The cryptocurrency industry had its share of highs and lows in 2023. While Bitcoin and other popular cryptocurrencies had a good performance during the middle of the year, in the latter part of the year they either stayed stable or went down. In this article, we will understand the crypto market trends and forecasts for the fall of 2023.

A positive turn occurred in the Ripple court case with the U.S. Securities and Exchange Commission, which brought hope to investors. Additionally, the introduction of Worldcoin, a cryptocurrency that utilizes iris scans for user verification sparked conversations and debates. As the U.S. Government takes steps towards regulations for cryptocurrencies and with the Federal Reserve’s decisions on interest rates it seems that the upcoming fall will bring a phase, for the crypto market.

September’s Crypto Market Trends And Performance: A Closer Look

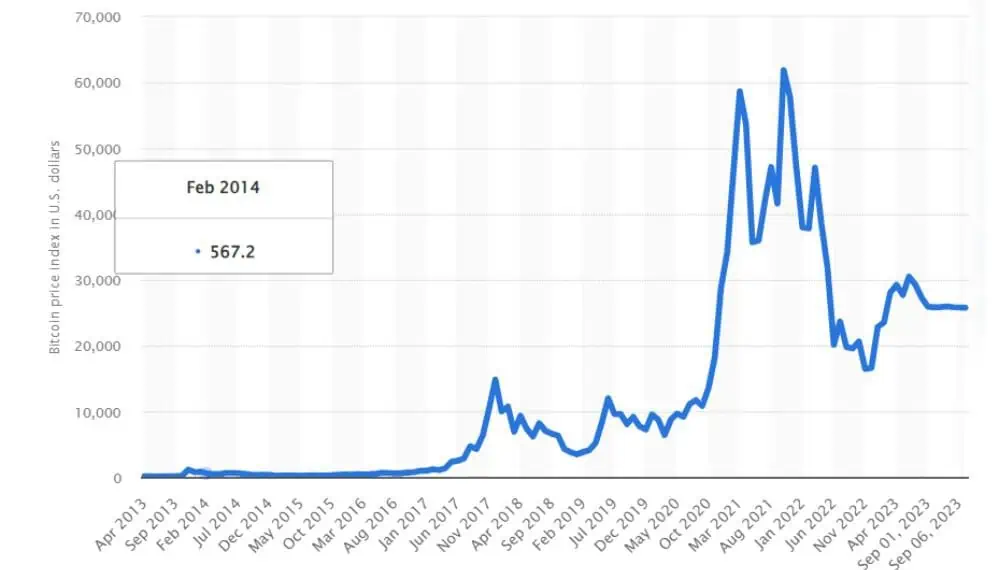

Bitcoins Journey in September: In the month of June it touched the highest this year at the $30,466 mark. These gains were attributed to reports indicating a decrease in inflation rates. However now in almost mid-September Bitcoins momentum slowed down to the present mark of $25,752 mark (September 12, 2023)

Image source: Statista

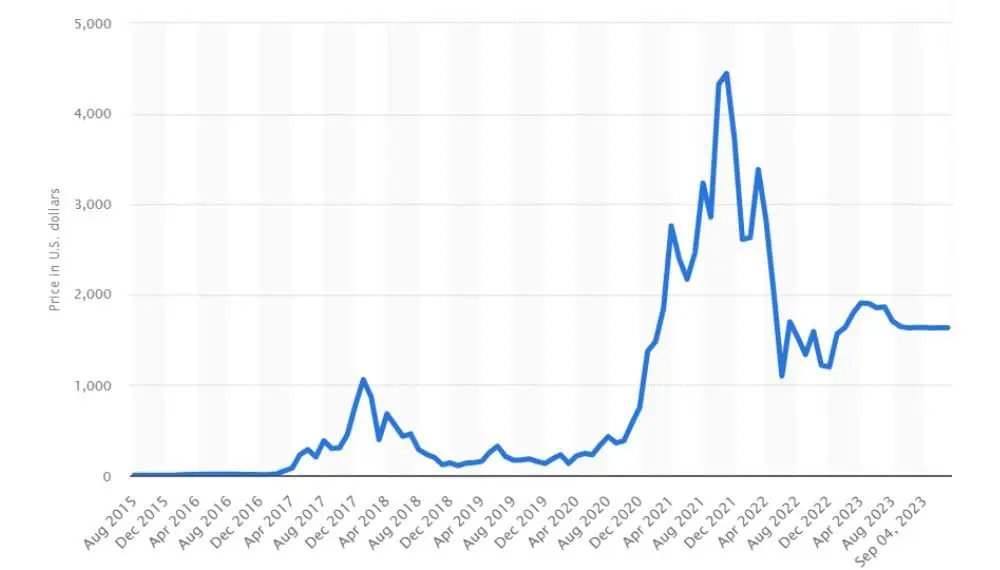

Ethereum: Just like Bitcoin Ethereum also gained its high in April 2023 which was $1905. In September it was down to $1632.9

