In 2018 Adyen, a payment company confidently made its debut on the Amsterdam stock exchange swiftly emerging as a strong contender, against industry giants such as PayPal and Sripe. This remarkable ascent was further fueled by their expansion in North America catching the attention of merchants and prompting a significant recruitment drive to fuel their growth.

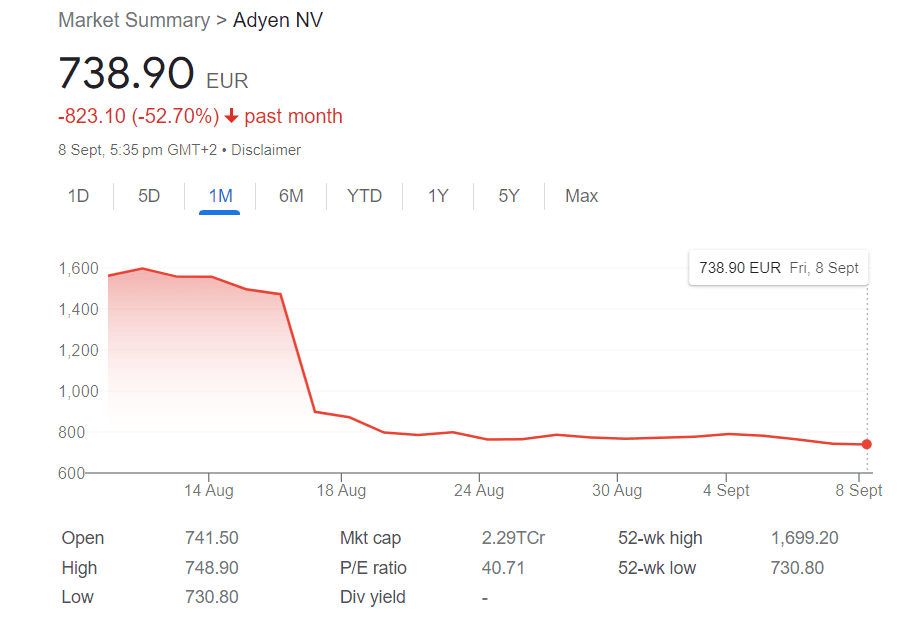

However, in 2023 they faced unexpected obstacles. The company experienced its lowest revenue growth ever recorded, resulting in a 39% decline in share value, within a single day. This sudden downturn wiped out a market value of 18 billion euros ($20 billion).

Investors were left stunned. The stock suffered another blow the day. The journey of Adyen serves as a reminder of how unpredictable the business world can be – even powerful entities can face challenges.

What is Ayden?

Adyen, a recognized name, among the 200 global fintech companies according to authorities like CNBC and Statista has rapidly become a major player in the payment services industry. With clients like Netflix, Meta, and Spotify their influence is undeniable. This positions them as leaders in financial technology.

Image source

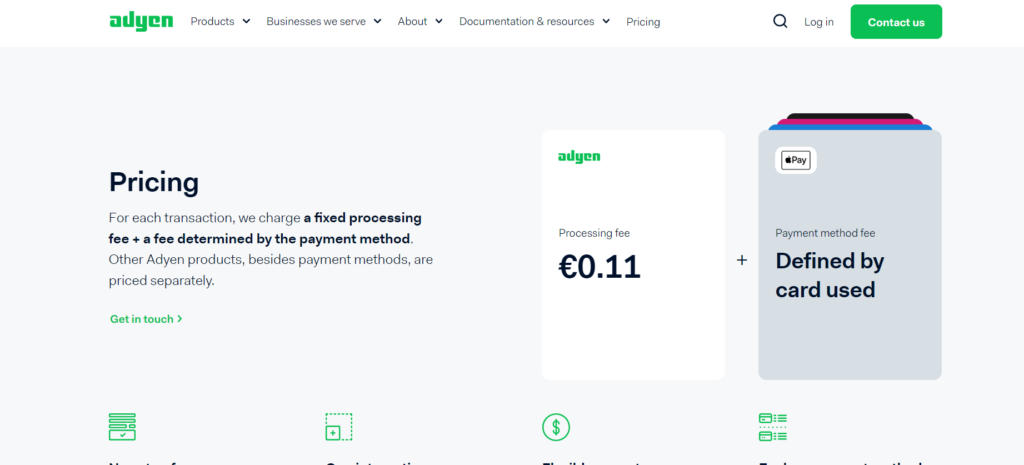

However, Adyen offers more than payment processing capabilities. They distinguish themselves by acting as a payment gateway that utilizes cutting-edge technology to enable merchants to accept card payments both in physical stores.

Their extensive system, designed for the age seamlessly integrates shopping experiences with traditional in-store purchases. In return for its role in streamlining transactions, the company earns a percentage fee from every transaction processed through its platform.

The company’s success story can be attributed to its founders; Pieter van der Does serving as CEO and Arnout Schuijff formerly holding the role of Chief Technology Officer. Their shared vision and expertise have not revolutionized transaction processes for businesses. It has also solidified the company’s position as an influential player, within the ever-evolving fintech landscape.

Adyen’s Unexpected Slowdown

Adyen recently shared its results for the half of this year and the numbers presented were not exactly what the market expected. While the company revealed a revenue of 739.1 million euros showing a 21% increase compared to the year it also indicated Adyen’s sales growth since its records began.

