Including real estate in your investment portfolio can be a smart move to diversify and generate passive income. If you are new to real estate investing, you have the opportunity to enter this field, succeed as an investor, and achieve your financial goals. Every journey starts with taking the first step.

This guide aims to provide you with the necessary knowledge about how to start investing in real estate. It will help you understand the basics of getting started with minimal risks and create a new path toward achieving your financial goals by investing in real estate.

Real Estate Landscape In 2023 – Is It Worth Investing in Real Estate?

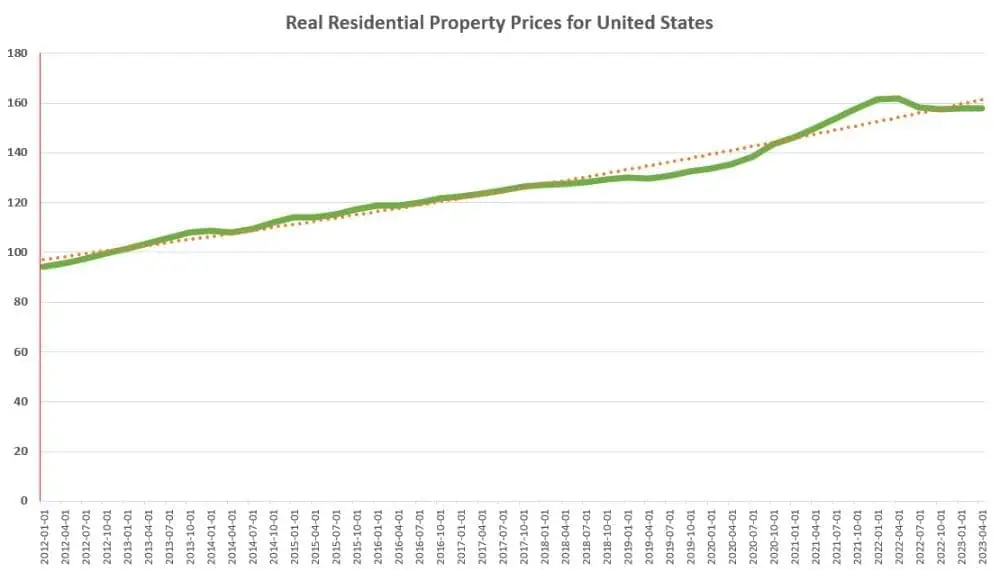

The real estate market has encountered significant difficulties as interest rates have increased. This situation has made homes less affordable for potential buyers, forcing sellers to reduce their asking prices. This pattern continued throughout the majority of 2022 and the initial months of 2023.

As 2022 began, interest rates were still relatively low. While mortgage rates had increased slightly from their lowest point in 2021, the Federal Reserve had not yet implemented significant rate hikes. However, it was clear that the central bank intended to raise rates significantly in the near future. As a result, savvy buyers took advantage of the opportunity to secure favorable mortgage rates for their property purchases.

