You might have not heard many investors talking about hotel investments. But investors may not be aware that investing in the hotel industry can be a potentially beneficial and profitable choice. There are numerous options available that can help diversify your portfolio while potentially yielding a profit. Whether you opt for investment through a real estate investment trust (REIT), publicly traded stock, or private equity company, certain crucial factors should be considered before starting on your hotel investment journey.

An Overview Of Hotel Industry

Hotel industry has many important segments. Every hotel in the world tries to do their best in each of these segments. The segments are as follows

- Accommodation or Lodging

- Food & Drinks

- Travels & Tourism

- Entertainment – Cruise, Casino, and Gaming

The hotel industry appears as a conglomerate of these sectors. Other than these, when families go on a vacation, they engage with nearly every facet of the hospitality industry. For instance, they might utilize aircraft and crew services, stay at a hotel, enjoy an elegant dinner, and partake in tourist attraction activities. Although none of these activities are essential but hotel consumers willingly invest both their money and free time in these experiences.

Types Of Hotels

Mainly there are four types of hotels, which include:

- Full Service Hotels

In simple terms, a full-service hotel goes beyond merely providing a place to sleep; it offers a diverse range of amenities and services. These can include bars, on-site restaurants, fitness centers, spas, conference rooms, and more. Full-service hotels have a longstanding history, adapting over the years to meet the evolving needs and preferences of travelers. Initially popular among business travelers seeking convenient and comfortable accommodations on the road, they now cater to a broader audience, including families, couples, and solo adventurers.

Full-service hotel provides high level of service delivered by friendly and knowledgeable staff. They are ready to assist with everything from check-in procedures to organizing local activities. Furthermore, you are likely to enjoy access to various on-site amenities, including multiple dining options, room service, a fitness center, a pool, and a spa.

- Limited Service Hotels

Also referred to as selected-services hotels, these are generally smaller establishments that provide a more concise set of amenities compared to full-service hotels. Originating in the 1970s, these hotels have gained popularity among both business and leisure travelers.

The key characteristic of limited service hotels is their emphasis on a streamlined experience that prioritizes the essentials. In contrast to full-service hotels, they typically offer fewer amenities and services. Nevertheless, these hotels ensure that guests receive the fundamental elements needed for a comfortable stay.

- Budget Hotels

Budget hotels are characterized by their simplicity and no-frills approach. While they may offer a limited number of guest services or amenities, their primary focus is on providing essential accommodations at affordable rates.

- Extended Stay Hotels

These hotels target business travelers with extended assignments or individuals in need of temporary housing. These establishments often provide discounts for stays lasting five days or more and feature home-like amenities not commonly found in standard hotels, such as self-serve laundry facilities and kitchens. While the quality and range of amenities and services can vary, most establishments in this category cater to the mid-range to budget segments of the market.

Are Investments In Hotels In 2024 A Good Decision?

Absolutely. Hotels stand out as an excellent source of income for investors, offering flexibility that allows revenue growth through different avenues, as discussed above. This revenue structure provides room for negotiations in one aspect without compromising revenue from another.

Opting to invest in a well-established hotel brand can yield a higher return on investment (ROI). The hotel industry at large may carry higher risks which are directly linked to foot traffic, which also justifies the associated risks. When we look at recent happenings, during COVID, Hotels were the most affected business. But as the world gradually reopens, hotels worldwide are experiencing a significant surge in bookings, indicating a promising ROI for investors in the coming future.

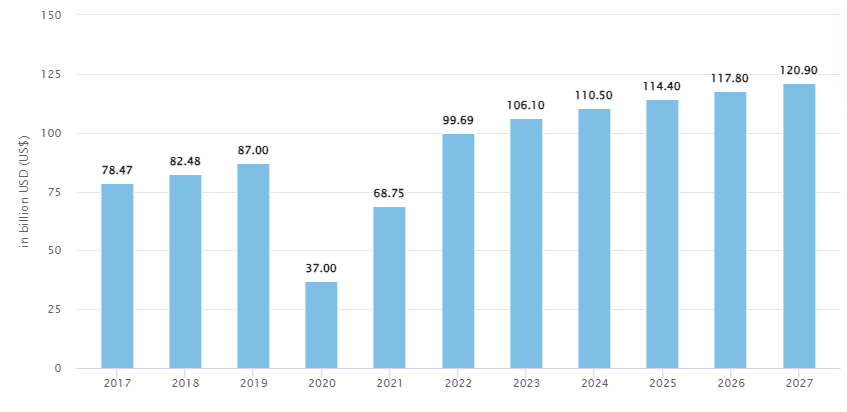

In 2024, the projected revenue in the hotel market is anticipated to reach $110.50 billion. The industry is anticipated to show a yearly rise of 3.32% from 2023 to 2027, leading to an expected value of $120.90 billion by the end of 2027. When it comes to users, the hotel market is estimated to have 160.60 million users by 2027. The anticipated rate of penetration by users is 45.2% in 2024, which is also anticipated to grow by 46.3% by the end of 2027.

