Buy Now Pay Later loans, or BNPL for short, have become increasingly popular recently. They offer convenience for people looking to buy a high-ticket product without paying for it all at once. However, the market for BNPL loan providers is pretty packed, and knowing which suits your needs best isn’t always easy.

One such provider, Sezzle, offers many great benefits, such as reporting your payments and interest-free loans. Still, learning everything about their services is the only way to know if they suit you.

In this article, you’ll learn the ins and outs of Sezzle and its Buy Now Pay Later offering, including its fees, how it works, and whether it is a good fit for you.

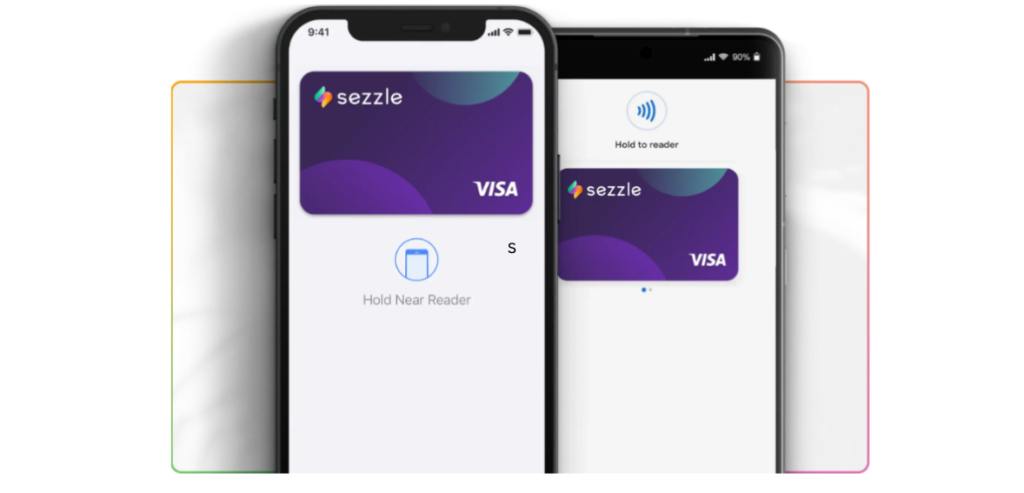

![]() Recommended: Sezzle Pay Anywhere Launched

Recommended: Sezzle Pay Anywhere Launched

Overview of Sezzle

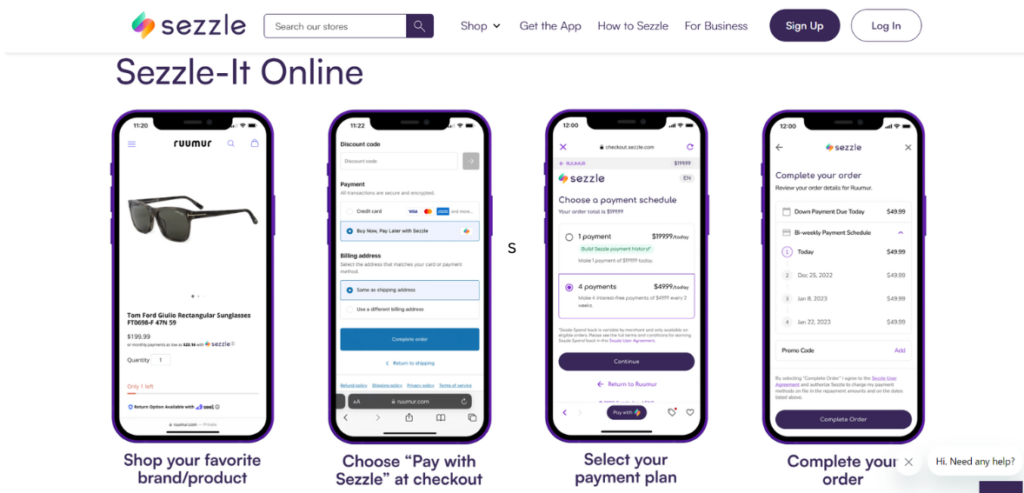

Sezzle is an online purchase finance tool that allows you to buy now and pay later. When you have a Sezzle account and shop online at a participating merchant, you can pay with a Sezzle loan. Sezzle’s app or website, as well as the merchant’s online storefront, are all options for shopping.

