Amazon allows its card members to implement its BNPL (Buy Now Pay Later Scheme) across different retail platforms. The cards, which were earlier limited to Amazon, can now be used for shopping across all eligible sites. Amazon Pay installments option has helped the company grow its audience base by allowing people to shop from anywhere, anytime, and complete their payments in equal installments. If you are wondering what this scheme means for Amazon’s existing and new customers, plus how it will affect the company, keep reading.

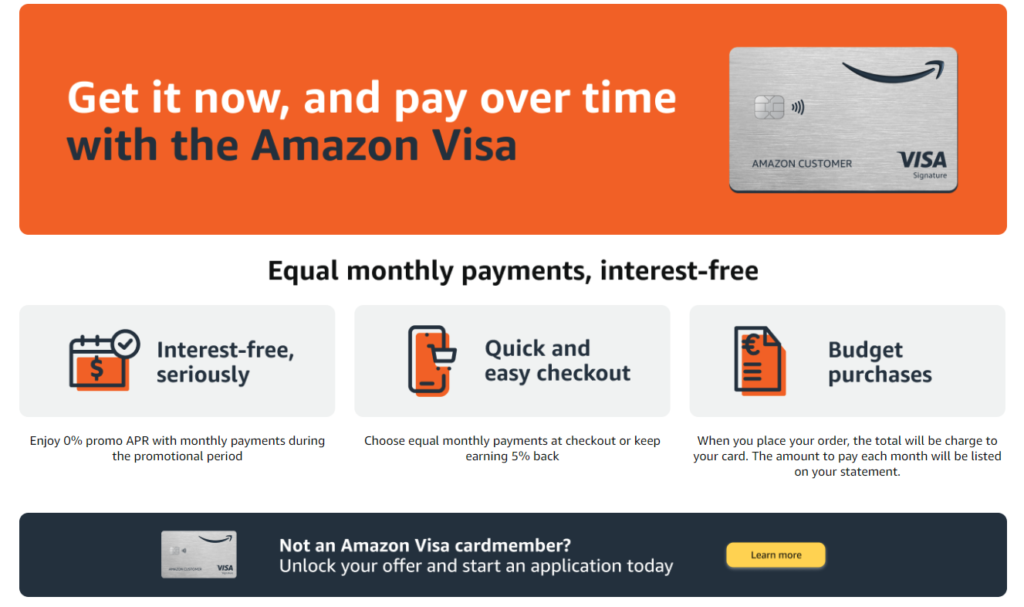

On 15th August 2023, Chase and Amazon announced a partnership and an offering for Amazon Visa, as well as, Prime Visa members. According to their statement, the companies have enabled the card members to use the buy now pay later scheme outside Amazon and enjoy the perks of paying in installments for all their eligible purchases.

The director of Amazon Pay, Omar Soudodi, mentioned in a statement that the company has always aimed to make payment and shopping experiences hassle-free for its customers. They are always on the lookout for ways to offer a seamless payment experience so that customers do not have to stick to the limited options to complete their transactions. The decision to take this outside Amazon shows the dedication of the team in helping Amazon customers and those who prefer shopping outside the app and its website.

Amazon Pay Installments Scheme

Amazon Pay’s director said the team was excited to launch an option that allows Amazon and Prime Visa card members to divide their payment into six equal installments. The amount is also payable in 12 months at 0% interest, making it a super affordable and convenient option for customers who can’t afford luxurious items that require immediate payment. By offering convenience in payments, the director said Amazon has found a new way to reach more customers more easily.

Image source: Amazon

The scheme enables buyers to use their cards to pay for their favorite products in equal installments across hundreds of thousands of retail stores. The eligibility requires customers to have either a Prime Visa or an Amazon Visa card. The order should be above $50 and they must shop at the store that qualifies for the scheme. A few examples of the popular retail stores where you can use these cards for BNPL are Authentic Watches, Tennis Express, Lenovo, and other stores where Visa is accepted.

Amazon’s and Chase’s collaboration for the scheme doesn’t come as a surprise, as the buy now pay later scheme is already gaining immense popularity all over the world and is seen as one of the most convenient ways to pay for your purchases at your convenient pace. With customers experiencing financial pressure, it’s obvious they will want a scheme that allows them to split their payments into equal installments, which are payable over a specific period. To understand how it works, let’s take a look at the brief overview of the Buy Now Pay Later scheme.

