Sezzle, one of the fastest growing payment platforms, has just unveiled a game-changing solution – Sezzle Pay Anywhere – that is set to revolutionize the way consumers shop and pay. But it’s not just about convenience; it’s about leveling the playing field for those who have faced barriers to traditional financing.

With this latest innovation, Sezzle is heralding a new era of responsible financing, offering unparalleled choice and flexibility to consumers seeking a seamless shopping experience.

Company Overview

Sezzle is a dynamic and forward-thinking financial technology company that has rapidly grown to prominence in the bustling world of online payments. Headquartered in Minneapolis, U.S., with a widespread presence in both the United States and Canada, the company has solidified its position as a leading player in the alternative payment sector. At its core, Sezzle offers a groundbreaking platform that empowers consumers with interest-free installment plans, fostering a seamless and responsible shopping experience at a wide array of online stores.

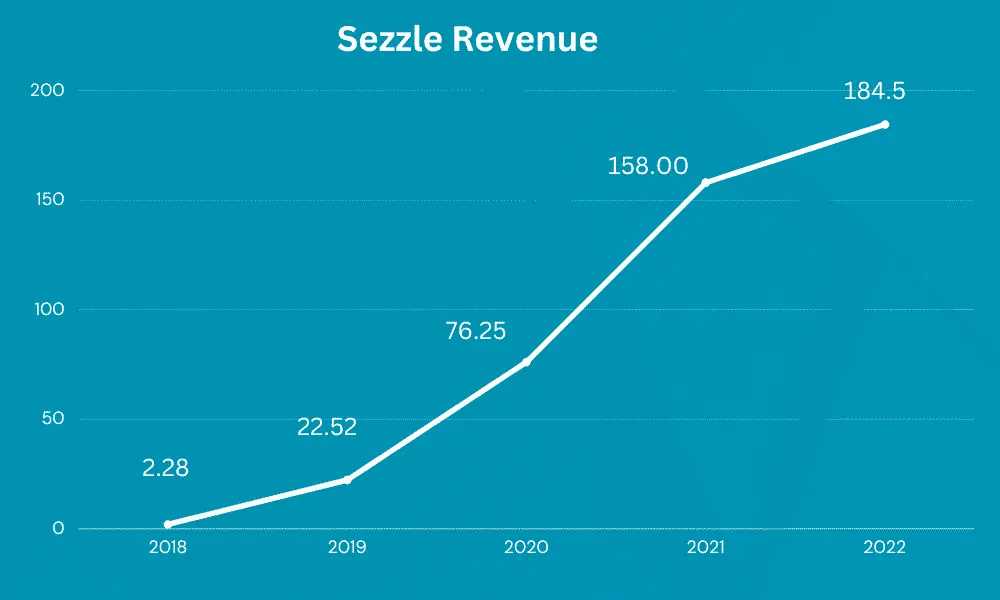

Sezzle revenue in $ million

Driven by a mission to make finance more accessible and inclusive, Sezzle has disrupted the traditional payment landscape by redefining the way consumers shop and pay for their purchases. With a commitment to innovation and customer satisfaction, the company has garnered a loyal customer base while forging strong partnerships with renowned retailers. As a publicly traded entity, Sezzle continues to inspire confidence and trust among its stakeholders as it pioneers the future of modern, flexible, and responsible financing.

What is Sezzle Pay Anywhere?

Sezzle Pay Anywhere is a groundbreaking subscription-based service offered by Sezzle Inc., designed to revolutionize the world of payments. It enables consumers to utilize their Sezzle Virtual Card for interest-free installment payments at any retailer or merchant where Visa Inc. transactions are accepted. This innovative payment solution offers unparalleled flexibility and convenience, catering to modern consumers’ evolving preferences for responsible financing options.

Whether shopping online, making in-store purchases, or paying bills, Sezzle Pay Anywhere empowers users to split their purchase amount into multiple installments, eliminating the need for immediate full payment. With a seamless integration process, transparent fee structure, and the added benefit of rewards and credit-building opportunities, Sezzle Pay Anywhere stands at the forefront of financial inclusion, ensuring consumers have access to a frictionless shopping experience across a vast network of participating merchants and retailers.

Why is Sezzle Pay Making A Move To BNPL?

