Mobile payment processing systems allow merchants to accept debit and credit cards without having to be connected to a wire. Most systems integrate with smartphones and tablets but there are also more traditional credit card machines that work on cell service. The biggest benefit of processing through smart devices is the robust interface and point of sale management system that is included. Overall mobile processing is great for businesses on the go. There are many mobile credit card processing systems and a solution for every need. We’ll help you figure out which is best for your business.

Who Uses Mobile Payment Processing?

Mobile payment processing is great for many different business types! Below is al short list of some of the most popular businesses that love mobile credit card processing:

-

Food Trucks

-

Farmers Market

-

HVAC / Air Conditioning

-

Restaurants

-

Cafes and coffee shops

-

Locksmith and towing services

These are just a few of the businesses that use mobile payment processing. Small businesses of all types find mobile systems to be more cost-effective than purchasing a full POS system. A tablet stand will turn your mobile credit card processing solution into a desktop system. Call us to find out how valuable a mobile system can be for your business! (877) 517-HOST(4678)

Mobile Credit Card Machines

Why Not Use Square?

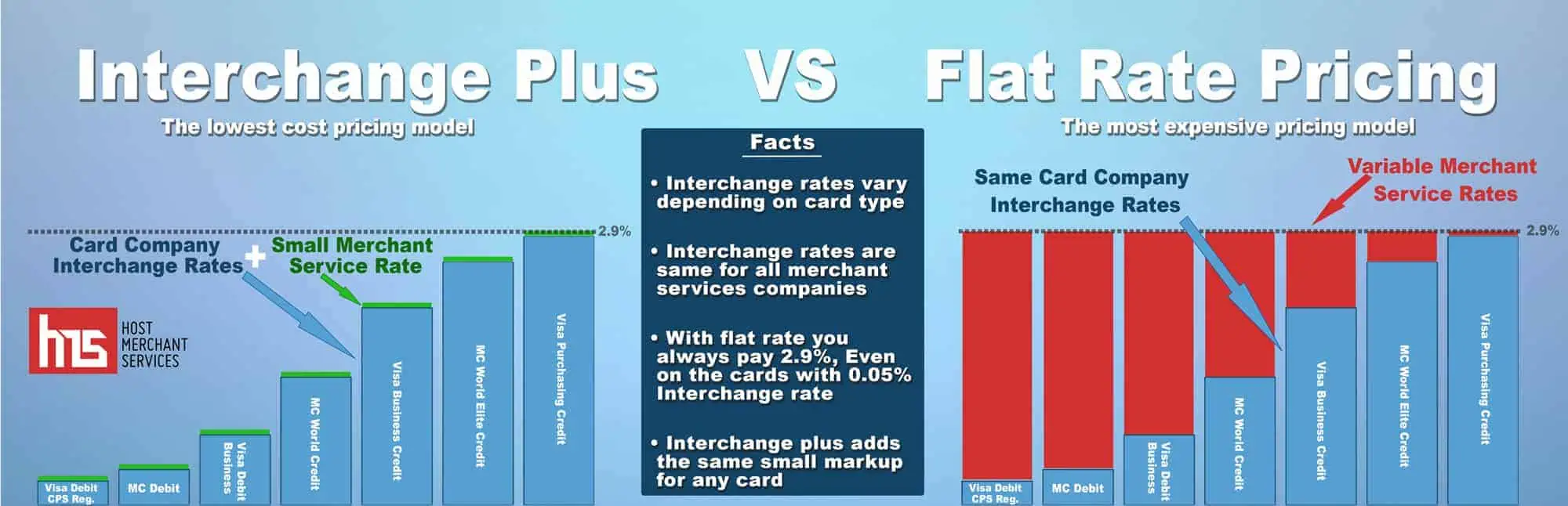

Square processing is great for many businesses, especially those processing under $2,000 per month. After that point, Square can be much more expensive as the volume processes per month increase. While square doesn’t have a monthly fee, they do have a flat-rate pricing plan that ends up costing a lot of money as the business grows. To help you visualize – every card run has a different rate. Debit cards are 0.05% which is very low. On the other hand, business credit cards are very expensive up to 2.9%. Square charges you a flat rate equal to that of expensive credit cards – for every transaction! The chart below shows the difference between our pricing model – “interchange plus”, and Square’s very expensive “flat rate” pricing model. The infographic below will help you to understand why it is so much more expensive.