As we enter the latter half of 2023, the landscape of payments is transforming at an unprecedented pace. Driven by technological breakthroughs, shifting consumer habits, and global economic shifts, the evolution in digital payment trends is striking. This period sees the incorporation of cryptocurrencies into widespread platforms and the adoption of advanced authentication methods to secure transactions. Numerous innovative possibilities are unfolding in the world of digital payments. Join us as we explore these pioneering trends and gain insights into the dynamic world of payments during this thrilling phase. Let’s delve into what the second half of 2023 holds for digital payment trends.

What Are Digital Payments?

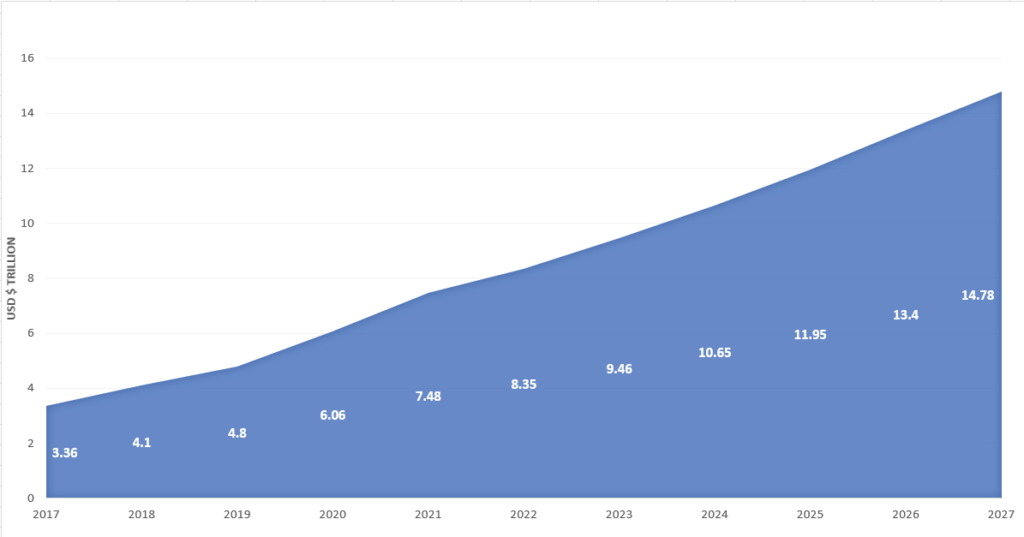

Digital transaction growth trends and projections [Data / Image source]

Digital payments refer to methods of money transfer or conducting transactions without cash. These forms of payment take place through channels like online platforms, mobile apps, e wallets and other digital devices. Digital payments have gained popularity in years due to their convenience, speed and security features. They have become a choice, for both consumers and businesses. 2023 digital payment trends are significantly different from the payment trends in the past many years. These digital payments trends are going to change the entire ecosystem of the global economy. Never ever in the history of mankind, the payment system was so democratized like we are witnessing now in the present payment trends.

Biggest and the fastest growing digital payment markets in the world (2023-2030) – Data source

There are payment methods available including:

1. Mobile Wallets: Anything that can be of the most significant aspect of modern digital payment trends is mobile wallets. This smartphone applications store payment information, like credit/debit card details or bank account numbers. They allow users to make secure transactions through their devices.

![]() Read more: Mobile payment vs. mobile wallet

Read more: Mobile payment vs. mobile wallet

2. Online Banking: This method enables individuals to conduct transactions directly through their bank’s website or mobile app. It facilitates fund transfers, bill payments and more.

![]() Suggested: Top 10 best business bank accounts in 2023

Suggested: Top 10 best business bank accounts in 2023![]() Banks: Ally vs. Marcus by Goldman Sachs

Banks: Ally vs. Marcus by Goldman Sachs

3. Contactless Payments: Contactless payments utilize near field communication (NFC) technology. Users can make transactions by tapping their contactless enabled cards or devices on payment terminals.

![]() Read more: What is contactless payment. A comprehensive FAQ.

Read more: What is contactless payment. A comprehensive FAQ.

4. Peer to Peer (P2P) Transfers: P2P payment services allow users to send money directly to one another using apps or online platforms without intermediaries.

5. Cryptocurrencies: Digital currencies like Bitcoin, Ethereum and others enable peer to peer transactions over networks. Cryptocurrencies offer enhanced security and anonymity.

6. Biometric Payments: This innovative approach utilizes data such as fingerprints or facial recognition for authentication making payments more secure and user friendly.

