In a striking development that has sent ripples through the financial world, the nation’s largest and most prominent banking institutions have recently made headlines. Bank of America layoffs approximately 200 employees from its wealth management unit. Most of them were shifted to the bank’s different units. Only a few lost their job in the bank.

- Understanding the Rationale Behind Bank of America Layoffs

- Impact of Layoffs on Employees: Navigating Uncertainty and Emotional Strain

- The Lending Industry's Languishing Job Market: Tracing the Impact of Higher Interest Rates

- Why Layoffs are Happening in the Lending Unit

- Conclusion

- Frequently Asked Questions (FAQs)

As whispers of restructuring and reallocation swirl around the financial giant, the fate of hundreds of dedicated employees hangs precariously in the balance. Let us understand how these layoffs will impact the financial sector across the US.

Understanding the Rationale Behind Bank of America Layoffs

Adapting to Market Conditions and Business Strategy

In a strategic move that has sent shockwaves through the financial sector, Bank of America has undertaken a series of layoffs, reallocating approximately 200 employees from its wealth management unit to other areas within the organization. To comprehend the reasoning behind these layoffs, one must examine the evolving landscape of the banking industry and the bank’s pursuit of aligning its resources with current market conditions and long-term business objectives.

Aligning Talent with Shifting Business Needs

Image source: Bank of America

The global financial landscape is a dynamic arena, subject to constant fluctuations influenced by various economic, regulatory, and market forces. Bank of America’s decision to implement layoffs is indicative of the institution’s proactive approach to adapting to these ever-changing conditions. By reallocating talent from the wealth management unit to other areas of the bank, the institution aims to strengthen its capacity to address the areas of greatest need in the current market climate.

Responding to Market Conditions

As markets shift and financial dynamics evolve, so do the demands of clients and investors. With higher interest rates dampening demand for loans, the bank has likely assessed that certain roles within the wealth management and lending unit may be experiencing decreased demand. This has led to a strategic decision to re-align resources accordingly.

Small and medium businesses are evolving rapidly and so are their demands and requirements regards to loans. And realigning is eminent in the banking sector. Bank of America is the leading bank in small business loans.

By making these adjustments, Bank of America can enhance its ability to cater to the evolving requirements of its clientele and remain competitive in a volatile financial landscape.

Targeted Growth Strategies

The redeployed employees are reportedly not part of the targeted growth plan for the wealth management banking specialists, a segment that the bank aimed to expand substantially by the end of the previous year. This indicates a strategic shift in priorities, wherein the bank may be focusing its growth efforts on different areas within the organization to capitalize on emerging opportunities and address specific market demands.

The layoffs at Bank of America’s wealth management unit are part of a calculated strategy to re-align the institution’s talent pool and resources with the evolving needs of the business and the financial industry. By responding to current market conditions and fine-tuning its growth strategies, the bank aims to maintain its competitive edge and provide clients with unparalleled service.

While the impact of these layoffs on the affected employees is significant, the underlying rationale underscores the bank’s commitment to adaptability and sustainability in an ever-changing financial landscape.

Impact of Layoffs on Employees: Navigating Uncertainty and Emotional Strain

Layoffs are a distressing event for any workforce, and the recent move by Bank of America to shift approximately 200 employees from its wealth management unit to other roles, while letting go of fewer than 10 individuals is no exception. Let us analyze the impact of these layoffs and change in units.

Emotional Turmoil and Job Insecurity

The first and most immediate impact that layoffs have on employees is the emotional toll it takes. The sudden realization that one’s role is no longer secure can lead to feelings of anxiety, fear, and stress. Employees may grapple with self-doubt and question their abilities, even if the decision was based on broader economic factors rather than individual performance.

Change in the unit also lead to uncertainty surrounding employees’ future within the organization and can create a cloud of doubt that looms over their daily productivity and life.

Loss of Job Satisfaction and Loyalty

Layoffs can also erode employees’ job satisfaction and loyalty to the organization. Many may feel a sense of betrayal, especially if they had dedicated years of their lives to the company, only to find themselves being reassigned or let go. The emotional bond that ties them to the organization may be severed, making it challenging for the remaining workforce to maintain high morale and productivity.

Adjustment to New Roles

For those employees who are shifted to other roles within the bank, adapting to the unfamiliar can pose its own set of challenges. Even though salaries are maintained, the change in responsibilities and job expectations may require a steep learning curve.

Moreover, the fear of not performing up to par in the new roles, and the pressure to prove their worth in unfamiliar territories, can add to their anxiety.