Source: Statista – Hotel revenue growth in the US

Driving Factors In Hotel Industry

The demand for hotel rooms is influenced by various factors, including the preferences, travel behaviors and income levels of potential customers. Additionally, the availability and attractiveness of alternative accommodation options play a significant role. Each hotel has unique demand drivers that reflect its local market, for instance some hotels may be attracting demand due to nearby events, tourist attractions, and colleges. Tourism typically boosts traffic, especially during weekends or throughout the week in high-season periods. And hotels catering to seasonal markets, like beachside hotels or winter ski resorts in the summer, often experience increased demand during specific periods.

Additionally, Hotels equipped with amenities like meeting and event spaces are better positioned to attract business travelers.

Some hotels function as destinations in themselves, appealing to both tourist and business travelers. Examples include hotels linked to water parks, theme parks, convention centers, or casinos. Proximity to transportation hubs, such as airports or major highways, allows hotels to capitalize on their location and attract a broader range of guests.

Top 6 Tips For Hotel Investments For Beginners

- Familiarize Yourself with Hotel Brands

Before making a hotel investment decision, conduct thorough research on various hotel brands. Determine which brands are gaining popularity globally and which ones may be losing appeal. Make an informed choice based on these factors.

- Consider Local Factors

While assessing hotel brands globally, closely examine the US market to understand the brands likely to thrive in the coming years. Evaluate the specific local area you are considering for investment and determine whether luxury accommodations or budget hotels are more likely to succeed.

- Establish a Financial Plan

Calculate the expected returns from your hotel room investment and use this information to determine the required investment amount. If the financial figures don’t align, consider exploring other asset classes. If you’re financing your investment, factor in the potential impact of changes in interest rates on your overall financial performance.

- Review the fine print

When entering into partnerships with hotels, it’s crucial to note that each hotel investment comes with distinct terms and conditions governing the investor’s share of the monthly room income. Carefully examine the details of your contract and only proceed with signing once you are satisfied that the financial aspects align with your objectives.

- Be Aware of Potential Challenges

Recognize that no investment is entirely risk-free, so it’s essential to understand the specific challenges associated with hotel sector investments before moving forward. Factors such as construction delays and setbacks in achieving the desired hotel occupancy can potentially result in returns being delayed or lower than initially anticipated. Consider these factors in your planning process.

- Comprehend the operators

Understanding which hotel operator will be overseeing the income generation for your investment is a critical aspect of selecting where to invest. Therefore, thoroughly investigate this aspect before committing to any specific investment. Conduct thorough research to ensure you have a clear understanding of the operator who will be managing your room.

Some Best Ways To Invest In Hotels As Beginners

When considering how to invest in a hotel, there are several avenues to explore. Below, we’ve highlighted some of the best options:

● Starting Your Own Hotel:

As a beginner you can start with investing in hotel properties or undertaking a new hotel construction project . But, the best option is to directly purchase a well-established hotel. This path demands a higher level of entry, involving a high-risk, high-reward approach where the investor assumes full responsibility for hotel management.

This avenue can be broadly categorized into two primary types: hotel purchasing, where you acquire an existing hotel from another owner, and construction, where you initiate and oversee a hotel construction project, ultimately owning the resulting property. In both cases, this constitutes a significant financial commitment, necessitating a grasp of hotel strategy, hotel technology, and prevailing industry trends.

● Buying Stocks of Hotels:

Consider investing in hotel stocks as another avenue for involvement in the hospitality industry. This includes purchasing common equity in hotel stocks associated with your preferred hospitality brand, granting you partial ownership of the company and its assets.

This method is particularly popular among those who prefer not to engage in the operational aspects of hotels. Common stockholders typically play a role in decisions such as determining the board of directors or voting on mergers. However, it’s essential for investors using this approach to be aware that, in the event of company liquidation, they are often among the last to receive payouts.

● Chipping in REITs

Consider Hotel Real Estate Investment Trusts (REITs) as a strategic investment option. REITs invest in real estate and distribute profits to their shareholders. A hotel-focused REIT specifically channels investments into hotels with the aim of generating profits. While strategic buying and selling of hotels contribute to profitability, the primary source of income for hotel REITs is proficient hotel management.

The bulk of their revenue is generated through the sale of hotel rooms and the provision of additional services. In line with the broader hotel industry, the definition of hotel REITs encompasses various properties, including resorts, motels, and other guest lodgings. Successful hotel real estate investment trusts meticulously choose hotels for investment based on a well-defined business strategy.

● Purchasing a Franchise

Consider the option of investing in a hotel franchise such as Hyatt, Hilton, or Holiday Inn as an appealing avenue for ventures in real estate. However, partnering with a successful hotel brand comes with a substantial price tag. According to reports, the investment required to open and operate a Courtyard by Marriott hotel ranges between $7 to $14 million, in addition to the initial $60,000 franchise fee.

