JP Morgan Chase recently announced that they will be shutting down safe deposit box services at all of their bank branches. For over a century, Chase and other major banks have offered customers secure storage for valuables and important documents. However, after conducting an in-depth review of safe deposit box operations, Chase found that costs had spiraled out of control while customer usage had severely declined over the past decade.

At its peak, safe deposit boxes were enormously popular, seen as a convenient and foolproof way to keep possessions out of harm’s reach at home. Today though, superior storage options have rendered them largely obsolete. Homeowners now have high-tech security systems, fireproof cabinets, and hidden safes to choose from – all at a fraction of the cost and inconvenience. Meanwhile, the expenses of staffing large vaults and monitoring hundreds of safe deposit boxes per branch have become unsustainable. Chase was losing money on this service in a drastic fashion yet still charging clients an arm and a leg for the privilege.

It was a no-win situation, so the difficult decision was made to discontinue safe deposit boxes entirely. For existing customers, the clock is ticking as Chase will be shutting down access at every location by the end of 2023. While this means losing a service that families had relied upon for generations, Chase argues that staying the course would have only led to greater financial troubles down the road. So goes the way of the dodo, as safe deposit boxes join the list of outdated offerings now swept into the dustbin of history.

Chase’s move is sure to be met with dismay, particularly among older generations most accustomed to this form of off-site storage. At the same time, they have little choice but to cut services that just don’t add up anymore. Safe deposit boxes served banks and their clients well for over a century but ultimately could not survive the test of time.

History and use of safe deposit boxes

Safe deposit boxes have been a staple of banking for over a century, offering account holders a secure location to store physical valuables outside the home. Introduced in the late 1800s, safe deposit boxes quickly became popular as a superior alternative to hiding assets in wall safes, mattresses, or other locations within the home that provided little real protection.

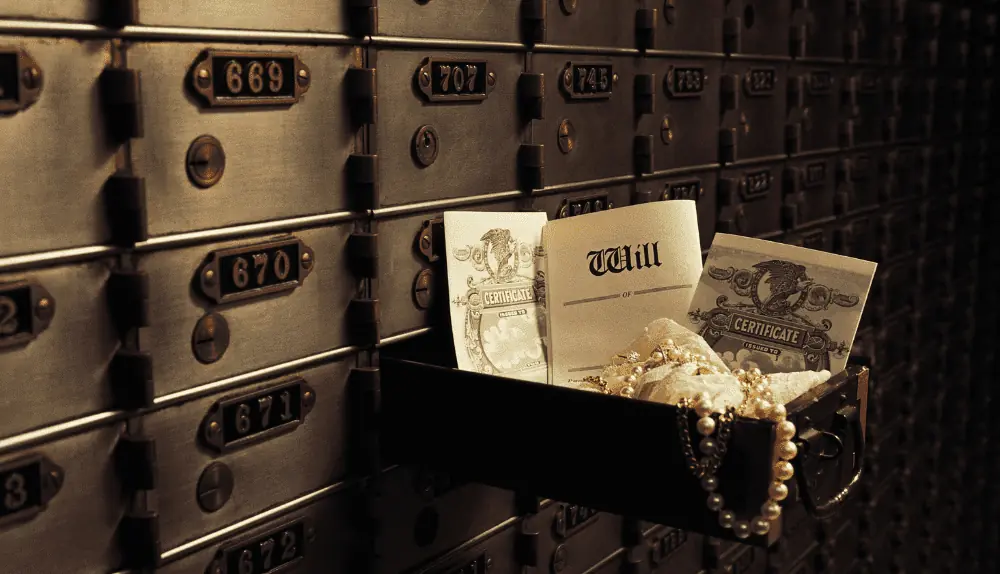

Banks marketed safe deposit boxes as a foolproof way to safeguard jewelry, silver, documents, bonds, stocks, collectibles, and other prized possessions. For a monthly rental fee, any item could be locked inside an individual box within the bank’s vault, under 24-hour guard. This was reassurance that life’s most cherished treasures would be protected from hazards like fire, theft, floods, and natural disaster – perils that could destroy everything in a heartbeat.

Whole families often rented safe deposit boxes, passing down usage rights across generations. Rarely did anyone actually need access to the contents of their box, yet its presence provided peace of mind. For the cost of a modest storage unit, one could ensure security, temperature control, and a calmness of mind, knowing that precious keepsakes would be precisely where they left them, year after year.

