Merchant Services and Credit Card Processing Done Right Get the payment processing solution that fits your business

Host Merchant Services (HMS) is a payment processing company that provides credit card and electronic payment processing services to merchants. We provide merchant services payment systems for all businesses. Get a credit card processing system customized for mobile payments, point of sale, e-commerce credit card processing, EMV terminals, and more. We will greatly reduce your merchant services fees while substantially improving the customer service you receive. Browse a credit card processing type below or submit any contact form, and a merchant services payment specialist will reach out to start building a relationship.

Retail Processing

Simple, low-cost, in-person credit/debit card processing with or without a POS.

Restaurant Processing

Restaurant processing through a POS, terminal, or mobile device.

Ecommerce Processing

Accept credit and debit card payments on your online store.

Mobile Processing

Process anywhere, with or without service on a plethora of devices.

Don't see your industry? From medical and construction to veterinary and automotive, we have a merchant services solution for all of your credit card processing needs. Click on Merchants in the Menu to find your industry, or contact us to find out about credit card processing terminals, point of sale, mobile payments, and solutions for every business type!

Get Your FREE Merchant Services Account Review and Quote!

Or Call us! 877-517-HOST (4678)

Merchant Services Made For You

We provide merchants of all types with payment processing and point of sale systems. We use straightforward pricing, no cancellation fees, and fantastic customer service making us the last merchant services company you will ever want.

-

No Cancellation Fees

Our excellent customer service and low rates retain customers, not termination fees. Cancel anytime but we bet you won't want to.

-

No Up-Front or Hidden Fees

No setup fees and no hidden charges. Just the lowest merchant services rates available.

-

Free Equipment Program

Qualify for a free EMV compliant mobile swiper or terminal with a merchant account.

-

24x7x365 Customer Service

We are always here for you with access to industry-leading customer service 24 hours a day – 7 days a week – 365 days a year.

-

Lifetime Rates

Experience the freedom of locked-in credit card processing rates that won't increase over time.

-

Business Tools

Get more for your business with Host Merchant Business Solutions – from websites and email to customer analytics and more.

-

Payment Processing

Accept all credit and debit cards at your business with the lowest transaction rates on the market with your Host Merchant account.

-

Point Of Sale

We offer the latest POS systems including Clover POS, Vital POS, SwipeSimple, and more. From retail to restaurants and everything in-between.

Founded On Fantastic Service

Host Merchant Services was founded in 2010 and was structured around a strong backbone of customer service. 11 years and thousands of happy merchants later, customer service is still our number one priority. In fact, our merchant support team is 4x larger than our sales team! We don’t believe in hold queues either, so you’ll never have to wait in line. When you’re with Host you’ll get first-class treatment!

Top-Rated Merchant Services What Our Clients Are Saying

Our merchants love us and it shows. We are top-rated in the Better Business Bureau, Consumer Affairs, and Card Payment Options. Our #1 priority is merchant satisfaction! Find out why we are the top rated credit card processor in the world!

“Host Merchant Services has been an excellent partner for enabling credit card processing services in our gym software. They are a great fit because, in addition to providing technical support for our software integration, they match our focus of providing excellent customer service and cost savings for the gyms that use our software.”

