On March 21, as the gaming world held its breath, GameStop shattered expectations yet again with a momentous announcement: the company reported its first profit in years. In a Tuesday earnings release, the video game retailer revealed a stunning net profit of $48.2 million for the quarter that concluded in January, a stark contrast to the harrowing $147.5 million loss recorded in the same quarter just a year prior.

In this article, we will understand the journey of how GameStop moved from bankruptcy to profitability. We will also analyze the strategy that helped GameStop earn profits when people rumored that GameStop would go out of business.

Company Overview

Image Source: Game Stop [www.gamestop.com/]

GameStop, a name synonymous with gaming culture, stands as a trailblazer in the ever-evolving landscape of video game retail. Since its inception, the company has been at the forefront of the gaming industry, captivating enthusiasts and casual players alike with its vast array of games, consoles, and gaming accessories. Founded in 1984, GameStop has grown into a global gaming empire with a widespread network of retail stores and a robust online presence.

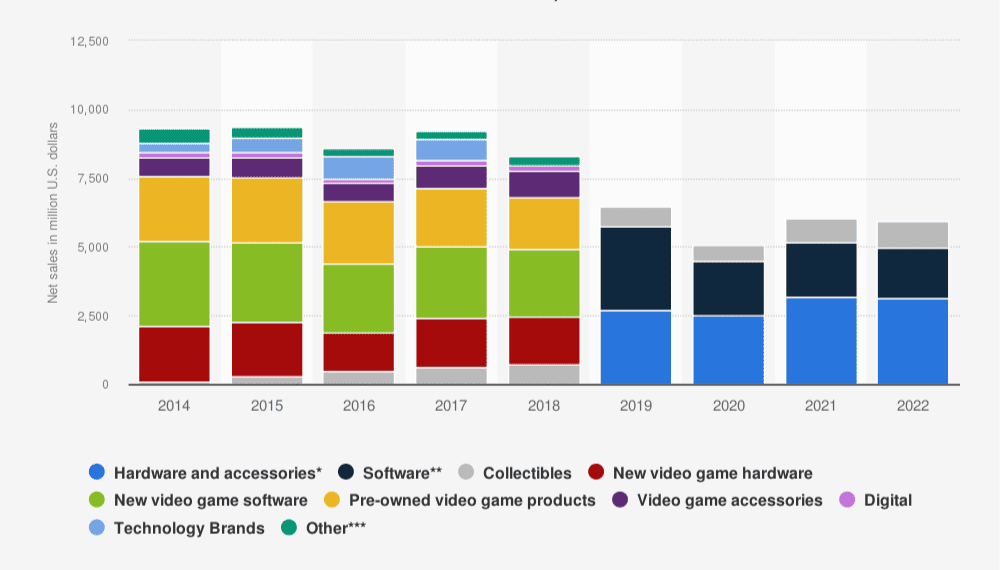

GameStop net sales worldwide by product category from [2014 to 2022] – Source

With its iconic storefronts and knowledgeable staff, GameStop has created a unique and immersive gaming experience for its customers. Gamers flock to its stores not just to purchase the latest releases but also to seek guidance, engage in gaming discussions, and connect with like-minded enthusiasts. The company’s dedication to providing exceptional customer service has earned it a loyal fanbase, cementing its position as a leading player in the gaming retail arena.

Image source

As the gaming industry has evolved, so has GameStop. Recognizing the digital revolution’s impact on gaming distribution, the company has adapted its business model to incorporate digital content, downloadable games, and online marketplaces. Embracing e-commerce, GameStop has expanded its reach to gamers around the world, offering a seamless online shopping experience and delivery options that cater to modern gamers’ preferences.

Beyond its retail prowess, GameStop has ventured into other areas of gaming, including its involvement in esports, gaming merchandise, and collectibles. This diversification has allowed the company to maintain its relevance and stay ahead of the curve in an industry marked by rapid innovation and ever-changing trends.

While GameStop has faced its fair share of challenges, its enduring spirit and commitment to its gaming community have helped it navigate the tides of change. As the gaming landscape continues to evolve, GameStop remains a central figure, fueling the passion and excitement of gamers worldwide and promising an exciting future that is intrinsically intertwined with the boundless world of gaming.

