In today’s fast paced world there is a groundbreaking trend that has captivated consumers: Buy Now Pay Later companies. These innovative businesses have completely changed consumer behavior by allowing users to instantly acquire products and services without paying the full amount upfront. And the industry has seen an astounding growth as there were very few regulations on BNPL companies.

- No Regulations On BNPL Companies

- Pros And Cons Of Buy Now, Pay Later

- How Does the BNPL Industry Operate?

- US Plans to Regulate BNPL Companies: An Unprecedented Move in the Fintech Landscape

- Overcoming Operational Challenges

- Balancing Innovation and Regulation

- What Is Happening Around The World In Regulating the BNPL Industry?

- Impact of Regulation on BNPL

- Conclusion:

- Frequently Asked Questions (FAQs)

No Regulations On BNPL Companies

Inspired by the moves of the tech industry the BNPL market initially thrived without government regulations on BNPL companies, enjoying high level of success and growth. Initially the BNPL was used for short term property rentals or streaming media subscriptions. Fintech disruptors experienced success and started implementing in other sectors of the market. At the same time government was struggling as there were no controls on this new trend.

However, as the BNPL sector continues to grow, concerns about consumer protection, financial stability and fair lending practices have sparked debates. In this analysis we understand the catalysts and implications of this on BNPL industry and its customers.

Pros And Cons Of Buy Now, Pay Later

Pros

Convenience: Buy Now Pay Later (BNPL) offers convenience by allowing consumers to make purchases without paying the amount upfront. This can be especially helpful when funds are tight.

Interest Free Periods: Some BNPL services provide interest-free periods. Thus, enabling you to pay the same amount in installments that was used for purchase. Thus making purchases accessible to a larger buyer group.

Split Payments: BNPL breaks down the cost into installments making larger purchases more affordable and simpler to budget for over a period of time.

Flexible Credit Requirements: Many BNPL providers have low credit requirements and they may not be eligible for traditional loans and credit cards. With buy now, pay later option even people with low credit scores can enjoy purchasing easily.

Instant Satisfaction: With BNPL consumers can enjoy their purchases immediately even if they don’t have the amount at the time of purchase.

Cons

Interest On BNPL: While some BNPL options are interest free others may impose interest or fees if you fail to pay off the amount within a timeframe. It’s important to be cautious as this could lead to higher cost than actual, if not managed carefully.

Spending Beyond Limits: The convenience of BNPL can tempt buying. Going overboard with spending. Without discipline you may find yourself buying things which are of no real use to you. And also increasing your debt burden. BNPL is an encouragement to spend more.

This also leads to debt accumulation and can be financially devastating for many.

![]() Suggested: BNPL schemes make it easy to spend, but harder to understand the risks

Suggested: BNPL schemes make it easy to spend, but harder to understand the risks

Credit Consequences: While some BNPL providers may not require a credit check others might report your activity to credit agencies. Late payments or defaults could have an impact, on your credit score.

Lack of Awareness: Consumers may not fully grasp the terms and conditions of BNPL agreements leading to surprises like fees, interest charges or payment deadlines.

Complexity Concerns: Managing multiple BNPL payments, from providers can become complex and overwhelming potentially resulting in missed payments or confusion.

How Does the BNPL Industry Operate?

