With mounting debt, changing customer tastes, diminishing sales, and rising expenses, Joann Inc., a retailer of crafts and fabric, is now facing bankruptcy, which was all but inevitable. Joann filed for Chapter 11 bankruptcy. Despite the financial obstacles, the Hudson, Ohio-based corporation plans to continue operating Joann stores at more than 800 locations during the restructuring process. According to Joann, the company owes between $1 billion and $10 billion. According to the bankruptcy documents, the company’s financial health is significantly impacted by a fall in consumer interest and higher costs associated with delivering goods internationally.

Joann expects to reduce its financed debt by approximately $505 million as part of its restructuring activities. Joann has acquired around $132 million in new funding, which is said to be a significant step forward in enabling the stores to continue operating.

Key Takeaways

- Joann Enters Chapter 11 Bankruptcy Protection Amid Shifting Consumer Trends: Joann Fabric and Crafts Stores filed for Chapter 11 bankruptcy due to a drop in disposable income and a loss of interest in doing crafts at home, indicative of larger shifts in post-pandemic consumer behavior.

- Continued Operations During Restructuring: Joann plans to continue operating its more than 800 stores and its online platform while filing for bankruptcy, providing consumers and stakeholders with continuous service.

- Financial Restructuring and Debt Reduction: Joann’s efforts to procure $132 million in fresh funding and curtail its financed debt by about $505 million signify a crucial stride towards reorganizing its capital structure and bolstering continuous operations.

- Challenges and Future Prospects: The bankruptcy filing underscores challenges such as increased costs, declining sales, and intensifying competition in the crafts market. Joann’s ability to adapt to evolving consumer preferences and streamline operations will be critical for its future success amidst changing market dynamics.

Joann Files for Chapter 11 Bankruptcy Protection Amid Shifting Consumer Trends

Fabric and crafts retailer Joann has entered Chapter 11 bankruptcy protection due to a downturn in discretionary spending and a drop-off in pandemic-era hobbies. In a statement released Monday, the company, headquartered in Hudson, Ohio, announced its anticipation to exit bankruptcy by the end of next month. Post-bankruptcy, Joann is expected to transition to private ownership by certain lenders and industry stakeholders, which means its shares will no longer be listed on public stock exchanges.

Joann’s more than 800 locations and website will stay open during the reorganization. Thanks to a financial deal obtained with the majority of its shareholders, the company has guaranteed that payments to vendors, landlords, and other trade creditors will not be disrupted.

In addition to its recent bankruptcy filing in the U.S. Bankruptcy Court, Joann announced it has secured approximately $132 million in new financing and anticipates reducing its funded debt by roughly $505 million.

Scott Sekella, Joann’s CFO and co-leader of the interim CEO office, remarked that the transaction support agreement represents a crucial advancement in restructuring the company’s capital framework. He emphasized that the retailer is dedicated to maintaining normal operations and continuing to serve its millions of customers across the country.

Joann’s bankruptcy comes when overall discretionary spending is slowing, and consumer interest in at-home crafting activities is waning, especially compared to the surge experienced at the onset of the COVID-19 pandemic.

Neil Saunders, Managing Director of GlobalData, noted that the crafting sector, which thrived during the pandemic, is now experiencing a modest decline as people shift their focus and spending towards outdoor experiences like dining out or attending sporting events. This shift is creating challenges for all players in the crafts market. Saunders also pointed out specific hurdles for Joann, including significant debt and intensifying competition.

Joann had a brief period of time as a publicly traded firm. Motivated by a notable surge in sales, the store launched a $100 million IPO in early 2021. Comp sales in the first ten months of 2020 increased by more than 24%. This increase was mostly brought about by the social isolation and lockdowns imposed during the epidemic, which led to increased crafts being done at home.