GameStop’s Turbulent Financial Journey

GameStop, the iconic video game retailer, has weathered its fair share of financial storms over the years, facing a series of bankruptcies that shook the gaming industry and sent shockwaves through the stock market.

Despite its enduring popularity among gamers, the company’s business model faced significant challenges with the rise of digital gaming and online distribution platforms.

The Struggles of a Traditional Retailer

GameStop, once a dominant force in the gaming retail space, began experiencing significant difficulties in the face of digital disruption. As video game developers and publishers increasingly shifted to online distribution models, physical game sales declined, leaving the company’s brick-and-mortar stores struggling to stay afloat.

The shift to digital gaming not only impacted GameStop’s revenue from game sales but also affected its used game business, which had been a vital revenue stream.

Stock Market Turmoil and Bankruptcies

The decline in GameStop’s financial performance and the shifting gaming landscape took a toll on the company’s stock value. Over the past year, the company’s stock price plummeted by 41%, signaling a lack of confidence among investors in its ability to adapt to the digital era successfully. These mounting challenges culminated in multiple GameStop bankruptcies as the company grappled with debt and declining sales.

Leadership’s Attempt at Turnaround

Despite the dire situation, GameStop’s leadership remained determined to navigate a path to profitability. CEO Matt Furlong, who took the reins during this tumultuous period, acknowledged the company’s need to transform its legacy brick-and-mortar business.

In an effort to reassure investors, Furlong outlined a vision that encompassed a comprehensive strategy, leveraging both physical stores and emerging sales channels to meet customers’ evolving needs.

The Recent Turnaround

After grappling with losses and declining sales, GameStop’s fortunes began to shift. In a surprising twist, the company reported its first profit in years, sparking a significant surge in its stock value. During the company’s earnings call, CEO Matt Furlong expressed optimism about GameStop’s improved health, attributing the turnaround to their efforts in adapting to the changing retail landscape and capitalizing on emerging opportunities.

GameStop’s journey from multiple bankruptcies to newfound profitability is a testament to the company’s resilience and determination to adapt to the dynamic gaming industry. As digital gaming continues to reshape the market, GameStop’s ability to balance traditional retail and e-commerce will be crucial to sustaining its success. The recent positive performance has reignited hope among investors and gamers alike, setting the stage for an exciting chapter in GameStop’s bankruptcy history.

Whether the company can maintain this upward trajectory and solidify its position as a major player in the gaming industry remains to be seen, but the recent turnaround has undoubtedly breathed new life into the once-troubled retailer.

Past History of Rumors: Is GameStop Going Out of Business?

In recent years, GameStop has faced a series of challenges that have sparked concerns about its future viability. Amidst declining sales, stock market turmoil, and multiple GameStop bankruptcies, speculations and rumors have circulated about the fate of this iconic gaming retailer.

Declining Sales and GameStop Bankruptcies

One of the primary indicators fueling worries about GameStop’s survival is its consistent decline in sales.

As the gaming industry shifts towards digital distribution and online sales platforms, traditional brick-and-mortar retailers like GameStop have faced a significant reduction in foot traffic and physical game purchases. The company’s financial woes have been exacerbated by its struggles to adapt to the digital era effectively.

These challenges led GameStop to experience a series of bankruptcies, with the company grappling with mounting debt and financial losses. Each bankruptcy event further intensified concerns among investors and industry experts about the retailer’s long-term viability.

Digital Disruption and Changing Consumer Behavior

GameStop’s troubles can be attributed, in part, to the rapid digital disruption that has transformed the gaming landscape. With an increasing number of gamers opting for digital downloads and online gaming platforms, the demand for physical copies of games has steadily declined. As a result, GameStop’s traditional business model, heavily reliant on selling physical game discs and consoles, has become increasingly outdated.

Furthermore, changing consumer behavior has also played a role in GameStop’s struggles. Many consumers now prefer the convenience of online shopping and digital downloads over visiting physical stores. This shift in consumer preferences has left GameStop grappling with an identity crisis and struggling to find its footing in an increasingly digital world.