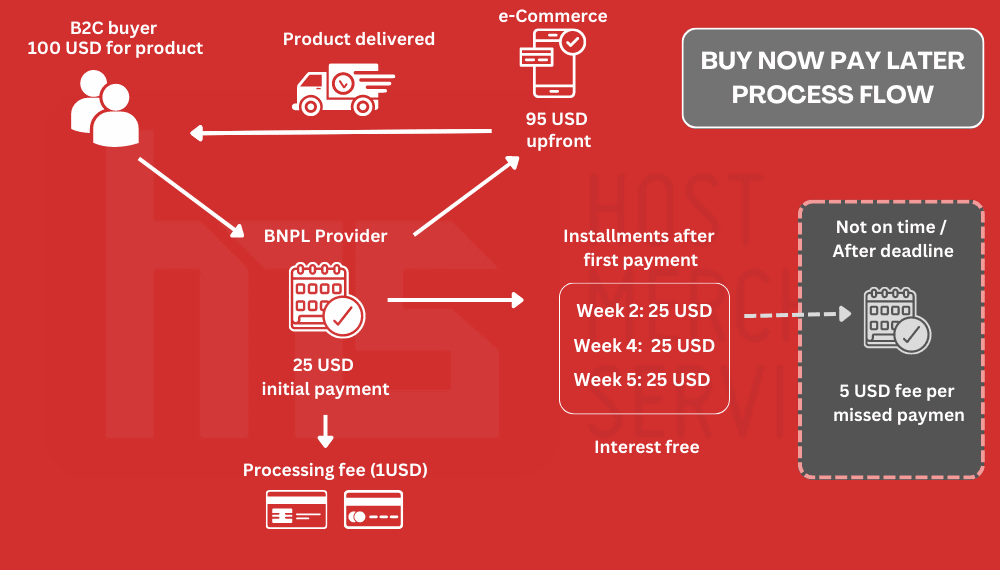

The industry of Buy Now Pay Later (BNPL) is causing disruption in the retail and finance sectors by revolutionizing how consumers make their purchases. Essentially, BNPL enables shoppers to get their hands on goods and services while spreading out the payment into multiple instalments over a certain period of time.

This innovative payment option has become incredibly popular due to its convenience, flexibility and ability to empower consumers with control. The operation of the BNPL industry is relatively straightforward.

![]() Recommended: What is BNPL?

Recommended: What is BNPL?

When a customer chooses the BNPL option during checkout they go through an approval process which is often automated. Many online stores, as well as, brick-and-mortar stores offer BNPL services but more or less the verification process is the same.

The verification process evaluates the consumers creditworthiness based on factors like their credit score, spending habits and transaction history. Unlike credit cards BNPL providers usually take a lenient approach when assessing creditworthiness. Thus, making this payment method accessible to a wider range of consumers.

Once it’s confirmed that the customer is eligible for BNPL they can proceed with their purchase without having to pay the amount upfront. Rather, the total cost is divided into instalments typically ranging from two to six months (although some BNPL companies offer even longer plans). These instalments are often interest free which gives shoppers flexibility without having to worry about high interest rates associated with credit card debt.

BNPL companies generate revenue using a two strategy. First, they charge merchants a fee, for utilizing their BNPL services. This is similar to the transaction fee applied by traditional payment processors. This encourages merchants to offer BNPL as a payment option since it attracts customers and boosts sales.

Second, BNPL providers make money through fees and interest charges if a customer fails to make payments on time as scheduled. While some BNPL companies maintain an interest-free structure for a certain period of time, others may apply interest to specific payment plans or in cases where the customer fails to pay on time.

