Unlike many new corporate leaders, PayPal’s New CEO, Alex Chriss, has not hesitated to make significant directional changes early in his tenure. In the Q3 earnings call. Chriss, who took over as CEO after Dan Schulman on September 27th, emphasized his focus on achieving growth.

This marks a departure from Schulman’s emphasis on PayPal’s checkout service. Initially, this shift caused a decrease in investor confidence and a decline in the company’s stock value.

Key Takeaways:

- New CEO’s Strategic Shift: Alex Chriss highlighted the importance of focusing on growth and moving away from the checkout service that Dan Schulman previously had priority on. Chriss’s leadership signifies a change in strategy aiming for an effective and growing organization.

- Resilient Q3 Performance: Despite facing difficulties in the market and experiencing heightened competition, PayPal displayed a strong performance in Q3 of 2023. Some notable achievements during this period include a 15% rise in payment volume, an 8% increase in revenues, and a 20% growth in EPS. Moreover, the company exhibited good operating cash flow and free cash flow throughout this timeframe.

- Strategic Overhaul: As part of its revamp, PayPal made notable changes to its operations, like divesting its logistics branch, Happy Returns to UPS. The company’s goal is to make operations more efficient and provide experiences for customers by implementing automation and enhancing the checkout process. Moreover, PayPal plans to utilize AI technology to engage consumers and improve its range of business solutions.

- Financial Overview and Company Profile: PayPal provides an overview of its situation, including information about its cash holdings, investments, and debts. Additionally, the company demonstrates its dedication to rewarding shareholders through stock repurchases. Moreover, PayPal’s mission revolves around stimulating empowerment and focusing more on economic participation through its inclusive digital payment platform that serves millions of active account holders worldwide.

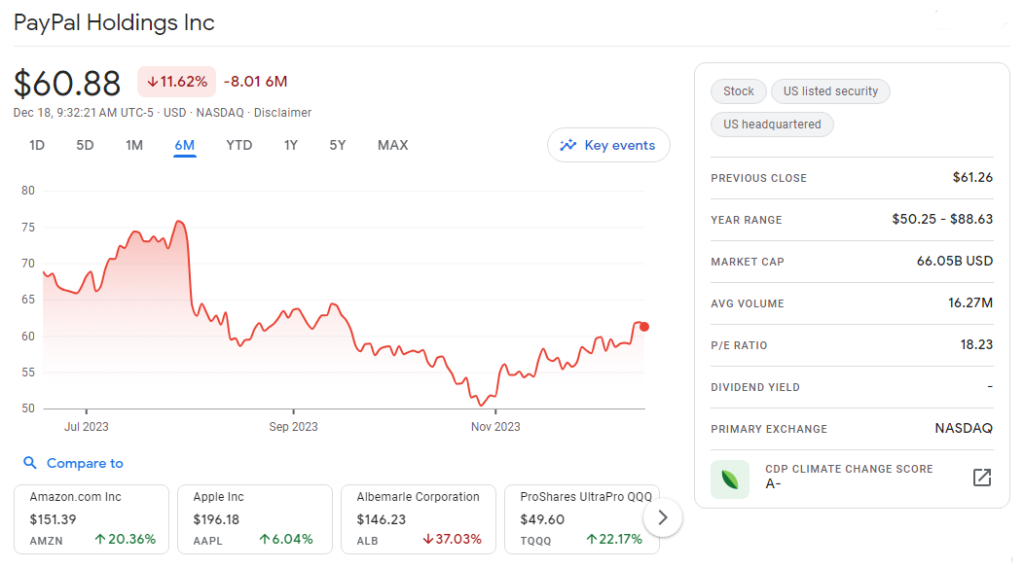

PayPal Stock Price On 12-18-2023 (11:00 am) ( Source Google Finance)

PayPal New CEO, Alex Chriss: Background

PayPal’s New CEO, Alex Chriss assumed the position of CEO on September 27, replacing Dan Schulman when PayPal was head-on with various challenges in the fintech industry. The company has faced a decrease in its stock value due to decreasing investor interest in fintech companies, tough competition from Apple, and slower growth in its branded checkout business over the past few years.

Given Chriss’s extensive experience at Intuit, he is expected to lead PayPal’s recovery. However, analysts on Wall Street caution that reviving the company might take a long time and extensive efforts.

The year 2023 proved difficult for PayPal, as its stock mostly traded at low levels compared to the long-term average. While this made the stock more affordable, potential investors were still worried about uncertainties in the economy and reduced consumer spending. However, there was a positive market response to the plans of PayPal’s new CEO, Alex Chriss. He aimed to streamline the company’s resources towards its growth priorities to create a leaner, more efficient, and effective organization. Overall, market observers hold a confident view of the stock’s long-term prospects.

