With the evolution of the payment processing industry, merchants and consumers regularly come across multiple ways to process payments for a purchase. From credit cards to NFC payments and fast online transactions to monthly installments, users enjoy a variety of payment options at their convenience. BNPL is no exception. It is one of the many financing solutions that several renowned financial service companies offer for users to purchase a product and pay for it later within set intervals.

There are many different types of BNPL payments; it all comes down to individual preferences and requirements. Users can choose between an installment plan with interest or without interest. The length of the installments varies for different service providers. Pay-in-4 is a loan installment plan with four intervals. This article will discuss how Pay-in-4 is equally popular among customers as any other payment form and is sometimes even more favored than credit cards.

What is Pay-in-4?

Pay-in-4 is a highly preferred buy now, pay later service, in which a payment is split into four equal installments, generally without a high-interest rate. Today, many reliable companies offer this service to make it easier for buyers to pay for the items they typically can’t afford. If we talk about the statistics, one out of every 5 BNPL users chooses pay-in-4 as their preferred mode of payment, compared to debit, credit, or cash payments.

In this mode of payment, users pay the first installment at the time of purchase, and the rest of the dues are payable every two weeks. According to surveys, almost half of the users opt for pay-in-4 for their purchase, and over 69% of customers indicate the need for BNPL service in their area. It implies that current generations highly demand BNPL services to be more accessible.

BNPL is also one of the commonly mentioned reasons for higher sales and reduced costs by many retailers in the U.S. In short, BNPL directly benefits buyers and sellers, and pay-in-4 comes at the top of the list of favored BNPL services.

Pay-in-4 by Afterpay

Afterpay is a financial technology company offering payment processing solutions to customers in Australia, the United States, the United Kingdom, Canada, and New Zealand. The company facilitates BNPL and comes under the list of top-picked providers for pay-in-4 payment services. Reports reflect that two in every five U.S. users trust Afterpay for its BNPL offerings. In the debate over credit cards vs. pay-in-4, almost half of U.S. consumers choose the latter as their desired payment method.

With Afterpay, you can keep a close eye on your spending and budget your purchases. Its pay-in-4 interest-free installment plan is designed to enhance customers’ financial health and allow them to earn rewards while shopping.

As an Afterpay user, you can manage your finances while buying whatever you need. Can it get any better? With the release of an app, users can discover thousands of popular, global brands only with a tap and enjoy secure loan installments to pay for their favorite items. If you are concerned about missing your payments, Afterpay sends regular reminders to help you be on top of your dues.

Credit Cards vs. Pay-in-4

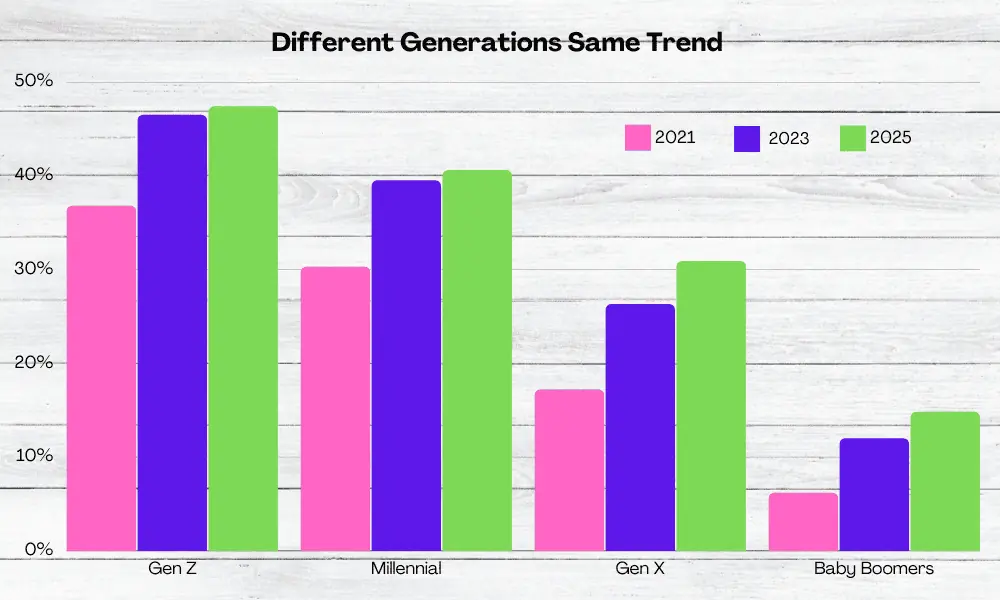

In today’s modern world, merchants are advantaged to offer more than one way to process payments. As a result, customers are free to choose a convenient payment method. In the last couple of years, the buy now, pay later service has gained much recognition. Many popular payment processing companies are acknowledging the fast-growing demand.

Source: Statista – BNPL popularity growing in different generations of people

Even though credit cards are notably the most used mode of payment for in-store and online shopping, the BNPL payment plan is receiving equal online traction. Now, it’s true that some differences between these services have long since blurred; many credit card companies provide pay-over-time installment plans, and some BNPL service provides grant virtual and physical cards. Yet, there are still some distinct qualities restricted to each payment method.

If you aren’t sure what payment method is better for your personal or business usage, here are some main differences between credit cards and BNPL services:

Account Opening

To use a credit card, you need to apply for and open an account with a bank. The requirements for opening and using an account vary for each card issuer. Your credit score, monthly bills, and income are some of the many factors that can come in the way of opening a credit card account.

As for the buy now, pay later facility, you can either open an account before making a purchase or request it at checkout. Most pay-in-4 services do not require a hard credit check and are accessible (sometimes) even if you have a bad credit score.