– Mike Spencer, RX Gym Software

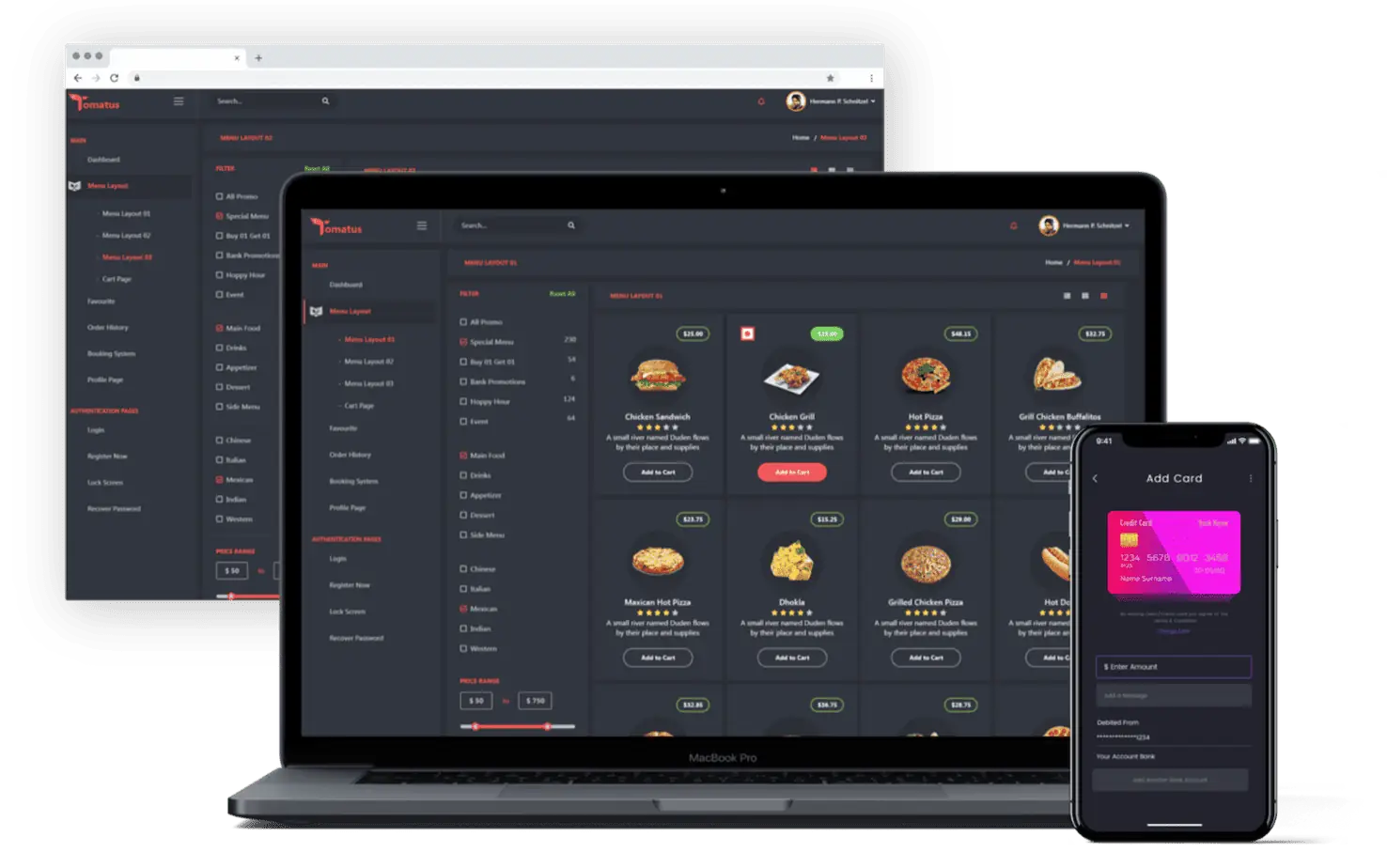

Integrate Payment Processing Into Your Software

You’ve created an app but need to integrate payment processing. You’ve come to the right place! We offer custom direct integrations with an easy-to-use API and a broad range of terminal solutions. We specialize in helping ISVs and SaaS providers integrate payments seamlessly into their software.

Merchant Services And Credit Card Processing News

Joann Stores Closures and Layoffs: Joann Fabrics and Crafts Stores File Bankruptcy

With mounting debt, changing customer tastes, diminishing sales, and rising expenses, Joann Inc., a retailer of crafts and fabric, is now facing bankruptcy, which was…

List of Walmart Stores Closing in 2024

Four months into the new year, we are beginning to see more precise patterns in retail performance from the busy Q4 holiday shopping period, identifying…

Let's Get Started

Not sure where to start? Call us or click Get Started below and our merchant services experts will guide you to the perfect solution that meets your needs.