7. QR Code Payments: QR codes can be scanned by smartphones enabling payments without the need, for cards or cash.

As technology advances the world of payments is set to evolve and expand offering seamless and efficient ways to conduct transactions in today’s era. Trends in digital payment as we see in 2023 will bring in a complete change in the global economic system, especially when payment solution companies start integrating AI for a better customer experience and results.

Advantages of Digital Payments

In the changing landscape of finance digital payments have emerged as a game changer transforming the way we transact and do business. With technology constantly evolving, adopting new payment methods bring benefits to individuals, businesses and society as a whole. Let’s explore some advantages that come with using payments.

Convenience and Accessibility

One of the benefits of digital payments is the unmatched convenience they offer. Users can easily make transactions from the comfort of their homes. Or, while, on the go with just a few taps on their smartphone or clicks on their computer. This level of accessibility allows people to manage their finances effectively making it simple to make payments and keep track of spending.

Speed and Efficiency

Traditional payment methods like checks or cash often involve time consuming processes, for both consumers and businesses. In contrast digital payments enable real time transactions that significantly reduce the time required to complete exchanges.

The use of fund transfers, automatic bill payments and fast checkout processes has become the practice saving valuable time, for everyone involved.

Improved Security

When it comes to digital transactions, security is of importance. Digital payment methods incorporate security protocols to protect data and prevent fraudulent activities. Measures such as encryption, tokenization and two factor authentication are implemented to ensure transactions and safeguard user information. As a result users can feel more confident about using payment platforms.

Cost Efficiency

Digital payments offer cost efficient solutions for both consumers and businesses. Customers can enjoy reduced fees when conducting transactions compared to banking services or money transfers. Similarly, businesses can benefit from transaction costs, payment processes and reduced reliance on physical cash handling.

Financial Inclusion

Digital payments play a role in promoting inclusion especially in underserved or remote areas. With the increasing internet and smartphone penetration worldwide more people have access to payment platforms. This helps break down barriers that limited individuals access, to financial services. The inclusion of these individuals empowers them to participate in activities. Effectively manage their finances.

Transparency and Accountability

Digital payment systems offer increased transparency and accountability by generating electronic transaction records. This is advantageous, for businesses as it enables them to maintain records and easily track cash flows. For consumers it provides the ability to monitor spending patterns and review transaction histories contributing to management.

Environmental Impact

The adoption of payments also has environmental implications. By reducing reliance on paperwork, checks and cash digital payments help reduce paper waste and energy consumption associated with printing and transportation. This aligns with sustainability efforts. Contributes to a greener ecofriendly future.

Overall, the advantages of payments are undeniable. Their convenience, speed, security, cost effectiveness and positive impact on inclusion and the environment make them an appealing choice for individuals and businesses. With advancements we can anticipate even more innovations, in the realm of digital payments that will further enhance our financial experiences and transform how we interact with money in the digital age.

