If you’re a business owner who dreads the tax filing process because the complexities of the 1099 form are a task in itself, rest assured that you’re not alone. It may seem overwhelming. Fear not! This intricate procedure can be simplified.

By familiarizing yourself with the IRS regulations pertaining to merchant services 1099 reporting, you can approach tax season with confidence, knowing that your completed documents comply with the laws. So let us discuss all 1099 forms and demystify them together – let’s explore what you need to understand before submitting this paperwork.

Introduction to 1099 Forms

The forms known as 1099 play a role in the process of filing taxes for businesses and self-employed individuals. They serve as a way to report sources of income that are not covered by a Wage form. It may include dividends, interest, royalties, rent, and payments received from contractors.

There are types of merchant services 1099 reporting forms created for reporting types of income. This article will mainly focus on Form 1099 K, Form 1099 MISC, and Form 1099 NEC.

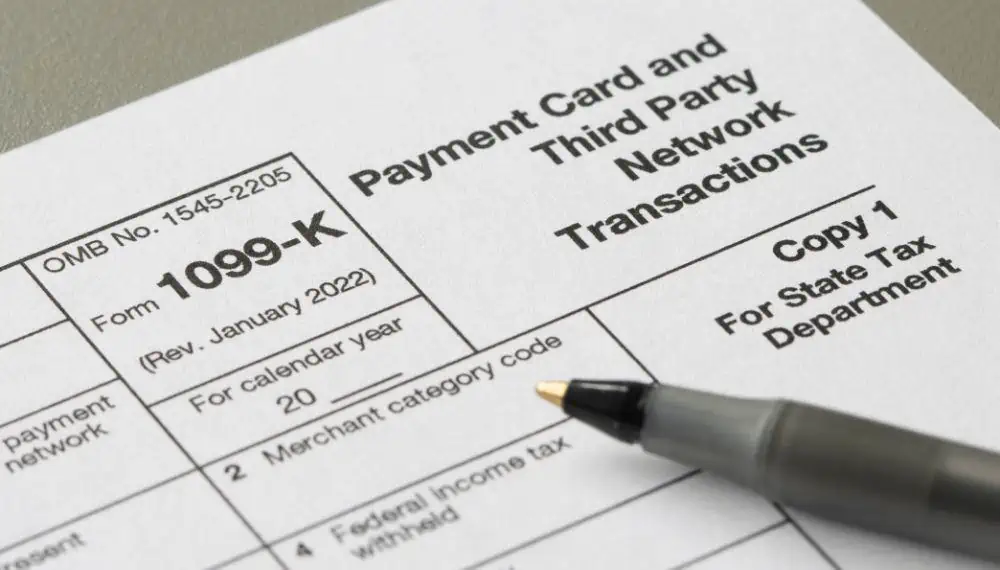

What is Merchant Services 1099-k?

Form 1099 K acts as a documentation of the payments you have received annually from two sources;

1. Payments made through stored value cards, credit cards or debit cards. The value cards include gift cards (commonly referred to as payment cards).

2. Payments received via online stores, payment applications. Online store or marketplace is also called third-party payment networks.

If the total gross amount of payments exceeds $600, then it is an obligation of the online payment networks to submit Form 1099 K.

However, it’s important to remember that Form 1099 K should not have any gifts or reimbursements for expenses received from near ones like a friend or a family member.

When it’s time for tax filing, you can utilize Form 1099 K along with your tax records to calculate and report your taxable income.

What is 1099-MISC?

If you’ve made payments to an individual or business that qualified for merchant services 1099 reporting, there’s a reporting document called Form 1099 MISC that you’ll need to file. You should file this form under the following circumstances;

1. Instead of dividends if you have paid an amount of $10 in royalties as well as broker payments.

2. If you paid tax-exempt interest.

3. If you’ve paid a minimum of $600 in any of the following:

- Rent

- Awards and prizes

- Income payments

- Generally, cash payments made under a to an individual from notional principal contract. Also includes partnership or estate

- Proceeds from a fishing boat

- Health care payments

- Crop insurance proceeds

- Attorney fees

- Deferrals under Section 409A

- Deferred compensation that are nonqualified

If you have withheld federal income tax from an individual based on withholding rules you will have to file Form 1099 regardless of payment amount.

What is 1099-NEC?

Form 1099 NEC is one of the merchant services 1099 reporting forms designed by the Internal Revenue Service (IRS) to document income. It specifically caters to businesses that need to report payments made to individuals or businesses that are not their employees. These recipients often include contractors or sole proprietors. It is essential to note that Form 1099 NEC should not be used for reporting employee wages and salaries.

Previously, before the year 2020, this type of income reporting was done using Form 1099 MISC. However, the IRS reintroduced 1099. It is now exclusively used for these income reports. For information on what needs to be reported under your 1099 MISC form, you can refer directly to the official IRS website.

Filing of Form 1099-NCE is required if you have made payments of at least $600 for services provided by someone (should not be your employee). This includes payments for services as well as any related parts or materials. Additionally, cash payments made for purchasing aquatic life like fish from individuals who do fish catching business also fall under this category. And attorney payments for their services regardless of the amount being paid.

Who Gets Form 1099-K for Payment Card and Third-Party Network Transactions?

You can expect to receive Form 1099 K by January 31st if you received payments through payment card transactions (like debit cards, credit cards, or stored value cards) or settlements from third-party payment networks (such as PayPal, Venmo, Zelle, etc.) in the calendar year. Here are the criteria for receiving this form;

- For the tax year 2021, if your total payments exceeded $20,000 and involved more than 200 transactions.

- Starting from the tax year 2022 and onwards if your total payments exceed $600 with no transaction threshold.

Each payment settlement entity (PSE) that provided you with income from payment transactions in the year will send you a separate 1099 K. This includes any transactions made through a payment card or third-party network.

