Since its establishment in 2017, Binance Exchange has emerged as a major cryptocurrency player. The platform is renowned for its focus on facilitating the trading of various alternative cryptocurrencies or altcoins.

With over 350 cryptocurrencies and virtual tokens available for crypto-to-crypto trading, Binance offers a comprehensive platform for cryptocurrency enthusiasts. Binance offers popular options like bitcoin (BTC), Ether (ETH), Litecoin (LTC), Dogecoin (DOGE), and their proprietary coin, BNB (Binance Coin).

Although Binance is already acknowledged as the most prominent exchange globally, it has encountered several challenges recently. These include a significant number of customers withdrawing billions of dollars.

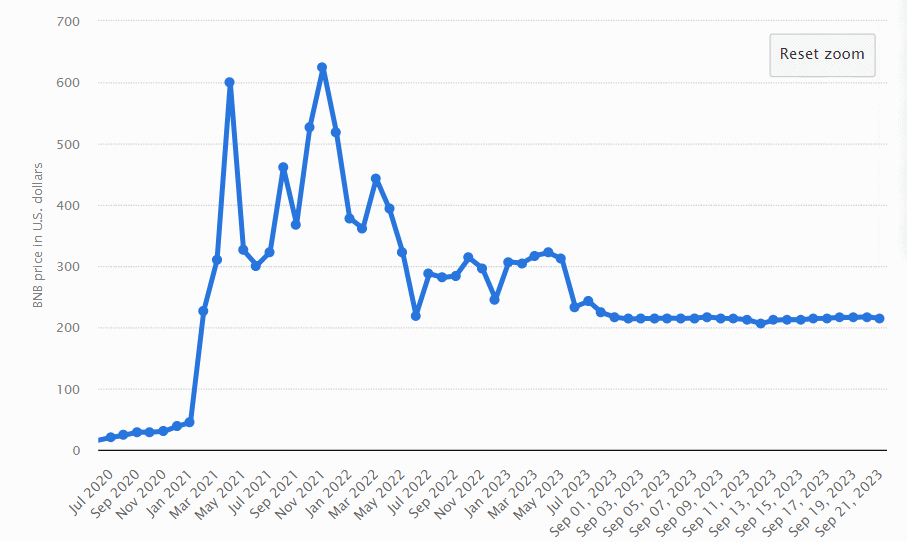

Source: Statista – Binance Coin (BNB) price

The gradual discontinuation of its stablecoin BUSD and legal conflicts with regulatory agencies such as the SEC (US Securities and Exchange Commission) and CFTC (US Commodity Futures Trading Commission) regarding its US operations has made it difficult for the company to sustain. So will Binance survive or collapse?

Binance Coin Price On September 28, 2023. Source: CoinMarketCap

This article will explore essential questions regarding Binance, a prominent cryptocurrency exchange. We’ll also discuss the impact of recent regulatory changes on Binance and the industry.

Binance’s History

In 2017, Binance CEO Changpeng Zhao, a renowned entrepreneur, investor, and software engineer, started the Binance Exchange. He started this venture in July, and astonishingly, within just six months, the exchange skyrocketed to become one of the largest cryptocurrency exchanges on a global scale.

Changpeng Zhao the founder of Binance – Source: Wikipedia

Binance Exchange carved its niche primarily in the worlds largest crypto-to-crypto trading, facilitating the exchange of various cryptocurrency pairs. It gained a reputation for offering some of the industry’s lowest transaction fees. Additionally, users who utilized BNB, the exchange’s native cryptocurrency token, enjoyed exclusive discounts.

Security has always been at the forefront of Binance’s priorities. Leveraging a multi-tier and multi-clustered architecture, Binance has consistently delivered exceptional processing with robust safety standards.

However, in 2019, Binance faced regulatory hurdles in the United States, leading to its global exchange operations being banned. In response, Binance introduced Binance US (Binance.us), an exchange designed to adhere to US regulatory requirements, ensuring its continued presence in the American market.

Why Binance Is Under Scrutiny?

The regulatory scrutiny surrounding Binance, one of the world’s leading cryptocurrency exchanges, has increased since 2018. This thorough investigation focuses on how Binance complies with U.S. Laws against money laundering and sanctions.

Several prosecutors are deeply involved in this case. They are contemplating pressing charges against executives, including Changpeng Zhao, the founder.

Source: US Security And Exchange Commission

The investigation involves many branches, including the National Cryptocurrency Enforcement Team, the US Department of Justice, and MLARS. According to regulations set by the Justice Department, any pursuit of money laundering charges against an institution requires approval from the MLARS’ chief.

Not only are authorities in the United States focusing on Binance, but regulators from countries like the UK, the Netherlands, Canada, Japan, Malaysia, Thailand, Germany, the Cayman Islands, Lithuania, and Hong Kong are also actively involved. They are implementing restrictions on the Binance platform.

