As we approach the tax deadline for 2024, it is crucial to emphasize the importance of selecting the right tax software. Choosing the right software could be a hard one, as only adequate and user-friendly software can ensure that your taxes are prepared accurately and efficiently.

Out of thousands of choices out there, one option that always appears on every “best software list,” is TurboTax. This software offers benefits, such as access to live expert assistance and a user-friendly interface.

In this Intuit TurboTax review we will give you a comprehensive and idepth analysis of the software and their services. We will provide an insights that will help you decide whether it could be the right option for your business in assisting you with your taxes this year.

Background On TurboTax

Intuit’s TurboTax has a longstanding history of excellence spanning over 30 years, and this year’s product lineup upholds that tradition. TurboTax brings both substance and style to its offerings, providing comprehensive coverage of tax topics in an easy-to-follow interview format backed by top-notch support. For many years, it has consistently ranked as the best personal tax preparation service in our reviews.

Image source – Intuit TurboTax

The latest enhancements in Intuit TurboTax’s extensive range of products are primarily focused on two key areas – tools tailored for self-employed individuals and live expert support through chat or video calls. These improvements have elevated an already outstanding tax preparation platform, earning TurboTax the coveted Editors’ Choice award once again.

Who Should Opt For TurboTax?

TurboTax is a good option for beginners, tax preparers, and professional certified accountants when it comes to user-friendliness. TurboTax makes the process easy by guiding you through it with an interview-style approach. It offers on-screen support options whenever you need assistance.

Intuit TurboTax, created by Intuit, a well-known provider of financial, accounting, and tax preparation software, is one of the most popular solutions for filing taxes. Its popularity stems not only from its history (serving users for over three decades) but also from its commitment to user-friendly design and a wide range of valuable features.

For individuals and families with straightforward tax returns, meaning they have a single W-2 and no investment or rental income, the basic software is available for free. But as the saying goes, “everything is not perfect,” and it also holds for the TurboTax. If your tax situation is more complex – for instance, if you’re a self-employed individual with multiple connected ventures – TurboTax’s business packages might be excessive and potentially more costly compared to other alternatives.

Pros

- Exceptional user-experience

- Interview-style question and answer process for most accurate tax-related guidance.

- Comprehensive information on various tax topics.

- Offers excellent help resources and live support options.

- Switching and starting up is simple from other softwares.

- Convenient mobile apps

Cons

- Costly

- Imposes fees on every state

return you submit

Intuit TurboTax Review – Plan, Features And Support

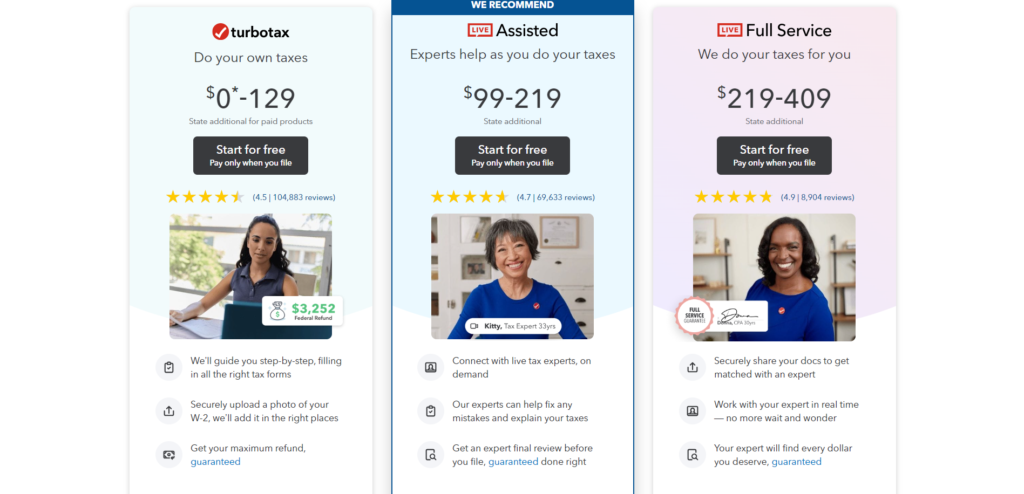

Different Plans By TurboTax

How much does turbotax cost? To understand this here are all the plans offered by Intuit TurboTax:

1. Free:

The Intuit TurboTax Free Edition is an excellent choice for individuals whose income primarily comes from a W-2 or savings account. This version enables you to file federal and state tax “simple” returns for free. It covers essentials like money received from a W-2 account, EIC, CTC, interest deduction on student loans, normal deductions, and simple dividend and interest reporting, which is 1099-INT and 1099-DIV.

