Welcome to the world of consumer finance! As we step into the year 2023 it’s clear that the financial landscape is going through a big transformation, with the emergence of Buy Now Pay Later services. BNPL has become a game changer in the industry captivating people worldwide and revolutionizing how we shop and pay for our purchases.

Let us explore today some of the most important buy now pay later trends in 2023 and beyond. These BNPL trends will set the course of how the market forces will interact with consumers in future. It will redefine the entire market for better.

From groundbreaking advancements to collaborations 2023 holds immense promise for the BNPL industry. It offers us a glimpse into a future where “shop now pay later” isn’t just a phrase but a way of life.

What is BNPL?

It’s an increasingly popular payment service that completely transforms notions of buying goods and services.

BNPL allows consumers to make purchases without having to pay the amount upfront. Instead they can choose to divide the cost into interest free installments over a specific period typically ranging from a few weeks to several months.

This new payment model offers advantages, for both consumers and merchants. For shoppers BNPL offers flexibility and affordability by allowing them to spread out their obligations over time. This makes it easier for them to manage high cost purchases and eliminates the need for credit cards since many BNPL platforms have no credit checks making it accessible to an audience.

From the merchants perspective BNPL drives conversion rates and increases average order values as it encourages customers to make impulse purchases without significant financial strain. However there are concerns about overspending and accumulating debt if not used responsibly. As BNPL continues to reshape the landscape consumers should exercise prudence and budgeting while enjoying its conveniences.

How Does BNPL Work?

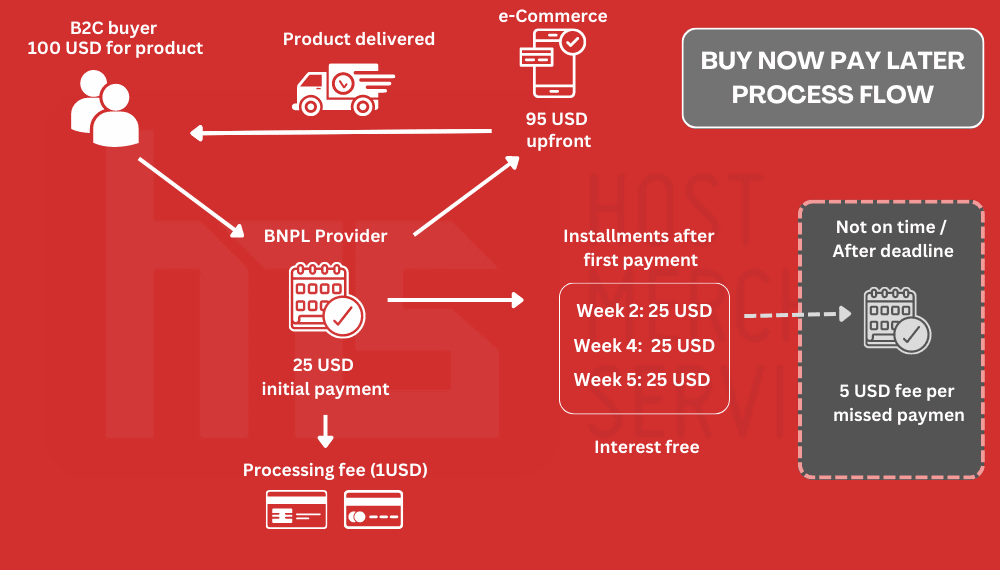

BNPL process flow diagram

In years Buy Now Pay Later (BNPL) has emerged as a game changer, in consumer finance offering a payment option that transforms the traditional buying experience.

With its appeal of interest free payments and increased flexibility Buy Now Pay Later (BNPL) has become increasingly popular, among both consumers and merchants. It is crucial to understand how BNPL operates in order to responsibly leverage its benefits and make informed choices. Lets delve into the mechanics of BNPL and explore the process that empowers shoppers to make purchases while deferring payment thus revolutionizing the retail industry.

