay in-person, online, or in iOS apps, Apple Pay can be a great alternative to carrying a credit card with you all the time. Wondering how it works? It’s pretty simple. Just take a photo of your credit card, load it in your phone’s wallet, and hold it near an NFC-enabled point-of-sale terminal whenever you make a purchase.

This digital mode of payment is a convenient replacement for PIN and credit/debit card chip transactions. Apple Pay’s evolution over the years has allowed its many users to enjoy the perks of a faster, more efficient payment alternative. By eliminating the need to search through a wallet for the correct card or worry about losing a credit card, Apple Pay has (without a doubt) made checkout easier for its users.

Apple Pay Later

Apple Pay Later enables users to pay for their purchases in four installments over a period of six weeks. Even though the idea was first announced in 2022 during the Worldwide Developers Conference, it was officially released the following year.

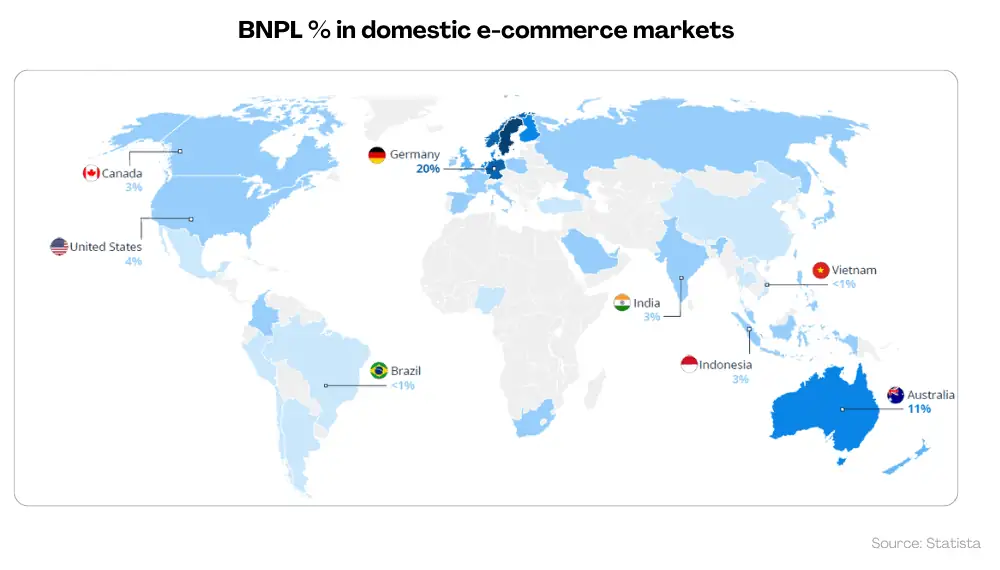

Looking forward to buying your desired product but worried that you can’t afford it right now? Apple Pay Later is the right solution for you. It is one of the leading BNPL (Buy Now Pay Later) service providers like PayPal, Afterpay, and Affirm. This service will allow you to split the costs and improve your financial health without binding you to a hefty interest rate or late fee.

Image source: Apple Newsroom

Initially, at the time of the Apple Pay Later release date, it was accessible to only a few selected people. The company planned to increase the user capacity in the coming months. Currently, this feature is only accessible to U.S. residents aged 18 years or older.

While there is no ‘one size fits all’ solution to managing people’s finances, everyone prefers flexible payment options without putting a strain on their wallet. Let’s dive into what’s available since the Apple Pay Later release date. This article will cover the benefits, restrictions, and everything else you want to know about this service.

What Should I Know About BNPL?

Most retailers provide a ‘buy now, pay later’ facility allowing customers to purchase their desired item and pay for it over time instead of paying on the spot. It is a short-term financing solution offered by BNPL service providers with multiple installment plans. The interest rate and late fee vary from financer to financer.

Even though BNPL is a clever way to make purchases and split the cost. In the best-case scenario, you might find a provider that charges zero interest. Assuming you can afford the installment, you can get quick approval as there is no credit score requirement. However, this payment plan is still a type of debt and isn’t without risks. Before you decide, make sure Apple Pay Later is the right option for your financial situation.

How To Use Apple Pay Later?

As an Apple Pay user, you can apply for a loan ranging from $50 to $1000 to pay for your purchase. First, you need to open the Wallet app on your device. After entering the amount for the loan in the Waller app, you will be prompted to agree to Apple Pay Later terms and conditions. If it is your first time setting up Pay Later, you will be asked to fill out a short application form.