Variable Bonuses and Financial Uncertainty

While salaries remain unchanged, the variable nature of bonuses based on the new roles can create financial uncertainty for the affected employees. Bonuses often play a significant role in an employee’s total compensation, and the potential reduction or fluctuation in these rewards may impact their financial stability and long-term planning.

Impact on Work Culture and Team Dynamics

Layoffs can disrupt the established work culture and team dynamics within the organization. The departure of colleagues and teammates can leave a void that affects productivity and collaboration. Employees may become cautious about forming close bonds with their new colleagues, fearing that they might face another round of layoffs in the future.

The layoffs at Bank of America’s lending unit can have a profound impact on the affected employees. The emotional strain, job insecurity, and adjustment to new roles can lead to a turbulent period for these individuals. Maintaining open communication, offering support, and providing avenues for professional growth and development may help alleviate some of the challenges that arise during such a transformative period.

The Lending Industry’s Languishing Job Market: Tracing the Impact of Higher Interest Rates

The lending industry, once a beacon of economic growth and prosperity, is now grappling with a stark reality as slow hiring rates cast a shadow over its future. The recent decision by Bank of America to pause hiring in its wealth management and lending unit comes as no surprise, given the prevailing circumstances that have dampened business on Wall Street.

This trend is not isolated to Bank of America alone; the entire lending industry has experienced a sluggish job market as higher interest rates wreak havoc, and major players like Wells Fargo and JPMorgan Chase resort to substantial job cuts within their home lending units.

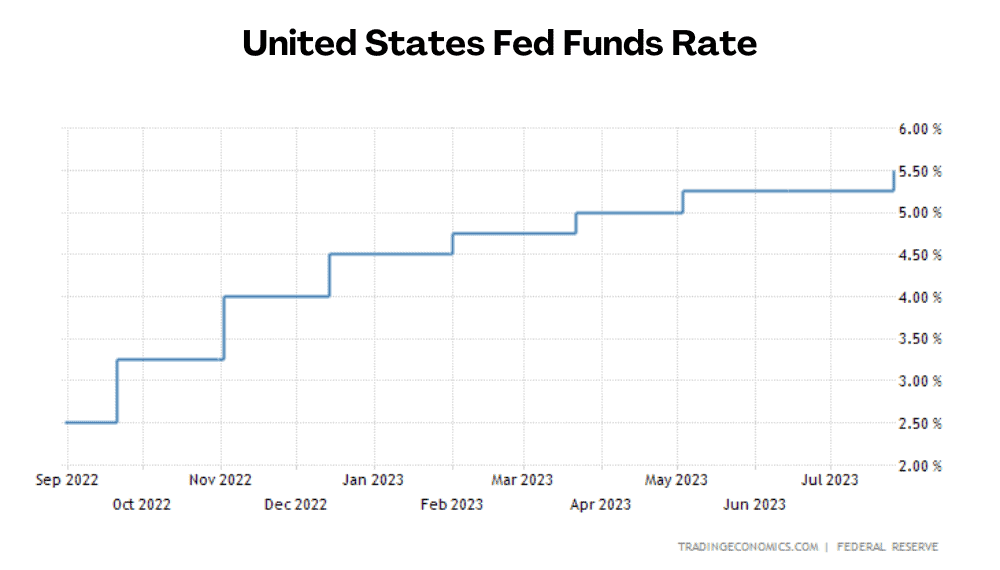

Higher Interest Rates Take Their Toll

A significant factor contributing to the slow hiring rates across the lending industry is the impact of higher interest rates. As interest rates rise, borrowing becomes costlier for consumers and businesses alike, resulting in a decreased demand for loans and credit products. This, in turn, leads to reduced activity in the lending sector, prompting financial institutions to reevaluate their workforce needs and put a hold on new hires to align with diminished business volumes.

A Reactive Approach to Economic Uncertainty

The partial hiring freeze implemented by Bank of America and the sweeping job cuts carried out by other industry giants reflects the cautious stance of the lending industry in light of looming economic uncertainty.

With the specter of a possible recession on the horizon, banks are taking proactive measures to protect their bottom lines and mitigate potential risks. By adopting a more conservative approach to hiring, financial institutions aim to ensure their resilience in the face of an unpredictable economic landscape.

Sector-Wide Impact

The slow hiring rates are not exclusive to Bank of America; rather, they echo throughout the entire lending industry. Major players like Goldman Sachs, Morgan Stanley, and Credit Suisse have taken drastic measures to streamline their operations, slashing over 15,000 jobs collectively.

