Most of the businesses in the United States require an EIN or Employer Identification Number. It is not mandatory for sole properiters though but they can also apply for an EIN. But how long does it take to get an EIN? Let us explore today.

Introduction To EIN – Employer

For many new or restructuring businesses, obtaining an EIN from the IRS is a crucial step. This unique nine-digit number serves as a business identifier for tax-related matters. Just like we have Social Security for personal use the Employer Identification Number is specifically for business purposes.

As a business owner, you’ll require an EIN to open a business bank account, apply for licenses, and file tax returns. It’s advisable to apply for one early in your business planning process to avoid potential delays in acquiring necessary licenses or financing for your operations. While businesses with employees must have an EIN, non-employers operating as corporations or partnerships also need one.

Is EIN Really Necessary?

An EIN is necessary for businesses primarily for tax-related purposes, but not every business needs one.

The criteria for determining whether you need an EIN include:

- Registering a new business entity.

- Hiring employees for the business, including domestic staff for sole proprietorships.

- Initiating a business bank account.

- Making changes to the organizational structure and ownership of the business.

- Establishing entities such as LLPs, Trusts, Corporations, or Partnerships.

- Withholding taxes on capital for one or more non-resident aliens.

- Operating a Keogh plan, a retirement structure for a self-employed corporate entity

- Filing various tax returns, including those for tobacco, employment, alcohol, firearms, and excise

- Being involved in business entities like non-profits, trusts, plan administrators, estates, and mortgage investment conduits of real estate.

- Engaging in the importation of goods to the US, especially for marketplace sales, for example, Amazon. An EIN is necessary when the products surpass a specific cost or are shipped to the USA via sea routes.

A sole proprietorship LLC without employees doesn’t require an EIN.

How Long Does It Take To Get An EIN

The time to get an EIN depends on how you apply. If you apply online, you get it immediately. If you apply by fx it may take more than 10 business days. And last but not the least, if you apply by post, it can take more than 4 weeks.

As mentioned earlier, if you apply online you will get an EIN quickly. But it typically takes about two weeks for it to be permanently registered in the IRS system. This registration is necessary before you can use the EIN for various purposes, such as filing an electronic return or making electronic payments. Additionally, it’s needed for passing an IRS Tax ID Number matching program.

It’s important to note that an EIN is a permanent number and does not expire. However, if you undergo certain changes, such as incorporating or forming a partnership, you may need a new EIN. Let us go through each process to apply to get an EIN and also see how long does it take to get an EIN with each of these proceses.

Getting An EIN By Different Ways

Estimated Timeframe for an Online EIN Approval – Instant

The processing time is the shortest when you apply online for an EIN. When applying for an EIN or Employer Identification Number. The Internal Revenue Service (IRS) has streamlined the online application process to expedite EIN issuance. Here is an overview of the estimated timeframe for an online EIN approval.

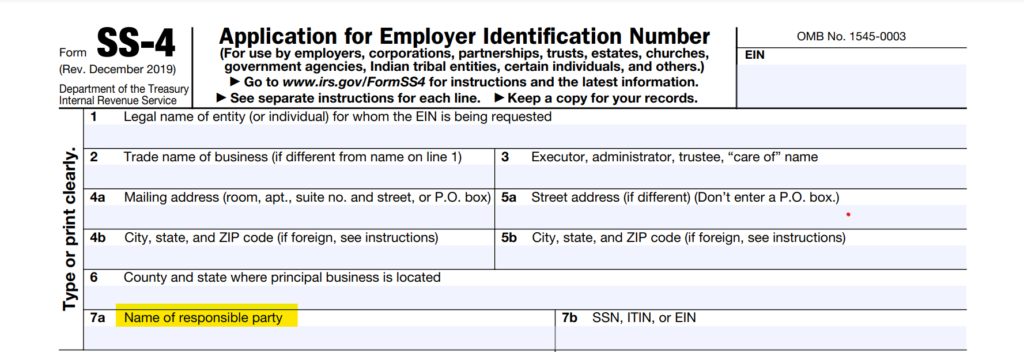

1. Submission and Confirmation: The first step is to complete the online application form also known as Form SS-4. You will have to enter the correct business information. After that you submit it electronically. And you will get an immediate confirmation if the submission is successful.

2. Average Processing Time: The processing time to get an EIN by applying online is fast. It takes a few minutes of time to get the confirmation with the EIN number after the submission.

3. Instantaneous Validation: The online system validates your information in real-time, ensuring accuracy and reducing the need for manual review. This efficient process eliminates the wait time typically associated with traditional paper applications.

4. EIN Notification: When your EIN is approved, the IRS will immediately provide you with your unique nine-digit EIN. It is crucial to record and retain this number as it serves as your business’s identifier for federal tax purposes.

5. Confirmation Letter: Although not always necessary, the IRS may send you a confirmation letter via mail for your records. This letter will contain your EIN and provide additional information regarding your responsibilities as an employer.

Remember, while the online application method offers a swift process, it is essential to double-check your information for accuracy before submission. Any errors or inaccuracies can result in delays in receiving your EIN.

Online application is the best for any business who wants to get an EIN as quickly as possible.

Mailing Instructions And Time Required By Mail Application – 4-6 Weeks

If you prefer to submit your EIN application by mail, follow these simple instructions to ensure a smooth process.

Begin by accessing and completing Form SS-4, which is available on the IRS website. Double-check that you have included all required information, such as your business type, purpose, responsible party and the reason for applying.