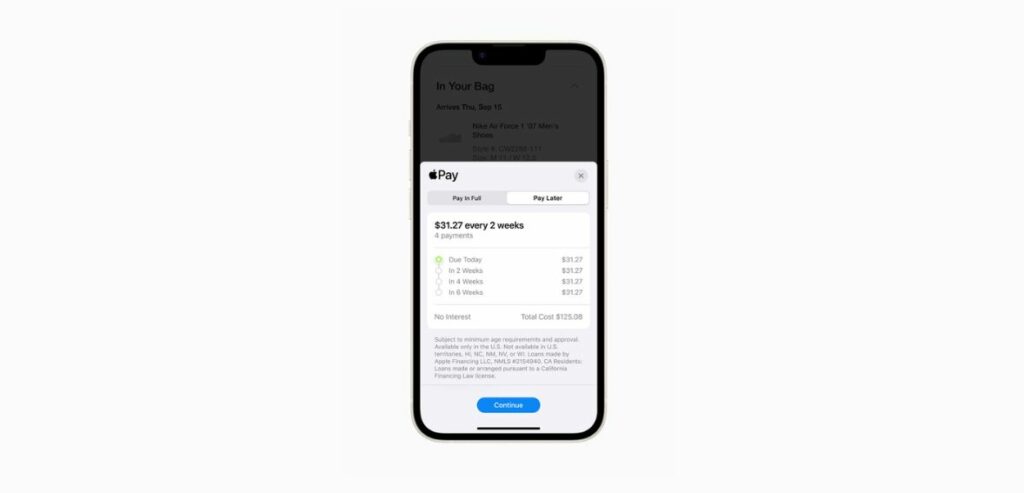

After approval, a ‘pay later’ option will appear at checkout whenever you select Apple Pay for your online or in-app purchases. You can review your payment plan and loan agreement and add it to your Wallet app.

If this feels like a drag, you can also apply for a loan directly at checkout for a particular purchase once Apple Pay Later is formally set up.

Apple Pay Later Eligibility and Restrictions

Apple Pay Later eligibility criteria are simple. All U.S. citizens aged 18 or above can use Apple Pay Later. You are required to provide a physical U.S. address (Not a P.O. Box). Apple requires you to verify yourself with a photo ID issued by the state or a driver’s license. You will need the latest version of iOS or iPadOS with two-factor authentication enabled at all times.

It should be noted that you will be asked to link a debit card from the Wallet app as your loan repayment method. Some users might think of paying their debt by taking another loan. This restriction will prevent that from happening. Your bank might charge a fee if your account has insufficient balance to pay the dues.

Image source: Apple Newsroom

How Can Apple Pay Later Benefit Me?

While it is a convenient service, Apple Pay Later is not for everyone. Whether it is a good idea or a total flop highly depends on your financial situation. Let’s discuss the pros and cons of using Apple Pay Later to help you understand what to expect.

Track and Manage Loans

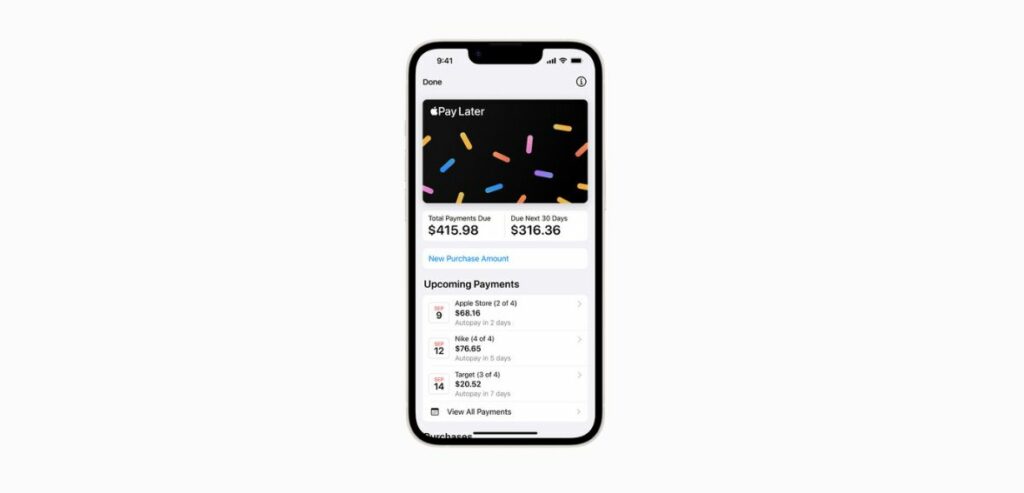

Since Apple Pay Later is built into your Wallet app, you can easily track and manage all your loans within your device in one place. You can also view the total due amount for all your loans and the amount payable within the next month. All your upcoming payments can be tracked on a calendar view of Apple Wallet. Moreover, once your loan application is approved, you can review the remaining amount in the ‘available to spend’ section.

An email and Wallet notification will help you plan accordingly and be on top of your payments. Before completing a purchase, you will see an overview of the four installments. You can either pay manually or use autopay. Tracking your loans and unpaid debts can help you plan and organize everything in the best possible way.