Image source: Amazon Pay

Understanding Buy Now Pay Later

Buy Now Pay Later is exactly what the name suggests. The scheme allows people to buy their favorite products and pay for them in equal installments. The amount is payable in 4, 6, and 12 installments, depending on the purchase amount and where you are buying it from. The first installment must be paid right at the time of purchase and the remaining is payable on specific dates, as predetermined by the store.

The amount is debited to your cards or bank accounts, depending on the payment method you choose, and it’s deducted automatically until it is paid in full. Most of these plans are available at 0% interest, although they might cost you a fee and interest. Here’s how it works.

How Does BNPL Work? And Is It Effective?

At the time of checkout, you will see the BNPL option which enables you to pay a small amount of money at the checkout and the remaining in equal installments over a specific period. If you are interested in continuing, you will need to fill out a small application form, which requires your email, phone number, name, social security number, and basic IDs. Once done, you are supposed to submit a suitable payment method, which will either be accepted or rejected depending on your account balance and other factors, usually, the store owner runs a soft credit check before proceeding.

The question is does BNPL work for all kinds of purchases? While it’s a good idea to consider the plan for heavy and expensive purchases, like a computer and other stuff, it’s not a wise idea to use it for small items. Buy now pay later is still a kind of debt, even if that comes without fee or interest. You don’t want to take on unnecessary debt unless it’s absolutely important. That’s because late payments or missed payments can lead to fees, which can accumulate over time, making your purchase more expensive than it should be.

Due to the increasing popularity of the BNPL scheme, it’s become popular across different retail stores. Even the small stores are considering the scheme, as it gives customers the freedom and flexibility to make payments at their convenient pace. It encourages them to buy the items of their choice without any worries. Amazon has embraced the same concept at a time when BNPL’s popularity has reached new heights.

How Does the BNPL Scheme Benefit Amazon and its Customers?

Buy Now Pay Later isn’t just for customers, but it’s equally beneficial for Amazon. Below we are going to explore some common benefits of the scheme for both.

Benefits for Amazon

- Increased Conversions: It’s difficult to convince people to buy expensive items without discounts and promotional deals. But, BNPL works wonders for those who can’t afford luxury items but are willing to buy them if they get to spread their payment over time. By allowing your customers to split the payment into several installments, Amazon has made it easier for them to buy their favorite stuff without hesitation.

- Gives Amazon a Competitive Edge: Amazon has always embraced the latest trends to ensure a positive customer experience and a smooth shopping journey. Adapting to the BNPL scheme is one of the effective ways to get a competitive advantage over your rivals. And Amazon has done it perfectly. Partnering with Chase has helped the company expand its business to a larger audience and encourage customers to buy stuff across different retail stores seamlessly.

- Achieve Customer Loyalty: It’s obvious that customers will want to shop at stores that support BNPL. The convenience of paying money in installments rather than a lump sum sounds super appealing and is a great way to drive customers’ attention.

Benefits for Customers

- Convenient: As mentioned before, BNPL offers customers the convenience of making payments over time. They can purchase expensive items without worrying about paying the entire amount at the checkout. They can spread the payment over time and complete it in multiple installments. This helps them buy stuff that was previously not a purchase option.

- Interest-and-Fees-Free: You might wonder what makes Buy Now Pay Later different from credit cards. Well, the most attractive thing about the scheme is its interest-free and fee-free payment option. You are not charged a single penny extra for the purchases you made using the Buy Now Pay Later Scheme, no matter the duration of the payment. However, you may incur a charge if you delay the installments. Usually, the company sets up autopay where a specific amount from your chosen payment method is deducted automatically. So, late payment fees should almost never be a problem.

- Budget-friendly: Paying small amounts over time doesn’t put you in financial pressure. It also means that you can make several purchases at the same time and set up installments for each, so you can pay a small amount every month.

Buy Now Pay Later aligns with Amazon’s ultimate goal of providing customers with a seamless shopping experience, while improving the company’s bottom line. As we can see, it improves customer loyalty and results in a positive customer experience, which eventually helps in increasing conversions and sales. Partnership with Chase is a smart move, as there’s also a high demand for multiple payment options, especially the ones that allow customers the flexibility to pay in installments. Embracing BNPL is one such way to offer customers a chance to pay when it’s suitable.

