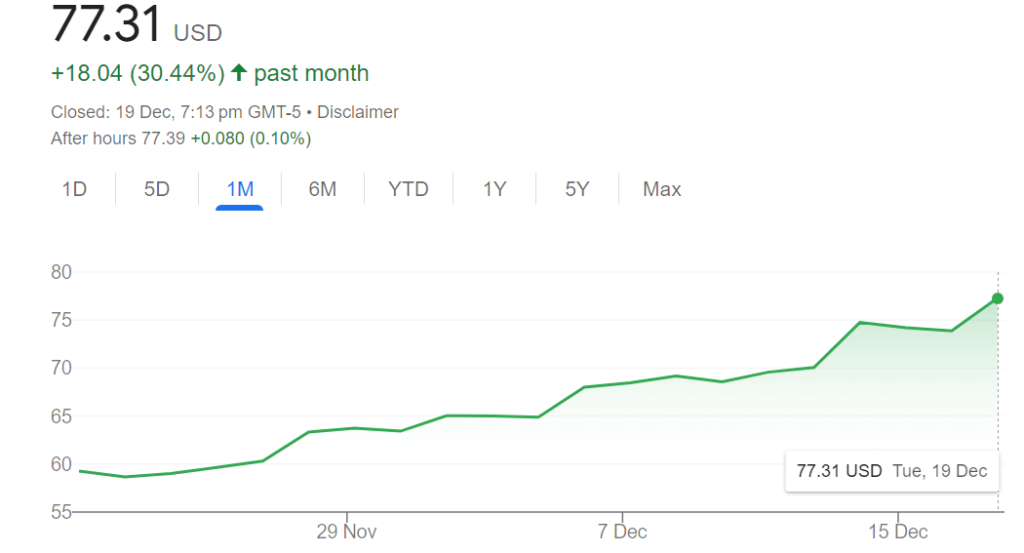

Following a robust quarterly performance, Block stock surged on strong earnings and upgraded outlook, with an increase of up to 17% during after-hours trading. The payment company, led by Jack Dorsey, has updated its adjusted profit forecast to show confidence in its ability to withstand the harsh economy’s impact on consumer spending. This positive revision aligns with the performance observed in the sector, which closely reflects consumer spending patterns.

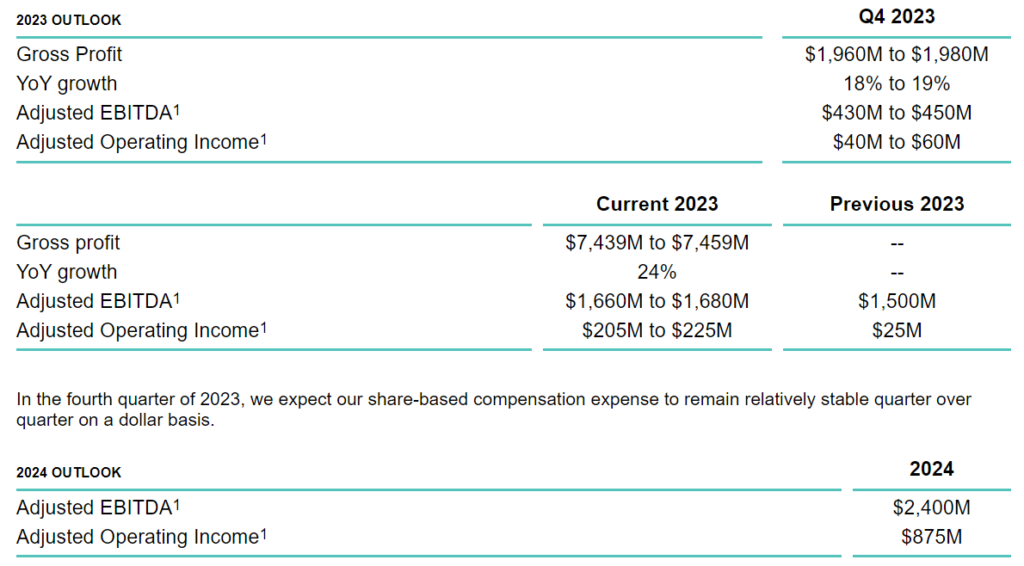

Block now expects to achieve adjusted core earnings ranging from $1.66 billion to $1.68 billion for the year, surpassing their estimate of $1.50 billion. Additionally, the company aims to achieve profitability based on operating income by 2024. Amrita Ahuja, the finance chief, has disclosed plans to reduce the workforce by year’s end as part of a comprehensive cost-saving program implementation.

