Fidelity National Information Services, Inc. (FIS) has achieved another significant milestone in its ongoing commitment to delivering secure and user-friendly open banking solutions to its customers. As a leading global fintech firm, FIS has strategically partnered with prominent data networks, including Envestnet | Yodlee, Akoya, Plaid, and MX. This collaborative effort is part of FIS’s Open Access platform advancement, representing a focused approach to open banking services. Through this initiative, individuals will have the capability to securely and efficiently share their financial data with a broader range of third-party financial applications and services, thereby enhancing convenience and accessibility.

Key Takeaways

- FIS Advances Open Banking Landscape: Fidelity National Information Services, Inc. has made significant strides in reshaping the financial sector by spearheading open banking solutions. The strategic collaboration with data networks Envestnet | Yodlee, Akoya, Plaid, and MX marks a crucial step towards fostering secure and user-friendly financial experiences.

- Open Access Platform Enhances Data Sharing: FIS’s introduction of the Open Access Platform within the open banking framework signifies a groundbreaking solution. This platform enables consumers to securely share financial information with third-party applications, emphasizing transparency, user control, and adherence to data protection standards.

- Empowering Consumers with Data Control: The FIS-backed open banking solution facilitates seamless and secure data sharing and gives users complete control over their information. The detailed access to personal data and the ability to restrict access at any time place consumers in the driver’s seat, ensuring transparency and privacy.

- Strategic Collaboration with Banked for Innovative Payments: FIS’s strategic partnership with Banked reflects a commitment to pioneering innovative payment options. The introduction of pay-by-bank services, leveraging the advantages of real-time payments and open banking, promises decreased friction, reduced fraud, and enhanced efficiency for businesses and consumers. This collaboration positions FIS at the forefront of the evolving digital payments landscape, aligning with the growing digital wallets and mobile app usage trend.

FIS Takes Crucial Step in Open Banking Solution

FIS, renowned as a global frontrunner in financial technology, recently unveiled another significant advancement in its mission to democratize open banking accessibility. Discussions regarding potential collaborations are underway with industry leaders such as Envestnet | Yodlee, Akoya, Plaid, and MX, with the aim of integrating them into FIS’s innovative Open Access Platform. This platform represents a pioneering solution within the open banking framework, empowering consumers to securely share their financial data with various third-party applications and services.

Image source

This news of “integrations” comes with a growing open banking trend. The Consumer Financial Protection Bureau (CFPB) further developed the “Personal Financial Data Rights” proposal to set clear standards of consumer data accessibility and how it’s being used. This FIS-backed solution allows users to seamlessly and securely share their data with third-party providers. It allows them to see what type of information is being taken, who is using it, and how it’s being used. This detailed access to consumers ‘ personal details benefits the users as they can see what is happening behind the scenes. Plus, consumers have the choice to restrict access to data at any time.

This solution allows seamless data exchange, all thanks to the FDX APIs. Financial Data Exchange standardized (FDX) by partnering with industry-leading providers gives the most comprehensive coverage throughout the market-which means that the FIs who are using Open Access Banking by the FIS can assist their customers in accessing a wide array of capabilities and experiences through an unparalleled variety of services and applications.

Hashim Toussaint, who leads Digital Solutions at FIS, shared that people of all ages are now more frequently turning to outside apps to manage their money whenever they choose. Classic banks and credit unions must make this process smooth if they want to keep their customers and attract new ones. They believe that supporting the global shift to Open Banking is crucial to their goal of improving the way the world handles payments, banking, and investments.

FIS’s Collaboration with Banked

On the other front, FIS announced the partnership with Banked while the news of its integrations with data networks surfaced. With Banked, which is a leading provider of open banking solutions, FIS aims to introduce new pay-by-bank options for both businesses and consumers.

Image source

Pay-by-bank is a fantastic solution that also uses an open banking framework. It streamlines payments by merging the advantages of real-time payment systems with the flexibility and efficiency of open banking. Third-party financial service providers gain direct access to banking data in open banking, facilitating seamless digital payments. This enables consumers and businesses to make direct payments between their bank accounts without needing card details, sort codes, or account numbers.

Businesses get multiple benefits due to the pay-by-bank facility. Pay-by-bank is a user-friendly system that reduces fraud, lowers processing fees, and has quicker settlements than traditional payment systems. Consumers get a smoother payment experience, simplified verification processes, and faster access to funds.