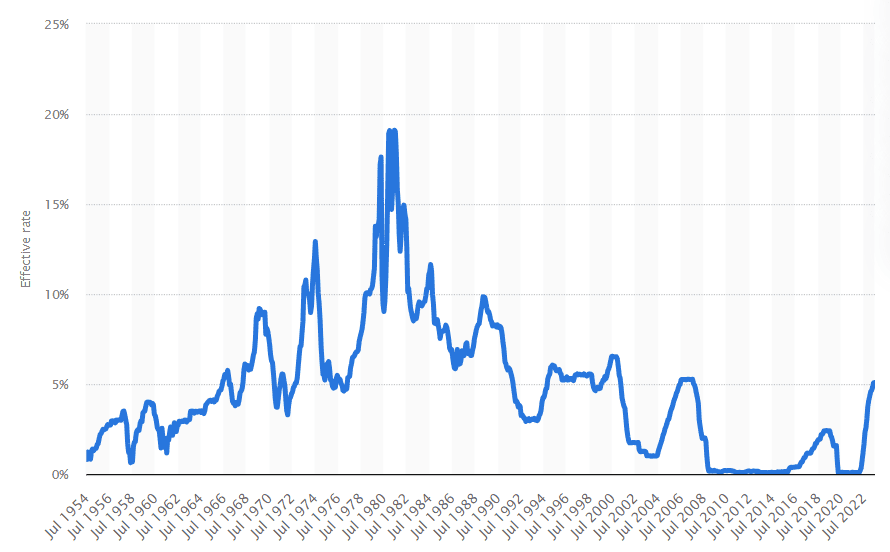

Source: Statista– Monthly Federal funds effective rate in the United States

Subsequently, the Federal Reserve saw an extraordinary series of interest rate increases. These hikes have resulted in reduced affordability in the housing market, leading many sellers to adjust their prices accordingly. By early 2023, the average 30-year mortgage rate approached 7 percent, reaching its highest level in over ten years.

It is crucial to understand that investing in real estate is usually a long-term commitment. Individuals considering entering this market should approach it with patience. Despite high interest rates, it might be a good time to save money for a down payment while waiting for potential rate reductions. Keeping this perspective in mind, let’s explore five essential strategies for real estate investment.

Tips For Investing In Real Estate

It makes sense that a lot of new-age investors are unsure about how to step into the real estate market without complications. Here are some of the top strategies to get started:

Consider Investing in REITs

For individuals seeking the advantages of real estate investments while maintaining the liquidity and simplicity associated with owning stocks, a Real Estate Investment Trust presents an enticing option. Moreover, REITs offer the added benefit of dividend payouts.

Investing in a real estate investment trust offer numerous advantages over traditional real estate investments, potentially simplifying the investment process. However, it’s essential to be aware of the downsides. Like any stock, REIT prices can fluctuate in response to market dynamics. Therefore, if the market experiences a decline, REIT values may follow the trend.

This might pose a lesser concern for long-term investors who can digest market fluctuations. On the other hand, individuals who find themselves in need of selling their REIT holdings may face a disconnect between the sale price and the actual value of their investment at that specific moment.

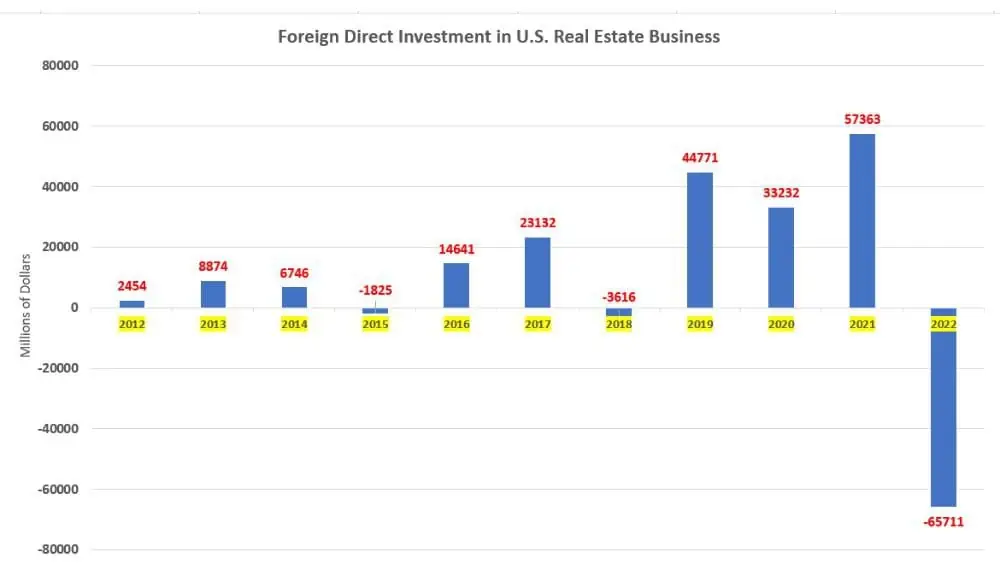

Source: FRED

To make informed decisions about individual REIT stocks, it’s important to conduct a comprehensive analysis using the same tools employed by professional analysts. Another way to minimize risk is by investing in a REIT fund, which offers a diversified portfolio of REITs.

