When managing personal finances, prioritizing security is crucial, particularly regarding online banking and digital payment services like Plaid. Plaid is considered a reliable method to securely link your bank or other financial institution with apps, facilitating the seamless sharing of necessary data for app functionality. Whether you’re signing up for a new app to make payments, manage finances, secure a loan, or invest, the sign-up process may require sharing specific financial information.

So, what is Plaid? Is Plaid safe? Before linking your accounts, you might find the answer to your questions. This article aims to provide you with a comprehensive understanding of how Plaid operates. We’ll get into the security measures Plaid implements to safeguard user data and finances, ensuring your information remains secure throughout your service use.

What Is Plaid?

Plaid stands out as a financial technology platform founded in 2012, facilitating the seamless connection of user bank accounts with various apps and services to streamline financial management. Rapidly gaining popularity, Plaid has become a go-to tool for both fintech companies and consumers alike.

Essentially, Plaid is the intermediary between financial services and their users. Apps such as Robinhood, Venmo, Wave, and Drop leverage Plaid to link user accounts to their platforms securely. This strategic approach ensures that these financial apps never directly access your information; instead, they rely on Plaid to furnish the necessary data. With over 8,000 apps and more than 12,000 financial institutions utilizing Plaid, many apps depend on its capabilities to effortlessly establish secure financial connections with their users.

Plaid operates through a series of APIs (Application Programming Interfaces) that facilitate secure data transfer between financial institutions and third-party applications. Plaid’s API can efficiently gather data on balances, transactions, and other account details. Additionally, the company provides authentication and identity verification features, reinforcing user security.

A notable advantage of Plaid lies in its provision of a robust infrastructure for developers to construct financial applications. By eliminating the need to create data-sharing solutions from scratch, Plaid saves both time and money, enabling various companies to introduce new financial products and services to the market effortlessly.

How Do Plaid Work?

Plaid basically acts as the crucial link between your bank account and the applications you use. Through a streamlined process that eliminates the need for temporary test deposits or extensive paperwork, Plaid’s software efficiently connects new users to their banks for swift identity verification, often with just a copy of their passport or another identification document. Here’s a concise breakdown of the process:

- Users open the app, pick what they want to buy, and hook up their bank accounts.

- Important details are collected, locked, and bundled up, then shot off to your bank’s computer via Plaid’s custom-built code machine, fitted to suit each unique platform.

- Your bank does its thing, double-checking your account’s life and cash and replying with the go-ahead.

- Plaid’s clever code checks out all this info and the user too, laying down the tracks for smooth sailing when shopping, trading, or bidding in auctions on the Plaid platform.

While the process may appear straightforward, its absence would necessitate constant contact with the bank for identity and account verification. Plaid not only simplifies these interactions but also goes the extra mile by developing and implementing robust systems to guard against data theft, account overdrafts, and fraud during transactions.

Plaid also makes accessing various data points like user details, transactions, and account specifics easy. It works well within certain apps, eliminating the need for its app or separate account. Users choose their bank, enter their login information in the app, and share the necessary data with trusted third-party apps. To get how safe Plaid is, you need to understand APIs. APIs, short for Application Programming Interfaces, help different software programs work together smoothly.

For example, adding a payment method to an online store via an API connection simplifies the card payment process. It only redirects the customer here. In the same way, Plaid’s strong API works like a go-between. It securely links apps to bank accounts, ensuring data is shared efficiently. Developers can ask Plaid for unique API keys, allowing easy, real-time access to critical financial data.

Where Else Is Plaid Used?

Plaid finds its application in various apps you may download, particularly those requiring access to your financial details, such as transaction history, account balances, investments, or payments. These apps utilize Plaid for a secure and seamless connection to your bank or other financial accounts.