Image source

This was quite different, from what analysts had predicted. According to Refinitiv Eikons forecasts they had estimated the revenue to be around 853.6 million euros, with a year-on-year growth of 40%.

A Shift in Market Dynamics

Since Adyen made an entrance, into the stock market in 2018 it has gained a reputation as a growth stock consistently demonstrating a surge in revenue every six months of about 26%. However recent changes in the market seem to be impacting this trajectory.

During an interview with CNBC’s “Squawk Box Europe ” Ethan Tandowsky, Adyen’s CFO shed some light on the situation. He discussed how rising inflation rates have led to increased interest rates resulting in a shift in their business focus from growth, to a more bottom-line-oriented approach.

Courtesy: CNBC

Tandowsky was quick to reassure that the company has experienced customer losses and highlighted that none of their clients have left.

Challenges and Future Prospects

However, Adyen has expressed concerns, about the landscape in North America. They believe that local competitors are approaching with cost solutions posing a potential threat to Adyen’s established position in the market. This competitive pressure is evident in Adyen’s shareholder letter, which mentioned a decrease in their EBITDA margin; from 59% in the half of the previous year to 43% during the same period in 2023.

The decline was attributed to growth in North America and increased employment costs due to their hiring strategy.

Despite these challenges, Tandowsky, a representative of the company remains hopeful about the value proposition that Adyen offers. He believes that while competitors may provide services at prices it is Adyen’s focus on “functionality” that sets them apart.

Tandowsky expressed confidence in Adyen’s ability to innovate and stated; “We have an approach to developing functionality that surpasses our competitors and this will help us gain the market share we anticipate.”

This statement highlights Adyen’s commitment not to compete based on price. Also by offering superior service. Only time will reveal if this strategy will guide the company back, toward its heyday of growth.

Adyen’s Core Dilemma: A Structural Overview

- The Customer Dependence Challenge

- Adyens recent challenges stem from its business model, which relies heavily on clients’ loyalty, to a platform for all their payment needs. This approach requires not only retaining customers but also ensuring that Adyen’s offerings outperform those of its competitors.

- Given the uncertainties, such as rising interest rates and increasing inflation many of Adyen’s North American clients are reassessing costs and seeking optimized solutions. In their year 2023 report, the company acknowledged this trend pointing out that businesses are now prioritizing cost-effectiveness, over features.

- The Pricing and Profitability Equation

- Despite the changing landscape, the company has remained steadfast in its pricing strategy aiming to reflect the value it brings to the table. However this focus, on value has come with its drawbacks. Adyen’s commitment to recruitment efforts for example has impacted its profitability.

- The company experienced a 10% decrease in EBITDA compared to the year’s half amounting to 320 million euros. In contrast, some of its competitors such, as Stripe took an approach by reducing their workforce by 14% in November 2022.

- The Pricing and Profitability Equation

- Despite the changing landscape, Adyen has remained steadfast in its pricing strategy aiming to reflect the value it brings to the table. However this focus, on value has come with its drawbacks. Adyen’s commitment to recruitment efforts for example has impacted its profitability.

- The company experienced a 10% decrease in EBITDA compared to the year’s half amounting to 320 million euros. In contrast, some of its competitors such, as Stripe took an approach by reducing their workforce by 14% in November 2022.

- Growing Competition and Market Dynamics

- . Adyen faces more, than internal challenges. The broader market landscape brings its set of difficulties. One major hurdle is the rise of competitors who offer rates undercutting the company. Van der Does, the CEO of Adyen acknowledged this situation in a conversation, with the Financial Times. He mentioned how merchants are increasingly opting for providers to minimize costs.

- While van der Does emphasized that Adyen is not shrinking but rather growing at a pace his statement highlights the company’s struggle in a market where price competitiveness is becoming increasingly important.

- Adyen’s Unique Workforce Strategy

- In the past, the company has been quite selective, in its hiring strategy preferring to have a team compared to its competitor, Stripe, which has almost double the number of employees.

- This approach has its advantages and disadvantages. On one hand, it showcases Adyen’s efficiency. On the other hand, it brings up concerns, about the company’s ability to handle significant demands and competition.

- The Future: What Lies Ahead?

- Simon Taylor, a representative, from Sardine.ai provides a perspective indicating that Adyen may reach a point where it faces limitations in its growth potential and needs to reconsider its profit margins in order to continue expanding. He emphasizes that like any participant in the e-commerce industry, Adyen is not immune to the macroeconomic challenges.

- However, he also reminds stakeholders that achieving a growth rate of 21% is something many professionals in the field would be envious of despite these obstacles.

- In conclusion, while the company does face challenges within the ever-changing digital payments landscape it’s important to acknowledge its accomplishments and strategic decisions that have propelled it to its current position. Adapting to these shifts in structure while staying true to its core value proposition will play a role, in determining Adyen’s trajectory.

Conclusion

Adyen is currently facing a variety of challenges that make their situation complex. These challenges include relying on customers to make pricing decisions dealing with increased competition and managing changes, in their workforce. Although the company is doing a good job of providing value it can’t ignore the pressures it face particularly from competitors who offer lower costs.