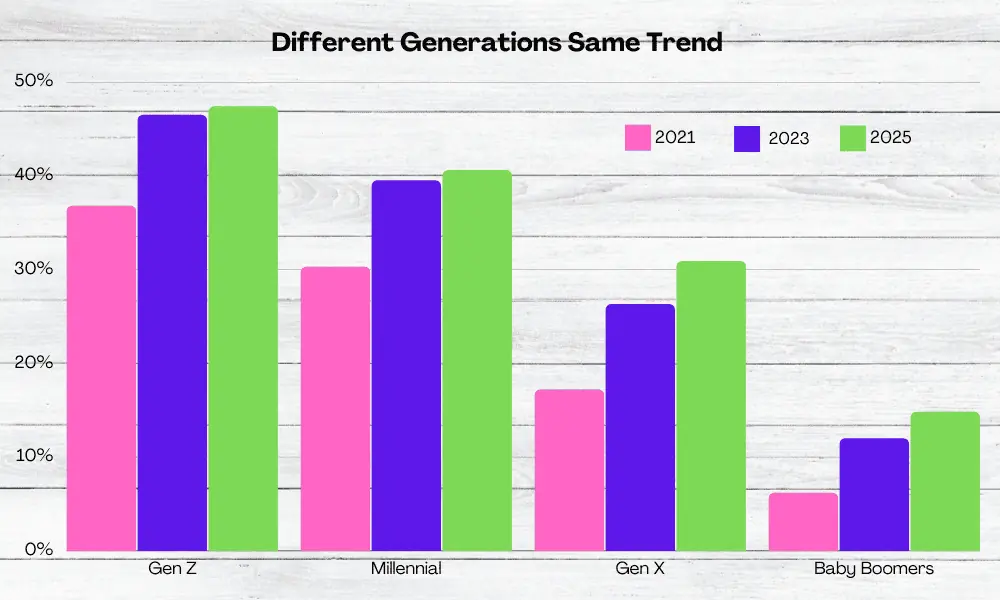

BNPL is highly popular with Gen Z.

The success of the BNPL industry can be attributed to its appeal to both consumers and merchants. Shoppers are attracted to the convenience of splitting payments for priced items without accumulating burdensome interest. Merchants benefit from increased conversion rates, order values and decreased cart abandonment rates because the customer doesn’t have to pay the full amount. The customer gets far more time to pay back the amount in parts.

The workings of the BNPL industry have revolutionized how consumers approach purchases and payments ushering in an era of flexibility and accessibility. As the popularity of BNPL continues to rise both consumers and merchants are likely to embrace this evolving payment model that shapes the future of retail and finance with its approach, to commerce.

US Plans to Regulate BNPL Companies: An Unprecedented Move in the Fintech Landscape

The U.S. Government is planning to introduce regulations on Buy Now Pay Later (BNPL) companies marking a move in the fintech industry. This decision comes as the sector faces increasing pressure due to rising funding costs and reduced consumer spending caused by soaring inflation.

The Consumer Financial Protection Bureau (CFPB) led by director Rohit Chopra took the lead in this effort. They are now focusing on examining technology driven companies that have been encroaching upon traditional financial institutions.

![]() Read More : Press release by CFPB to highlight the reasons why we need regulations on buy now, pay later companies.

Read More : Press release by CFPB to highlight the reasons why we need regulations on buy now, pay later companies.

The BNPL industry is currently under strain from challenges it is encountering. The escalating funding costs have significantly impacted the profitability of BNPL firms compelling them to explore approaches to stay competitive. Additionally, due to inflation the consumers are adopting an approach towards purchases due to a decrease in their spending power.

These factors combined have dealt a blow to the BNPL market raising many concerns about its sustainability in the run.

Overcoming Operational Challenges

The regulatory crackdown on BNPL companies in the United States will undoubtedly pose hurdles for industry players. Companies will need to invest in compliance infrastructures that meet the regulatory requirements.

This could involve strengthening data privacy and security measures implementing risk assessment models and offering consumer education programs to promote responsible spending habits.

Balancing Innovation and Regulation

As the U.S. Government crafts its framework for the BNPL industry finding a balance, between innovation and regulation becomes crucial.

![]() Suggested: HM Treasury (UK) draft for regulating BNPL

Suggested: HM Treasury (UK) draft for regulating BNPL

It is crucial for policymakers to avoid suppressing innovation and competition in the fintech industry. Buy Now Pay Later (BNPL) has proven to be an attractive and a market disruptive payment option for consumers. By implementing forward thinking regulations on BNPL companies, the government can create an environment that balances consumer interests and market growth.

The U.S. Governments intention to regulate BNPL companies indicates a change in the fintech landscape. Under Consumer Financial Protection Bureau (CFPB) there will be scrutiny of the industry so that all important issues and concerns related to consumers can be addressed. As regulatory frameworks evolve, finding a balance between promoting innovation and ensuring fair practices will shape the future of BNPL in the United States.