These regulatory actions have been prompted due to concerns regarding money laundering using cryptocurrencies and the perceived risks associated with products offered by Binance.

Additionally, Binance has faced allegations of accepting payments from creators of cryptocurrencies, which is not legitimate. In return for these payments, privileged access to its platform was granted. Such allegations have further intensified the scrutiny.

While some nations have initiated investigations into Binance operations and offerings, others have taken severe measures by imposing partial or complete bans on its activities. The situation remains grim for Binance.

How Much Of An Impact Will It Be If Binance Is to Fall?

So the next question is what happens if Binance shuts down or fails?

In the event of a catastrophic failure at the world’s largest cryptocurrency exchange, the consequences would be far-reaching and potentially more significant than the recent FTX crash (https://restructuring.ra.kroll.com/FTX/).

The credibility of the crypto industry is already under intense scrutiny from regulators and analysts worldwide. If Binance crashes, the industry will suffer a severe blow.

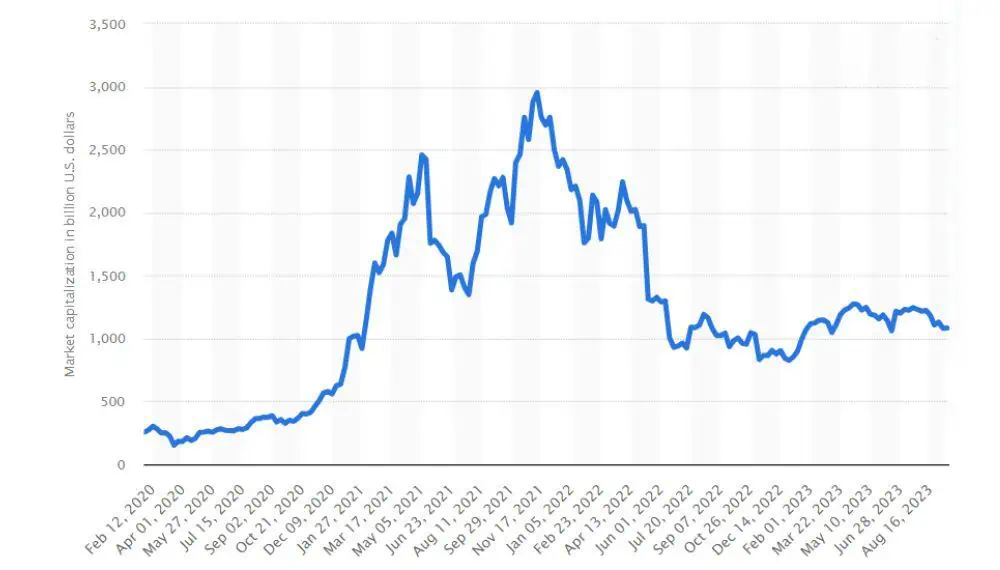

Source: Statista – Cryptocurrency market capitalization per week from July 2010 to September 2023

Any such event can have ripple effects on the broader Web3 project, as emphasized by Deane. At present, Binance Labs, the company’s investment arm, is reported to have invested $325 million in 67 different Web3 projects this year. This investment was more than double their investment from the previous year.

Given recent incidents and the increasing scrutiny from governments, stricter regulations on the cryptocurrency industry are being considered. If Binance were to collapse, it would likely accelerate this regulatory process.

As the world’s largest exchange by trading volume, Binance has so far gained a significant level of trust from its users. It is difficult for us to quantify the impact of the things that have yet to happen. Anyhow, we will discuss the two most probable scenarios that can give you an idea about the effects of the fall of Binance:

Scenario 1

The potential collapse of Binance could erode the already fragile trust in the cryptocurrency industry. This could result in a widespread sell-off and potentially spell doom for numerous crypto projects, including major ones.

Given its status as the most significant global crypto exchange and its influence on the industry’s trajectory, some have referred to Binance as “too big to fail.” However, if Binance were to stumble, there might not be anyone willing or able to prevent the ensuing fallout. It will be a freefall in a short period, taking down the entire industry with it.

Scenario 2

Currently, Binance handles half of all cryptocurrency trades, but this has decreased from around 70% at the beginning of the year. While it is possible that other companies might step in to fill the gap left by Binance in the long run, the immediate consequences of its collapse would be significant.

If Binance were to collapse, it could impact market liquidity. Its absence would disrupt standard transaction flows. This disruption could lead to a drop in cryptocurrency prices because the market will be busy dealing with reduced liquidity and increased uncertainty. The short-term effects of such a scenario would likely affect the cryptocurrency ecosystem. But as per scenario two, the market will quickly recover in the long run.

Will Binance Survive Or Collapse? What Is The Future Of Binance?

The dynamics of the crypto market are multifaceted. It is challenging to give a precise answer as to whether Binance has some hopes or it is a downhill journey from here.