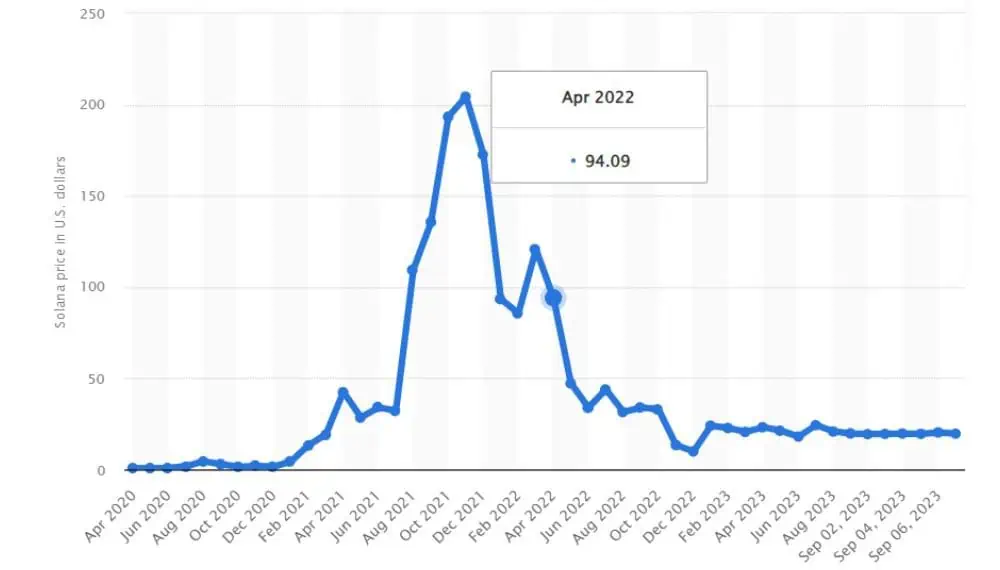

Solanas Remains Stable: Among the ten cryptocurrencies based on market value, Solana remained stable in 2023. In March 2022 it reached a level of $204.35. In January 2023 it was around $23.96 and on September 7, 2023, the value was almost stable at $19.63.

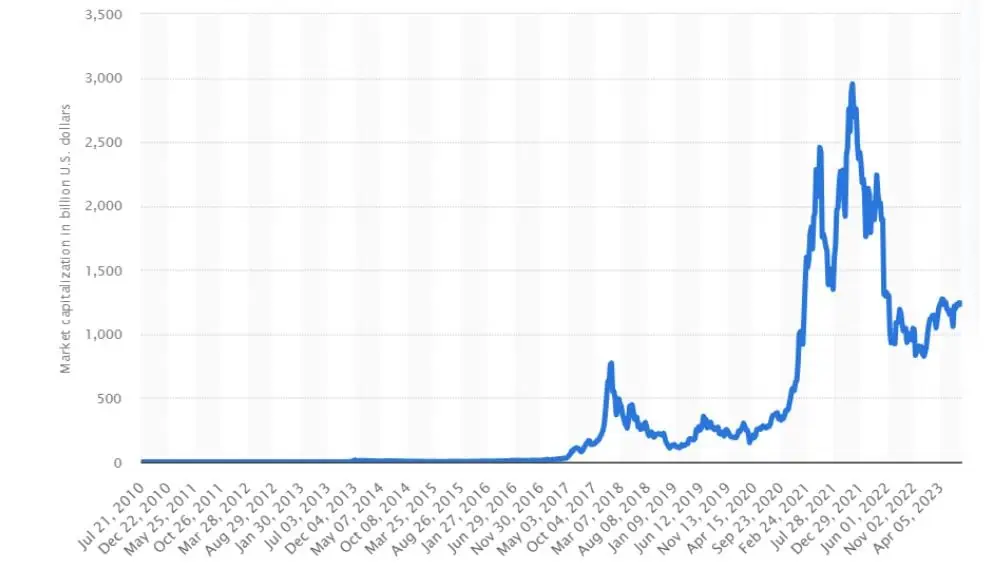

Overview of Market Capitalization: Taking a look back, at performances the global cryptocurrency market reached its peak in November 2021 with a capitalization exceeding $2.9 trillion.