Additionally, it accepts Form 1099-K, allowing you to report income from activities like hobbies or side gigs. However, it doesn’t handle the 1099-G form for unemployment income and itemized deductions. This TurboTax basic edition also guides if there will be an audit, with TurboTax’s support option for audit. Keep in mind that it’s suitable only for straightforward tax returns, and not everyone may qualify for free filing.

2. Deluxe:

TurboTax Deluxe encompasses all the benefits of the Free Edition and adds extra benefits. It’s particularly useful for homeowners seeking to maximize their tax savings related to homeownership.

For example, if you want to deduct mortgage interest, Intuit TurboTax Deluxe guides you through the process. It also conducts a comprehensive search for over 350 credits and tax deductions to ensure you don’t miss any potential tax breaks. Additionally, if you need to alter something to your tax return, this software allows you to do so online with a filing option for up to three years after filing with IRS acceptance. TurboTax Deluxe provides personalized support from the TurboTax specialists.

3. Premier:

TurboTax Premier inherits all the advantages of the Deluxe version and is especially suitable for investing in cryptocurrency, stocks, rental property income, bonds, robo-investing, and ESPPs. If you are actively trading on platforms like Coinbase, this version streamlines the reporting of these taxable transactions, even if there are many. It can import data of each transaction from brokerage accounts directly.

Additionally, suppose you are a homeowner and rent out a basement or a room. In that case, Intuit TurboTax Premier assists in reporting rental income and identifying deductions that could save you a substantial amount. Similar to other TurboTax options, Premier actively finds over 450 credits and tax deductions to maximize your tax savings.

4. Self-Employed:

The Self-Employed version (Also known as deluxe premier selfemployed turbotax) offers all the options found in all the previous versions, along with specific tools for self-employed individuals. It’s designed for freelancers and gig workers, like those with freelance jobs. If you fall into this category, TurboTax Self-Employed is tailored to your needs. It can help you with necessary tax forms and determine if the IRS requires Schedule SE.

Moreover, this version scans your financial transactions for any specific industry deductions, covering areas like delivery driving, ride shares, real estate, personal services, and online retail. If you have hired some employees, TurboTax Self-Employed enables you to prepare and print as many 1099 forms and W-2 forms.

You can use free edition deluxe premier selfemployed version as a trial.

Each Intuit TurboTax version is designed to maximize tax savings and cater to specific financial situations, ensuring you choose the one that suits your needs best.

Pricing Of TurboTax Plans – Could Be Better?

(Rating 3.8)

When it comes to TurboTax, there’s a lot to appreciate, but pricing isn’t necessarily one of its strong suits. The regular price of TurboTax software tends to sit on the higher side of the pricing range, especially when you factor in the expenses of filing state returns. And if you’re seeking human assistance, be prepared to pay an additional premium.

Here is a table showing the pricing of each plan offered by TurboTax:

| Product | State | Federal | With Live Assisted | With Live Assisted (Full Services) |

| Free | $0 | $0 | $89 | $54 (State) and $209 (Federal) |

| Deluxe | $59 | $59 | $64 (State) and $129 (Federal) | $64 (State) and $259 (Federal) |

| Premier | $59 | $89 | $64 (State) and $179 (Federal) | $64 (State) and $369 (Federal) |

| Self-employed | $59 | $119 | $64 (State) and $209 (Federal) | $64 (State) and $399 (Federal) |

Features Of TurboTax

Choosing TurboTax for your 2024 taxes comes with several advantages worth considering:

1. Intuitive Interface: Intuit TurboTax simplifies the tax filing process with its user-friendly question-and-answer format. It effortlessly gathers essential information and guides you through each step, ensuring a smooth experience.

2. Live Support: If you’re uncertain about handling your taxes, TurboTax offers two levels of live support. With the “Live” option, you gain access to an expert who can review your return before filing. For TurboTax Live Basic, this service costs $99 for federal simple tax returns (plus $54 per state filing). If your tax situation involves itemized deductions or freelance income, you may need a higher-tier package, starting at $129, with pricing increasing based on the level of assistance you require.