Source: Binance.us

Various factors can impact the future. Many positive as well as negative factors can affect the future of Binance. One positive aspect of Binance is its position as the leading cryptocurrency exchange worldwide regarding trading volume. In short, the sheer volume of transactions and the users’ confidence are the most positive aspects that can save Binance.

The platform has consistently demonstrated a commitment to innovation and has successfully broadened its services to encompass various crypto-related offerings. Additionally, Binance boasts a significant and devoted user community.

The negative impact can come from the regulatory authorities. Regulatory agencies in various nations, notably the United States and the United Kingdom, are conducting investigations into Binance’s operations.

Additionally, critics have raised concerns regarding the lack of transparency exhibited by the company and inadequate customer service standards.

Moreover, the overall cryptocurrency market is experiencing a downturn. As a result, the prices of numerous cryptocurrencies have been declining significantly in recent months. This decline has adversely affected Binance’s revenue and profitability. And as of now, there is no hope that this negative market sentiment will change soon.

However, we have compiled a list of essential factors which could affect Binance’s future:

- The current status and outcome of the regulatory investigations being conducted against Binance are still uncertain.

- Binance’s ability to improve its transparency and customer service.

- The overall performance of the cryptocurrency market.

- Binance’s ability to continue to innovate and expand its product offerings.

Binance’s ability to navigate these challenges will determine its position as the top cryptocurrency exchange. Overcoming these obstacles is crucial for Binance’s future success, while failure may pose significant difficulties.

It’s important to acknowledge that the cryptocurrency market is still in its early stages and is characterized by high volatility. As a result, predicting the future of Binance and the overall cryptocurrency industry remains challenging.

What Binance Is Doing To Avoid A Breakdown?

Binance is the undisputed leader in cryptocurrency exchanges, boasting impressive statistics that underscore its dominance. Recent data reveals a staggering daily trading volume of $9.23 billion and a remarkable user base of over 28 million active users and more than 100 million registered users.

The services Binance offers include spot trading, futures trading, margin trading, staking, lending, and participation in decentralized finance (DeFi). Notably, Binance has also taken steps to diversify its offerings, catering to a broader spectrum of crypto enthusiasts.

Further solidifying its influence in the crypto landscape, Binance operates its own blockchain, Binance Smart Chain (BSC). This blockchain serves as the host for numerous popular DeFi applications and tokens.

BSC has become a pivotal platform for DeFi projects, facilitating services like lending, borrowing, swapping, farming, gaming, and creating non-fungible tokens (NFTs). It enjoys a substantial user base and is known for its cost-effective transaction fee structure.

In addition to its technical prowess, Binance has cultivated a powerful brand identity and nurtured persistent customer loyalty. The company has adopted a diversified business model that spans various segments of the cryptocurrency market, ensuring its relevance and adaptability.

Recognizing the importance of regulatory compliance, Binance has taken proactive steps by appointing former regulators and compliance experts to lead its legal and policy teams. The exchange has expressed a willingness to collaborate with authorities and adhere to local regulations in all its markets. However, Binance faces the challenge of navigating regulatory changes and evolving customer expectations. It must also preserve its core principles of decentralization and global accessibility.

Conclusion

Binance, the global cryptocurrency exchange giant, is at a crucial turning point as it confronts challenges and opportunities. Since its establishment in 2017, Binance has swiftly emerged as a leader in the crypto industry, driven by its dedication to innovation and user-friendly services.

However, Binance’s future is still uncertain due to increased regulatory scrutiny, particularly from the United States and other countries. The platform faces investigations relating to compliance with US laws, accusations of money laundering, and doubts about the legitimacy of cryptocurrencies on its platform. These issues have put significant pressure on Binance.

Only time will reveal whether it can overcome these challenges and emerge stronger. As the cryptocurrency market evolves, Binance’s ability to adapt and thrive will be crucial in shaping the industry’s future.

Frequently Asked Questions

Is Binance considered “too big to fail”?

Nothing can be considered “too big to fail” in the crypto industry. A single regulation by the government can make a significant impact.

What would happen if Binance were to fail?

If Binance were to collapse, it could erode the remaining trust in the crypto industry, potentially triggering a sell-off and impacting various crypto projects.

Can US Citizens Use Binance?

US citizens can use Binance.us, which operates under US laws, to ensure their protection.

Why is there a proposed Binance ban?

The CFTC sued Binance for running what it deemed an “illegal” exchange and having a questionable compliance program. Additionally, the SEC filed a lawsuit against Binance and its CEO, Changpeng Zhao, alleging actions such as inflating trading volumes, diverting customer funds, failing to restrict US customers, and misleading investors.

Is Binance superior to Coinbase?

Neither Binance nor Coinbase is inherently better than the other. It mostly boils down to personal preference. Coinbase tends to be more beginner-friendly, while Binance may require more familiarity with the platform. Ultimately, the choice between them depends on your needs and comfort level.

Is Binance in trouble financially?

No, as of now Binance is not in trouble financially.