Sezzle is a company that offers payment plans to thousands of merchants, including Target, Bass Pro Shops, and others.

These plans allow you to divide your purchase at checkout to pay the complete balance in installments rather than all at once. Sezzle does not charge interest when you use its plan, but it may impose fees. Sezzle is comparable to other BNPL providers, such as Afterpay and Klarna.

Though it can be a cost-effective way to finance a purchase if all payments are made on time, BNPL is still a type of debt, and NerdWallet suggests paying for non-essential purchases with cash whenever possible.

The company claims that Generation Z and Millennials make up most of its clientele, aiming to “enable the next generation.” Sezzle provides interest-free loans with the option of a credit-building feature. The corporation has operations in the United States and Canada.

How Does Sezzle BNPL Work?

Sezzle has one main BNPL option for customers: a four-payment plan. Under this plan, your sum will be divided into four equal payments, with the first due at checkout and the rest due every two weeks.

For example, if you have a $200 cart and choose Sezzle, you will pay $50 at checkout, followed by three $50 installments over six weeks. Following the initial payment, installments are automatically charged to the debit or credit card used to make the initial payment or to a bank account.

If Sezzle does not receive a payment within two days of the due date (for example, because you do not have enough funds in your bank account), it disables your account from making further transactions. A $10 reactivation fee is required to restart your account, but you can reschedule a payment once per purchase for free to avoid it.

Sezzle’s pay-in-four payment plan does not include interest. The company also provides longer loans with fixed interest rates of up to 60 months.

Approval Process

You can qualify for Sezzle financing if you are at least 18 years old, have a US or Canadian cell phone that can receive SMS, and a working email address. In addition, you must have an active bank account and a credit or debit card.

You can begin using Sezzle by creating an online account. The company requests your first and last name, phone number, email address, birth date, and PIN. You’ll also have to agree to a soft credit check.

Your profile will be activated after getting security codes to authenticate your phone number and verify your billing address. To begin shopping, you must first authenticate your Sezzle account via email. You can complete your purchase through 24,000 stores and pay with Sezzle at the checkout. Also, there’s no penalty for paying the remaining payments before they are due.

By joining Sezzle Up, which records your payment history to credit bureaus, you can view and boost your credit limit. To sign up for Sezzle Up, you must link a bank account, complete one order on time, and enter your Social Security number.

You can manage your account with the Sezzle app. The app allows you to explore online retailers, review orders, reschedule payments, change payment methods, and receive notifications.

Interest Rates and Fees

Sezzle has no interest charges, making it more enticing than personal loans and credit cards.

You may have a lower limit for your initial transaction, often $50 to $200. Sezzle may raise your limit over time as you establish a track record of timely payments for smaller orders.

However, if your payment fails, Sezzle gives you 48 hours to make it right. If you fail to meet the deadline, the company will charge you $10. You can postpone one payment for free with Sezzle. After that, you’ll have to pay $5 for each extra rescheduling of that payment.

Credit Checks

Sezzle will perform a soft credit check when you apply for a payment plan. This does not affect your credit score, and Sezzle has no minimum credit score requirement.

Customer Service

Sezzle encourages using an email form to contact help with issues. If you prefer phone calls, remember that getting a live person on the line is difficult. The customer support phone number can be found on the Sezzle Legal Definitions page.

App Functionality

You can manage your account with the Sezzle app. The app allows you to explore online retailers, review orders, reschedule payments, change payment methods, and receive notifications.