Key Digital Payment Trends to Watch in 2023 And Beyond

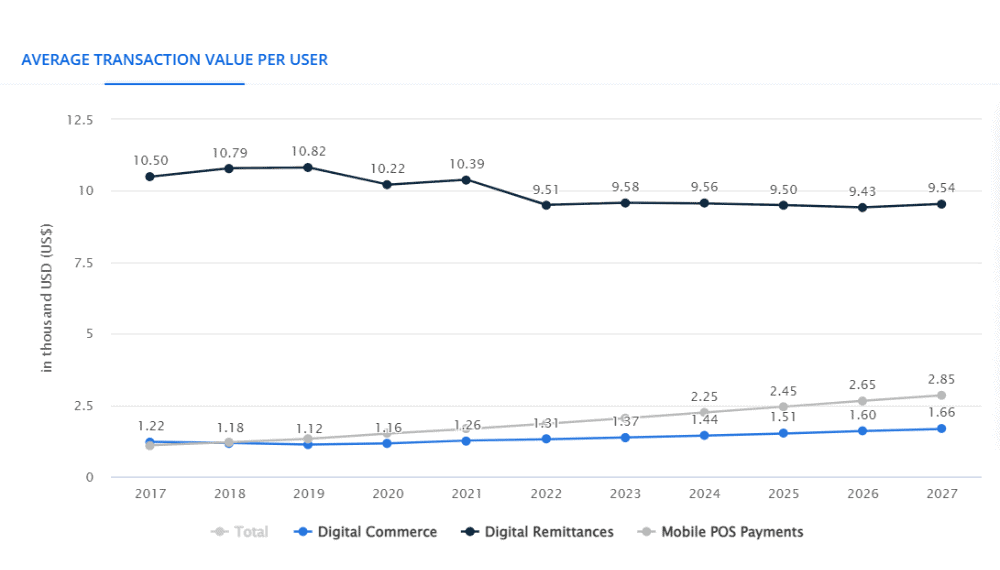

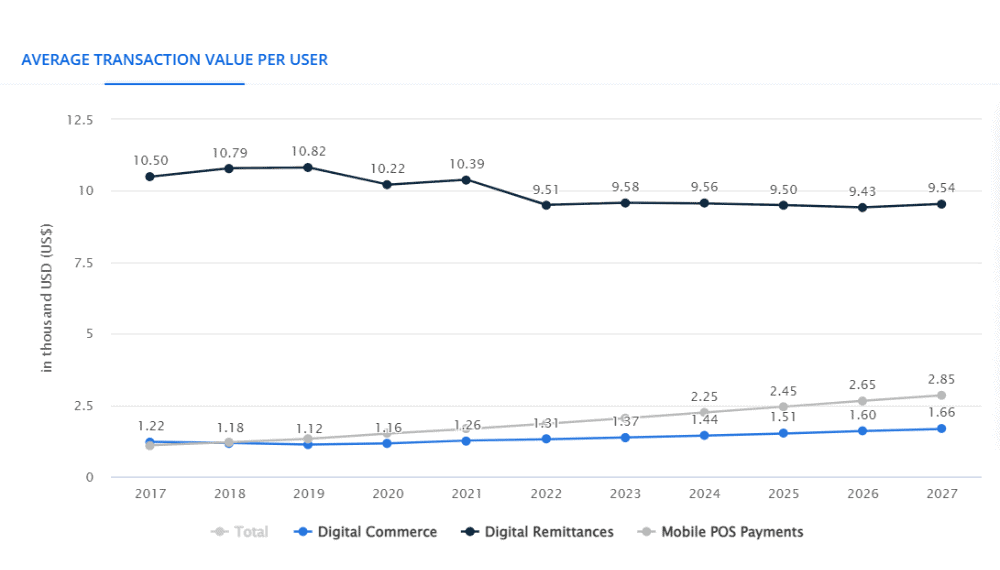

Global average transaction value per user for digital commerce, digital remittances and mobile POS payments. Data source

The landscape of payments is always evolving. As we step into 2023 exciting trends are shaping the future of transactions.

The world of transactions is undergoing a transformation thanks, to advancements like mobile first fintech solutions and the emergence of central bank digital currencies. In this article we’ll delve into the trends in digital payments to keep an eye on in 2023. These trends in digital payments are poised to have an impact on the financial ecosystem.

Mobile First Fintech

Mobile fintech solutions continue to dominate the landscape of payments. With the increasing penetration of smartphones businesses are harnessing apps and platforms to offer convenient payment experiences. From wallets to peer-to-peer payment apps consumers can now perform transactions effortlessly while on the move. A few taps on their devices enable purchases and fund transfers. As we look ahead to 2024 we can anticipate innovative mobile payment solutions that cater to the evolving needs of tech savvy consumers.

Data Privacy and Security

As digital payments become more prevalent ensuring data privacy and security remains paramount. The rise in cyberattacks and data breaches has underscored the importance of security measures for safeguarding financial information. In 2023 and beyond there will be an increased focus, on enhancing security protocols through encryption methods, multi factor authentication and biometric verification – all aimed at ensuring secure digital transactions.

![]() Read more: A comprehensive guide on data security for merchants

Read more: A comprehensive guide on data security for merchants

E commerce

The field of e commerce has seen growth in years and this upward trend is expected to continue in 2023. As more and more people shift towards shopping digital payment platforms play a role, in facilitating smooth transactions for consumers. To cater to audience, eCommerce businesses are likely to offer payment options such as digital wallets, cryptocurrencies and more. This approach aims to enhance customer convenience and further boost the industry’s growth.

Digital Identity Verification

As cyber threats become increasingly sophisticated authentication methods are also evolving. In 2023 we can anticipate advancements in identity verification techniques that include verification, behavioral analytics and blockchain based solutions. These technologies will contribute to establishing a seamless process for verifying one’s identity while reducing the risk of fraud. Ultimately, they aim to provide users with a frictionless payment experience.