The range of apps incorporating Plaid is diverse and continually expanding. Some key areas where Plaid is commonly used include:

- Mobile banking: Varo, Chime, M1 Finance, and MoneyLion

- Saving and investing: Acorns, Digit, Qapital, and Ellevest

- Personal finance: YNAB, Albert, Truebill, and Copilot

- Payments: WorldRemit, Venmo, Cash App, and Metal

- Lending: SoFi, Petal, Avant, and Figure

These are just a few examples, and the list of apps integrating Plaid continues to grow, showcasing its versatility across various financial domains. And in every case, a link to your bank account becomes essential for fintech apps to deliver their services. By accessing your Plaid Portal, you gain visibility into the shared data with each app and the reasons behind it.

Why do various fintech apps, including these, opt for Plaid? Connecting directly to an external banking institution, let alone managing connections with thousands, proves impractical for most apps. The complexity and cost associated with establishing and sustaining such connections make it a challenging endeavor. Plaid addresses this issue by already having the requisite technological infrastructure in place. This infrastructure facilitates seamless and compliant connections between banks and services. As a result, numerous financial platforms can effortlessly integrate Plaid’s banking API, saving resources and ensuring the security of their products.

What Does Plaid Bank Verification Mean?

Plaid’s platform offers an adept bank validation process. It checks the account ownership and balance accurately and safely. The hassle-free process starts when users are moved from their app to Plaid. It’s a protected platform that’s known for keeping user data safe. Using the newest encryption methods and high-tech gear, Plaid ensures each user’s details are checked safely before any data swap happens.

Plaid establishes a secure connection between your bank account and the applications requiring financial information. Through this connection, Plaid efficiently retrieves the necessary data for your financial applications while protecting your sensitive information. Whether it’s your account balance or the essential account numbers needed for deposits or withdrawals, Plaid retrieves this data using encrypted and safeguarded tokens, ensuring the confidentiality of your actual account information.

Is Plaid Secure?

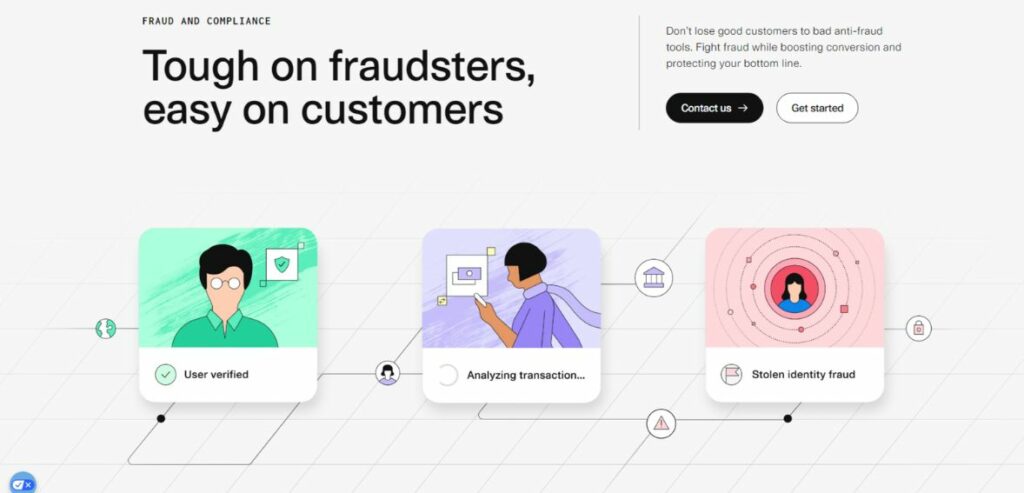

Like many companies involved in transferring financial information, Plaid emphasizes its commitment to the security of customer data. When transmitting financial data, plaid employs robust encryption protocols, including the widely recognized Transport Layer Security (TLS) and Advanced Encryption Standard (AES 256). The use of these secure settings during data transmission aims to instill an additional layer of confidence in users.

Beyond adhering to top-tier security protocols for data handling, Plaid implements various other security best practices to ensure the ongoing safety of your information. This multi-faceted approach reflects Plaid’s dedication to maintaining a secure user environment. Plaid implements several security protocols to safeguard customer data:

- Data Encryption: Plaid prioritizes the security of sensitive data during the bank account linking process by instantly encrypting it. This encryption, a standard practice in information security, shields data from unauthorized access by encoding it. And as mentioned, Plaid employs a combination of AES 256 for safeguarding stored data and TLS to protect data during transmission.