Source: Global Payments Report

Seamus Smith, representing Fidelity National Information Services, emphasized the widespread desire for enhanced efficiency and speed in money transfers. Leveraging advancements in open banking, FIS is poised to introduce pay-by-bank solutions tailored for businesses and consumers, focusing on enhancing fraud prevention measures. Smith underscored the significance of FIS’s collaboration with Banked, portraying it as a pivotal stride in the company’s overarching strategy to provide seamless and secure payment solutions across diverse industries. This partnership solidifies FIS’s commitment to innovating new payment systems and furthering its efforts to meet evolving market demands.

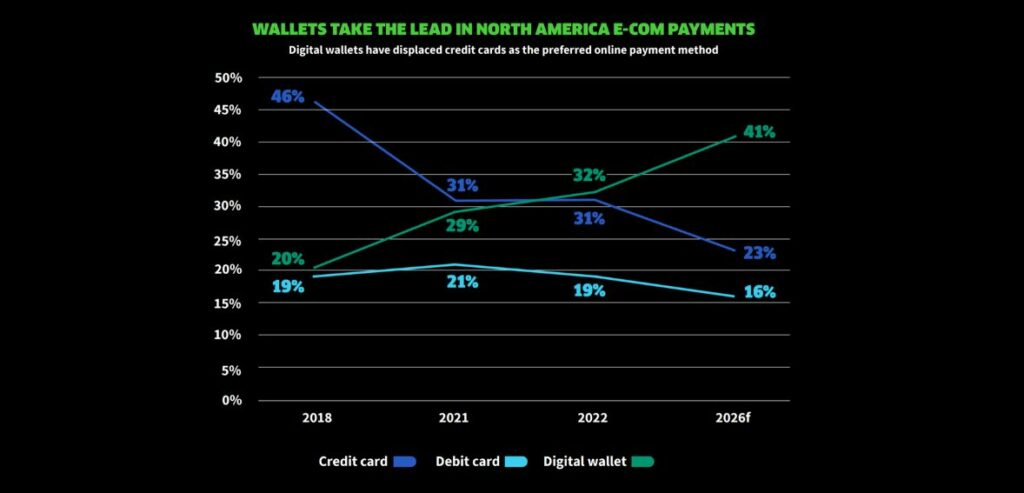

Digital payments are increasing as people prefer to use digital wallets and mobile apps for shopping. Digital wallets and mobile payments are customers’ preferred choices now. A report by FIS in 2023 revealed that transactions where you pay directly from A2A were worth about $525 billion in online sales last year. This trend isn’t slowing down either, with predictions of a 13% growth rate each year.

Source: Global Payments Report

Banked’s co-founder, Brad Goodall, is thrilled about joining forces with Fidelity National Information Services. He believes this partnership will make paying for things better for everyone. FIS is known for its innovative solutions to common problems, and Goodall is confident that pay-by-bank services will be a game-changer for many different situations, now and in the future. He’s excited to see where this partnership will lead regarding new payment options.

In 2023, Fidelity National Information Services was at the forefront of adopting instant payments by being among the first in the fintech field to test and get approval for the FedNow Service. This collaboration with Banked is set to use this momentum to shake up the payments industry, promising a brighter, more convenient payment future for all.

About Fidelity National Information Services (FIS)

Image source

Fidelity National Information Services, Inc. (FIS) is a multinational company from the US. It is one of the top-notch providers of technological solutions not just for banks but for big organizations and SMB companies across various industries worldwide. They are the key to providing innovative financial services, changing how people pay, bank, and invest, and ensuring the customers are always at the forefront with FIS’s reliable innovation, top-notch system performance, and adaptable tech.

FIS is here to help its clients tackle the business’s most significant challenges and ensure its customers have an experience, all through the magic of technology. Fidelity National Information Services is based in Jacksonville, Florida, but its services are accessible worldwide. Additionally, FIS has been a part of the Fortune 500 and the S&P 500 Index, showing how much of a difference they’re making.

Conclusion

Fidelity National Information Services, Inc. continues to revolutionize the financial landscape with its strategic moves in open banking. The collaboration with Envestnet | Yodlee, Akoya, Plaid, and MX underscores FIS’s commitment to providing secure and user-friendly financial solutions. The Open Access platform addresses the evolving trend of open banking, empowering users to share financial information with third-party applications safely.

Fidelity National Information Services’s partnership with Banked introduces innovative pay-by-bank options, enhancing the efficiency of digital payments for businesses and consumers. FIS’s dedication to staying at the forefront of technological advancements reaffirms its role in shaping a seamless and secure future for the world of finance.