Regarding growth, one of the primary hurdles facing the company is intense competition. The market dynamics have significantly changed since PayPal’s separation from eBay approximately eight years ago, with consumers now having alternative options, such as Apple Pay, that provide a fast and convenient checkout experience. The payment systems of Amazon and Google continue to gain traction, posing challenges for PayPal, which heavily relies on e-commerce for revenue generation. It is essential to note that the termination of PayPal’s operating agreement with eBay a few years ago has impeded its growth.

PayPal’s Third Quarter 2023 Earnings Reflect Resilience Amidst Market Challenges

Following a more-than-expected third-quarter report, PayPal experienced a much-needed upturn in its stock value, which had been struggling since its peak in 2021. Despite its position as a leading figure in the payments sector, PayPal has faced challenges in sustaining its growth momentum during the pandemic surge, leading to ongoing struggles in its stock performance.

Speaking about it, Alex Chriss, acknowledged the obstacles ahead, highlighting the competitive pressures from firms like Block (formerly Square) and Stripe, as well as traditional financial service providers such as Fiserv and FIS. To address these challenges and improve financial performance, PayPal aims to streamline certain aspects of its operations. Chriss emphasized the need to address the company’s high-cost structure, which has been impeding its agility and clarity of focus.

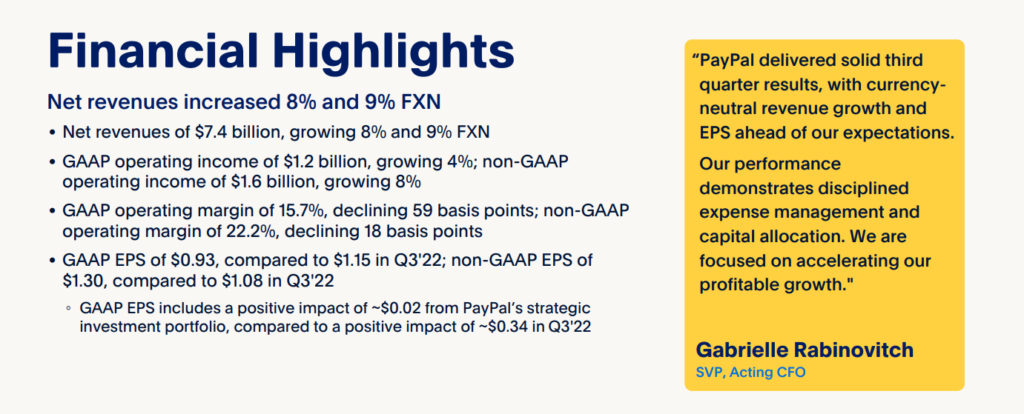

On November 1, 2023, PayPal disclosed its third quarter of 2023 earnings, showcasing a robust performance with notable growth in both revenue and EPS. The company’s Overall payment volume reached $387.7 billion, marking a 15% increase and a 13% growth on an FX-neutral basis. Notably, net revenues stood at $7.4 billion, demonstrating an 8% growth and a 9% FX-neutral increase. The GAAP operating income saw a 4% rise, amounting to $1.2 billion, while the operating income (excluding GAAP) showed an 8% increase, reaching $1.6 billion.

Source: PayPal’s third quarter of 2023 earnings

GAAP EPS was reported at $0.93, compared to $1.15 in the third quarter of 2022, whereas the EPS for non-GAAP showed an impressive 20% growth, totaling $1.30 compared to $1.08 in the prior year. Additionally, the company recorded a significant operating cash flow of $1.3 billion and a free cash flow of $1.1 billion.

PayPal’s Strategic Overhaul – Enhancing Consumer Experience and Streamlining Operations

PayPal recently divested its logistics arm, Happy Returns, to UPS, as part of its strategy to streamline operations and focus on its core payments model. CEO Chriss emphasized the need to address duplication and manual work, intending to invest in automation for improved efficiency.

During his initial month in the role, Chriss engaged with various stakeholders to outline a plan that aims to revolutionize product development and reporting practices. This plan, to be unveiled in the upcoming earnings call, involves a comprehensive overhaul of the consumer experience, centering on a seamless checkout process that adds value to each transaction.

For consumers, PayPal intends to leverage its rich database to power a sophisticated shopping recommendation engine and enhance incentive marketing using AI technology. In the business segment, the company plans to accelerate the advancement of PayPal Complete Payments, an offering tailored for digital merchants. Utilizing consumer data for refining checkout form autofill is also a focus.