This spreads your investment across different companies and sectors. Investing in a REIT can be an excellent starting point for beginners with limited capital. However, it’s crucial to approach it with dedication and caution, as there are still potential challenges in REIT investments that need careful understanding.

Pros

- Offers real estate investment opportunities without property ownership.

- A chance to invest with just a few thousand dollars.

- Responds to distinct economic factors compared to the stock market.

- Tradable on many public exchanges.

Cons

- Lacks full property control.

- You can’t benefit from tax advantages related

to home purchases or real estate. - This approach may include additional fees.

Utilize Real Estate Investment Platforms Online

Innovation is making investments easier by the day. You get plenty of choices online to grow your net worth. One such source to invest in real estate crowd funding platforms and these platforms bring together individual investors and real estate developers in one virtual circle.

These platforms function as hubs for collaborative financing of residential and commercial projects; this helps you expand your horizon for potential investments.

The concept of real estate crowd funding is straightforward. Developers or sponsors showcase their projects on online platforms, looking to source funds for further development. Interested investors can then peruse these opportunities and choose where to allocate their capital. Depending on the specific platform and project, the entry threshold can be as modest as $10.

Prominent platforms like Crowdstreet, Realty Mogul, and Fundrise have attracted thousands of interested investors, offering a diverse array of investment possibilities, ranging from individual projects to diversified real estate portfolios.

Pros

- Real estate investment starts at just $10.

- Generates passive income through dividends.

- Features expertly screened real estate opportunities.

- Get the best commercial property listings with a low initial investment. Investing in commercial real estate can bring huge profits.

Cons

- Liquidity may be limited for the long term.

- Comes with no tax advantages related to

real estate. - Some platforms charge 1% – 2% fees.

Buy Rental Properties

If you’re contemplating a step up in your investment journey, residential rental properties, such as single-family homes or duplexes, could be the next option to explore. These properties offer several advantages, making them an attractive option, especially for those starting in real estate.

Additionally, the initial investment required for residential properties, such as a single-family houses, tends to be lower. It’s possible to enter the market with as little as $20k, a far cry from the potentially hefty sums needed for commercial properties. If you’re resourceful, you may even discover distressed properties at a more affordable price through foreclosure.

Typically, to initiate such an investment, you’ll need to provide a substantial down payment, often around 30 percent of the purchase price. This may pose a challenge if you’re just starting and lack a substantial capital reserve.

Pros

- A good side income from the tenants.

- Tax benefits.

- Price appreciation in the long-term.

- Leverage for higher returns over time.

Cons

- Requires active involvement and

management. - Mortgage payments must be maintained

regardless of tenant occupancy.

Property Flipping Strategy

Much like intraday traders differ from long-term investors, real estate flippers’ strategy is entirely different from what we discussed previously. Flippers acquire properties with the explicit aim of holding them for brief periods, typically spanning three to four months, and then swiftly selling them for a profit.

There are two primary approaches to property flipping:

- Repair and Upgrade: In this method, you purchase a property with the expectation that its value will be appreciated after specific repairs and upgrades. The goal is to complete these improvements as expeditiously as possible and subsequently sell the property at a price exceeding your total investment, which includes renovation costs.

- Hold and Resell: This variant of flipping follows a different strategy. Instead of purchasing a property to renovate, you enter a rapidly appreciating market, retain the property for a few months, and then sell it at a profit.

Regardless of the chosen flipping approach, there’s an inherent risk that you might not be able to sell the property at a price that ensures a profit. This can be particularly challenging since flippers typically don’t maintain sufficient liquid assets to cover long-term property mortgages. However, when executed correctly, flipping can be a lucrative avenue for real estate investment.

Pros

- It offers hands-on management, allowing you to take charge.