Efforts at Turnaround and Speculations

In an attempt to reverse its fortunes, GameStop’s leadership has implemented various strategies, including expanding into collectibles, offering digital content, and revamping its online presence. Additionally, the company’s involvement in the emerging esports market has sought to tap into new revenue streams and attract younger gaming enthusiasts.

Despite these efforts, speculations about GameStop going out of business have persisted, fueled by the company’s financial instability and a bleak outlook on its traditional retail model. Some experts argue that GameStop’s turnaround efforts may be too little, too late, as the digital gaming revolution continues to reshape the industry.

As GameStop continues its fight for survival, the fate of the gaming retailer remains uncertain. While the company has taken steps to adapt to the digital era and diversify its offerings, the challenges posed by declining sales, stock market fluctuations, and multiple GameStop bankruptcies are significant obstacles to overcome.

Whether GameStop can defy the odds and find a sustainable path forward in an ever-changing gaming landscape is a question that still looms large, leaving investors, gamers, and industry observers eagerly watching as the story unfolds.

GameStop’s Transformative Trajectory: From Crisis to Hope

Over the past two years, GameStop’s trajectory has been nothing short of a rollercoaster ride, marked by extraordinary events that shook the gaming world and captivated global attention. Since the infamous trading frenzy in January 2021, which led to wild swings in its stock price and whispers of “GameStop going out of business,” the company has embarked on a transformative journey to not only survive but thrive in an ever-evolving industry.

Navigating the Stock Market Frenzy

The unprecedented trading activity that catapulted GameStop into the spotlight in early 2021 saw its stock value surge to extraordinary heights, reaching levels previously deemed unimaginable. Amidst the chaos, GameStop capitalized on its surging stock valuation to raise much-needed capital, injecting financial stability into a company that had faced repeated uncertainties.

Strategic Financial Moves

Under the stewardship of Chair Ryan Cohen, GameStop embarked on a series of strategic financial maneuvers to bolster its position. One of the most notable moves was the successful implementation of an at-the-market equity offering program, enabling the company to raise a substantial $1.13 billion. This influx of cash played a vital role in strengthening GameStop’s balance sheet and providing the necessary resources for future growth initiatives.

Transformation and Leadership Change

Chair Ryan Cohen’s visionary leadership became a catalyst for change within GameStop. He undertook a comprehensive overhaul of the company’s board of directors, including the appointment of Matt Furlong as the new CEO, replacing former CEO George Sherman. This fresh leadership injected new energy and a forward-thinking perspective into the company, signaling GameStop’s commitment to embracing innovation and adapting to the digital era.

Seizing New Opportunities

With its financial position fortified, GameStop set its sights on transformation and diversification. Ryan Cohen and his team capitalized on the cash inflow to reduce debt burdens, paving the way for a healthier balance sheet. The company unveiled an ambitious business transformation plan, strategically focusing on strengthening its e-commerce capabilities and exploring opportunities in emerging technologies such as cryptocurrencies and NFTs (Non-Fungible Tokens).

Challenges and Hope for the Future

While GameStop’s balance sheet has become more robust, the company still faces challenges in revitalizing its revenue streams and charting a sustainable growth path. Despite generating a profit after a long period of time the company needs to focus on innovative strategies to maintain a positive trajectory.

The GameStop Stock Dilemma

The GameStop stock has been the subject of intense volatility and media frenzy, leaving investors in a state of uncertainty. Amidst the backdrop of GameStop bankruptcies and its tumultuous journey, investors are left wondering whether they should be worried about investing in this enigmatic company.

Rollercoaster Ride: The GameStop Stock Saga

The GameStop stock’s wild ride in recent years, driven by retail investor activism and short squeezes, has been a rollercoaster of extreme highs and lows. The infamous trading frenzy in January 2021 saw the stock price soar to astronomical levels, catching investors and market pundits by surprise. However, such meteoric rises can often be unsustainable and may lead to concerns over long-term viability.

