Tedious manual tasks are becoming a thing of the past in many areas thanks to automation. So why should your accounts payable process be any different?

Accounts payable automation eliminates costly, time-consuming manual data entry and processing. Your finance department is free to focus on high-value tasks such as cash flow management and forecasting.

Automation doesn’t only free up time, though. It also improves accuracy, reduces costs, and gives real-time visibility into your finances, alongside numerous other benefits.

In this article, we’ll explore the six key benefits of using automation technology to help you visualize what it could do for your accounts payable department and overall business.

What is accounts payable automation?

Accounts payable (AP) automation is a tool for creating automated workflows to replace your manual methods. These include data entry, invoice processing, approval routing, payment tracking, and your reconciliation or matching process. The most sophisticated solutions can even send payments automatically and improve vendor management.

AP automation may come as a standalone solution, or it may be part of a broader accounting solution. On top of this, it may be in the cloud (with a similar model to the top SaaS companies), on-premises, or a combination of the two.

Accounts payable automation software digitizes the entire payable process. This removes the need to handle physical paper invoices and purchase orders. The goal is to save time, improve accuracy, and reduce your cost per invoice. AP automation workflows generally include the following steps:

- The software scans the invoice and converts it into a digital file.

- The key information from the invoice is extracted using optical character recognition (OCR).

- The invoice is sent for approval according to your predefined approval hierarchy.

- The software matches your invoice against your purchase order and flags any discrepancies. Some software offers both two- and three-way matching for extra certainty.

- Assuming your documents match, the software makes the payment using your preferred payment method.

The accounts payable software also provides detailed analytics dashboards to improve the transparency of your AP workflow and inform your decisions. Some software also uses machine learning to optimize the process over time.

6 Benefits of accounts payable automation

There are numerous benefits to deploying an accounts payable automation solution in your business. Let’s look at six of them in detail.

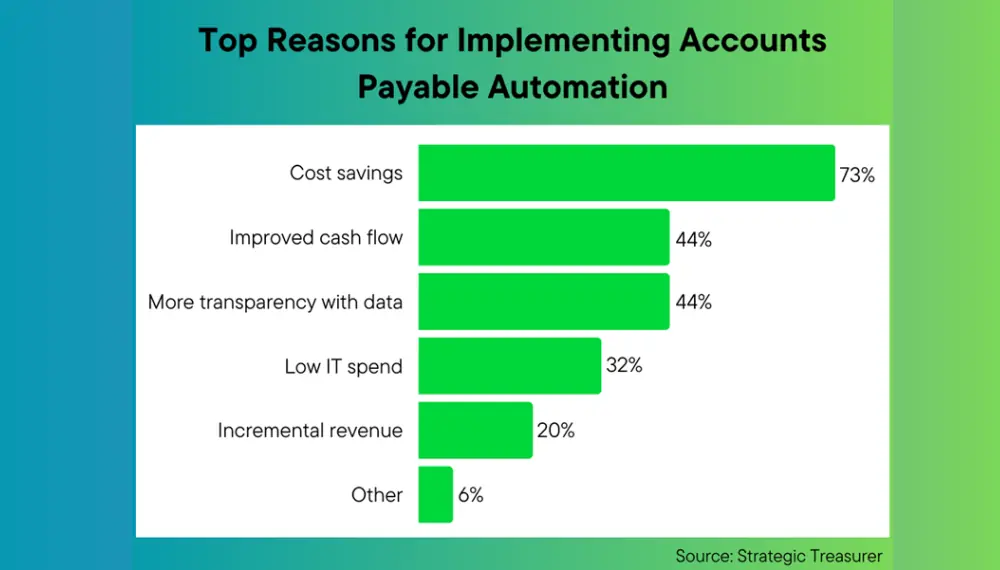

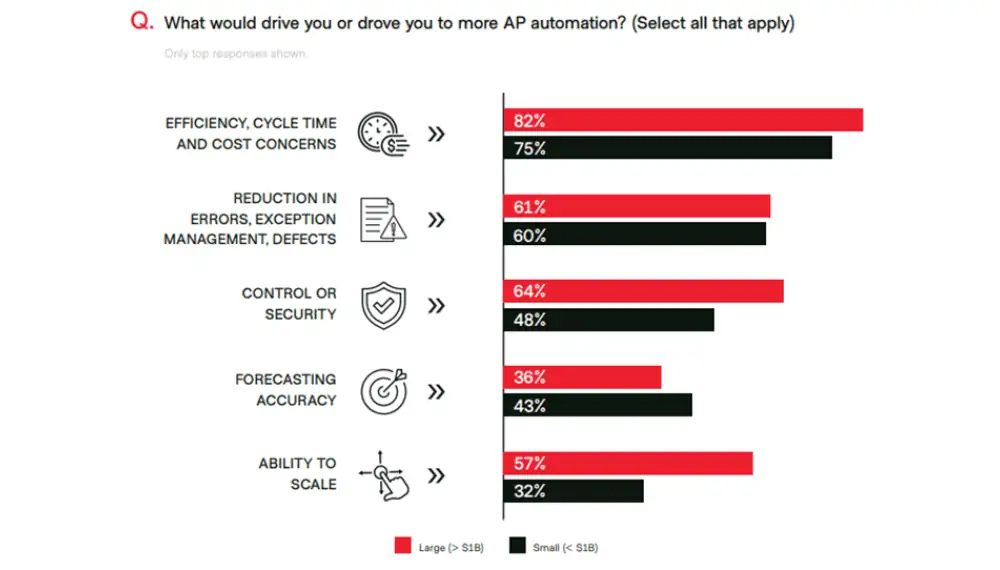

Image created by the writer (Data sourced from strategictreasurer.com)