Source: Google Finance

Key Takeaways:

- Stock Surge Following Upgraded Forecast: Block Stock Surges on Strong Earnings and Upgraded Outlook, with shares climbing as much as 17% in early trading, buoyed by an improved forecast for the entire year’s adjusted EBITDA, signaling investor confidence in the company’s financial health and prospects.

- Exceeding Financial Expectations: Block has surpassed the expectations set by Wall Street in Q3 2023. Their adjusted earnings per share (EPS) of $0.55 exceeded consensus estimates, resulting in a surge in Block shares price after their impressive earnings beat and increased full-year guidance. This strong performance aligns with their revenue growth trend, as their net revenue has increased by 24%. Moreover, their adjusted EBITDA has significantly surpassed expectations.

- Strategic Cost-Saving Initiatives: To enhance efficiency and profitability, Block is implementing a cost-saving program that includes measures like downsizing the workforce and automating processes. Their goal is to achieve profitability on an operating income basis by 2024.

- Robust Growth Across Platforms: Blocks Cash App and Square segments have experienced robust growth year over year. The monthly active accounts for Cash App have seen an increase, while Squares revenue has grown by 12%. This noteworthy growth across platforms further supports Block’s raised earnings expectations and ambitious targets for the future.

Block Stock Surges: Soaring Shares and EBITDA Outshine Estimates With Strong Outlook

Block stock surged, climbing as high as 17% during early trading, following the company’s upward revision of its adjusted EBITDA projection for the year. In the third quarter, Block reported a significant rise in EPS to $0.55 compared to $0.42 in the previous year, surpassing the expected value of $0.47. The company’s net revenue reached $5.62 billion, showing a growth of 24% YOY.

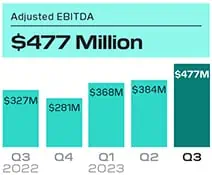

Adjusted EBITDA exceeded expectations at $477.5 million, surpassing the estimated value of $373.8 million, while the total payment volume increased by 10% annually and reached $60.08 billion. Cash App stood out as a competitor with an account activity of $55 million for transactions, marking a 1.9% increase from the previous quarter.

Source: sec.gov

Additionally, Block revised its adjusted EBITDA projection for the year to be around $1.67 billion. The company expects significant growth in adjusted EBITDA to reach approximately $2.4 billion by 2024. Furthermore, Block announced a stock buyback program of $1 billion.

Ahuja mentioned that they have identified areas where they expect to find cost savings, such as real estate, process improvements through automation, and discretionary spending.

With consumer spending in the US maintaining a generally positive trend, analysts anticipate a rise in sales during the crucial holiday shopping season, supported by retailers offering substantial discounts on various products to attract buyers. Furthermore, Block has now projected a gross profit for 2023 ranging from approximately $7.44 to around $7.46 billion.

As the Block stock surges on strong earnings, the expectations for 2024 are high, with the company expecting a significant enhancement in adjusted operating income margin compared to 2023. In its shareholder letter, the company stated that its outlook does not consider any additional macroeconomic deterioration that could affect its results.

During the Q3 results, net revenue experienced a 24% YOY growth, escalating from $4.52 billion to around $5.62 billion. Bitcoin revenue surged from $1.76 billion to $2.42 billion YOY. Gross profit increased by 21% compared to the same period last year, rising from $1.57 billion to $1.9 billion.

Source: sec.gov

Adjusted EBITDA stood at $477 million, in contrast to $327 million in the year prior. Block observed particularly robust growth in its payment platform, Cash App, and its POS options from Square.