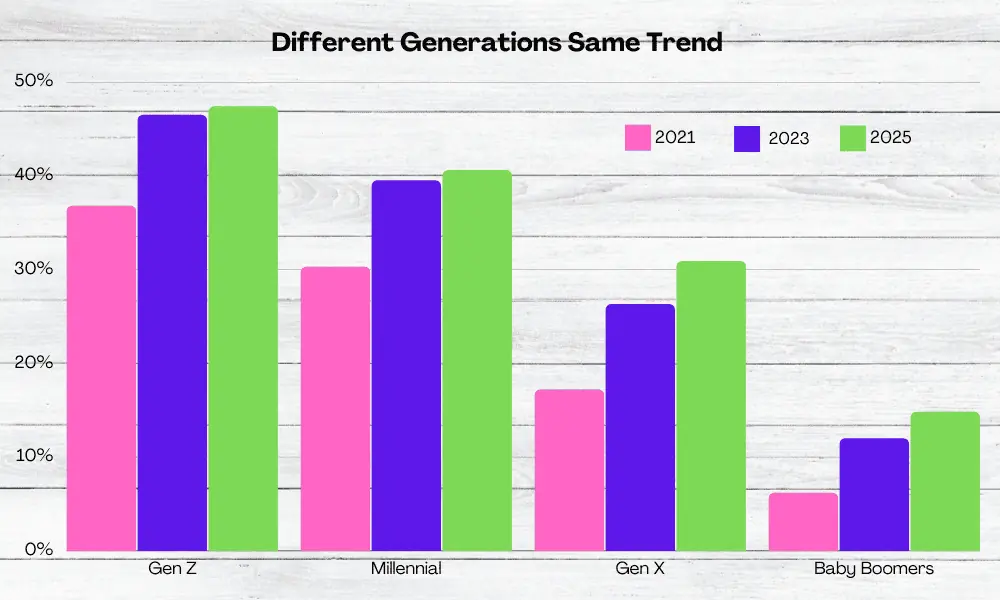

BNPL is getting quickly popular with Gen Z.

With the booming popularity of the buy now, pay later (BNPL) trend, Sezzle Inc., a prominent payment provider, recognizes the importance of catering to evolving consumer needs and preferences. As forecasts project the U.S. BNPL volume to soar to a staggering $6.5 billion by 2027, Sezzle is strategically positioning itself to empower consumers with more flexibility and accessibility.

![]() Recommended : Sezzle Buy Now Pay Later Review

Recommended : Sezzle Buy Now Pay Later Review

To achieve this goal, the company has recently unveiled Sezzle Pay Anywhere, a revolutionary subscription-based service designed to enhance the BNPL experience by enabling consumers to use Sezzle’s virtual card across various shopping platforms, including online, in-store and anywhere Visa Inc. transactions are accepted. In this article, we delve into the key factors driving Sezzle’s move into BNPL, the benefits it offers to both consumers and merchants and its anticipated impact on the future of payment solutions.

Catering to Consumer Preferences

The rapid ascent of BNPL in recent years has been fueled by its ability to offer consumers an alternative to traditional payment methods. Shoppers, especially millennials and Gen Z, appreciate the convenience of making purchases without the immediate burden of paying the full amount upfront.

By making the move to BNPL, Sezzle acknowledges the changing dynamics of consumer behavior and the increasing demand for flexible payment options. Sezzle Pay Anywhere emerges as a strategic response to consumer preferences, ensuring they can utilize the installment payment service across a wide range of retail settings and payment channels. This inclusivity opens up new avenues for Sezzle to reach a broader customer base and foster stronger brand loyalty.