Soft Credit Check

Unlike most loan lenders, Apple Pay does a soft credit check to determine your eligibility for the loan. This way, it can check your credit history without affecting your score or reporting it to any credit bureau. Most companies conduct a hard credit check that can lower a user’s credit score.

It should be noted that Apple Pay Later is planning to start reporting Pay Later loans to U.S. credit bureaus later this year. As a result, these loans will appear in your financial profiles. This is to ensure well-informed lending for both parties involved.

Zero Interest

As discussed earlier, Apple Pay Later does not demand an interest fee, making it more affordable than its counterparts. Most financing options charge a hefty monthly interest fee, which can be a problem for many users depending on their financial situation. Apple Pay Later can help you save the cost of requesting a loan.

User Convenience

If you are already an Apple user, you can directly apply for an Apple Pay Later loan without going through the tedious process of setting up an account with another BNPL service provider. This will save you from losing your credit score.

Consumer-Friendly Features

Several Apple Pay Later features are user-friendly and designed to keep customer convenience and financial health in mind. For instance, if you forget to pay an installment, any additional Pay Later loans will not be accepted, and you will be notified about the missing payment. This will keep you from overspending and getting caught up in debt.

Flexibility

Even though there is an autopay option, you can always opt out of using it. This way, you can avoid over-drafting when you don’t have enough money in your bank account. Users who have enabled autopay can turn it off anytime to avoid inconvenience. If you forget to turn off autopay and payment gets declined, Apple Pay Later will toggle it off on your behalf.

User Security

Every Apple Pay Later purchase is verified through Touch ID, passcode, or Face ID. Keeping user security in mind, none of your transaction history or loan information is shared with third parties. User’s data is not used for advertisement or marketing; your privacy is highly respected.

Some Apple Pay Later Shortcomings to Look Out For

U.S.-based users have several BNPL service providers in their access, and choosing the right one can be tricky. Even though Apple Pay Later has plenty to offer to its customers, here are some loopholes to beware of;

Limited Loan Amount

With Apple Pay Later, you can only request a loan of up to $1000. It is a lot less than what most BNPL providers offer. This loan can cover small purchases and help you manage your minimal financial needs. There is no lie in that. But the chances of buying expensive items like a computer or furniture are improbable with this loan. If you are a heavy shopper, looking for a different BNPL provider wouldn’t be that hard.

Payment Plan Restrictions

Unlike most BNPL providers, Apple Pay Later does not offer a monthly payment plan. Its six-week financing option cannot finance higher purchases, unlike monthly plans, spread over six months to years. However, most BNPL providers demand hefty interest rates, which isn’t the case with Pay Later. So, it all has its perks and losses. Moreover, there isn’t any option to reschedule a payment, and your account will be paused if a payment is missed.

Only for Online Purchases

If you wish to use Apple Pay Later for in-store purchases, you would be bummed to know it isn’t possible. This service is only available for in-app and online shopping. You would have to switch to a different BNPL service provider to access the pay later option in in-store purchases.

Some Technicalities

Apple Financing will assess your credit to lend the loan. Goldman Sachs is the issuer of the Mastercard payment credential required to complete the process. The Mastercard Installments program also plays its part in enabling Apple Pay Later.

If you are a business owner who uses Apple Pay, your customers paying with Apple Pay will be automatically given the option of Apple Pay Later at checkout. In short, you won’t have to go out of your way to enable Pay Later for your customers.

What is the Approval Process for Apple Pay Later?

The Apple Pay Later approval process is relatively less complicated than most BNPL providers. You will be asked to provide your payment details and purchase history. The approval eventually depends on your credit report. Remember that each loan request requires separate approval.

If Apple Pay Later Loan Isn’t Approved

Even if you are a U.S. citizen with access to Apple Pay Later, some factors can cause hindrance to your loan approval process. You will receive an email stating the details of the rejection. Sometimes, a loan application might get rejected for the total amount but approved for a lower amount. In that case, you can purchase other items with a lower price tag or remove items from your cart. You can also switch to Apple Pay to pay in full.

What if I don’t See the Pay Later Option?

You won’t see the Pay Later option at checkout if:

- You are not a U.S. citizen or live in an unsupported area

- The seller does not offer this BNPL service or isn’t from the U.S.

- The items you are purchasing are not eligible for the loan

- You purchased after your first loan got approved but forgot to tap on ‘add to wallet’ before purchasing

Contact

Over the years, the ‘buy now pay later’ service has enabled many users to shop while keeping their financial health in check. Apple Pay Later by Apple Financing is doing the same for its U.S.-based users. Currently, the loan amount it offers is limited, but hopefully, things will improve in the near future. All in all, Apple Pay Later is a convenient alternative to the many BNPL providers that charge high interest and late fees.

If you are a U.S. national and regularly pay for products through Apple Pay, Pay Later can help you divide the cost and pay it over a six-month period. (If it costs between $50 to $1000.)