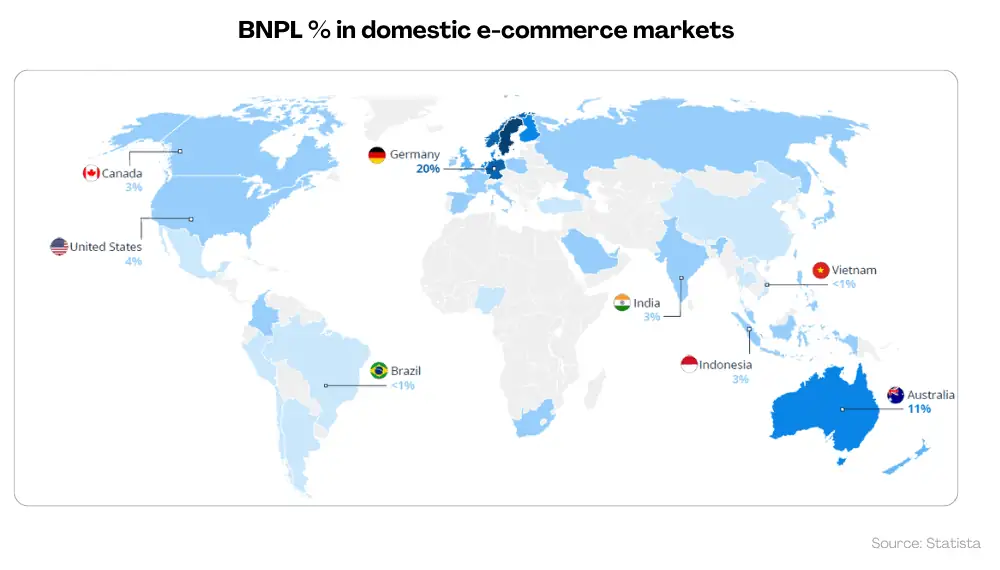

What Is Happening Around The World In Regulating the BNPL Industry?

Perspectives from Europe and the United States

Regulators on both sides of the Atlantic are closely monitoring the growth of Buy Now Pay Later (BNPL) services. The Consumer Financial Protection Bureau (CFPB), in the United States is proactively investigating any risks associated with using BNPL options.

Meanwhile in Europe significant progress has been made towards developing a framework that incorporates this emerging payment model into existing credit regulations. Lets take a look, at the factors and strategies that each region is employing to create comprehensive legislation for Buy Now Pay Later (BNPL) services.

Regulation of BNPL in the European Union: Progressing with Purpose

In contrast to the United States significant progress has been made within the European Union (EU) in developing regulations on BNPL services. In 2021 an amendment was approved by the European Commission to incorporate BNPL offerings within existing consumer credit regulations, under the Consumer Credit Directive.

This strategy demonstrates the approach taken by the EU to address the opportunities and challenges presented by BNPL. The updated guideline aims to enhance consumer protection in the mobile centric BNPL market.

To achieve this the EU plans to introduce safeguards, including prohibiting selected contract agreement checkboxes that can trap customers into contracts unknowingly. Additionally, all BNPL contracts will be required to be available, in a mobile format allowing users to make decisions about their credit terms before committing.

Promoting International Standardization

As the EU and US move forward with their BNPL regulations there is an increasing possibility of harmonizing standards. Given the reach of the BNPL industry and its impact on customers worldwide it would be beneficial for collaboration in developing and robust regulatory frameworks. Such harmonization would enhance understanding among BNPL providers. This will also facilitate border transactions and strengthen consumer trust and confidence.

The BNPL industry is currently is at a juncture. Regulators in the EU and the US are actively considering implementing regulations to safeguard customers and promote ethical conduct. While the US regulations on BNPL companies are still in development the EU has made progress in integrating BNPL into its existing credit regulations.

Both regions aim to strike a balance that fosters the growth of the BNPL sector. This will ensure a transparent experience for customers by addressing risks and enhancing consumer protection.