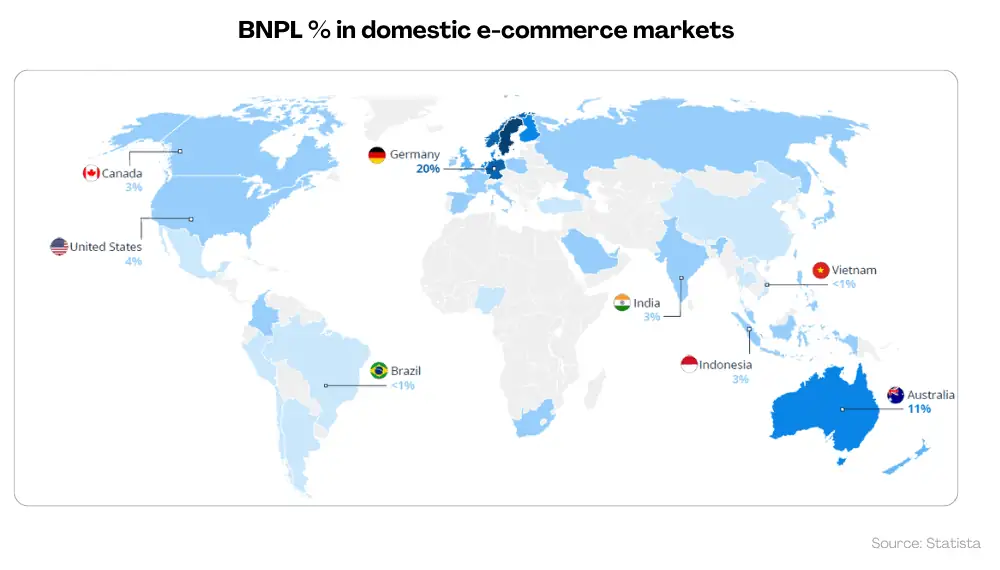

Expanding Market Presence

As the BNPL market continues its meteoric rise, competition among payment providers intensifies. To maintain its competitive edge and solidify its position as a market leader, Sezzle is proactively expanding its market presence with the introduction of Sezzle Pay Anywhere.

![]() Recommended: Buy now, pay later market trends in 2023

Recommended: Buy now, pay later market trends in 2023

By offering consumers the freedom to shop online, in physical stores, and virtually anywhere Visa Inc. transactions are accepted, Sezzle taps into a diverse and vast ecosystem of retailers and merchants. This move not only enhances Sezzle’s brand visibility but also establishes it as a versatile and comprehensive BNPL solution provider.

Enhancing Financial Inclusion

One of the key driving forces behind Sezzle’s move to BNPL is its commitment to financial inclusion. Traditional financing options often pose significant barriers for consumers with limited credit histories or those who face challenges accessing credit. Sezzle Pay Anywhere aims to bridge this gap by offering an interest-free installment payment service to consumers, regardless of their credit scores.

This not only provides responsible financing options by Sezzle to a broader spectrum of consumers but also instills confidence and financial empowerment among those who have previously been excluded from traditional payment methods.

Benefits for Merchants

Sezzle Pay Anywhere not only benefits consumers but also offers numerous advantages to merchants. By integrating Sezzle’s installment payment service into their checkout process, merchants can tap into a larger customer base and increase conversions.

The convenience of BNPL attracts impulse purchases and encourages higher cart values, thus driving revenue growth for businesses. Moreover, Sezzle’s commitment to responsible financing mitigates the risk of defaults, ensuring that merchants receive timely payments while offering consumers a frictionless shopping experience.

As the BNPL landscape continues to evolve, Sezzle’s move to introduce Sezzle Pay Anywhere represents a strategic leap forward in the payment industry. By catering to consumer preferences, expanding market presence, enhancing financial inclusion, and providing benefits to merchants, Sezzle is poised to revolutionize the way consumers shop and pay for their purchases. As Sezzle Pay Anywhere gradually rolls out and gains broader availability, it is expected to shape the future of payment solutions, empowering consumers with greater financial flexibility and driving the growth of e-commerce and retail industries alike.

![]() Recommended: Crackdown on Buy Now, Pay Later (BNPL) Companies

Recommended: Crackdown on Buy Now, Pay Later (BNPL) Companies

Key Features of Sezzle Pay Anywhere

Sezzle Pay, the innovative installment payment platform from Sezzle Inc., stands out as a pioneering solution that redefines the way consumers shop and pay for their purchases. Designed to provide responsible financing to underrepresented consumers, Sezzle Pay offers a comprehensive set of features that not only empower shoppers with flexible payment options but also incentivize them with rewards and opportunities to build credit. Let’s explore the key features that make Sezzle Pay a game-changer in the world of payments.

Bridging the Financing Gap

Sezzle Pay takes pride in addressing a significant challenge faced by many consumers: lack of access to responsible and flexible financing. By launching Sezzle Pay Anywhere, Sezzle is bridging this gap, ensuring shoppers can use the installment payment service across a vast network of retailers and payment channels. Whether consumers are shopping online, paying bills, or making in-store purchases, Sezzle Pay Anywhere enables them to enjoy the convenience of BNPL wherever Visa is accepted.

