In an increasingly interconnected world, the rapid evolution of financial technology has ushered in a new era of seamless transactions and real-time payments. While the United States has long been a powerhouse in the global financial landscape, its journey toward adopting real-time payments has been full of challenges and a cautious approach.

However, in India, a quiet revolution has been unfolding, fueled by a remarkable success story known as the Unified Payment Interface or UPI. This innovative and transformative system has not only revolutionized India’s digital payment landscape but also holds the potential to provide a compelling template for real-time payments in the US.

What is UPI?

Unified Payments Interface (UPI) is a groundbreaking digital payment system that has transformed the way transactions are conducted in India. Launched in 2016 by the NPCI, UPI has quickly become a ubiquitous and popular method of transferring funds, making payments, and conducting financial transactions across the country.

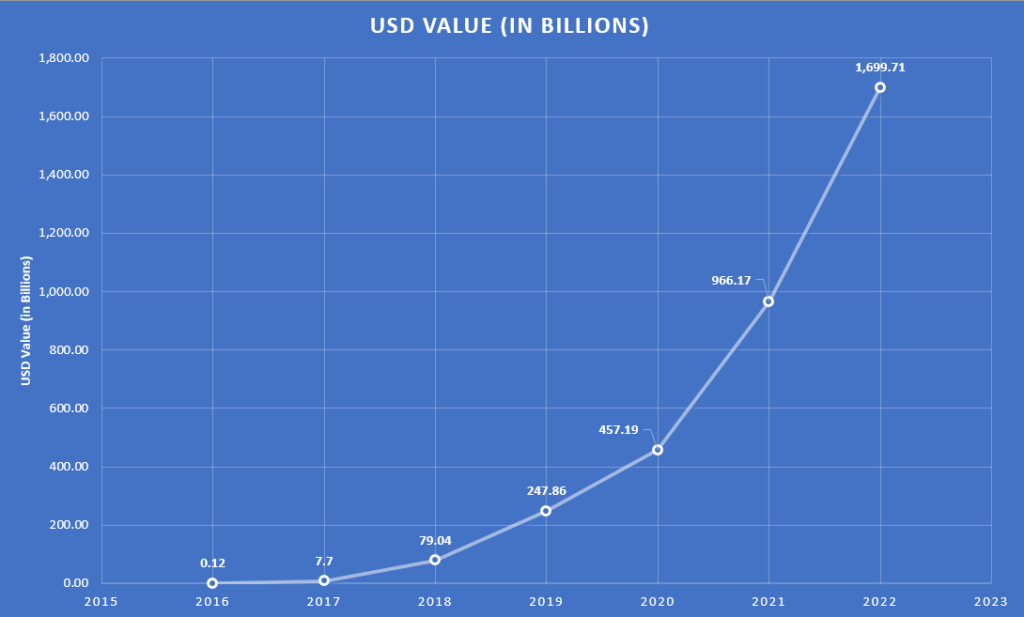

Data source: NPCI

At its core, UPI is a real-time, interbank payment platform that enables users to transfer money instantly between banks through their smartphones. It offers a seamless and secure experience, allowing individuals to link their bank accounts to a unique virtual payment address (VPA) or their mobile number. This eliminates the need for cumbersome account numbers and swift codes, making transactions simpler and more user-friendly.

One of UPI’s standout features is its interoperability, which means that it is not restricted to a specific bank or payment service provider. Instead, any bank or financial institution can participate in the UPI ecosystem, fostering healthy competition and innovation in the digital payment space. Moreover, UPI operates on a 24×7 basis, ensuring that users can make transactions at any time of the day, even on weekends and holidays.

Data source: NPCI

Since its inception, UPI has witnessed exponential growth, reshaping India’s economy and driving financial inclusion. Its user-friendly interface, instantaneous transactions, and minimal transaction costs have appealed to millions of users, from urban millennials to rural populations. Additionally, UPI has played a pivotal role in promoting cashless transactions and reducing reliance on physical currency.

The success of UPI in India has garnered international attention, with many countries looking to learn from its achievements and adopt similar real-time payment systems. As the world continues to embrace the digital revolution, UPI stands as a shining example of how innovative technology can revolutionize financial transactions and pave the way toward a more financially inclusive and connected global economy.