● Refinancing Hotel

Explore the option of hotel refinancing as a strategic asset management approach before seeking external real estate investments. This avenue offers the potential for lower interest rates, more economical monthly payments, and an infusion of additional capital that can be directed towards enhancing hotel operations. Traditional bank loans, including the SBA loans, represent suitable candidates for the refinancing process.

Moreover, the SBA7(a) loan designed for commercial real estate stands out as a viable option, particularly for hotel projects requiring a long-term loan within the $1 million to around $5 million range.

Key Metrics To Effectively Measure The Success Of A Hotel

Evaluating the financial return on hotel investments involves a meticulous examination of key metrics that offer insights into operational efficiency, revenue potential, and financial performance. Industry professionals and investors rely on these crucial metrics:

- Occupancy Rate:

It calculates the portion of available beds or rooms that are used throughout a given time frame. An increased rate of occupancy is an indicator of strong demand and possible income expansion.

For instance, an 80% occupancy rate, exemplified by a scenario where a hotel with 150 rooms has 120 rooms reserved, serves as a clear indicator of its profitability and appeal. This high level of occupancy suggests that a substantial majority of the hotel’s capacity is in use, contributing to a stable revenue stream and underscoring the attractiveness of the establishment to guests.

- RevPAR:

RevPAR stands as a crucial performance metric in the hospitality industry. To compute RevPAR, one multiplies a hotel’s average daily room rate by its occupancy rate. Alternatively, it can be determined by dividing the total room revenue by the overall number of available rooms during the specified period. This metric provides valuable insights into a hotel’s financial performance, combining both pricing and occupancy aspects for a comprehensive assessment.

Suppose a hotel with 80 rooms generates $12,000 in daily revenue, RevPAR comes at $150 ($12,000/80). A higher RevPAR indicates superior revenue generation.

- ADR :

ADR is determined by dividing the average revenue generated from room sales by the total number of rooms sold. This calculation excludes complimentary rooms and those occupied by staff, providing a clear and straightforward measure of a hotel’s room revenue per occupied room.

For example, a hotel making $20,000 in revenue with 120 ADRs for occupied rooms will be $166.6 ($20,000/120).

- GOPPAR:

GOPPAR is a crucial metric in the hospitality industry, providing insight into the relationship between hotel revenues and expenses. Understanding GOPPAR is essential for optimizing the conversion of revenue into profit. Regular benchmarking of GOPPAR, along with other key Profit and Loss (P&L) metrics, is vital for effective performance evaluation.

In the broader context, profitability benchmarking offers commercial teams a comprehensive view of operating and labor costs relative to revenues. It also assesses how efficiently revenues are converted into profits, considering the occupancy levels. Regular benchmarking enhances strategic decision-making and overall financial performance assessment.

For instance, a GOPPAR of around $200 in a hotel indicates a gross operational profit of $200 for each available room.

- ROI:

ROI compares profits or returns to the original investment cost to determine how profitable an investment is. When it comes to hotel investments, return on investment (ROI) assesses the project’s capacity to make money over a given time frame. It helps investors evaluate possible returns and decide how best to allocate their resources.

For instance, the ROI would be 10% if an investor made a hotel investment that needed a $500,000 original investment and received a $50,000 net profit ($50,000/$500,000).

Conclusion

Entering the hotel industry as a beginner investor presents unique opportunities for diversification and potential profitability. Understanding the diverse segments of the hotel industry, from accommodation to entertainment, is crucial for making informed investment decisions. Hotels offer various types, each catering to specific needs and preferences. With the projected growth in the hotel market, investing in well-established brands or exploring options like REITs and franchises can be lucrative.

Evaluating key metrics such as occupancy rate, RevPAR, ADR, GOPPAR, and ROI is essential for gauging the success and profitability of hotel investments. Overall, the dynamic nature of the hotel industry, coupled with strategic investment approaches, makes it a compelling choice for beginners in 2024.

Frequently Asked Questions

What advice can you offer to beginner investors?

– Leverage your personal brand knowledge.

– Understand the fundamentals of investing.

– Utilize technical indicators to identify trends.

– Crunch the numbers – ensure a sound financial approach.

– Set and commit to your investment goals.Is investing in a hotel a profitable venture?

Hotels, with their daily revenue generation, can offer stable income streams, especially when the occupancy rate is high. This stability is advantageous for hotel investors, leading to potentially higher financial returns.

Can a small hotel be profitable?

Yes, owning a hotel can be profitable with the right combination of factors such as location, price point, quality of the physical asset, effective marketing strategy, dedicated employees, and supportive investors and management partners. However, profitability isn't guaranteed, and success often requires considerable effort and strategic planning.

What is considered a good ROI for a hotel investment?

In the hotel industry, an ROI ranging from 6% to 12% per year is generally considered favorable. This benchmark provides a guideline for assessing the financial performance and viability of hotel investments.