![]() Recommended: Common challenges of identity verification that that a business face

Recommended: Common challenges of identity verification that that a business face

Changing Regulatory Environment

The digital payments industry operates under evolving regulations and compliance requirements. Governments and regulatory bodies worldwide closely monitor this sector to ensure consumer protection, data privacy and fair competition. In 2023 we can expect updates in existing regulations as the introduction of new frameworks designed to address emerging challenges and promote responsible innovation, within the realm of digital payments.

Customer Communication

Effective communication with customers is crucial in the payment field as it helps build trust and loyalty. In the year 2023 businesses will increasingly utilize customer support through chatbots, AI powered assistants and social media platforms to engage with customers promptly and efficiently. These enhanced communication channels will not assist in resolving issues. Also provide real time transaction updates ultimately fostering stronger relationships with users.

Sustainability and Ethics

Sustainability and ethical considerations are becoming more important across all industries, including payments. Consumers are now more aware of the social impacts of their choices, which has prompted businesses to adopt eco practices and ethical frameworks. In 2023 we can expect digital payment providers to take steps towards reducing their carbon footprint while promoting inclusion and adhering to ethical standards in their operations.

Embedded Finance

Embedded finance is an emerging trend that seamlessly integrates services into financial platforms. For instance, retail apps now offer in app purchases and financing options. This trend blurs the lines between banking services and everyday consumer experiences making financial services more accessible and convenient for everyone. In 2023 we anticipate collaborations, between fintech companies and non-financial entities as they strive to offer embedded finance solutions.

![]() Recommended:

Recommended:

What is embedded finance

Embedded finance trends for 2023 and beyond

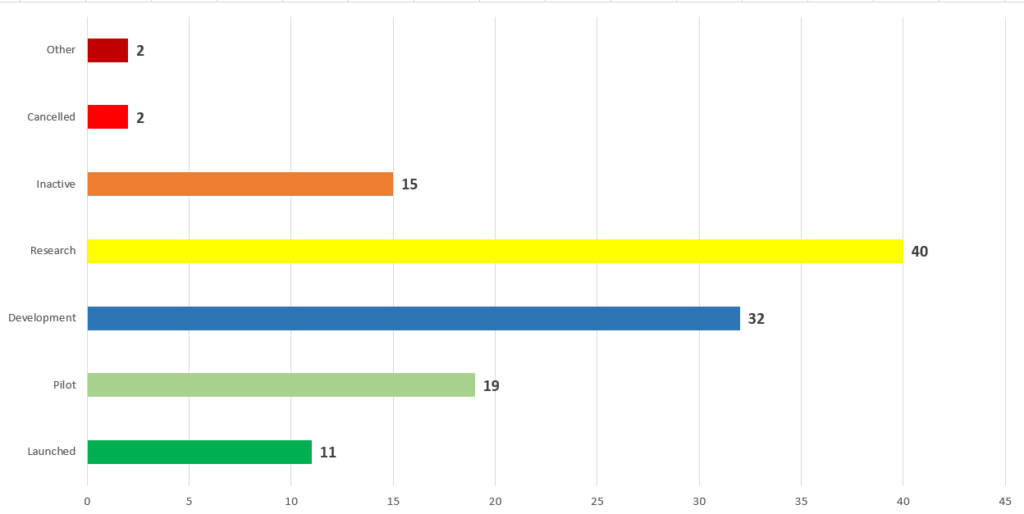

Central Bank Digital Currencies (CBDCs)

Many central banks, around the world are currently exploring the idea of introducing their currencies, commonly known as CBDCs. These digital versions of currencies have the potential to bring about a revolution in the realm by improving payment efficiency reducing costs and promoting financial inclusion. In the year 2023 we can expect to see pilot programs and trials of CBDCs taking place in countries as central banks continue to study and assess their implications for implementation.

The year 2023 holds promise for transformations in digital payments. This will be driven by advancements in technology shifts in consumer behavior and changes, in frameworks. The trends outlined here regarding payments will shape the future of transactions and contribute to a more seamless, secure and inclusive global financial ecosystem. As businesses and consumers embrace these trends the world of payments is set for an evolution that promises remarkable developments.

![]() Recommended: Watch our video on digital payment trends in 2023

Recommended: Watch our video on digital payment trends in 2023

Why Should Businesses Consider Following Digital Payment Trends?

There are reasons why businesses should seriously consider adopting digital payment trends. By embracing these trends businesses can position themselves to thrive within a changing landscape while meeting the evolving expectations of their customers.

There are reasons why businesses should consider embracing digital payment trends:

1. Customer Convenience: As digital payment methods become more widespread customers have come to expect businesses to offer secure ways to make transactions. By adopting payment trends businesses can meet these expectations providing customers with user friendly payment options. Offering a variety of payment methods helps cater to customer preferences enhancing overall satisfaction and encouraging repeat business.