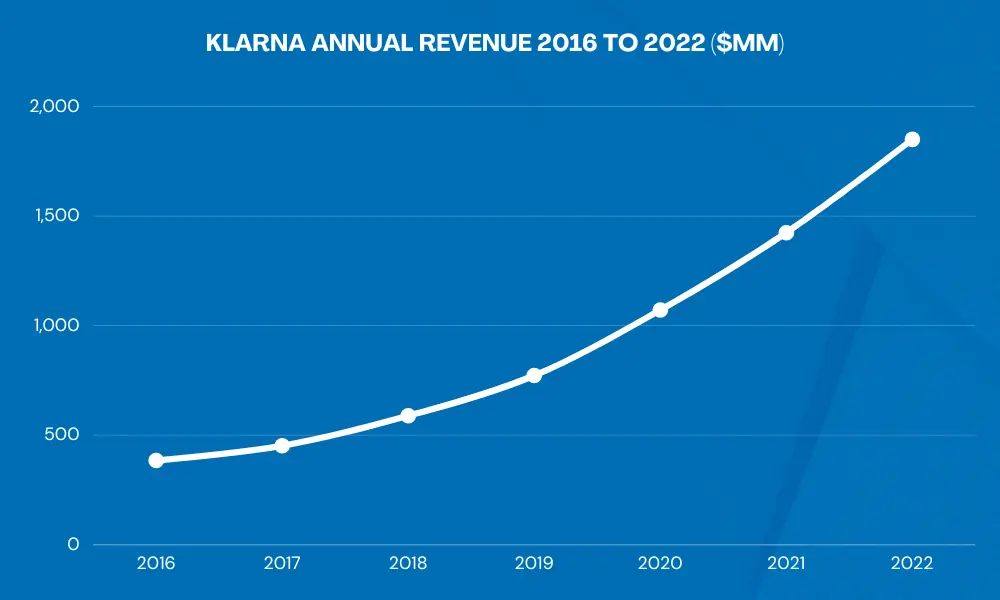

Sezzle, Perpay, PrimaHealth Credit, Klarna, etc. are some of the well-known BNPL companies in the US.

Source: Company data available in the public domain . Also read Klarna review

Choosing the BNPL Option during Checkout

When customers make a purchase online or in store they are given the choice to select BNPL as their payment method at the checkout stage. This option is typically available on partnered e commerce platforms or integrated into physical store point of sale (POS) systems.

Creating an Account and Obtaining Approval

If a customer is new, to the BNPL provider they will be prompted to create an account. This usually involves providing information and on occasion undergoing a soft credit check. The benefit of approval times often accompanies BNPL services enabling customers to start utilizing the service without delay.

Dividing Payments into Installments

Once the account setup is complete and approval granted customers can proceed with their purchase using BNPL. The total cost of items is split into a series of installments for ease of payment. The number of payments (installments) or how often they are made depend, on the BNPL service provider and the terms agreed upon by the customer.

Payment Schedule / Auto Debit

Customers receive a payment schedule that outlines when each payment is due. In cases these payments are automatically deducted from the customers chosen payment method, such as a linked bank account or a debit/credit card. This automated process reduces the risk of missed payments and late fees.

Interest Free Periods (Might Vary)

Some BNPL providers offer interest free periods where customers won’t be charged any interest on their purchases as long as they make all payments on time. However if customers fail to pay within the agreed timeframe interest charges may apply, with variations depending on the BNPL service.

Flexibility

BNPL provides flexibility for customers. They often have the option to pay off their balance without facing any penalties or fees. Early repayment can be especially beneficial for those who want to clear their debts and reduce interest costs.

BNPL providers typically offer communication channels and customer support to assist users with any questions, payment concerns or changes, to their payment plans.

This accessibility ensures that everyone can have an satisfying experience, with BNPL. The option to pay conveniently interest free and with flexibility has made BNPL a popular choice for both consumers and merchants. It has transformed the way we shop and pay for our purchases in todays landscape.

Key Features of BNPL

1. Flexible Payment Options: BNPL services allow customers to divide their purchase cost into more manageable installments. This lets them make purchases without having to pay the amount upfront.

2. Interest Free Periods: Many BNPL providers offer interest free periods encouraging customers to settle their balances within a timeframe. During this period customers can avoid paying interest charges making it an affordable choice, for budget shoppers.

3. Quick and Easy Approval: Setting up a BNPL account is typically easy and straightforward involving approval processes that may require no credit checks. This level of accessibility enables a range of consumers to utilize BNPL services compared to credit options.

4. Transparent Pricing: BNPL services are known for their transparency ensuring there are no fees or upfront charges. Customers can be confident that the costs and payment terms are clear and easily understandable.