Pros and Cons of Sezzle BNPL

Like any BNPL provider, Sezzle has a few advantages and disadvantages. These are:

Pros

- Sezzle provides interest-free loans with buy-now, pay-later terms. If you can’t afford to pay the whole amount up front, the alternative payment platform offers a four-payment plan spread over six weeks. The first installment is usually a down payment of 25% of your purchase.

- Payments on Sezzle can be made using a credit card: So, even if you make your interest-free Sezzle payments on time, if you don’t pay off your credit card debt in full, you may face interest charges on your purchases.

- Borrowers can opt into credit reporting: If you want Sezzle to record your payment history to credit bureaus, you can join Sezzle Up. Developing a track record of timely payments will help you create a great credit profile.

Cons

- Payment rescheduling may incur a fee: Sezzle gives you 48 hours to make it right if your payment fails. If you fail to meet the deadline, the company will charge you $10. You can postpone one payment for free with Sezzle. After that, you’ll have to pay $5 for each extra rescheduling of that payment.

- The dispute process is complicated: Unfortunately, all returns, canceled orders, or exchanges must be handled directly by the retailer. If you haven’t received your order, log into your account and select “Get Help” to contact Sezzle’s team. If you come into a circumstance that Sezzle deems disputable, you can request that it begin a dispute with the seller. You should receive a response within three business days about the next steps. However, Sezzle’s website makes no guarantees that it will assist you, and it is unclear what Sezzle would do for you if it initiates a dispute on your behalf.

Should You Use Sezzle BNPL?

Sezzle is an excellent option if you can afford the initial down payment and make the remaining payments on time. With three on-time payments, you won’t pay interest and can avoid fees, unlike when using a credit card or loan.

If you can’t pay off your bill in six weeks or utilize a credit card, you might want to look into solutions with a longer payoff timetable, such as a 0% APR credit card offer.

If you wish to finance a purchase without a hard credit check, Sezzle could be a viable option. You can also join Sezzle Up if you’re improving your credit and want your actions recorded to the credit agencies. You cannot use Sezzle Up if you do not want to link your bank account and enter your Social Security number.

Choose Sezzle if…

- You can’t get other sorts of inexpensive credit. Borrowers with weak credit might benefit from BNPL financing to make a critical purchase.

- If you want to use BNPL to improve your credit, follow these steps: Customers who use Sezzle can upgrade to Sezzle Up, which allows Sezzle to submit their payment history to TransUnion, one of the three major credit bureaus. This benefit, uncommon among BNPL lenders, can help you develop credit by demonstrating a history of on-time payments to your Sezzle account. Late payments, on the other hand, can harm your credit.

Avoid Sezzle if…

- Have an irregular pay schedule? Sezzle allows you to postpone payment for up to two weeks at no cost once per order, which may be enough for some customers but not enough for others. Rescheduling is only allowed thrice per order, and you’ll be charged $5 for the second and third times.

- Struggle to stick to a budget: Sezzle, like all BNPL providers, may entice some customers to overspend at the checkout because spreading out payments might make it appear like you’re spending less than you are. If you have trouble budgeting, limiting non-essential expenditures to the cash you have on hand is wise.

- Overdraft your debit or credit card regularly: Sezzle can help you avoid overextending yourself by stopping your account when a payment is missed. However, to continue shopping, you must spend $10 to reactivate your account. This fee is significant and might raise the cost of your loan, mainly if your account is frequently canceled.

Final Thoughts

Sezzle is a great BNPL provider if you are looking for an interest-free option that allows you to improve your credit, thanks to their Sezzle Up service. However, you’ll have to deal with late payment fees if you struggle to keep up with your installments. Sezzle allows you to postpone a payment for free for up to two weeks, but only one per order. More instances will incur a $5 fee.

Before choosing a BNPL provider, evaluate the pros and cons and whether the type of product you want to purchase makes sense.