A payment card transaction is considered when a payment card or associated account number is used for making a payment. On the other hand, a third-party network transaction refers to a transaction that is settled through a third-party payment network but only after it surpasses the mentioned thresholds.

It’s important to note that Form 1099 K reports the amount of income and does not include adjustments for credits, cash equivalents, discount amounts, fees, refunds, or other types of adjustments.

Merchant Services 1099 Reporting: Contractor and Vendor Payments

There is a difference when it comes to reporting payments to contractors and specific vendors. In these cases, you will need to use either Form 1099 NEC or 1099 MISC.

Form 1099 NEC: This form should be used if you pay contractors $600 or more for their services. It is also required for cash payments related to fishing or payments made to attorneys for their fees.

Form 1099 MISC: Use this merchant services 1099 reportingform for payments to vendors. The minimum payment in this case is $600. This includes things like rent, crop insurance proceeds, prizes, and awards. You will also need to complete a 1099 MISC if you pay $10 in royalties or broker payments.

Both Forms 1099 NEC and 1099 MISC need to be submitted to the IRS, the contractor or vendor, and potentially the state tax department.

It’s important to note that you do not have to prepare a 1099 NEC or 1099 MISC for payments made through credit cards, debit cards, store-valued cards (like gift cards), or mobile wallets (such as PayPal). These forms are only necessary when making payments to contractors using methods like cash, checks, or similar payment methods.

Contractors who receive payment cards or payments through third-party settlement organizations will receive the 1099 K for this. It is the point at which things become evident.

Exceptions in 1099

There are cases where you don’t need to worry about filing a merchant services 1099 reporting;

- When you make payments to corporations like both S Corporations and C Corporations, you generally don’t have to issue a Form 1099 (There might be exceptions in some situations).

- You don’t have to submit merchant services 1099 reporting forms for items like merchandise, telegrams, telephone services, freight, storage, or similar things.

- Rent payments made to real estate agents or property managers are usually exempt from Form 1099 reporting. Remember that the real estate agent or property manager should use Form 1099 MISC when reporting the rent paid to the property owner.

- Employee wages should not be reported on merchant services 1099 reporting. Instead, these payments should be reported on Form W 2, specifically designed for employee wage reporting.

- In some situations, depending on the amounts involved, business travel allowances paid to employees might need to be reported on Form W 2.

Fines and Penalties Associated with 1099

Failing to submit the merchant services 1099 reporting return on time or not submitting it all can lead to significant penalties imposed by the IRS. These penalties are applicable in the following situations;

- If you do not submit within the given deadline.

- If you omit the information on the return.

- If you provide false information on the return.

- If you choose to submit a paper form when electronic filing is required.

- If you report a Taxpayer Identification Number (TIN).

- If you neglect to report a TIN.

- If you do not use machine paper forms when applicable, revenue procedures require their use.

The specific amount of penalty depends on when you submit the merchant services 1099 reporting return and is structured as follows;

- If you correctly file in a span of 30 days than $50 per information return. The date ends on March 30 (If the due date is February 28). The maximum penalty is $588,500 per year ($206,000 for businesses).

- If you correctly file then $110 per information – 30 days after the date but before August 1. In this case the maximum penalty amount is $1,766,000 per year ($588,500 for businesses).

- In case you file after August 1, or did not file the required information return then it is $290 per information return. Maximum amount of the fine is $3,532,500 per year ($1,177,500 for businesses).

Submitting merchant services 1099 reporting on time and providing correct information is necessary to prevent expensive repercussions from these penalties.

Conclusion

Tax season can pose difficulties for business owners. The task of filing taxes, staying updated on tax law revisions, and comprehending tax forms can be overwhelming. Fortunately, this 1099 Survival Guide is available to simplify the process and equip you with the knowledge you need to confidently go through tax season seamlessly.

Whether you’re dealing with 1099 forms or other tax-related matters, this guide will assist in making tax season more manageable and less stressful for both you and your business.

Frequently Asked Questions

What Payment Methods are Excluded from 1099?

Payments made using credit cards, merchant services, and digital wallets like PayPal and Venmo are typically not included in the reporting for Form 1099 MISC and Form 1099 NEC. Instead, these types of payments are reported separately on Form 1099 K.

There have been changes to the reporting threshold for Form 1099 K. Previously, the threshold was set at 200 transactions with a transfer amount of $20,000 or more per year. However, the American Rescue Plan Act of 2021 has now lowered the threshold to $600 per year. This means that if a single transaction exceeds $600, it may trigger the requirement for reporting on Form 1099 K.How can you verify the figures on your 1099 K?

You should be able to match the sales amount with the sales stated on your merchant statements. It's important to note that the numbers on the 1099 K represent your sales and do not factor in returns or deducted fees. Additionally, if you have merchant accounts linked to the Taxpayer Identification Number (TIN), these accounts may have been consolidated into a single reporting form.

Which States Require 1099 Forms?

The obligation to file merchant services 1099 reporting form goes beyond requirements as many states now also require reporting of specific income. Some states participate in a program called “Combined Federal and State ” where the IRS shares information from the submitted 1099 forms with state tax authorities.

Here is a compilation of the states that are currently involved in this program;

Alabama,Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Hawaii, Idaho, Wisconsin, Missouri, Indiana, Kansas, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, South Carolina, Montana, Nebraska, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, OklahomaWhat does MCC indicate on Form 1099 K?

MCC stands for “Merchant Category Code.” Your payment processor assigns this code to your merchant account according to the guidelines set by card associations.

Will I receive a 1099 K if my merchant account has been closed?

Yes, even if your account has been closed, you will still receive a 1099 K. As long as you have met the IRS's requirements for reporting during the tax year.