5. Seamless Integration with Retailers:

BNPL platforms have integrated with a range of physical retailers making it incredibly easy for customers to select BNPL as their preferred payment option when checking out.

6. No Need for Credit Cards:

Unlike credit cards that often involve credit checks BNPL services may not require customers to possess a credit card. This accessibility ensures individuals without established credit histories can also benefit from using BNPL.

7. Automatic Payments:

BNPL payments are usually set up for deductions from the customers chosen payment method. This automated process helps prevent any missed payments or late fees ensuring a smooth and hassle free payment experience.

8. No or Low Interest Charges:

While certain BNPL services may charge interest particularly if payments are missed or delayed others offer interest free alternatives. This makes it an appealing choice for those seeking an alternative, to credit card financing.

9. User Friendly Mobile Apps:

BNPL providers often provide user apps that allow customers to conveniently manage their accounts track payments and stay updated on their payment schedules.

10. Early Repayment Options:

Customers have the flexibility to pay off their balances early without incurring any penalties. This empowers them financially. Allows them to clear their debts ahead of schedule.

11. Wider Range:

A wide variety of partner retailers collaborate with BNPL services spanning across industries. This collaboration provides customers with a range of options, for their shopping needs. By utilizing these features BNPL has become an convenient payment method that empowers consumers to make immediate purchases while maintaining control and flexibility over their finances.

As the retail industry continues to evolve BNPL is expected to play a role in shaping the future of consumer finance.

Buy Now Pay Later Trends for 2023 and Beyond

Looking ahead to 2023 the world of Buy Now Pay Later (BNPL) is poised for transformations and innovations. Here are some key trends in BNPL to keep an eye on throughout the year:

1. Integration, with Cryptocurrencies:

With the growing popularity of cryptocurrencies certain BNPL providers may explore incorporating currencies into their payment options. This expansion would provide customers with choices when it comes to making payments and could attract tech consumers who are already involved in the cryptocurrency market.

2. Sustainable and Ethical Shopping:

As environmental and social concerns gain attention BNPL services may collaborate with retailers that are committed to practices and ethical standards. This trend is likely to resonate with eco consumers who prioritize shopping choices.

3. BNPL For Services:

Buy Now Pay Later (BNPL) is no longer limited to purchases. Its now extending its reach to cover a range of services, including travel, fitness memberships and educational courses. This means that installment based payment options are becoming a part of our lives in aspects.

4. Rewards:

To encourage people to use BNPL providers might form partnerships, with other fintech companies, credit card issuers or loyalty programs. These collaborations could offer rewards like cashback offers or discounts for BNPL users.

5. Regulation and Compliance:

Considering the growth of the BNPL sector its expected that there will be increased scrutiny. Governments and financial authorities will likely introduce guidelines to ensure consumer protection and responsible lending practices among BNPL providers.

6. Personalization:

To better understand customer behavior and preferences BNPL platforms are likely to invest in data analytics. By utilizing this data providers can offer personalized shopping experiences. Customize payment plans according to individual needs.

7. Luxury Goods:

In addition to purchases BNPL services are also expected to make their way into luxury markets. This means that customers may have the opportunity to spread the cost of high end items over time. Such an approach could potentially democratize access, to luxury goods and open up the markets.

8. BNPL for In-Store Installments:

Buy Now Pay Later (BNPL) has traditionally been used for payments. It is now becoming more popular, in physical retail stores. This means that customers can have the flexibility of using BNPL options while shopping in store.