However, the cryptocurrency industry experienced a setback during the winter of 2022. By the end of July, the market cap had decreased considerably to a $1.2 trillion.

The XRP Court Ruling:

On July 13 the crypto community witnessed a development when Ripple, the company, for the XRP cryptocurrency achieved a partial victory in its ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). This legal dispute originated in 2020 when the SEC accused Ripple of violating securities regulations by selling XRP without registration. This had a strong impact on the crypto market trends that can change during the fall of 2023.

The recent ruling, delivered by a judge from the Southern District of New York clarified that XRP cannot be categorically classified as a security. This declaration had an impact on the value of XRP. Also influenced other alternative cryptocurrencies. However, it’s important to note that this ruling was nuanced and didn’t represent a triumph for Ripple.

While determining that sales of XRP through trading algorithms, exchanges, or employee compensation schemes did not meet the criteria for being considered securities there was an exception. The judge expressed their view that Ripple’s sale of XRP to institutions could indeed be categorized as securities transactions.

This ruling carried implications for major cryptocurrency exchanges. In response to the outcome for XRP, both Coinbase and Kraken swiftly reinstated XRP trading, on their platforms. Furthermore Coinbases stock price saw an uplift following the aftermath of the Ripple decision.

Investors were mainly optimistic because they saw the XRP ruling as an indication, for Coinbase. This gave them hope in Coinbase’s battle with the SEC, where it is accused of acting as an unregistered broker and exchange. However, it’s important to note that the court’s decision, on XRP didn’t entirely favor Ripple. It did bring some needed clarity to the world of cryptocurrency regulations and its impact was felt throughout the wider crypto community.

Worldcoin’s Intriguing Launch: Potential and Pitfalls

An Innovative Approach to Digital Identity

In July the world of cryptocurrencies saw the arrival of a contender called Worldcoin. Led by Sam Altman, who’s well known for his role, in OpenAI, the birthplace of ChatGPT Worldcoin has introduced a method, for digital identification. By incorporating iris scanning technology Worldcoin aims to issue ” passports” called World IDs. This initiative aims to address the growing problem of distinguishing people from AI entities in interactions.

Concerns Over Security and Privacy

The Worldcoin initiative although innovative has not avoided criticism. The gathering of data the sensitive iris scans has raised concerns. Those who oppose cryptocurrency are worried, about the risks, to security and privacy that may result from storing sensitive information.

Trading, Distribution, and Market Reception

The Worldcoin token, known as WLD was introduced on July 24. To encourage adoption people who underwent an iris scan were given tokens. Although people, in the United States, cannot currently acquire WLD tokens Worldcoin has made its presence felt in cities like New York, San Francisco, and Miami.

These cities are among the 30 locations where individuals can participate in the Worldcoin eye experience. During its week of trading, WLD’s performance showed volatility with prices fluctuating between $1.66 and $3.58 according to CoinMarketCap data. Despite being in its stages Worldcoin already has a market capitalization of around $267 million.

Worldcoins entry into the cryptocurrency realm has been far from ordinary. With its approach to identity and some underlying concerns, it is generating considerable interest, within the crypto community.

Emerging Cryptocurrency Legislation: A Glimpse into the Future

In July there was a lot of activity, in the U.S. Congress regarding cryptocurrency. With the crypto industry growing investors and stakeholders have been eagerly waiting for guidelines on how it will be regulated.

The House Financial Services Committee (HFSC) took a step forward. They not only pushed forward a bill that focused on creating rules for payment stablecoins but also introduced another comprehensive bill. This detailed legislation aims to establish a framework for regulating cryptocurrency. One significant aspect is defining criteria to determine whether digital assets should be classified as securities or commodities.

At the time the Senate demonstrated its commitment to preventing the misuse of cryptocurrencies. A substantial defense spending bill was approved by the Senate. Included provisions that empower the Treasury Department to take action against using cryptocurrencies for illegal activities.

Overall July showed that U.S. Legislators are taking steps to shape the cryptocurrency industry while emphasizing the need, for innovation and responsible oversight.

Elon Musk’s Dogecoin Endeavors: More than Just a Meme?

In July there was a surge, in the popularity of Dogecoin, a cryptocurrency inspired by memes. This increase became particularly pronounced on July 24 when the value of this coin rose by 8%. The main catalyst behind this leap can be attributed to Elon Musk, the renowned tech mogul. As the CEO of Tesla and now leading the platform formerly known as Twitter but rebranded as “X ” Musk made a significant move by updating his bio on the platform to feature the symbol of Dogecoin.