Cash App revenue reached $3.58 billion, marking a 34% YOY growth, while Square revenue increased by 12% YOY to $1.98 billion. Jack Dorsey remarked that they have been relatively quiet recently due to their intense focus.

Key Revenue Details

- Transaction Segment: The company’s transaction revenues reached $1.66 billion, reflecting a 9.3% increase from the previous year. However, this figure was slightly below the expected $1.68 billion.

- Strong Square Ecosystem: Within the transaction revenues, the robust Square ecosystem contributed $1.54 billion, marking a 10% growth from the prior year.

- Subscription and Services: Revenues from this category amounted to $1.49 billion, indicating a significant 25.3% surge year over year, surpassing the expected $1.46 billion. The solid performance of the Square ecosystem played a role, contributing $402 million to subscription and service revenues, up 21% from the previous year.

- Hardware Segment: The company’s business generated $42.3 million in revenues, showing a slight decline of 2.4% from the previous year, missing the projected $45.9 million.

- Bitcoin: Revenues from the Bitcoin category totaled $2.42 billion, representing a substantial 37.5% increase from the previous year.

These figures demonstrate the company’s varied revenue streams and its continued growth in different segments.

Block’s Q3 Earnings – Balance Sheet And Operation Details

For the third quarter of 2023, the company saw its gross profit increase by 21.1% from last year, reaching $1.898 billion. However, the gross margin saw a slight decrease of 0.9% from the previous year, ending at 33.8%. Breaking it down, the Cash App was a standout, with its gross profit rising to $984 million, which is a 27% boost from the previous year. Similarly, Square’s earnings were up, with a gross profit of $899 million, marking a 15% increase from the year before.

Source: sec.gov

When we look at the adjusted EBITDA, there’s a notable rise to $477.5 million, which is a 45.9% jump from last year. This is while keeping in mind that the non-GAAP operating expenses also climbed by 14.4%, reaching $1.44 billion.

There’s also good news regarding operating income. It saw a significant climb to $89.8 million, a substantial increase from the $32.2 million reported in the quarter last year. Turning our attention to the balance sheet, as of September 30, 2023, there’s a healthy cash and equivalents balance of $5.1 billion, up from $4.7 billion at the end of June. The short-term investments also saw an uptick, standing at $1.16 billion, compared to $1.12 billion in the previous quarter.

The long-term debt has remained more or less the same, with a slight increase to $4.118 billion from $4.114 billion in the previous quarter.

About Block

Block, Inc. concentrates on building comprehensive ecosystems tailored to specific customer groups. Operating across two primary segments, namely Cash App and Square, the company provides a range of services designed to meet the needs of businesses and individual consumers. Under the Square segment, Block enables businesses or sellers to process card payments, offering a suite of products and services that support their operational growth. This segment combines hardware, financial, and software services, creating user-friendly products and services.

Image source: Block

On the other hand, the Cash App segment offers a variety of financial tools and services, empowering consumers to effectively manage their finances. With a focus on enhancing financial management, Cash App facilitates money transfers, savings, spending, investments, and receipt management. Additionally, Block’s TIDAL platform serves as a global hub for musicians and their fans, providing engaging content and experiences to foster stronger connections between artists and their followers.

The company also engages in the Bitcoin ecosystem through Spiral, an independent team dedicated to contributing to the open-source development of Bitcoin technology.

Conclusion

The company’s strategic adjustments to its earnings forecast, coupled with cost-saving measures and a focus on operational profitability, have cemented investor confidence.

The strong growth across both Cash App and Square segments is a testament to the company’s robust business model and its ability to adapt and thrive in a volatile economic environment. As Block continues to diversify its revenue streams and enhance its operational margins, it stands as a compelling example of resilience and forward-thinking in the fintech sector. The upward trajectory in its financials, backed by a comprehensive ecosystem of products and services, positions Block to not only weather potential economic downturns but also to seize new opportunities for growth and innovation.