Countries Where UPI is Accepted

- Bhutan

- Nepal

- France

- Qatar

- Saudi Arabia

- Malaysia

- Singapore

- Thailand

- Cambodia

- Indonesia

- Oman

- Mauritius

- South Korea

- Bahrain

- Maldives

- United Arab Emirates

- Australia

- Switzerland

- Canada

- United Kingdom

- European Union

- Russia

- Vietnam

- Sri Lanka

- Japan

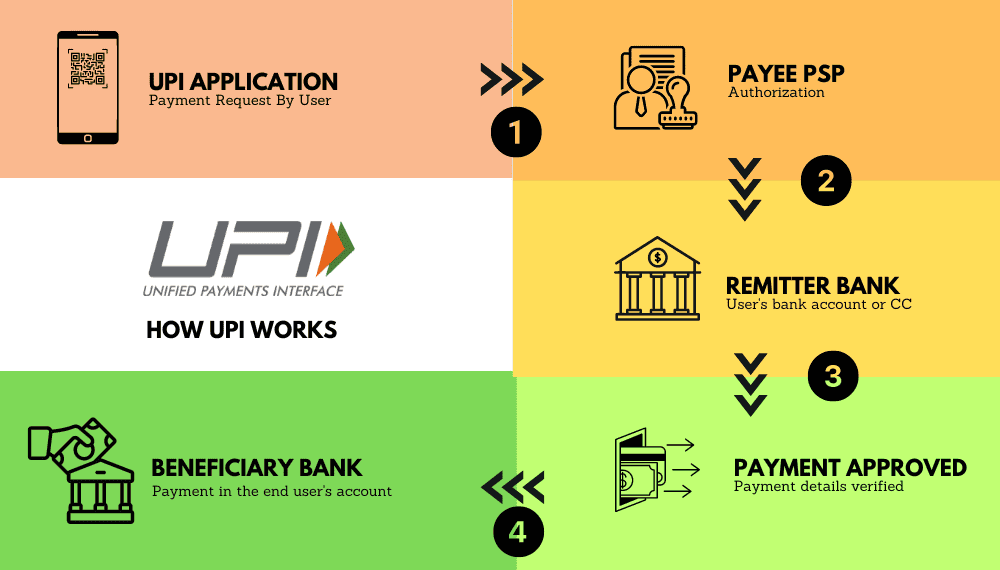

How UPI Payments Work?

To begin using UPI, individuals need to download a UPI-enabled mobile banking application from their respective banks or third-party payment apps available in app stores. After installing the app, users must complete a one-time registration process by providing necessary details like name, and mobile number, and creating a secure UPI PIN. This UPI PIN serves as the key authentication method for all transactions, adding an extra layer of security.

Once registered, users can link one or multiple bank accounts to their UPI app. The linked bank accounts will be accessible for transactions, and users can choose their preferred bank account for making payments.

Step By Step Explanation of How UPI Works

1- Initiating Transactions

UPI payments can be initiated in several ways. One common method is to use Virtual Payment Addresses (VPAs), which act as unique identifiers linked to bank accounts. Instead of sharing sensitive bank details like account numbers and IFSC codes, users can provide their VPA (e.g., yourname@bankname) to receive payments.

Alternatively, users can also use their mobile numbers to initiate transactions. By selecting the recipient’s mobile number from their phone contacts, they can directly send money to that person’s linked bank account.

2- Security and Authentication

Security is a fundamental aspect of UPI payments. Every transaction requires a two-factor authentication process. First, users need to enter their UPI PIN, which only they know, to authorize the transaction. Second, many UPI apps also incorporate biometric authentication, such as fingerprint or facial recognition, for an additional layer of security.

3- Authorization and Processing

When a user initiates a transaction, the UPI app communicates with the NPCI’s UPI system, which acts as the central authority and enables the seamless transfer of funds between banks. The NPCI verifies the transaction details, ensuring the authenticity of the request and the availability of funds.

4- Instant Fund Transfer

Once the transaction is authorized, the UPI system instantly transfers funds from the sender’s bank account to the recipient’s bank account. This real-time transfer is one of the key features that sets UPI apart from traditional payment methods like NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement), which may take hours or even days to complete.

5- Transaction Status and History

Users receive immediate notifications of successful transactions, including details of the amount transferred and the recipient’s information. Additionally, users can access their transaction history within the UPI app, providing them with a comprehensive record of all past payments.

6- Payment Requests and Collect Requests

UPI also supports payment requests and collection requests. Payment requests allow users to request funds from others, while collect requests enable users to receive payment requests and authorize payments accordingly. This feature is especially useful for merchants, bill payments, and splitting bills among friends.

Overall, payments UPI have revolutionized the way Indians transact, offering a fast, secure, and convenient method to send and receive money. With its interoperability, ease of use, and continuous innovation, UPI has set a precedent for real-time payment systems globally and continues to drive financial inclusion and digital adoption in India.

