The retail world is changing, thanks to Buy Now, Pay Later (BNPL) services like Affirm and Zip. These options let shoppers buy items and pay later, making shopping easier. Now, Google Pay pilots BNPL with Zip in the current quarter of 2024. Google Pay is teaming up with Affirm and Zip to add BNPL directly into Google Pay. More people are picking BNPL, especially during holiday shopping. This partnership aims to make paying more straightforward and enhance the shopping experience for customers.

In this latest move, now Google Pay users can pay in installments for online transactions in the US. The collaboration allows Android users to utilize Google Pay at checkout on select merchant apps and websites to opt for Zip or Affirm as their payment method. Affirm plans to launch its BNPL feature on Google Pay in the first quarter of the upcoming year, while Zip is set to conduct a test integration in January.

Key Takeaways

- Google Pay Enters the BNPL Arena: Google Pay is integrating with BNPL services like Zip and Affirm, allowing users to pay for purchases in installments. This move signifies Google’s intent to provide more payment options and enhance the user experience, particularly on Android devices.

- Merchant Revenue Boost: Collaborating with established BNPL services offers merchants a potential revenue increase. Affirm has reported a 60% surge in average order values with its services, indicating that such partnerships could be lucrative for businesses.

- Strategic Expansion Plans: Google Pay’s initial trial phase aims to broaden its reach by including more merchants and additional BNPL services. The company is aligning its offerings with user preferences and market trends, ensuring a seamless integration into the broader retail landscape.

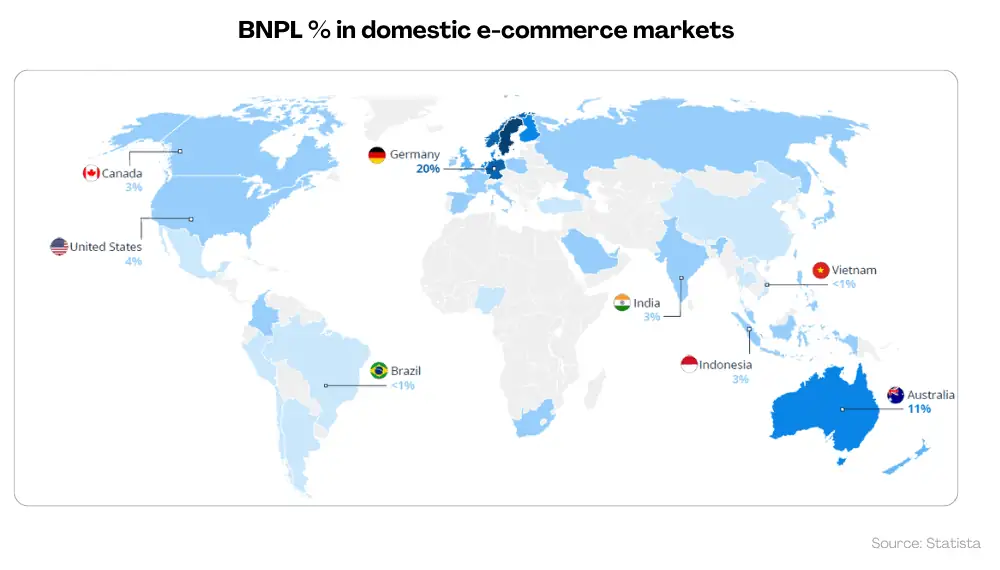

- BNPL Market Growth: The Buy Now, Pay Later sector is witnessing exponential growth, with projections indicating a staggering increase by 2024. This surge, fueled by changing consumer behaviors and financial challenges, presents a significant opportunity for retailers and payment platforms alike.

Google Pay Pilots BNPL With Zip And Affirm As BNPL Move Gets Momentum

Starting in the first quarter of 2024, Google Pay users on Android will have the option to use Zip and Affirm’s “Buy Now, Pay Later” services when shopping at certain online stores. This new feature lets shoppers divide their payments into smaller, manageable chunks. For example, if someone picks Zip, they can review the terms and conditions and then follow a simple process to finish their purchase. After getting approval, they can use Zip’s pay-over-four-month plan for items priced at $35 or more.

Google Pay is testing out BNPL features for the first time in a small trial, with plans for a broader launch a few months down the line. Drew Olson, the Senior Director of Google Pay, mentioned that teaming up with these payment service providers offers users more ways to pay and gives businesses an extra way to boost their sales.

During the trial phase in January, when shoppers click the Google Pay online checkout button on certain merchants’ Android apps, a promotional banner will appear on Google’s home screen, informing them about the availability of the Zip BNPL option. If the user decides to change their payment method, they’ll see a list of BNPL providers with additional details about their offerings. Opting for Zip, users can review terms and conditions before completing the purchase through a few simple steps. Once approved, customers can conveniently spread out their payments for purchases.

Olson further explained that they’re collaborating with established BNPL services that already have a broad presence in the market. These services are familiar to merchants who are already using Google Pay. He emphasized that this collaboration allows them to expand payment choices for users without needing a direct link to BNPL providers.

Providing such options, Olson pointed out, can boost a merchant’s revenue. Affirm has observed that merchants using its services see a 60% increase in average order values compared to other payment methods. For BNPL providers, partnering with Google Pay means reaching more users who may explore BNPL options with different merchants down the line.