- Strong Authentication: Plaid employs Multi-Factor Authentication to enhance the security of sensitive data. This form of authentication demands an additional layer of verification beyond usernames and passwords for accessing internal systems.

- Independent Security Testing: Plaid engages external parties for regular security audits and stress tests to fortify information security measures.

- Robust Monitoring: A pivotal element of Plaid’s information security program is its continuous monitoring system. Automated alerts and a 24/7 on-call team enable Plaid to uphold its commitment to vigilant security.

- Compliance with Safety: Plaid keeps everything legal, strictly following data safety laws like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act). They keep your details safe by sticking close to these rules. They also follow industry norms like PCI DSS (Payment Card Industry Data Security Standard). This helps keep credit card info secure. Plaid’s focus on rules and standards ensures that their services are secure and reliable. This is comforting to their clients.

- Consent: Plaid strictly follows the rules when they share data and only do it after a user’s okay. They follow strict steps to fulfill the user’s consent. It’s the basic block for how Plaid works. They ask very carefully before they see and share important money information with other apps. Plaid thinks being open and answerable is very, very important.

Moreover, Plaid adheres to globally recognized security standards, namely ISO 27701 and ISO 27001, and participates in annual SOC 2 compliance audits. These certifications underscore Plaid’s active dedication to protecting customer data.

How Does Plaid Ensure Safety?

Plaid’s unwavering commitment to safety and security is evident in its meticulous approach to addressing concerns. The company prioritizes data security and user privacy with state-of-the-art encryption techniques, ensuring that sensitive information remains shielded from unauthorized access or manipulation. Robust authentication protocols further fortify this protective barrier, allowing only verified users to access their accounts.

To sustain a high level of trust, Plaid conducts regular audits to identify and promptly address potential vulnerabilities, showcasing a dedication to professionalism and user information protection. Plaid also respects users’ autonomy over their data-sharing preferences, ensuring they maintain complete control over when and how their information is shared with third-party applications.

Transparency is a cornerstone of Plaid’s operations, as evidenced by a clear privacy policy outlining how personal data is handled within the system. In addition to these proactive measures, Plaid maintains vigilant monitoring systems, ready to respond swiftly to any suspicious activities or breaches. This not only reflects their expertise but also underscores their relentless pursuit of preserving user safety in an informed manner.

How Does Plaid Safeguard Your Privacy?

The platform lets you manage exactly how and where your info is used. Put simply, you decide what specific data apps you can use. This control allows you to pick and choose what financial aspects to share, ensuring a custom-fit experience within your comfort zone. It’s your say on balances, account numbers, investments, transactions, student loans, account profile info, and credit card information when using Plaid.

Adding weight to their privacy pledge, Plaid is firm on protecting your data. Their private safeguard policy strictly declares no selling or renting of any personal info given to them. Instead of trading secrecy for profit, Plaid shares important data with companies only you’ve okayed and just when you give the green light. It’s Plaid’s way of upholding users’ privacy and trust.

How Plaid Manages Your Data?

Plaid doesn’t just promise transparency about data use and collection through the Plaid Portal, but they also go further to make sure their users feel safe with their information. How does Plaid’s privacy policy help? It ensures your personal financial details won’t be shared unless you say yes. Another thing, Plaid avoids selling or offering user data to outsiders.

What about how customer data is applied? Plaid uses this information for many tasks: to deliver services, improve what’s already on offer, to keep fraud at bay, respect user privacy, give customer support, look into improper actions, meet legal responsibilities, and anything else with your green light. This way, Plaid’s dedication to taking care of user data and respecting privacy shines through.

So, Is It Safe To Allow Plaid Access To Your Bank Account?

In short, yes. Let’s delve into the specifics – Crucially, Plaid isn’t a bank or financial institution but a technology platform facilitating connections between banks and third-party applications. Consequently, Plaid doesn’t possess direct access to your bank account or financial details. When you allow a third-party app to access your bank account through Plaid, you are essentially approving Plaid to collect your financial information for that application.