GameStop Bankruptcies: A Red Flag?

One of the most significant worries for investors is GameStop’s history of bankruptcies. The company’s struggles in adapting to the digital era and the declining sales of physical game copies led to financial challenges that resulted in multiple bankruptcies. While the recent turnaround and efforts to strengthen the balance sheet are promising, the specter of past bankruptcies may linger in the minds of cautious investors.

The Uncertainty of the Retail Business Model

The traditional brick-and-mortar retail model, on which GameStop heavily relies, faces increasing threats from digital distribution platforms and online sales. As more gamers shift to digital downloads, the demand for physical game discs declines, raising concerns about the sustainability of GameStop’s business model in the long run.

Leadership and Transformation

GameStop’s recent leadership changes and business transformation initiatives offer glimmers of hope. Under the guidance of Chair Ryan Cohen, the company is seeking to adapt to the digital era, strengthen its e-commerce capabilities, and explore new opportunities such as cryptocurrencies and NFTs. While these efforts signal a commitment to change, investors may remain cautious until tangible results are demonstrated.

Market Speculation and Volatility

The GameStop stock has become a magnet for speculative trading, contributing to heightened volatility. Such market dynamics can lead to short-term price swings that may not necessarily reflect the company’s underlying fundamentals. For long-term investors, this uncertainty may raise concerns about the stock’s stability.

Caution and Consideration

Investors should approach GameStop stocks with caution and thorough consideration. While the company’s recent turnaround efforts and strategic initiatives are encouraging, the history of GameStop bankruptcies and uncertainties surrounding the retail business model warrant careful analysis.

As with any investment, it is crucial for investors to conduct their due diligence, assess risk factors, and align their investment strategies with their financial goals. The GameStop stock remains a high-risk, high-reward proposition, and investors should weigh the potential for gains against the inherent volatility and challenges associated with the gaming retailer’s trajectory.

Conclusion

The trajectory of GameStop over the past few years has been nothing short of a rollercoaster ride, filled with intense highs and lows, stock market frenzies, multiple GameStop bankruptcies, and transformative efforts. Despite facing significant challenges in the wake of digital disruption and changing consumer behavior, the company has displayed remarkable resilience and determination to adapt to the dynamic gaming landscape.

Frequently Asked Questions (FAQs)

What is the history of GameStop bankruptcies?

GameStop has faced financial challenges in the past, resulting in multiple bankruptcies. These struggles were driven by declining sales of physical game copies as digital gaming became more prevalent, leading to a shift in consumer preferences away from traditional retail.

What are the recent transformation efforts by GameStop?

Under the leadership of Chair Ryan Cohen, GameStop has embarked on a business transformation plan. This plan involves strengthening the company's e-commerce capabilities, exploring opportunities in cryptocurrencies and NFTs, and diversifying its offerings beyond traditional video game retail.

What are the challenges facing GameStop's retail model?

GameStop's traditional brick-and-mortar retail model faces challenges due to the rising popularity of digital gaming and online distribution platforms. As more gamers prefer digital downloads over physical copies, the demand for physical game sales has declined, impacting the company's revenue streams.

What are the risks and rewards associated with investing in GameStop stock?

Investing in GameStop stock comes with inherent risks and rewards. While the potential for significant gains exists, the stock's extreme volatility and uncertainties surrounding the company's long-term viability may make it a high-risk investment.

What is GameStop's strategy for the future?

GameStop's strategy for the future involves adapting to the digital era, expanding its e-commerce capabilities, and exploring emerging technologies such as cryptocurrencies and NFTs. The company aims to become a more resilient and diverse player in the gaming industry.

How has the gaming industry impacted GameStop's business?

The gaming industry's shift towards digital distribution and online gaming platforms has impacted GameStop's business model. The declining sales of physical game copies have posed challenges for the company's traditional retail operations.

What should investors consider before investing in GameStop?

Before investing in GameStop, investors should carefully consider the company's financial performance, its transformation efforts, industry trends, and their own risk tolerance. Due diligence is essential when making investment decisions in a high-risk, high-reward stock like GameStop.