Over time though, alternate options emerged to challenge the dominance of safe deposit boxes. Homeowners began installing private vaults, safes, and security systems of their own, rendering banks’ facilities nearly obsolescent. Less frequent access and mounting fees further reduced appeal until at last, they seemed an outdated and overpriced solution.

Though once invaluable, safe deposit boxes could not withstand the test of progress. But for those who came of age relying upon them and passed that same expectation to their children, the loss strikes at a piece of financial folklore sure to be sorely missed. Safe deposit boxes held memories as priceless as the treasures once kept within their walls, representing comfort, trust, and the timelessness of family. Their day has now passed, yet the imprint they left on banking and society shall endure.

Widespread adoption and use for decades

By the mid-20th century, safe deposit boxes had been adopted by the masses and become an integral part of mainstream banking. Nearly every bank branch offered them, and customers of all walks rented boxes large and small to suit their needs.

Whole families would often share a single box, passing it down through generations like a cherished heirloom. Community leaders, businessmen, and professionals alike all depended upon them, using boxes to safeguard important documents, stocks, bonds, jewelry, collectibles, silver, and gold – anything of value that belonged to future generations.

For the average middle-class family, a safe deposit box provided an affordable means of protection without the high cost or inconvenience of a home safe. They offered 24-hour guarding, temperature control, and fireproof walls – attributes not easily matched. Renting a box also gave peace of mind that prized possessions would remain undisturbed, precisely as left, for years to come.

The 1960s and 1970s saw a rise in alternate options including private vault companies, home safes, and security systems. Still, safe deposit boxes remained a staple, tied to childhood memories and a sense of financial responsibility passed down from one’s elders. Accounts were often opened for children shortly after birth, starting a legacy of dependability and trust in the institutions that housed family assets.

By the turn of the 21st century though, safe deposit boxes had faced a severe decline. Chains like JP Morgan Chase and others that once zealously promoted them now saw only mounting costs and emptying vaults. Despite nostalgia for the past, modern convenience and price had rendered them nearly obsolete. Most accounts went unused for years at a time, yet per-box fees continued to rise, finally forcing customers to seek newer, more affordable solutions.

And so the era of the safe deposit box has now drawn to a close, representing not only the passage of time but a shift in how we manage our financial lives and most prized possessions. Though once inseparable from banking tradition, safe deposit boxes could not withstand the test of progress and have thus, faded into history.

Reaction and Impact

The announcement sent shockwaves through the banking industry and among longtime Chase customers. For those who had rented safe deposit boxes for decades, often passed down through the family, the loss struck an emotionally resonant service that had become ingrained in how people managed their financial lives and valued possessions.

Sure, alternatives now abounded, yet none could match the nostalgia surrounding traditional bank-issued safe deposit boxes. They represented security, trust in established institutions, and the shared financial memories of generations past. To have that connection severed seemed a severing of ties to simpler times, an admission that the world moves ever onward while traditions fade into obscurity.

Younger generations, less familiar with safe deposit boxes, viewed the change with more practicality. For them, the high fees, limited access, and inconvenience far outweighed any sentimental appeal. If useful security could be bought for less through other modern solutions, so be it. Still, there remained a sense that something pivotal about the banking experience had been lost forever.

The impact of Chase’s move is double-edged. On one hand, it forces the hand of progress, adapting services to match contemporary needs and budgets. On the other, it marks the end of an era, dismantling a foundation of the industry that inspired trust for over a century. Other major banks will likely follow suit, gradually phasing out safe deposit boxes till soon, they exist only in memory.

Customers now face the difficulty of retrieving contents from closed boxes or finding an alternative solution. Valuables once secured now need re-location, documents need re-filing, and comfort has been disrupted. Meanwhile, banks move on to embrace technologies like digital vaults, secured lockers, and home security integrations, betting these newer offerings will appeal more to modern lifestyles while still meeting core needs.

The demise of safe deposit boxes shows how even the most familiar can fade with time. Their impact is felt in the nostalgia of loss, the change in how we manage our most prized possessions, and the way generational knowledge gets passed, evolving with each new day. While ending an era, Chase has created an opportunity to forge new traditions, finding meaning and security in the novel rather than the sets that came before. The future remains unwritten.