Olson highlighted that this approach aligns well with the seamless Google Pay experience that users are already accustomed to. Olson mentioned that as they move past the initial testing phase in the first quarter of the upcoming year, Google plans to expand by including more merchants, additional BNPL services, and exploring new business sectors for the full launch.

Google’s move to work with two BNPL providers isn’t surprising, considering Amazon teamed up with Apple Pay Later and Affirm for last year’s Black Friday event. Google Pay might be testing the waters to see which option users prefer, but they’re probably aiming to attract a broader audience familiar with either Zip or Affirm.

It’s interesting to see Google keeping a close eye on its rivals. Apple introduced Apple Pay Later in October, and Amazon joined forces with Affirm. With Google Pay stepping into the BNPL scene, we can expect a surge in its popularity in 2024, especially as people manage their post-holiday budgets amid rising living costs.

The Growth Of BNPL Is Evident And Stronger Than Ever!

The 2019 pandemic worsened existing financial challenges, leading to more missed payments and reduced credit card usage in the US This decline created space for new payment methods like BNPL to step in. BNPL services offer an alternative to traditional credit cards. They let consumers buy items and pay for them in set installments, often without extra interest or hidden charges.

In 2019, the BNPL market in the US was valued at a few billion dollars. However, it’s predicted to skyrocket, growing by an impressive 1,200% by 2024. This rapid rise of BNPL presents a clear opportunity for retailers aiming to stay competitive—they just need to seize it.

Plus, the recent adoption of big-name BNPL services further boosted its existence. Apple is introducing its own BNPL service with Apple Pay Later. Plus, during the Black Friday sale last year, Amazon partnered with Affirm and Apple Pay to offer BNPL to its customers on a large scale. According to recent data from June 2023, about 360 million people globally were using BNPL services. With this industry booming, experts predict it could be worth a staggering $3.27 trillion by the year 2030.

About Google Pay

Google Pay serves as a digital wallet that lets you handle various transactions right from your phone. You can send money to friends, pay bills for utilities like electricity and phone services, and even recharge your mobile. Available on both iOS and Android, this app-based platform has evolved over the years. Starting as Google Wallet in 2011, it underwent several name changes like Tez and Android Pay before settling as Google Pay in 2018. With Google Pay, you can shop online, manage bills, and make in-store purchases all in one place.

Today, Google Pay stands out as a leading choice for mobile payments, making up 26% of online transactions last year. With over 150 million users in 42 countries, it’s a go-to option for people who want a simple and efficient way to handle their payments with just a tap or swipe.

About Zip

Zip is a tech company from Sydney, Australia, founded in 2013 by Niamh Mc Enaney, Peter Gray, and Larry Diamond. Specializing in digital retail finance, Zip helps consumers and small to medium businesses in countries like New Zealand, Australia, the US, and Canada. They offer “Buy Now, Pay Later” options both online and in stores, along with other financial services. Originally called ZipMoney Limited, the company switched to its current name, Zip Co Limited, in 2017. Zip offers clear and adaptable payment choices, empowering customers to manage their money wisely while aiding businesses in their growth. Committed to ethical lending, Zip operates as a regulated credit provider.

The company offers a range of financial services. For consumers, they provide flexible credit lines through Zip Money and Zip Pay, as well as installment plans through platforms like Spotii, QuadPay, PayFlex, and Twisto. They also extend loans to small and medium businesses through Zip Business. While Zip’s success is closely linked to the BNPL sector, many of its services, such as QuadPay and Zip Pay, don’t charge interest on unpaid amounts. A significant portion of Zip’s revenue comes from customers, primarily through account fees and interest. On the other hand, their installment services earn money by charging merchants, compensating for the risk of non-payment, and encouraging more frequent transactions from consumers.

About Affirm

Affirm, a fintech services company, specializes in offering installment loans to consumers right at the POS. Driven by a mission to create transparent financial products, Affirm aims to empower consumers and enhance their lives. The company envisions transforming the banking industry, making it more accountable and accessible. Affirm provides an alternative to traditional credit cards, allowing shoppers to make purchases at the point of sale and opt for straightforward monthly payments.

In contrast to payment methods with hidden costs and compounding interest, Affirm ensures transparency by showing customers the exact monthly payments upfront, without surprises or additional fees. With partnerships spanning over 2,000 merchants, Affirm offers shoppers the convenience of using its services at checkout across various sectors, including renowned brands in retail, travel, home furnishings, electronics, personal fitness, beauty, and apparel.

Conclusion

The integration of BNPL services into Google Pay marks a significant shift in the payment landscape, responding to the growing consumer demand for flexible payment options. As Google Pay collaborates with BNPL giants like Affirm and Zip, it not only enhances the shopping experience for users but also provides businesses with an avenue to increase sales.

This strategic move by Google Pay reflects the broader trend in the retail sector, where BNPL services are gaining momentum, especially in a post-pandemic world characterized by changing financial behaviors. With the BNPL market poised for exponential growth, retailers and payment platforms must adapt and innovate to meet evolving consumer preferences, ensuring a seamless and inclusive shopping experience for all.