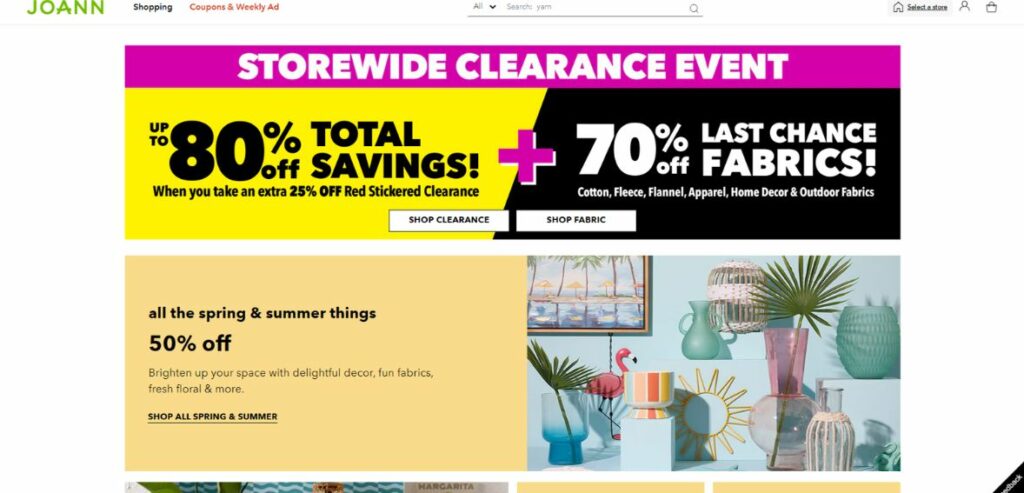

However, as pandemic restrictions eased, the initial surge in interest waned. Over the past few years, consumer spending has shifted away from discretionary purchases, with shoppers increasingly seeking discounts. According to Neil Saunders, Managing Director of GlobalData, crafters have turned to more economical options like Hobby Lobby or online shopping. Saunders also noted that Joann is partly to blame for its challenges, citing a decline in store standards and customer service, often due to staffing reductions.

These issues have made physical stores less appealing, while the convenience of online shopping from various craft supply websites has grown. Despite efforts to enhance its own website, Joann has seen limited success in countering these trends.

In February, Joann shut down its Wooster store, following the closure of its Zanesville location in January. The company, which has been in business for approximately 80 years, also experienced layoffs at its Hudson headquarters last year. Joann reported a 4% decrease in revenue in December, failing to meet analysts’ expectations as it struggled to regain stability post-pandemic—a period that had initially boosted sales and interest in home-based hobbies.

According to the most recent city data, Joann is the largest employer in Hudson, with 979 employees as of last January.

What Would Bankruptcy Mean for Joann Stores and Customers?

Image source

Should Joann proceed with a bankruptcy filing, legal experts indicate that customers would likely see little change in the retailer’s day-to-day operations. The primary goal of such filings is to reorganize the company’s finances and restructure its debt, aiming to preserve the fundamental aspects of the business.

During the restructuring process, efforts to reduce expenses might lead to further store closures, mainly targeting underperforming or costlier locations, as part of a strategy to streamline operations.

About Jo-Ann Stores LLC

A division of Joann Inc., Jo-Ann Stores LLC is a specialty retailer that specializes in textiles and craft products. The company sells a wide variety of goods, such as frames, scrapbooking equipment, crafts, paper crafts, faux flowers, sewing supplies, home decorations, seasonal goods, and different do-it-yourself (DIY) projects.

These goods are sold under several national and exclusive labels, including Jo-Ann Sensations and Fabric and Craft. Jo-Ann Fabric, Jo-Ann, and Jo-Ann are the store names under which Jo-Ann oversees its retail activities. The business also sells its goods online at joann.com, its e-commerce platform. Jo-Ann’s corporate office in the United States is in Hudson, Ohio.

Conclusion

Joann’s filing for Chapter 11 bankruptcy reflects a culmination of challenges stemming from evolving consumer preferences, mounting debt, and shifting economic landscapes. Despite the adversity, the company remains committed to preserving its operations across its extensive network of stores and online platforms.

Joann aims to emerge from bankruptcy with a strengthened financial footing with a focus on securing new financing and reducing debt. However, uncertainties persist regarding potential store closures and the overall impact on customers and employees. As Joann navigates this restructuring phase, its resilience and ability to adapt to changing market dynamics will be crucial in determining its future success in the competitive fabric and crafts retail sector.