How UPI Payments in India Helped Economy

The Unified Payment Interface (UPI) has revolutionized the way transactions are conducted in India, igniting a financial transformation that has had a profound impact on the nation’s economy. As of 2022, UPI transactions have witnessed a staggering 91% surge, with the total value of transactions exceeding $1 trillion USD equivalent.

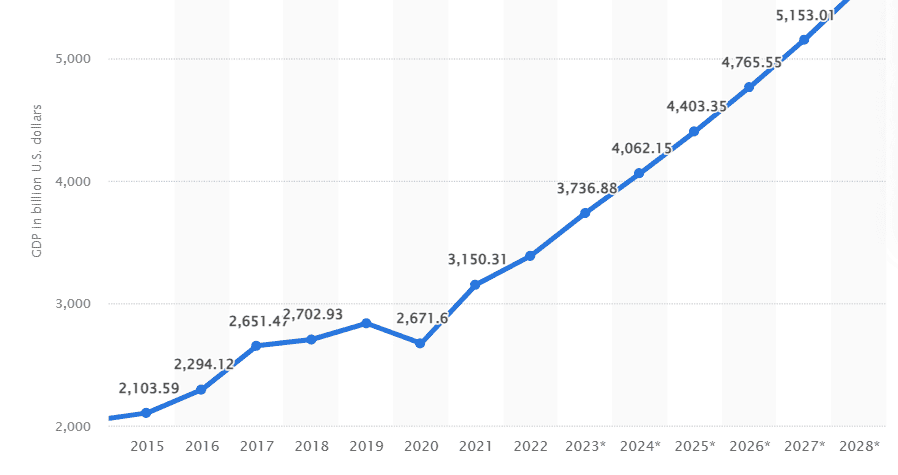

Indian GDP to cross 5 Trillion in 2027. Source

The rapid adoption of UPI payments has not only driven financial inclusion and digital adoption but has also spurred e-commerce growth, reduced reliance on cash, and empowered small and medium enterprises (SMEs).

Let’s explore how UPI payments have been instrumental in shaping the Indian economy and helping to achieve a more inclusive and digitally-driven financial system.

Financial Inclusion and Increased Digital Adoption

One of the most significant contributions of UPI payments to the Indian economy is its role in driving financial inclusion. UPI has enabled millions of previously unbanked or underbanked individuals to gain access to formal financial services.

With a simple smartphone and internet connectivity, even those in remote areas can now participate in the digital economy. This increased financial inclusion has brought more people into the formal banking system, leading to a broader base of consumers and potential investors, thus fueling economic growth.

Boosting E-commerce and Digital Transactions

The rise of UPI payments has had a profound impact on e-commerce and digital transactions in India. With the ease and convenience of UPI, consumers have embraced online shopping and digital payments, leading to a surge in e-commerce transactions. This boost in online consumer activity has encouraged the growth of the digital economy, enabling businesses to expand their customer base and operations. As more businesses and merchants adopt UPI as a payment option, it creates a thriving ecosystem for online commerce, ultimately contributing to the overall economic growth of the country.

Promoting Cashless Economy and Reducing Black Money

UPI has been instrumental in India’s push towards a cashless economy. The convenience and accessibility of UPI payments have motivated individuals to conduct transactions digitally, reducing their reliance on physical cash. Reducing cash transactions not only increases transparency in the financial system but also helps combat black money and tax evasion. By leaving a digital trail of transactions, UPI payments have contributed to greater accountability and improved tax compliance, positively impacting government revenue and fiscal management.

Enhancing Small and Medium Enterprises (SMEs) Growth

Small and medium enterprises (SMEs) form a crucial segment of India’s economy, contributing significantly to employment generation and GDP growth. UPI payments have empowered these businesses by providing a cost-effective and efficient means of receiving payments from customers.

With UPI, SMEs can easily accept digital payments, eliminating the barriers posed by traditional cash-based transactions. This, in turn, enhances the SMEs’ ability to scale their operations, access credit, and invest in growth opportunities, ultimately contributing to economic development.

Reduction in Transaction Costs and Time-Efficient Transactions

UPI payments have led to a reduction in transaction costs for businesses and consumers alike. Traditional payment methods, such as credit cards and bank transfers, often involve higher fees and processing charges. In contrast, UPI transactions typically incur lower costs, making it an attractive option for both individuals and businesses.