Eliminates manual errors to improve accuracy

Manual data entry and invoice processing are vulnerable to human errors—typos, duplications, and missing data, for example. Fixing potential errors means extra work for your accounting team, including chasing duplicate and erroneous payments. Not to mention the damage to your reputation and relationships with suppliers if errors cause late payments.

With accounts payable automation software, you can eliminate human error from your AP workflow. Automated data capture saves time and guarantees each invoice is input accurately, since the software automatically updates your financial records, reducing the chances of errors.

On top of this, there are built-in checks to flag errors that manual processing can miss. This results in accurate, timely payments to vendors every time (vital for robust supplier management). With AP automation, you can maintain your reputation and even gain access to payment discounts if suppliers never have to chase payments.

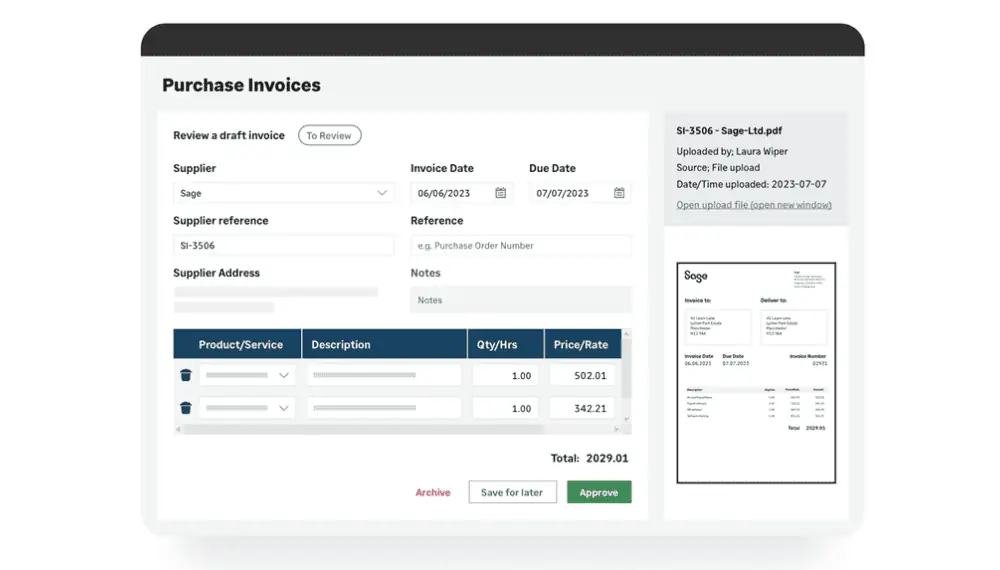

Image sourced from Sage.com

In addition, improved accuracy helps you make better financial decisions. It also increases stakeholder confidence in your business and the confidence of potential investors, which is especially important for small businesses.

Cuts costs by ending manual processing requirements

If you’re still relying on a manual invoice processing system, your cost per invoice will be high. Costs include paper, printing, mailing, storage, and the time spent on manual payment reconciliation and data entry.

AP automation can streamline your AP process and remove the need for paper-based document management.

You won’t have to store boxes of documents, buy paper or printer ink, or pay for postage. Instead, you can store your financial documents electronically. This is significantly cheaper一and more environmentally friendly. On top of this, thanks to automated data capture, you can handle the approval of invoices over email.

Faster invoice processing times also reduce processing costs and improve productivity. Instead of paying your accountants to process and approve invoices, you can pay them for tasks that bring value to your business. Plus, you won’t have the cost of late payment fees or regulatory fines.

Enhances accounts payable control and visibility

Another problem with manual processes is a lack of visibility into invoices and payment status. This can make it difficult to control spending.

Automation tools help overcome this barrier. Dashboards display real-time insights, including cash flow and spending patterns. That means better financial management. You can also strengthen supplier relationships by ensuring you pay each invoice on time whether they’re in the US, UK, or somewhere else.

You can check an invoice status with one click, including where it is in your approval process. If a payment deadline is looming, your finance teams can chase it up. They can also get insights into how each team member is performing, helping them pinpoint opportunities for training. Not to mention that performance reviews will be a breeze!

What’s more, automated systems can flag reconciliation issues and generate accurate financial reports. This helps you quickly address problems and make more informed decisions.

Plus, you can more accurately define financial controls to guarantee you stay within your monthly budget. You can also analyze and categorize your data in real-time to pinpoint challenges and opportunities.