Responsible Financing

The core philosophy of Sezzle Pay revolves around promoting responsible financial practices. Unlike traditional credit options that may come with high interest rates and hidden fees, Sezzle Pay offers interest-free installment plans, providing consumers with a transparent and manageable way to spread out their payments. This approach fosters financial discipline and helps consumers stay within their budget while making essential purchases.

1% Cashback on Eligible Transactions

Sezzle Pay goes beyond just facilitating installment payments; it also rewards consumers for their loyalty and usage. With Sezzle Pay Anywhere, shoppers have the opportunity to earn 1% cashback on eligible transactions. This enticing incentive not only encourages consumers to use Sezzle Pay more frequently but also adds value to their shopping experience.

Building Credit with Sezzle Up

Sezzle Pay demonstrates its commitment to the financial well-being of consumers through its innovative feature, Sezzle Up. This opt-in program allows users to build their credit while utilizing Sezzle’s installment payment service responsibly. By making timely payments, consumers can improve their credit scores, paving the way for better financial opportunities in the future.

Seamless Integration

Sezzle Pay boasts a user-friendly and seamless integration process that makes it easy for consumers to access the service across various platforms. Whether it’s integrating into an online store’s checkout process or facilitating in-store transactions, Sezzle Pay ensures a smooth and hassle-free experience for both consumers and merchants.

Increased Conversions for Merchants

Merchants partnering with Sezzle Pay benefit from increased conversions and higher cart values. The convenience of BNPL attracts more customers, leading to reduced cart abandonment rates and an uptick in sales. Moreover, Sezzle’s responsible financing approach reduces the risk of defaults, giving merchants peace of mind and a reliable payment solution for their businesses.

Sezzle Pay’s key features encompass a holistic approach to payments, focusing on responsible financing, consumer rewards, and building credit. By bridging the financing gap and making installment payments accessible at any Visa-accepting retailer, Sezzle Pay empowers consumers with a flexible and transparent payment solution.

As it incentivizes responsible financial behavior through cashback rewards and Sezzle Up, the platform not only benefits consumers but also proves to be a valuable asset for merchants seeking increased conversions and customer loyalty. With its user-friendly integration and commitment to financial well-being, Sezzle Pay is set to reshape the payment landscape, leading the charge towards a more inclusive and responsible financial future.

Image source: Sezzle Up

Benefits of Sezzle Pay Anywhere

Universal Accessibility

The primary advantage of Sezzle Pay Anywhere is its universal accessibility. Consumers can use Sezzle’s installment payment service not only for online purchases but also for in-store transactions and anywhere Visa transactions are accepted. This broad acceptance ensures a seamless and consistent shopping experience, whether customers are shopping online or visiting physical retail locations.

Bridging the Financing Gap

Sezzle Pay Anywhere is specifically designed to cater to consumers who may have had difficulty accessing traditional financing options. By offering interest-free installment plans, Sezzle bridges the financing gap and provides a responsible financing alternative to individuals with limited credit histories or those facing financial constraints.

Increased Shopping Power

With Sezzle Pay Anywhere, consumers can enjoy increased shopping power. They can make purchases without the need for immediate full payment, making higher-priced items more attainable and encouraging impulse buying, thereby benefiting both consumers and merchants.

Seamless Integration

Sezzle Pay Anywhere seamlessly integrates with various retailers and payment platforms. This user-friendly integration ensures a smooth checkout process for consumers and a straightforward implementation for merchants, making it a hassle-free solution for both parties.

Rewards and Credit Building

Sezzle Pay Anywhere offers additional incentives to consumers. Shoppers can earn 1% cashback on eligible transactions, providing an added benefit to their shopping experience. Moreover, the opt-in Sezzle Up program allows consumers to build their credit by making timely payments, potentially improving their financial standing in the long run.

Consumer Loyalty

By providing a flexible and rewarding payment option, Sezzle Pay Anywhere fosters customer loyalty. Satisfied consumers are more likely to return to merchants who offer Sezzle Pay, leading to increased repeat business and enhanced brand loyalty for participating retailers.