Once you have completed the form accurately, ensure that you send it to the appropriate IRS address based on your location. It’s crucial to use the correct address to avoid delays. The processing time for mailed applications typically ranges from four to six weeks, so plan your timeline accordingly.

Processing Time for EIN Applications via Fax – 4-10 Business Days

If you prefer applying for an Employer Identification Number (EIN) via fax, the process is relatively straightforward. To begin, complete the Form SS-4, ensuring that you provide all the required information related to your business. Once the form is complete, fax it to the appropriate IRS address.

Keep in mind that the processing time for faxed applications is generally around four to ten business days.

To ensure a smooth and efficient process, double-check that you have included all the necessary documents and supporting information. The IRS recommends verifying that the fax number you are using is correct and ensuring that you have access to the fax transmission report for reference. By applying via fax and adhering to the provided guidelines, you can expect your EIN to be processed in a timely manner.

Don’t forget to include your contact information and any other required documents or forms when sending the fax. Following these steps will help streamline the EIN application process and ensure a prompt response from the IRS.

Remember, an EIN is a crucial identifier for your business, so it’s essential to choose the application method that best suits your needs and time constraints. Applying via fax provides a convenient alternative for those who prefer not to apply online or via mail.

Telephone Application Process for International Applicants – 1-2 Months

International applicants can also apply for an EIN through the telephone application process. This method is particularly useful for those who may not have access to online or mail-in options. To begin the telephone application process, international applicants need to call the Internal Revenue Service (IRS) and provide the necessary information and documentation required for an EIN application.

The timeframe for EIN issuance through the telephone application process can vary. While the IRS strives to process applications in a timely manner, it’s important to note that international applicants may experience longer processing times due to the additional verification steps involved. It is recommended to check with the IRS for the most up-to-date information on the timeframe for EIN issuance through the telephone application process.

Factors Affecting the Timeframe for EIN Issuance

There are several factors that can impact the timeframe to get an EIN. If you are planning to apply for an EIN, here are some key factors you should know.

Application Method:

The method you choose to apply for your EIN can affect the processing time. Online applications tend to be quicker, with an average processing time of 15 minutes to receive your EIN immediately. In contrast, applying via mail or fax can take up to four weeks.

Workload at the IRS:

The workload at the Internal Revenue Service (IRS) can also impact the processing time. During peak periods, such as tax season, there may be a higher volume of applications, leading to longer processing times. Conversely, applying during off-peak periods can result in faster processing.

Accuracy and Completeness:

Ensuring the accuracy and completeness of your EIN application is crucial. Any errors or missing information can lead to delays as the IRS may need to contact you for clarification or additional documentation. Double-checking your application before submission can help avoid unnecessary delays.

Special Circumstances:

Certain circumstances, such as applying for an EIN for a specialized tax line or if your business falls under an exempt entity, may require additional time for review. These cases may involve further scrutiny from the IRS, which can impact the overall timeframe for EIN issuance.

By considering these factors and taking proactive steps, such as applying online during off-peak periods and ensuring accuracy in your application, you can help streamline the EIN issuance process and receive your EIN in a timely manner.

What Is The Reason For A Delayed EIN?

Various factors can influence the timeframe for receiving your EIN from the IRS. Although digital EINs are typically swift, the delivery of official paper records might take up to 30 days. However, wait times are often shorter than this. Consider the impact of holidays and office hours on the processing time.

The IRS imposes a limitation of one EIN per day per responsible entity, regardless of the chosen application method. Consequently, if you require multiple EINs, you must apply for them separately on different days.

Although rare, your application might face rejection if:

- It has incomplete or inaccurate information.

- There is already a company with the same name.

- They are already existing records.

To minimize the likelihood of rejection, ensure that your application is thoroughly and accurately completed.

What If I Lost My EIN Card?

Losing your EIN is a very common thing. However, retrieving it is quite simple and can be done from various sources. Begin by checking any filed tax returns for your company, as your EIN should be noted within the document.

Another choice is to locate the original confirmation mail you received when you initially applied for EIN. If stored correctly, this letter should contain your EIN. If not, explore alternative options. Contact your bank, as they usually mandate an EIN ID to open bank accounts for businesses. They should have this number on record. Similarly, the agency through which you obtained a state or local license may also possess your EIN.

If you do not succeed in retriving your EIN number then reach out to the IRS with their dedicated helpline number for these purposes (18008294933). They will confirm your identity through a series of questions before providing you with the EIN over the phone.

Conclusion

As an owner of the company, an EIN is indispensable. It’s essential for crucial tasks like filing returns and taxes, obtaining a credit card for the business, and opening a bank account. This need is even more crucial if there are employees in your company.

Obtaining an EIN enables you to maintain a clear distinction between your finances and business. It’s instrumental in upholding this as a shield that safeguards you from any personal responsibility for your company’s debts.

Frequently Asked Questions

Q: How long is an EIN valid for?

EINs and SSNs do not have an expiration date.

Q: How can I verify my EIN in the USA?

You can search for another business's EIN using the SEC Edgar system, provided the business is a public company. Alternatively, you can utilize the IRS’s Search tool.

Q: What are the causes of delays in EIN?

Generally, obtaining an EIN has a quick turnaround, especially when applying online. However, certain situations can lead to delays. Business entities incorporated outside the US and its territories can apply for an EIN, but not through online means. Consequently, these businesses might experience delays as they rely on slower application processes.