The connection between Musk and Dogecoin runs deep. Not only has he previously allowed Dogecoin as a form of payment for Tesla merchandise but he also holds significant investments in this cryptocurrency.

Given Musk’s efforts to rebrand Twitter as “X,” there is speculation within the crypto community about the potential integration of Dogecoin as an officially recognized payment method, on this platform. Only time will reveal whether these speculations will become reality.

July To September Crypto Headlines: A Month of Revelations and Transformations

July witnessed an array of notable events in the cryptocurrency world. From corporate strategies to regulatory actions, the industry was abuzz with activity. Here’s a roundup:

MicroStrategy’s Future with Bitcoin

On July 26th TD Cowen issued a rating, for MicroStrategy (MSTR) a well-known company that has made significant investments in Bitcoin. Lance Vitanza, an analyst at TD Cowen expressed support for the company’s long-term strategy. Shared his perspective;

- • The company’s decision to consistently invest its retained earnings in Bitcoin is not a short-term tactic.

- • Bitcoin has the potential to surpass metals and fiat currencies as a store of value.

- • MicroStrategy offers an opportunity for those in gaining exposure, to Bitcoin.

Binance’s Woes Continue

Binance, a leading cryptocurrency exchange, faced a rough patch:

- The company terminated over 1,000 staff roles.

- Benefits for the existing team were trimmed.

- Regulatory challenges from the SEC and the Commodity Futures Trading Commission plagued Binance. These allegations pertain to Binance’s illicit U.S. operations. Consequently, Binance.US experienced a drastic fall in market share, plummeting from 27% in April 2023 to just above 1% in July.

CoinDesk’s Potential Acquisition

An investor consortium spearheaded by Tally Capital and Capital6 is on the brink of purchasing the crypto-centric media entity CoinDesk for a whopping $125 million. This acquisition seems promising, given CoinDesk’s robust 2023 revenue of $50 million sourced from various channels.

Celsius Network’s Downfall

July 13 marked a low point for Alex Mashinsky, Celsius Network’s originator. Arrested and slapped with multiple charges, including securities fraud and market manipulation, the collapse of Celsius is reminiscent of FTX’s demise in 2022’s crypto winter.

Bitcoin ETF Prospects

In the Bitcoin ETF arena, a recent study by NYDIG proposed a potential $30 billion spike in Bitcoin demand due to a Bitcoin spot exchange-traded fund. Despite the SEC’s reservations about investor protection, the crypto community remains hopeful. They anticipate that fresh Bitcoin ETF applications from giants like BlackRock and Fidelity might tilt the scales.

In summary, July was a dynamic month for the crypto universe, marked by highs and lows, painting a vivid picture of an industry in flux.

Final Words

As we head towards the autumn of 2023 the world of cryptocurrencies finds itself at a juncture where innovation and regulation intersect. As Bitcoin and other major digital currencies navigate through market fluctuations, changes, and technological advancements the future ahead appears both captivating and challenging.

From the outcome of the case involving Ripple to the introduction of projects, like Worldcoin along with ongoing efforts to establish clear regulations within the crypto realm this upcoming season holds great significance for developments.

As we observe how market dynamics interact with forces, those involved in the community eagerly await how these trends will shape the destiny of digital assets. The path ahead will undoubtedly be influenced by striking a balance, between innovation, responsible governance, and meeting the evolving needs of investors and enthusiasts who contribute to this vibrant ecosystem.

Frequently Asked Questions (FAQs)

What were the major trends in the cryptocurrency market during the first half of 2023?

The first half of 2023 saw significant fluctuations in the value of major cryptocurrencies, with Bitcoin and others hitting 52-week highs before facing a slowdown in the latter part of the period. Additionally, regulatory developments, such as the Ripple court ruling and the launch of Worldcoin, garnered substantial attention.

How did the Ripple court ruling impact the crypto market?

The Ripple court ruling offered a partial victory for the company in its legal battle with the U.S. SEC. The court's determination that XRP isn't necessarily a security on its face had implications for the classification of digital assets. This decision affected investor sentiment and contributed to market trends.

What is the significance of Worldcoin's launch and its controversy?

Worldcoin's launch introduced an innovative concept of using iris-scanning technology for digital identity verification. This raised both interest and concerns within the crypto community due to potential privacy and security risks associated with collecting biometric data.

What can we anticipate for the cryptocurrency market in the coming fall of 2023?

The fall of 2023 holds the promise of continued market volatility, further regulatory developments, and potential technological innovations. Cryptocurrency enthusiasts and investors are eager to witness how these factors will interact to shape the trajectory of digital assets in the months ahead.