PayPal’s New CEO also highlighted the potential of generative AI in fostering meaningful connections between consumers and merchants, ensuring responsible use of this technology. The company anticipates recruiting seasoned professionals to reinforce its talent pool in the upcoming months, recognizing the need for enhanced execution speed in driving growth and delivering on its promising outlook.

Jamie Miller has been appointed as the new CFO of PayPal to aid the company under its new expense management approach led by the new leader, Alex Chriss. Previously serving as the global CFO at EY, Miller brings a wealth of experience from her previous roles at General Electric and Cargill. She takes over from Gabrielle Rabinovitch, who has been serving as acting CFO during the transition period. In Q3, PayPal’s net income saw a 23% decline, settling down to around $1.02 billion YOY, with the company’s Q4 performance falling slightly below expectations till now, as noted by Rabinovitch.

Expanding Service Offerings to Braintree Customers

In a bid to cater to larger companies associated with Braintree, Chriss intends to broaden the range of services offered. Describing Braintree’s position as a foothold for future growth, Chriss emphasized the company’s commitment to addressing additional customer needs, including fraud management, payouts, chargeback automation, and Forex services.

According to William Blair, the company’s long-term prospects remain substantial, particularly as it has transitioned from a traditional checkout button to a comprehensive E2E solutions platform for both consumers and merchants. While it’s still early, the company’s sharp focus on leveraging its wealth of data for enhanced operational efficiency is encouraging for the future, as management emphasizes its commitment to pursuing profitable growth.

While acknowledging the dedication of PayPal’s current employees, Chriss also expressed the intention to bring in new talent to help achieve his objectives. In the meantime, he is diligently working to gain a comprehensive understanding of the company, with plans to present a more detailed strategy to analysts during the upcoming earnings call in February.

Key Highlights Of Q3 Results 2023

PayPal exhibited a robust performance in the third quarter of 2023, marked by an 8% increase in net revenues, which grew to 9% on an FX-neutral basis. The company saw a 4% rise in GAAP operating earnings, amounting to $1.2 billion, and an 8% increase in operating income (non-GAAP), reaching $1.6 billion. The GAAP EPS was $0.93, down from $1.15 in the third quarter of the prior year, while the EPS for non-GAAP stood at $1.30, demonstrating a 20% growth YOY.

As of September 30, 2023, PayPal’s cash equivalents and investments amounted to $15.4 billion, with a total debt of $10.6 billion. During the third quarter of 2023, the company bought back approximately 23 million common stocks, delivering $1.4 billion in returns to stockholders.

The company generated $1.3 billion in cash flow from operations and $1.1 billion in free cash flow during the quarter. These figures include a $0.8 billion of adverse impact from European BNPL loans originated as HFS in the period.

About PayPal

PayPal offers a secure and efficient way to send money, pay and create online invoices, and establish a merchant account. With a core belief in the transformative power of accessible financial services, PayPal is dedicated to democratizing financial opportunities and empowering individuals and businesses to participate and thrive in the global economy. Their inclusive digital payment platform empowers 277 million active account holders to transact with confidence, whether online, through a mobile device, an app, or in person.

Through a blend of innovative technology and strategic partnerships, PayPal continuously develops improved methods for managing and transferring funds, providing users with flexibility and options for sending, receiving, and paying. Operating in over 200 markets globally, the PayPal ecosystem, encompassing Venmo, Xoom, and Braintree, facilitates transactions in more than 100 currencies, allowing users to withdraw funds in 56 currencies and hold balances in their PayPal accounts in 25 currencies.

Conclusion

PayPal’s New CEO, Alex Chriss, left an indelible mark by charting a clear course for the company’s future. Departing from the previous strategy, Chriss outlined his vision for prioritizing profitable growth, setting the stage for a more efficient and agile organization. Despite market challenges, PayPal’s robust third-quarter performance, including notable increases in overall payment volume and net revenues, showcased the company’s resilience and enduring potential.

Moreover, the strategic overhaul, evidenced by the divestment of Happy Returns and a commitment to streamline operations, underscores Chriss’s dedication to optimizing consumer experiences and refining business offerings through advanced AI technologies. With the appointment of Jamie Miller as CFO, PayPal is poised to fortify its financial management and steer the company’s trajectory toward sustained growth.

As PayPal continues to empower millions of users worldwide through its secure and accessible financial services, Chriss’s leadership, coupled with the company’s continued dedication to innovation and strategic partnerships, bodes well for its continued success and enduring prominence in the global digital payment landscape.