3. Full-Service Option: TurboTax’s “Full Service” products connect you with a tax expert who manages the entire process once you upload the documents. However, this convenience starts at $219 for simple tax returns and goes up to $409 for self-employed taxpayers.

4. Convenient Document Upload: TurboTax simplifies the process of uploading your tax documents, especially if you receive them digitally, like your W-2 or other tax forms. Additionally, TurboTax retains a record of your documents for reference throughout the year and can even upload your previous year’s tax returns if you return to their service.

5. Reliability: TurboTax provides several guarantees to ensure your taxes are handled correctly and that you receive the maximum refund possible.

- For individual filers, Intuit TurboTax stands behind the accuracy of your return’s calculations and offers audit support if needed.

- If TurboTax makes a calculation error that results in penalties or interest on your state or federal taxes, the company will cover those costs.

- If you’re unsatisfied with your refund or tax due and another tax software could provide a better outcome, TurboTax will refund your purchase.

- TurboTax can assist you if you are audited after using their software. Individual users receive one-on-one support from a tax professional, helping them navigate a stressful situation (please note that this support does not include legal advice or representation before the IRS).

Support by TurboTax

When it comes to filing your taxes with TurboTax, you have a range of support options at your fingertips to make the process smoother.

General Support: TurboTax offers a wealth of resources for on-the-fly research. You can access and participate in forums, utilize calculators, and watch helpful video tutorials.

Tech-Related Support: TurboTax provides multiple avenues for technical assistance. The TurboTax chatbot and virtual assistant are available to all users. Additionally, there’s a contact form for reaching out. If you opt for one of the paid packages, you gain a pass to specialists of Intuit TurboTax who can provide personalized help. TurboTax also maintains a support page online, addressing common questions about its services and information related to tax returns, along with a dedicated forum for its community for discussions and finding helpful information.

Support For An Audit: Facing an IRS audit can be daunting, so understanding the support you have is crucial. TurboTax offers complimentary audit support to everyone, connecting you with an experienced professional to assist you in understanding the audit process if you receive a notice regarding your previous returns.

If you desire representation before the IRS, you’ll need TurboTax’s service known as MAX, which costs an additional $49. MAX includes valuable features like restoration assistance, insurance for loss, and monitoring for identity theft.

Receiving Tax Refund: TurboTax provides various options for receiving your tax refund –

- Direct deposits to your bank account.

- Direct transfer to your Coinbase account.

- Receiving a paper check.

- You can also apply for a refund for taxes due in the coming year.

With TurboTax’s extensive support and flexibility in refund options, you can navigate the tax filing process with confidence and ease.

Conclusion

TurboTax is a leading tax software in the market, offering users an intuitive interface and reliable support options. The software allows for easy document upload and handles taxes efficiently. However, potential users need to assess their specific tax needs and budget before choosing a Intuit TurboTax plan.

For individuals with simple tax situations, the TurboTax Free Edition provides a cost-effective solution, while those who are self-employed or have investments may benefit from the higher-tier plans.

TurboTax remains a trustworthy and highly regarded option for tax preparation in 2024, thanks to its strong reputation and dedication to user-friendly design.

Frequently Asked Questions

How Can I Get in Touch with TurboTax’s Customer Service?

If you have any questions related to your taxes, the Intuit TurboTax AnswerXchange online community is there for you. It's available 24/7 and provides a helpful platform where TurboTax experts and fellow users can provide answers and assistance with your tax-related inquiries.

Can I File My Taxes for Free Using TurboTax?

Yes! However, there are specific requirements that need to be met. Intuit TurboTax provides free federal and state tax filing options, but it is generally suitable for individuals with simple tax returns. This includes those with W-2 income, standard deduction claims, and potential eligibility for the Earned Income Tax Credit and child tax credit.

What Happens If the IRS Audits My Return Prepared with TurboTax?

If the IRS decides to audit a tax return that you filed using TurboTax, there's no need to worry. You will receive complimentary audit support from Intuit TurboTax, which includes having an expert review any correspondence from the IRS and guide what to anticipate and how best to prepare. If you require direct representation throughout the audit process, you have the option to upgrade to TurboTax MAX.

Why Should I Choose TurboTax?

For a seamless and efficient tax filing experience, TurboTax is the preferred choice. Although it may not be the most affordable option, its wide range of products and simplified process make it a worthwhile investment, guaranteeing a smoother journey through tax filing.