Impact of Regulation on BNPL

The impact of measures on BNPL is expected to be substantial marking a moment for the industry and its stakeholders. As regulators in the EU and the US move forward with regulations on BNPL companies several key areas are likely to be influenced:

- Consumer Protection and Trust

One of the goals of BNPL regulation is to strengthen consumer protection. By establishing guidelines regarding data usage, transparency and responsible lending practices customers will have information to make informed financial decisions.

Building trust among consumers in BNPL services will be crucial, for sustaining industry growth and ensuring long term viability.

- Business Operations and Compliance

BNPL companies will need to adjust their business operations to align with the requirements. Investing in risk assessment models, implementing data security measures and educating customers are some of the steps that may need to be taken.

However, complying with these regulations on BNPL companies could result in consolidation, within the industry as smaller players struggle to meet the standards set by regulators.

- Market Competition and Innovation

When it comes to market competition and innovation finding the right balance between regulation and fostering innovation will be crucial. While regulations on BNPL companies are intended to protect consumers, strict rules could hinder the creativity and subsequently growth of fintech companies.

- Access to Credit

One important factor to consider is how BNPL regulations impact access to credit. While stricter regulations can promote responsible and safe lending practices, they may also restrict credit access for individuals. Without regulation even a customer with lower credit scores get to purchase with BNPL. But this won’t be possible after regulations.

- International Regulations

It is believed by the experts that after the regulation of the BNPL in the US and EU it will be possible to move ahead to the next step. The next step will be for international standard regulations. This can be achieved only if there is a harmony between BNPL regulations of different nations.

This will help the BNPL industry grow further. This will facilitate cross-border operations and offer standardized protection measures for consumers.

- Financial Stability

Financial stability is not possible without proper regulations. This applies to BNPL market too. Good regulations on BNPL in the US will help in maintaining financial in this market. These regulations will mitigate the risks associated with debt accumulation. It will protect the consumers as well by controlling over-spending.

The main aim of the regulators is to prevent potential financial crises stemming from uncontrolled lending practices.

The growth and adaptation of the industry will be influenced by the regulations, on Buy Now Pay Later (BNPL). Companies will need to come up with ideas and adjust their business models to fit the changing environment while still ensuring growth and profitability.

Conclusion:

To conclude the impending regulatory measures in the US marks a defining moment for the industry. Regulators want to safeguard consumers and encourage safe practices. Thus, both challenges and opportunities lie ahead for this industry.

Striking a balance between fostering innovation while also protecting consumers will be essential for growth and sustainability of BNPL services. While regulations in the US are still being developed significant progress has been made in incorporating BNPL into existing credit regulations in the EU.

By focusing on serving consumers best interests the BNPL sector can continue to thrive as an innovative payment option for consumers.

Frequently Asked Questions (FAQs)

Why is there consideration for BNPL regulation?

Regulators are contemplating BNPL regulation in order to address risks faced by consumers. These risks include issues like accumulating debt and data privacy. As the industry rapidly expands it is crucial to ensure lending practices and protect consumers from harm.

Who is leading BNPL regulation efforts in the United States?

The Consumer Financial Protection Bureau (CFPB) has taken charge of regulating BNPL services in the United States. The CFPB conducted a study on these services highlighting risks faced by consumers and is expected to propose new rules.

Will the new regulations have an impact on consumers access to credit?

The implementation of BNPL regulations could indeed affect consumers access to credit. While stricter regulations may promote lending practices, they could potentially limit credit availability for individuals with lower credit scores or limited financial histories.

How will BNPL companies adapt to meet the requirements?

BNPL companies will need to make adjustments to their business operations in order to comply with the new regulations. This may involve investing in compliance infrastructure enhancing data security measures and providing consumers with disclosures.

What impact will BNPL regulation have on the stability of the industry?

The primary objective, behind implementing BNPL regulation is to mitigate risks associated with debt accumulation and consumer overextension. By doing it aims to contribute towards enhancing the financial stability of the industry. They will also try to reduce the likelihood of potential crises.