Speeds up payments for improved cash flow

There are many strategies to improve cash flow, from offering a new product to buying in bulk. But did you know that AP automation can also improve cash flow?

Manual processes cause cash flow issues if unpaid invoices build up or you’re hit with late fees. By automating, you can eliminate delays caused by human error and speed up your entire payment workflow, from data entry to invoice approvals. This way, you can guarantee on-time payments and improve cash management throughout your business.

The software can issue payments automatically, further reducing processing times. You can even set up automated invoice approval workflows to reduce the need for manual approval. This leaves your management teams free to focus on the tasks that only humans can do.

On top of this, by improving cash flow visibility, AP automation software can help you optimize it. The software can use the data to create accurate cash flow forecasts, helping to prevent shortfalls.

Secures invoices and payments to reduce fraud risks

Manual processing and storage come with numerous security risks. A break-in could uncover sensitive financial information, misplaced invoices could fall into the wrong hands, or there could be a fire or flood that causes permanent loss of files. Unless you regularly review your books, you could also fall victim to fraudulent payments and other scams.

AP automation solutions come with various security features, including access control, encryption, and two-factor (or multi-factor) authentication. Only those with the right credentials can access critical or sensitive documents, so it’s harder for criminals to steal your information. It’s also harder for dishonest employees to view data they shouldn’t.

The system can flag suspicious payments and provide a comprehensive audit trail. This helps to prevent fraud from inside and outside your company. Pay your invoices with confidence and stay compliant with government regulations.

Plus, accounts payable automation backs up your records automatically. You won’t lose your important data if you’re hit by a natural disaster or cyberattack.

Image Sourced from Strategictreasurer

Ensures government compliance for businesses

No matter what size your business is or where you operate, you must make sure your AP process complies with government regulations. These include SOC 2, HIPAA, SOX, GAAP, and GDPR (if you have offices in the UK or EU).

It’s also essential to be aware of local tax laws. If you operate in the US, look for a platform that complies with IRS regulations. Businesses and sole traders based in Australia must consider software that is ATO compliant, while those based in the UK should be aware of HMRC requirements, such as Making Tax Digital (MTD).

Manual AP workflows are more prone to non-compliance due to their higher error rate and longer processing times. Accounts payable solutions automate this process for you by keeping a digital record of sales and purchase invoices—this is particularly noteworthy for UK-based businesses that need to be MTD-compliant by 2026.

Typically, AP automation software comes with built-in compliance checks and standardized approval workflows to reduce errors. It can also flag discrepancies and provide a detailed audit trail of who handled each invoice and when it was paid.

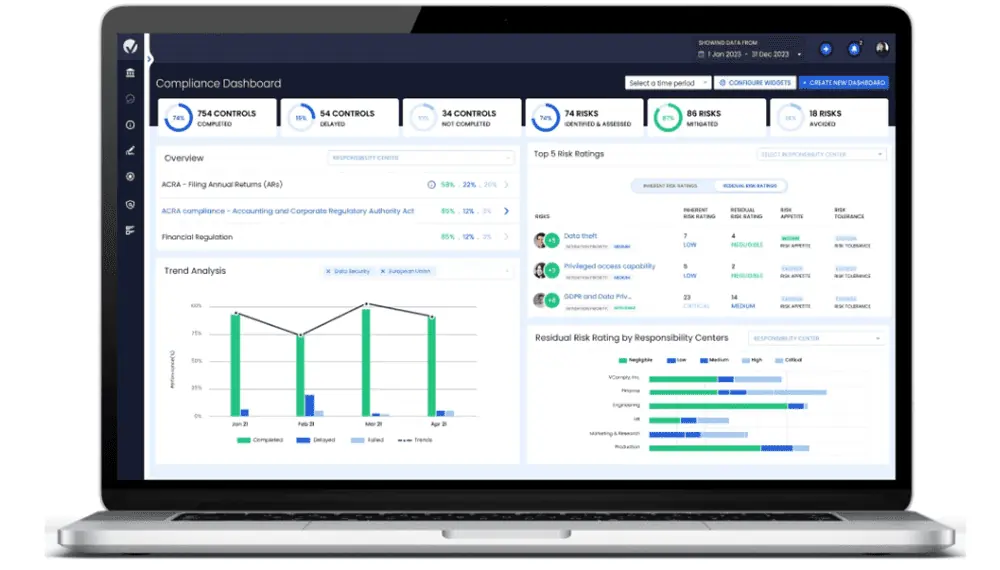

You can guarantee compliance by opting for an all-in-one software or a standalone solution, such the VComply compliance management program, StandardFusion for GRC compliance in Canada, or Sage self-assessment software for the UK.

Image Sourced from v-comply

Save money and maximize efficiency with accounts payable automation

As we’ve seen, accounts payable automation has a range of business benefits. It can reduce invoice processing costs, improve security and compliance, and make sure you make all your vendor payments on time.

It also gives you greater internal control and visibility into spending. This helps you manage cash flow and make better decisions. And, if you pair it with accounts receivable automation, you can streamline your entire accounting process.

The ultimate goal of automation is to serve you and make your work easier, so don’t waste any more time and money, choose the best software and enjoy the benefits of AP automation!