These actions reverberate through the industry, creating a challenging job market for finance professionals and aspiring talent seeking opportunities in the lending sector.

The slow hiring rates across the lending industry serve as a poignant indicator of the current challenges faced by financial institutions in the wake of higher interest rates, inflation, and economic uncertainty.

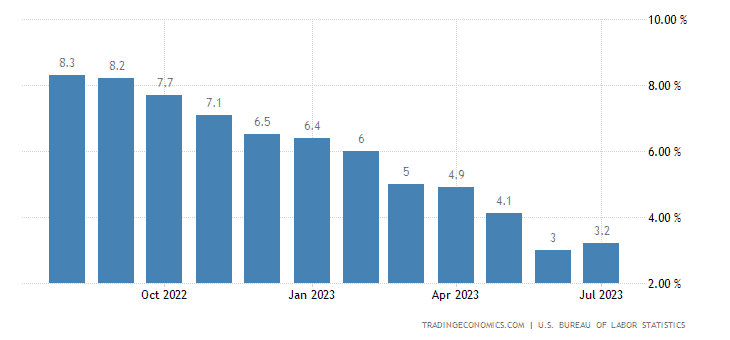

Inflation Rate

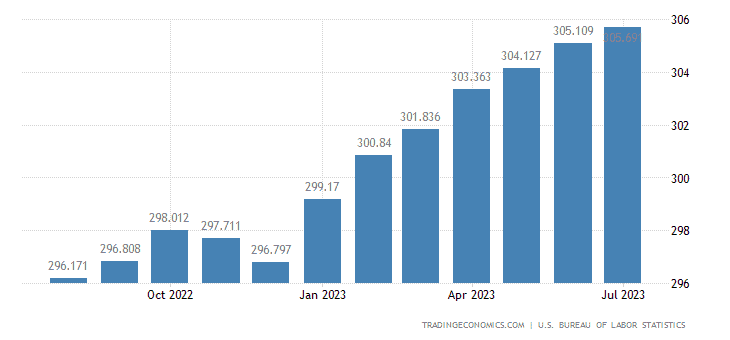

Consumer Price Index

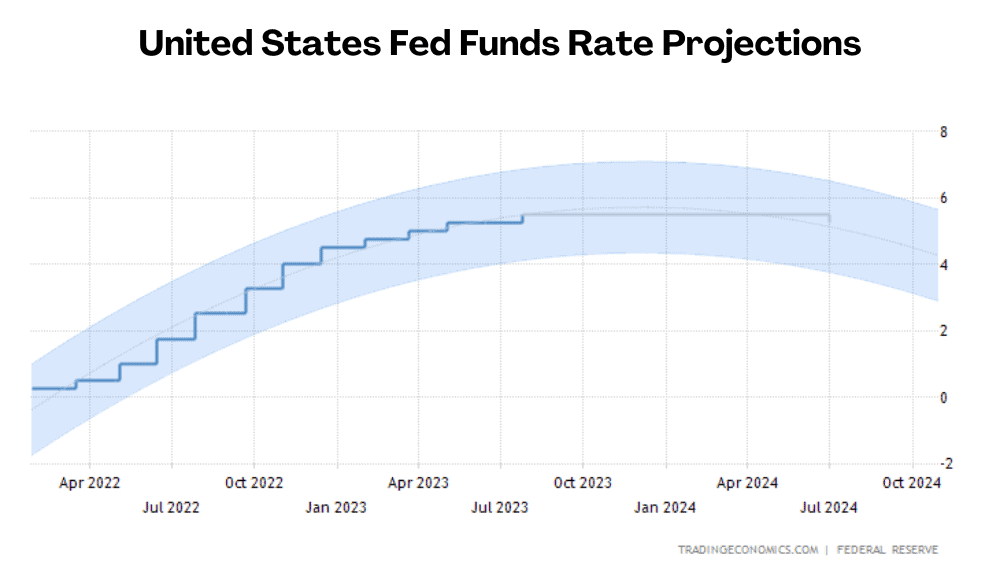

As banks like Bank of America opt to pause hiring and others resort to significant job cuts, it is evident that the lending industry is navigating uncharted waters. While these measures are essential for safeguarding financial stability, they undoubtedly create a difficult job market for prospective employees.

As the industry continues to grapple with ongoing economic shifts, adaptability, and strategic planning will be crucial for financial institutions to weather the storm and pave the way for a stronger, more resilient lending industry in the future.