Additionally, the instantaneous nature of UPI payments facilitates quicker settlements, reducing the time taken to complete financial transactions. This efficiency benefits various industries, such as retail, travel, and manufacturing, as it streamlines their supply chains and enhances overall productivity.

Enhanced Government Initiatives and Welfare Schemes

The Indian government has harnessed the potential of UPI to disburse welfare benefits and subsidies directly to beneficiaries’ bank accounts. This direct benefit transfer (DBT) system ensures that government funds reach the intended recipients without any intermediaries, reducing leakages and ensuring efficient delivery of social welfare programs.

UPI has thus played a crucial role in improving the effectiveness of government initiatives and boosting the standard of living for vulnerable sections of the population.

Overall, payments UPI have emerged as a transformative force in India, leaving an indelible mark on the nation’s economy. Its role in promoting financial inclusion, driving digital adoption, spurring e-commerce growth, and fostering SME development has been instrumental in shaping India’s economic landscape. As UPI continues to evolve and expand its reach, it holds the potential to drive further economic growth, modernize financial services, and set a precedent for real-time payment systems worldwide.

Benefits of UPI for Real-Time Payments

1- Speed and Efficiency

One of the most significant benefits of adopting UPI payments in the US is the speed and efficiency it brings to the financial system. UPI enables real-time, instantaneous transactions between banks, allowing individuals and businesses to send and receive funds within seconds. This swift processing time eliminates the waiting periods associated with traditional payment methods like wire transfers, providing a seamless and efficient payment experience.

2- 24/7 Accessibility

UPI operates on a 24/7 basis, allowing users to conduct transactions at any time of the day, including weekends and holidays. This round-the-clock accessibility ensures that payments are not limited by banking hours or settlement cycles, providing unparalleled convenience and flexibility for users. Whether it’s making urgent payments or processing time-sensitive transactions, UPI’s availability around the clock offers a significant advantage for real-time payments in the US.

3- Enhanced Financial Inclusion

The implementation of UPI payments in the US could enhance financial inclusion by providing a user-friendly and accessible platform for digital transactions. UPI’s simple registration process and interoperability allow people from all walks of life, including the unbanked and underbanked populations, to participate in the formal financial system.

By fostering greater financial inclusion, UPI can empower individuals and businesses with increased access to banking services and the ability to manage their finances more efficiently.

4- Lower Transaction Costs

UPI payments generally incur lower transaction costs compared to traditional payment methods like credit card processing or wire transfers. The reduced fees associated with UPI can translate to significant cost savings for businesses, especially for those handling a large volume of transactions. Lower transaction costs can encourage businesses to embrace real-time payments, as it makes financial sense while simultaneously benefiting consumers with reduced or eliminated transaction fees.

5- Security and Fraud Prevention

UPI incorporates robust security measures, including two-factor authentication and biometric verification, to ensure the safety of transactions. This security framework helps protect users against fraudulent activities and unauthorized access to their accounts. As real-time payments gain traction in the US, implementing a secure and trusted platform like UPI can provide users with confidence in the safety of their transactions, thereby reducing concerns about potential security breaches.

6- Streamlined Business Processes

For businesses, real-time payments through UPI can streamline cash flow management and simplify accounts receivable and payable processes. With faster settlements, businesses can optimize their working capital, reducing the need for complex credit management and enhancing overall financial efficiency. Additionally, UPI’s open API architecture allows businesses to integrate payment systems with their existing applications and infrastructure, making payment processing seamless and hassle-free.

7- Promoting Digital Innovation

The adoption of UPI payments can foster digital innovation in the US financial sector. As real-time payments become more prevalent, it will encourage the development of innovative payment solutions, mobile apps, and financial services. Moreover, the open nature of UPI allows fintech companies and developers to build new and creative applications that cater to the evolving needs of consumers and businesses.

Overall, payments UPI have the potential to revolutionize real-time payments in the US, offering numerous advantages ranging from speed and efficiency to enhanced financial inclusion and security. By embracing UPI’s proven success and incorporating its core principles into the US payment ecosystem, the nation can pave the way for a faster, more accessible, and technologically advanced financial landscape, benefiting both businesses and consumers alike.

Can the US Benefit From UPI?

UPI has proven to be successful in India. As the world becomes increasingly interconnected and digital, several key factors make UPI an ideal model to shape the future of payments in the US. Let us discuss each of them one by one.

- Real-Time Payments and Instant Settlements

One of the primary reasons why UPI is the future of payments in the US is its ability to facilitate real-time transactions and instant settlements. Consumers and businesses alike demand swift payment solutions that eliminate delays and waiting periods. UPI’s instantaneous fund transfers between banks empower individuals and enterprises to complete transactions within seconds.