Risk Mitigation for Merchants

For merchants, Sezzle Pay Anywhere offers a risk-mitigation advantage. With Sezzle handling the installment payments and ensuring timely disbursements, merchants are protected from potential defaults, allowing them to focus on their core business operations without financial uncertainty.

Increased Conversions and Sales

The availability of Sezzle Pay Anywhere at the point of purchase can significantly boost conversions for merchants. The convenience and affordability of BNPL options attract a broader customer base, reduce cart abandonment rates, and ultimately lead to increased sales for participating retailers.

Enhanced Customer Experience

Sezzle Pay Anywhere enhances the overall customer experience by providing a payment option that aligns with the preferences and financial situations of a diverse range of consumers. It eliminates the need for credit checks and empowers shoppers with more control over their purchases.

Financial Inclusion

Sezzle Pay Anywhere contributes to financial inclusion by extending responsible financing options to individuals who may have been excluded from traditional credit avenues. This empowerment fosters financial stability and opens doors to broader economic opportunities for consumers.

Overall, Sezzle Pay Anywhere offers a comprehensive set of benefits to consumers and merchants alike. Its universal accessibility, flexibility, and rewards make it an appealing payment solution for consumers, while merchants benefit from increased sales, risk mitigation, and enhanced customer loyalty. With its commitment to responsible financing and financial inclusion, Sezzle Pay Anywhere stands as a pioneering force in the world of modern payment solutions.

Conclusion

In conclusion, Sezzle Pay Anywhere emerges as a trailblazing payment solution that not only meets the evolving demands of modern consumers but also empowers merchants to thrive in a competitive landscape. With its universal accessibility, flexibility, and focus on responsible financing, Sezzle Pay Anywhere bridges the financing gap and extends financial empowerment to a broader audience.

By seamlessly integrating with various retailers and offering rewards through cashback and credit-building opportunities, Sezzle Pay Anywhere fosters consumer loyalty and enhances the overall shopping experience.

Moreover, its risk mitigation benefits and potential for increased conversions make it an invaluable asset for merchants seeking growth and success in the digital marketplace. As Sezzle continues to revolutionize the payment industry with its commitment to financial inclusion and responsible financing, Sezzle Pay Anywhere sets the stage for a future where convenience, accessibility, and consumer satisfaction reign supreme.

Embracing Sezzle Pay Anywhere not only marks a step towards financial empowerment for shoppers but also signifies a strategic move towards a more inclusive and prosperous retail landscape.

Frequently Asked Questions (FAQs)

How does Sezzle Pay Anywhere work?

To use Sezzle Pay Anywhere, consumers must first subscribe to the service. They can then choose Sezzle as their payment method during checkout at participating retailers or merchants. By using their Sezzle Virtual Card, they can split their purchase amount into multiple interest-free installments and pay over time.

Is Sezzle Pay Anywhere available everywhere?

Sezzle Pay Anywhere aims to be available wherever Visa Inc. transactions are accepted. While it is gradually rolling out, it is anticipated to be broadly available by the end of the third quarter. Consumers can check the Sezzle website or app for a list of participating retailers and merchants.

Are there any fees for using Sezzle Pay Anywhere?

As Sezzle Pay Anywhere is still in the beta stage, the fee structure is yet to be finalized. However, Sezzle has a transparent fee system for its installment payment service, and consumers can expect to have a clear understanding of any applicable fees once the service is fully available.

Can I earn rewards or build credit with Sezzle Pay Anywhere?

Yes, Sezzle Pay Anywhere offers additional benefits to users. Consumers can earn 1% cashback on eligible transactions, adding value to their shopping experience. Moreover, by opting into the Sezzle Up program, consumers can build their credit by making timely payments, potentially improving their financial standing in the long run.

Is Sezzle Pay Anywhere secure?

Yes, Sezzle Pay Anywhere prioritizes the security and privacy of its users. The platform implements robust security measures to safeguard personal and financial information, ensuring a safe and protected shopping experience for consumers.

Can I use Sezzle Pay Anywhere for all types of purchases?

Sezzle Pay Anywhere is designed for everyday purchases, whether it's shopping online, paying bills, or making in-store purchases. However, some merchants may have restrictions on certain product categories or transactions, so it's essential to review the terms and conditions of individual retailers.