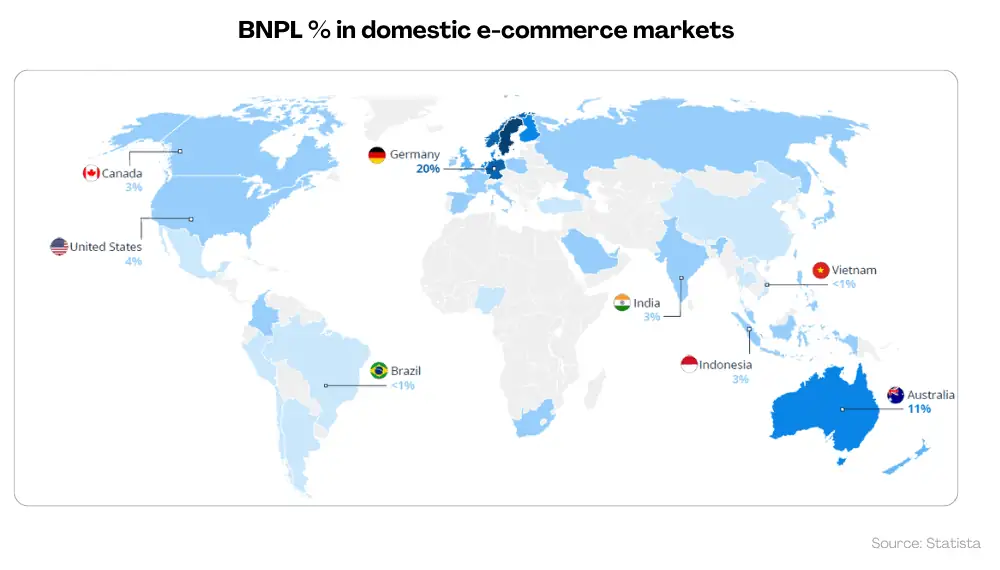

9. Global Acceptability:

As BNPL gains popularity worldwide providers may expand their services to regions allowing consumers from countries to enjoy the convenience and flexibility of paying in installments.

10. Responsible Usage:

To address concerns about consumer debt BNPL providers may focus on promoting literacy and responsible usage of their services. They could offer budgeting tools and educational resources to empower users in managing their finances.

In 2023 the BNPL landscape is expected to be dynamic and influenced by technology evolving consumer preferences and a commitment, to practices. By staying informed about these trends both consumers and merchants can make the most of the evolving BNPL ecosystem.

Why Should Businesses Use BNPL in 2023? BNPL Trends That Cannot Be Ignored

There are reasons why businesses should consider integrating BNPL options into their payment systems in 2023:

Increased Conversion Rates:

BNPL encourages purchases. Reduces cart abandonment rates.

When customers are given the choice to pay in installments they tend to be more inclined to complete transactions, which ultimately boosts conversion rates for businesses.

Bigger Average Order Value

One of the advantages of Buy Now Pay Later (BNPL) is that it allows customers to afford priced items by spreading out the costs over time. Consequently businesses often witness an increase, in their order value leading to revenue per transaction.

Attract New Customers

Another benefit of offering BNPL is its appeal to a range of consumers. This payment option caters not to those who prefer payment methods but also individuals who might not have access to credit cards or traditional financing. By embracing BNPL businesses can attract customers who appreciate the convenience and affordability it provides.

Improved Customer Loyalty

Furthermore implementing BNPL services can foster customer loyalty. Encourage repeat business. When customers have an experience with BNPL they are more likely to return for purchases from the same retailer thereby strengthening the relationship between customer and business.

Competitive Advantage

In a market landscape providing BNPL sets businesses apart from their competitors that solely rely on payment methods. Offering this alternative payment option can often be a deciding factor for customers when choosing where to shop.