This simplifies money management through a single interface or program without demanding manual data entry. Your agreement authorizes Plaid to gather the specifics of your accounts, permitting streamlined oversight and use within the third-party service. Though convenient, do consider carefully which applications receive such access.

And as we have highlighted before too, Plaid places the highest priority on safeguarding your personal information. The strongest encryption protocols available guarantee that all exchanges of data and interactions between Plaid’s system and outside programs remain completely private. Additionally, they adhere strictly to security requirements established within their industry, in full compliance with PCI DSS and SOC 2 frameworks. These standards help ensure financial details shared with Plaid remain protected.

Furthermore, Plaid uses OAuth, which is for user verification and permission, allowing consumers to manage their information and withdraw access any time needed. A comprehensive log of programs having access to your information and the data they obtain is accessible for inspection. Plaid is transparent about how it handles financial data, clearly stating its policies for accessing and distributing information. The company explains who can view data and how it shares the details. Users can choose whether or not to let Plaid distribute their records or revoke consent for particular programs.

How Much Does Plaid Cost?

Plaid comes in three plans, which are Test, Launch, and Scale. The pricing differs in different countries and depends on users’ needs. If you are confused about whether to subscribe to Plaid or not, you can always try out their Test plan. The Plaid pricing is as follows:

| Plans | Test | Launch | Scale |

| Price | Free | No Monthly Minimum (Pay as you go) | $500 |

With Test Plan – Utilizing the primary item in the product line, build and test with up to one hundred active items.

With Launch Plan – Launch your project with unlimited items and no contractual minimums.

With Scale Plan – Get tailored solutions, volume pricing, and dedicated support for your team.

With Plaid, many features come in different plans designed for different users. The Test plan lets users try out the platform for free, without any limits or trial periods – a great chance to really understand what it can do before spending any money. Within this Test plan, you get access to cool tools like Transactions Auth Balance, Payment Initiation, and unlimited test credentials built for testing. However, if you need more than just testing, Plaid also has advanced plans like Scale and Launch. These plans have more functions for more complicated needs.

Conclusion

Plaid is a powerful finance tech platform. It plays the middleman role, securely connecting users’ bank accounts with various apps. Over 8,000 apps and 12,000 financial institutions use it, proving its trustworthiness in establishing secure links. Plaid uses APIs to move data smoothly while taking care of user security. Plaid can do a lot with mobile banking, savings, investing, personal finance, payments, and loans. Its API keys give developers easy access to vital financial data, helping in quick app creation.

For Plaid, security comes first. It uses encryption, multi-factor authentication, independent security checks, and strong monitoring to fight off any threats. The company follows world-class standards and compliances, aiming to protect customer data fiercely. Plaid trusts in being open. Its privacy rules and user-control mechanisms make it a reliable platform. The platform has plans that won’t burn a hole in your pocket and can be tweaked to fit different user needs.

In short, Plaid provides a safe and quick way to link financial accounts with apps. This empowers users to handle their finances confidently.

Frequently Asked Questions

Q: What do people actually use Plaid for?

Plaid is a vital bridge between your bank data and various financial apps or services. When you integrate your bank account with a Plaid-powered app, Plaid gets paid a fee for the service of creating that link. On the bright side, Plaid itself is free for users of any of these apps. This lets them connect their bank accounts to whatever other app they are using in mere seconds, making the transactions seamless.

Q: Why is Plaid important?

When it comes to financial data, you want someone trustworthy to handle it. People trust Plaid for just that reason. The point of Plaid is not just to keep your information safe but also to only give out what’s necessary in order for things like apps or banks to work properly.

Q: Is Plaid safe?

Yes. This company goes above and beyond when it comes to security measures. And once you’re already linked via this platform, the system encrypts any sensitive information before sending it over in a secure manner through a separate connection.

Q: Who uses Plaid?

To name drop just a little few, some big names adopt this linking method from major banks like Bank of America, Chase, Citi, Wells Fargo, USAA, US Bank, PNC, Fidelity, TD Bank Capital One Navy Federal SunTrust BB&T and more.