Availability

Even though most popular credit card networks such as MasterCard, Visa, or Discover are widely used, some stores may not accept all credit card brands. Similarly, some stores may not offer the buy now, pay later service. Moreover, your ability to use pay-in-4 depends on where you shop, what you buy, and how much money you need. However, most BNPL providers have debit cards that can be used at any store that accepts the card network.

Loan Payment

If we talk about credit cards vs. pay-in-4 in terms of their installment plans, most credit card companies allow users to pay off one part of their balance and pay the rest in the next month. The minimum dues payable depends on your total balance; a percentage of your total balance will be deducted. Some companies may even fix an amount. The time it will take to pay off your balance depends on your minimum payments.

In the pay-in-4 BNPL service, the total amount is split into four equal parts. One part is paid at the time of purchase, while the rest is paid in six weeks. Some BNPL providers offer extended installment plans.

Fees and Interest Rate

It isn’t a secret that credit cards have a high interest rates. And they can charge late payment fees and annual fees. If you are lucky, your credit card might have a grace period that allows users to avoid interest by paying the credit card bill in full. On the other hand, if you fail to pay the bill in full when it is due, the interest can add up daily.

Most buy now, pay later services do not charge fees, and generally, pay-in-4 plans are interest-free. However, some providers do charge late fees. Loan installment plans besides the pay-in-4 one could have varying interest charges.

Ease of Access

Most short-term BNPL plans are easily accessible because of their high approval rate. This mode of payment is suitable for people with a low credit score and inadequate credit history. This service is highly recommended if you have faced trouble getting approved for a traditional credit card for any particular reason.

Contrarily, credit card loans are hard to get approved. There is a high chance of application rejection if you have a low credit score. For that reason, most people aged between 18-21 choose the buy now, pay later service when it comes to credit cards vs. pay-in-4.

Credit Impact

A hard inquiry is performed when you apply for a credit card loan. Your repayment and burrowing information is provided to credit bureaus. It means you can earn a good credit score by paying your credit card bill on time and keeping a low debt amount. However, missing payments and high credit card debt can lead to a bad credit score.

Since most BNPL service providers do a soft inquiry and do not report your details to credit bureaus, you can build a good credit score. However, some buy now, pay later providers will report you to credit bureaus if you fail to repay the debt.

Why do BNPL Users Prefer Pay-in-4?

Younger generations prefer Pay-in-4 instead of credit cards, and around 62% of customers use BNPL services once a month. According to most users, the buy now, pay later facility frees them from the stress of hefty expenses. It helps them spread the costs and manage their financial situation, especially during the holiday season. 60% of BNPL users have indicated that the pay-in-4 plan is a reliable alternative to high-interest credit card loans.

The convenience of set payments and reduced financial stress make BNPL the best option for most customers. With credit cards, users must pay a part of the total payment by the month’s end. In the case of buy now, pay later, you have multiple ways to clear your debt. The pay-in-4 plan gives you much control over your payments and allows you to manage your spending. It is also more pocket-friendly than credit cards, as most BNPL providers are very upfront about the payment plan and costs.

Why are Credit Card Loans Less Popular Among BNPL Users?

Even though credit cards are the most frequently used mode of payment, they can be ridiculously expensive for some users. It is definitely a big no for people with a low credit score. Credit card loans are becoming less popular among BNPL users because of their strict terms and conditions. The risk of getting caught up in heavy debt and the tedious loan approval process are two of the most common reasons for younger consumers to opt for BNPL payment plans.

The rising interest rate prevents many users from meeting the minimum payment requirement, and the number of people turning to the pay-in-4 payment structure has significantly increased. The late payment fee and many other usage-based charges can come in the way of your financial stability. The impact of delayed payments can be extensive and likely to cost you your credit score.

Is BNPL Surpassing Credit Cards?

Even though not everyone uses BNPL services (many merchants solely work with credit cards), the demand for pay-in-4 payment services is increasing day by day. Many consumers believe they would want to use the buy now, pay later payment plan if it is more widely accessible.

Paying for an expensive product on the spot is no doubt less convenient than taking out a small amount every two weeks to cover that cost. The ability to plan your budget and buy your desired things without straining your financial situation is the best perk of a BNPL plan.

However, it comes with a cost for some consumers. Even though more than half of consumers are leaning towards pay-in-4, they have not stopped using credit cards entirely. Saying that BNPL has replaced credit cards would be an overstatement. Nevertheless, its fan base is rapidly expanding.

Conclusion

Each payment plan has its perks and shortcomings, and pay-in-4 is not an exception; it is not suitable for all kinds of purchases. With that said, BNPL is becoming a top pick among users who prefer to split their budget over weeks and plan their spending accordingly. Unlike credit cards, the buy now, pay later option offers more transparency about how long it will take them to pay off the debt.

Some users switch between both facilities depending on their shopping. It indicates that the conclusion to the credit cards vs. pay-in-4 debate isn’t the same for everyone. While some consumers solely rely on credit cards, some prefer BNPL. It all comes down to individual needs. The BNPL service is best suited for short-term budgeting and large purchases. Over 60% of users acknowledge that the pay-in-4 plan comes with the ease of set payments and offers convenience.

The bottom line is that most shoppers look for more convenience at checkout. They look for flexible options to pay for their purchases and the easiest ways to cover their debts on time. BNPL gives them that. Even though most credit card service providers offer the option to pay in installments, these installments come with hefty interest rates.

With pay-in-4, users can receive micro-loans to divide an expensive purchase into equal parts with little to no interest. As a result, people are shifting their preferences, and their need to depend entirely on credit cards is decreasing.