Why Layoffs are Happening in the Lending Unit

The recent wave of layoffs in the lending unit can be attributed to a combination of factors that have influenced the banking industry’s approach to mortgages and commercial real estate lending. After the 2008 financial crisis, major US banking giants, including Bank of America, recognized the risks associated with excessive exposure to mortgages.

Subsequent legal settlements to resolve substantial liabilities stemming from troubled subprime-mortgage lenders Countrywide Financial Corp led banks to adopt a more cautious stance towards mortgages and lending practices.

Lessons from the 2008 Financial Crisis

The scars of the 2008 financial crisis remain etched in the collective memory of the banking industry. The aftermath of the crisis saw Bank of America and other financial institutions embroiled in numerous legal battles and settlements to address the consequences of excessive mortgage lending and subprime loans. As a result, these banks concluded that scaling back their exposure to mortgages and adopting more prudent lending practices would be essential to prevent a similar crisis in the future.

Retreat from Risky Ventures

In the aftermath of the financial crisis, banks have become increasingly risk-averse, particularly in the realm of commercial real estate lending. Despite a surge in lending during the first half of 2022, a combination of slumping demand and rising interest rates prompted a shift in the banks’ approach.

Firms have become more selective in their lending practices and tightened borrowing terms to mitigate potential risks. This shift in strategy, while necessary for financial stability, has led to a reduced need for personnel in the lending unit, leading to layoffs.

Evolving Market Conditions

The dynamics of the lending industry are subject to continuous change, driven by market conditions, regulatory changes, and economic trends. The slowdown in lending and retreat from certain areas of commercial real estate financing is a response to these evolving market conditions. As demand wanes and interest rates fluctuate, banks must reevaluate their lending strategies and workforce requirements, often resulting in workforce reductions to align with business needs.

The layoffs in the lending unit of Bank of America and other major banking institutions are a result of a careful assessment of the lessons learned from the 2008 financial crisis, a retreat from risky ventures, and an adaptation to evolving market conditions.

As the lending industry aims to strike a balance between growth and prudent risk management, workforce adjustments become an essential part of maintaining financial stability and sustainability. While the layoffs can be distressing for the affected employees, these strategic decisions are vital for ensuring the long-term health of the banking sector and mitigating potential risks in an ever-changing economic landscape.

Conclusion

Recent layoffs in Bank of America’s lending unit, as well as the slow hiring rates across the lending industry, have been driven by a confluence of factors that reflect the ever-evolving nature of the financial landscape. Higher interest rates have dampened business on Wall Street, prompting financial institutions to reevaluate their workforce needs and realign talent to areas of greatest need.

The aftermath of the 2008 financial crisis continues to shape the banking industry’s approach, with a cautious stance towards mortgages and a retreat from risky ventures. Furthermore, evolving market conditions, such as slumping demand and fluctuating interest rates, have further influenced the strategic decisions of financial institutions. As the lending industry navigates through economic uncertainty, banks have taken proactive measures, including layoffs and partial hiring freezes, to ensure their resilience and adaptability.

While these decisions may have implications for the affected employees and create a challenging job market, they underscore the importance of prudently managing risks and prioritizing financial stability. As the banking sector strives to strike a balance between growth and risk management, the path ahead calls for continued vigilance, adaptability, and strategic planning to forge a resilient and sustainable future in an ever-changing economic landscape.

Frequently Asked Questions (FAQs)

Why did Bank of America decide to implement layoffs in its lending unit?

Bank of America reportedly implemented layoffs in its lending unit in response to changing market conditions, including higher interest rates, which have slowed demand for loans and affected the business on Wall Street.

How many employees were affected by the layoffs in the lending unit?

Bank of America shifted approximately 200 employees from its wealth management and lending unit, with most being redeployed to other parts of the bank and a smaller number being laid off.

Were the laid-off employees part of the targeted growth plan for the lending unit?

According to the report, the employees who were laid off were not from the roster of wealth management banking specialists that were targeted for growth by the bank's leadership.

How have other major banking institutions responded to similar market conditions?

Other major banking giants, such as Wells Fargo and JPMorgan Chase, have also cut thousands of jobs in their home lending units in response to the slumping demand and the impact of rising interest rates on their lending businesses.

Has Bank of America made any other adjustments to its hiring practices amid the current economic climate?

Earlier this year, Bank of America paused hiring in preparation for a possible recession, but it has not made the same kinds of job cuts as some of its competitors in the lending industry.