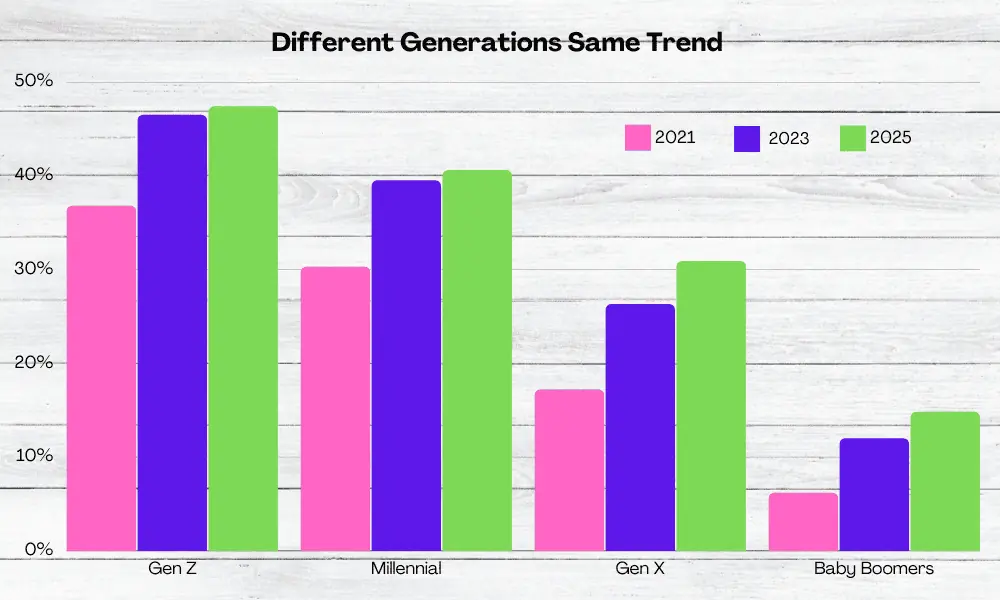

Appeal to Younger Demographics

Lastly incorporating BNPL appeals to younger demographics such as millennials and Gen Z. These generations are generally more open minded towards alternative payment methods like BNPL. By including this option, in their offerings businesses can better cater to the preferences of these consumer groups.

Seamless Integration and Support

BNPL providers typically offer to use integration options and dedicated support, for businesses. Implementing BNPL is straightforward making it convenient for businesses of all sizes to adopt this payment solution.

Reduced Risk of Unpaid Debts

BNPL providers often take on the credit risk associated with payments. This decreases the chances of businesses facing debts as they receive payment from the BNPL provider regardless of when customers repay.

Access to Customer Insights

Businesses may gain customer data and insights through BNPL platforms. Analyzing this information can help businesses better understand their customers customize marketing strategies and enhance customer experiences.

Responsible Financing Choice

BNPL services can be a financing option for customers since they usually come with terms and interest free periods. By offering BNPL businesses contribute to consumers financial well being. Encourage spending habits.

Overall embracing BNPL can bring advantages to businesses by creating a win win situation that benefits both the company and its customers. With increased sales improved customer loyalty and access to demographics BNPL becomes a tool, for driving growth and achieving success in todays competitive retail landscape.

Final Words

In summary Buy Now Pay Later (BNPL) is not a trend: it has firmly established itself as a game changer, in the world of consumer finance. As we move into 2023 the BNPL landscape continues to evolve offering opportunities for both businesses and consumers. With its promise of flexibility, convenience and increased purchasing power BNPL provides a win win solution that meets the shoppers needs.

For businesses incorporating BNPL into their payment systems can result in conversion rates average order values and enhanced customer loyalty. As this innovative payment option gains popularity across industries and global markets it has the potential to revolutionize our shopping and payment habits by empowering individuals to make financial decisions and embrace responsible spending practices.

By embracing BNPL and staying up to date with trends businesses can navigate this landscape successfully and cultivate long lasting relationships with customers – propelling their success, in the fast paced retail industry of 2023 onwards.

Frequently Asked Questions (FAQs)

Is buy now pay BNPL) interest free?

Some BNPL providers offer periods without any interest charges giving customers the option to avoid fees if they make their payments on time. However it's important to note that if payments are not made within the agreed upon timeframe interest charges might apply.

Who is eligible to use BNPL services?

BNPL is designed to be accessible, to a range of consumers. While certain providers may require credit checks others offer options without the need for credit checks making it available to individuals with credit backgrounds.

Will using BNPL impact my credit score?

The impact of using BNPL on your credit score can vary depending on the provider and their reporting practices. Some BNPL services report your activity to credit bureaus while others do not. Making payments can have an effect on your credit score but missed payments may have negative consequences.

Can I utilize BNPL for in store purchases?

Absolutely! Many BNPL services are expanding their availability to stores allowing customers to use this payment method at the point of sale when making in store purchases.

What happens if I need to return an item purchased through BNPL?

The return policies, for items bought through BNPL generally follow those of payment methods. If you decide to return an item the refund will be adjusted according to the payment schedule you agreed upon.

What are the consequences if I fail to make a BNPL payment?

If you miss a BNPL payment you may incur fees. It could potentially affect your credit score. This outcome depends on the policies and reporting practices of the provider you are dealing with.

Is BNPL an secure option?

Reputable BNPL providers prioritize the security of your data. Utilize encryption measures to safeguard your personal and financial information. However it is crucial to select well established providers.

Can I utilize BNPL for types of purchases?

BNPL can be used for various purchases, from everyday items to more significant investments, depending on the provider's terms and the retailer's acceptance.