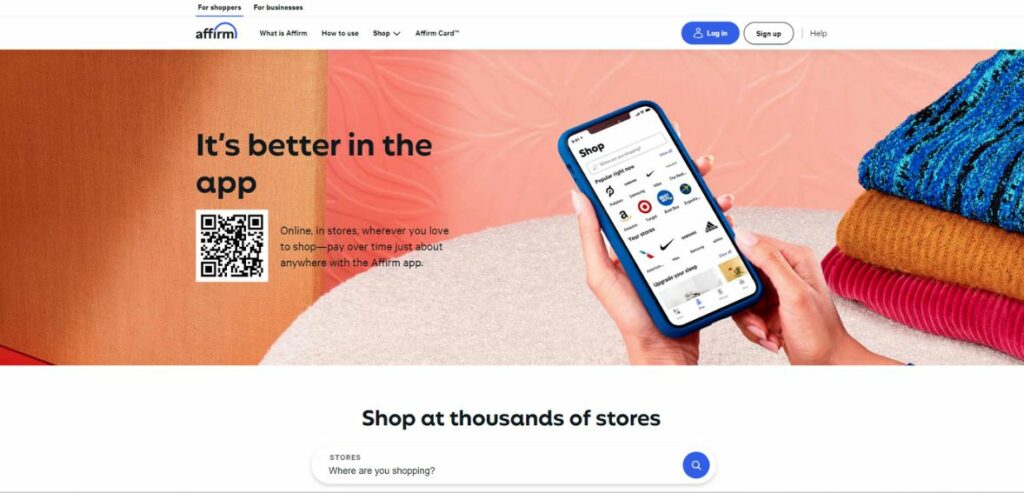

BNPL’s Partnership with Affirm Ended

Amazon’s partnership with Affirm ended on 31st January this year. Although the relationship seems to be still intact, Affirm is no longer Amazon’s only BNPL provider. The executives of both companies have remained quiet about the partnership. Affirm is experiencing tough competition, which might be the reason Amazon has ended its partnership with the company. Perhaps, this decision has opened up several opportunities for Amazon to expand.

When talking about the BNPL scheme, Sezzle’s CEO mentioned that budgeting was their main concern. It’s become the most crucial aspect of customers’ shopping journey and Amazon’s decision to work with Chase has helped hundreds of thousands of customers buy their favorite products without hesitation. BNPL is not considered a credit product. In fact, a vast majority of customers believe it is a great budgeting tool that helps them manage their cash flow effectively while giving them a chance to buy whatever they like.

Image source: Affirm

Credit cards do the same. In fact, both work in the same way, but more and more customers prefer BNPL, as it comes with zero interest and zero fees. Of course, paying for something today, tomorrow, or later doesn’t make any difference to the total amount. You will pay the same but over a specific period of time. However, it is the time that matters. Most customers have a specific budget that doesn’t allow them to overspend on a luxury product that requires immediate payment. That’s where the BNPL scheme comes into the picture.

Amazon’s Partnership with Citi

Before its partnership with Chase, Amazon had collaborated with Citi and offered Citi credit card members a chance to pay for their purchases over time using Flex Pay. They could get it in Amazon’s Pay wallet and buy whatever they like using Flex Pay. It worked on most eligible items.

A report by Insider Intelligence shows that the value of Buy Now Pay Later will cross $71.9 billion and will hit a whopping $124 mark by 2026. Not only does it offer convenience to customers, but the strategy might help Amazon boost its Amazon Pay’s success, as they are facing tough competition from PayPal, Shop Pay, and other rivals.

In addition, many merchants are also setting up their businesses on Amazon, as the multiple payment options seem pretty attractive to customers. Customers want convenient payment, but not every merchant has the resources to support that. This has encouraged merchants to sign up for a business account on Amazon to make the best of their sales.

A report by PYMNTS suggests that up to 27% of the population (gen-z, especially) do not buy products from stores that do not have buy now pay later schemes. The partnership between the two has worked as a win-win for merchants and customers. Merchants get to offer flexible payment choices, which eventually attract a large number of buyers, while customers get to pay for their purchases conveniently.

Bottom Line

Amazon and Chase’s partnership has given customers a new and innovative way to buy their desired products not only on Amazon but outside the app and across different retail stores that accept Visa. All that you need is an Amazon Visa or Prime Visa and you are all set to make your first purchase using the Buy Now Pay Later Scheme. So, what are you waiting for? Shop at whichever retail store you prefer and enjoy the convenience of paying in multiple installments. Make sure you pay on time, as late payments often result in interest and fees. We are excited to see how this partnership works and how it helps customers and Amazon.