2. Gaining an Advantage: In today’s market it is crucial for businesses to stay ahead of the curve in order to stand out from their rivals. Embracing payment trends can provide an edge by offering superior payment experiences compared to competitors who rely solely on traditional payment methods. This advantage not only attracts customers but also retains existing ones positioning the business as an innovative and customer centric brand.

3. Enhancing Efficiency and Cost Savings: Digital payment methods often streamline processes reducing the burden, on businesses. Through automation of tasks like digital payment processing, invoicing and reconciliation valuable time and resources can be saved for employees to focus on tasks. Furthermore, digital payments tend to be more cost effective than methods due to transaction fees and reduced reliance, on physical paperwork.

4. Improved Security and Fraud Prevention : Although there are concerns regarding security, with payment methods they actually provide protection against fraud in comparison to traditional payment methods. Numerous digital payment platforms include security measures, like encryption, tokenization and multi factor authentication all of which contribute to safeguarding financial information. By assuring customers that their data is secure and protected businesses can establish trustworthiness.

5. Expanding Horizons and Entering New Markets: The advancements, in payment methods have made it possible for businesses to go beyond boundaries and effortlessly access international markets. We already are witnessing a revolution in digital payment in healthcare market and construction industry.

By offering digital payment options companies can now sell their products and services to customers worldwide without being limited by cash or location-based transactions. This global reach opens up opportunities for businesses to explore revenue streams and drive growth.

6. Insights from Data and Personalized Experiences: Digital payment platforms generate insights about customer behavior spending habits and preferences. Businesses can leverage this data to gain an understanding of their customers enabling them to create marketing campaigns and tailored offers. With the help of data driven insights companies can optimize their strategies enhance customer engagement and boost revenue growth.

7. Compliance with Regulations: The payment landscape is subject to regulatory requirements and standards. To safeguard themselves from financial risks businesses, need to stay updated with the digital payment trends. Complying with regulations such as data protection laws and industry standards not ensures legal compliance but also builds trust among customers, vendors and partners.

8. Contributing Towards Environmental Sustainability: Digital payment trends play a role in promoting sustainability by reducing reliance, on paper based transactions. By embracing eco practices through payments instead of physical paperwork businesses contribute towards a greener future.

By encouraging customers to choose receipts and opt, for paperless billing businesses can actively contribute to reducing the impact on the environment in it’s own small way. In todays paced world driven by technology, businesses should view adopting digital payment processing as a strategic necessity.

Embracing these trends enables businesses to meet customer expectations gain an edge enhance efficiency improve security measures and access markets. By staying of the game and embracing payment solutions businesses can position themselves for growth, success and sustainability in the digital era.

The evolving digital payment trends of 2023, offer an opportunity for businesses to embrace innovation enhance customer experiences and drive growth. From the adoption of first fintech solutions, to exploring central bank digital currencies (CBDCs) the financial landscape is experiencing thrilling advancements.

By embracing these digital payment processing trends into their operations businesses can lead in the revolution by offering secure and efficient payment options that align with customer expectations. Embracing these payment trends not only provides a competitive advantage but also fosters trustworthiness regulatory compliance and contributes towards building a more sustainable future.

As we move forward in 2023 and beyond, companies that actively adapt to these trends will surely thrive in the evolving realm of payments.

Frequently Asked Questions (FAQs)

What is the future of digital payment industry?

The digital payment industry has seen a significant change during the last few years. And these digital payment trends are going to continue for long due to AI and fast technological evolution. The future of digital payment industry is bright.

Are digital payment secured?

Absolutely! Digital payments incorporate security measures, like encryption, tokenization, biometric authentication and multi factor verification to safeguard financial information and prevent any fraudulent activities. However, it's crucial for users to follow security practices and utilize trusted platforms for transactions.

Types of digital payments – What are they?

There are payment methods at your disposal, including mobile wallets, online banking, contactless payments, peer, to peer transfers, cryptocurrencies, QR code payments and more.

Can digital payments be used for international transactions?

Yes. Many digital payment platforms support transactions that enable businesses and individuals to conduct border payments and facilitate global trade.

Are digital payments environmentally friendly?

Indeed! Digital payments can contribute to friendliness when compared to payment methods involving physical paperwork and cash handling. By promoting paperless billing and utilizing receipts businesses can reduce their footprint.

What's embedded finance?

Embedded finance is an emerging trend where financial services seamlessly integrate into financial platforms.