- Leverage can amplify your returns over time.

- You might see rapid returns on your investment.

Cons

- The need for hands-on management can be

demanding. - Mortgage payments must be maintained, even if no

income is being generated. - Initial expenses for property renovation can

be substantial.

Purchasing Your Own Home

Homeownership often symbolizes the embodiment of the “American Dream.” While it serves as a place to establish roots and nurture a family, the financial aspect is undeniably significant.

But how does investing in your primary residence compare to other real estate endeavors?

At its essence, buying a home entails acquiring a tangible asset. Over time, as you diligently pay down your mortgage, your equity in this asset grows. The expectation is that, in addition to providing a place of shelter, your home will appreciate, ultimately yielding a return on your investment should you decide to sell.

Pros

- Experience potential increases in your home’s value over time.

- Enjoy the benefits of residing in your property instead of paying rent.

- A reliable asset to grow your wealth.

- Qualify for potential tax breaks related to mortgage interest.

- You can rent a spare room.

Cons

- Bear the responsibility for ongoing property maintenance expenses.

- Often, a sizable down payment may be required upfront.

Common Mistakes New Real Estate Investors Often Make

Expecting Quick Wealth

A frequent error among novice real estate investors is anticipating rapid, tangible results. The internet’s instant reward culture often fuels this misconception. Some industry influencers inadvertently promote this notion, neglecting to emphasize the importance of dedication and hard work.

In reality, real estate investment demands patience and persistence. Even the process of identifying a profitable property can span several months for those without a keen eye. Rushing into an investment without thorough property evaluation can lead to unfavorable outcomes.

Lacking a Defined Strategy

Some real estate investors adopt a day-by-day approach without a well-defined plan. This approach carries the risk of accumulating properties that don’t align with their investment profile.

Investors who fail to consider the consequences often find themselves in dire financial straits due to imprudent choices. Having a clear strategy provides a roadmap and prevents aimless ventures. It ensures investors stay on course rather than veering off in various directions.

Neglecting Property Inspection

Despite the convenience of virtual property tours through technology, physically inspecting a property remains crucial to ensure it meets your expectations. No detail should be overlooked during this phase. Checking the condition of common areas and even using tools like drones to assess the roof’s state can provide precise insights.

Additionally, evaluating the neighborhood’s condition is vital. These steps help avoid unexpected, substantial renovation expenses.

Conclusion

When it comes to real estate investments, the optimal choice aligns with your specific needs and preferences as an investor. It’s essential to factor in considerations such as the time you can dedicate, the level of capital you’re comfortable committing, and whether you’re inclined to handle household-related matters that inevitably arise. You can directly buy a property or start with investing in real estate funds. The choice is yours.

If you lack the cunning skills or the knowledge of a real estate mogul, you should start with the basics we have mentioned and walk your way through to be a successful player in the market.

Frequently Asked Questions

How Can I Add Real Estate to My Investment Portfolio?

Besides directly purchasing properties, everyday investors have options like investing in Real Estate Investment Trusts (REITs) or funds that specialize in REITs. REITs are investment pools that own and manage properties or hold their mortgages.

Can I Invest in Real Estate with Limited Funds?

Absolutely, even if you have limited funds, platforms like Fundrise and DiversyFund enable investors to enter the real estate market with as little as $10 and $500, respectively. Another way to start with limited funds is by using REITs and real estate exchangetraded funds (ETFs).

Is Real Estate Investment a Wise Choice?

Determining if real estate investment is a wise choice depends on your specific goals and circumstances. Investing in property can offer potential benefits such as long-term value appreciation, rental income opportunities, and various tax advantages, particularly for first-time buyers. However, it's important to consider that property investments can require significant capital, face challenges in certain markets, and involve ongoing maintenance and repairs.

Why Do Interest Rates Affect Home Prices?

Interest rates influence home prices because real estate often requires financing through loans. When interest rates rise, the cost of mortgage payments increases for new loans. This can deter buyers who need to factor in the monthly expense of owning a property.