- Seamless Interoperability and Open APIs

UPI’s foundation on interoperability and open APIs enables seamless integration with multiple financial institutions and payment service providers. This approach allows for greater collaboration and competition among various players in the financial ecosystem. By adopting UPI’s interoperability model, the US can create a cohesive and unified payments system that bridges the gap between different banks, payment networks, and fintech companies, providing users with more choices and convenience.

- Enhanced Financial Inclusion and Accessibility

UPI has played a pivotal role in driving financial inclusion in India, reaching previously underserved populations and bringing them into the formal financial fold. The US can draw inspiration from this success to enhance financial accessibility for its own unbanked and underbanked communities. UPI is user-friendly and fast. The learning curve for the users is short. Thus it can be easily adapted by any financial system.

- Lower Transaction Costs and Boosting Business Efficiency

With its cost-effective nature, UPI can help lower transaction costs for both consumers and businesses. Businesses can benefit from reduced processing fees, especially for high-volume transactions, while consumers can enjoy fee-free or low-cost payment options. This cost-efficiency will encourage businesses to embrace real-time payments, leading to improved cash flow management, streamlined accounting processes, and increased financial productivity.

- Security and Trust in Digital Payments

UPI has implemented robust security measures, making it a trusted and secure platform for digital payments. As cyber threats continue to evolve, security is a top concern for consumers and businesses alike. By adopting UPI’s security framework, the US can instill confidence in users, mitigating concerns regarding potential fraud or data breaches, and fostering a more favorable environment for adopting real-time payments.

- Catalyst for Digital Innovation and Fintech Advancements

UPI’s success in India has proven to be a catalyst for digital innovation, paving the way for a dynamic fintech ecosystem. Embracing UPI in the US can foster an environment of creativity and competition, encouraging fintech companies and developers to devise cutting-edge payment solutions and transformative financial services.

India’s united payment interface UPI is a shining example of how real-time payments can shape the future of financial transactions in the US. With its emphasis on speed, efficiency, interoperability, and financial inclusion, UPI offers a compelling template for the nation’s payment system transformation. By adopting UPI’s core principles and building on its successes, the US can create a more inclusive, secure, and innovative payments ecosystem that aligns with the demands of the digital era and drives economic growth and prosperity.

Conclusion

The Unified Payments Interface (UPI) has emerged as a transformative force, leading to a financial revolution in India and setting a strong template for real-time payments that any nation can use. Its remarkable success in India, with a surge of 91% in transactions and over $1 trillion USD equivalent in value, speaks to its potential to reshape the US payment landscape.

UPI’s speed, efficiency, 24/7 accessibility, and lower transaction costs make it a catalyst for enhanced financial inclusion, promoting a cashless economy, and empowering small and medium enterprises (SMEs). Furthermore, its robust security measures make it an attractive option for financial transactions.

Frequently Asked Questions (FAQs)

Is UPI secure for making payments?

Yes, UPI is secure for making payments. It incorporates robust security measures, including two-factor authentication and biometric verification, to ensure the safety of transactions. Additionally, UPI apps and platforms adhere to strict security standards to protect user data and prevent fraudulent activities.

Can I use UPI for international transactions?

As of now, UPI is primarily designed for domestic transactions within India. There are around 23 countries where UPI payment is accepted. This includes the EU also.

Are there any transaction limits for UPI payments?

Yes, UPI transactions typically have limits imposed by banks for security purposes. These limits can vary based on the user's bank and their transaction history. There are usually separate daily and per-transaction limits for both sending and receiving funds.

Can I use UPI for bill payments and online shopping?

Yes, UPI can be used for various purposes, including bill payments and online shopping. Many merchants and service providers accept UPI payments, allowing users to make quick and hassle-free transactions.

Can I use UPI for business transactions?

Yes, UPI can be used for business transactions as well. Many businesses and merchants accept UPI payments from customers, and it can be particularly beneficial for SMEs due to its lower transaction costs and real-time settlements.

Is UPI available in countries other than India?

While UPI was initially developed for India's domestic payments, some countries have shown interest in adopting similar real-time payment systems. However, as of now, UPI is primarily used within India.

How can the US benefit from adopting UPI principles for real-time payments?

By adopting UPI principles, the US can benefit from faster and more efficient payments, enhanced financial inclusion, reduced reliance on cash, lower transaction costs, and increased security. Additionally, UPI's open API architecture can foster innovation in the fintech sector, leading to the development of innovative payment solutions and services.