When you apply for an EIN, also known as a Federal Tax ID Number, you’ll need to designate a Responsible Party to IRS. This individual is tasked with managing, directing, and/or controlling the entity associated with the EIN.

Suppose there are multiple individuals involved in running the entity. In that case, you can choose which one you want a Responsible Party to be the single person acting on behalf of the company, as only an individual can be called a responsible party. But who exactly can be considered a Responsible Party?

Let’s explore the role and significance of a responsible party in an EIN application, along with how your choice can impact legal compliance and communication with the IRS.

Definition Of Responsible Party

The term “responsible party” as defined by the IRS refers to the individual who holds a significant position within a business or entity. This can include the primary officer in a corporation, a general partner in a partnership, the owner of a disregarded entity (typically a single-member LLC), or the owner, grantor, or trustor of a trust. Essentially, it pertains to the individual who possesses ultimate ownership or exercises ultimate control over the entity.

In the context of businesses, the individual who manages, directs, or has control over the company’s funds and assets is considered to be the responsible party. The IRS places importance on identifying the actual person in charge of handling the entity’s finances and assets rather than a lawyer who may not hold an ownership, directorship, or partnership position within the company.

In a partnership, there may be multiple partners who could be considered the responsible party. You have the option to select the individual you prefer for the IRS to recognize and communicate with in that role.

It’s important to mention that a responsible party for obtaining an EIN should typically be an individual, unless a government entity is involved. For example, if a corporation serves as the general partner of a partnership, then the principal officer of that corporation is to be considered the responsible party. Furthermore, the responsible party must have a tax identification number (such as an individual taxpayer number or Social Security number) in order to qualify for responsible party status on Form SS-4.

How Does Responsible Party Function?

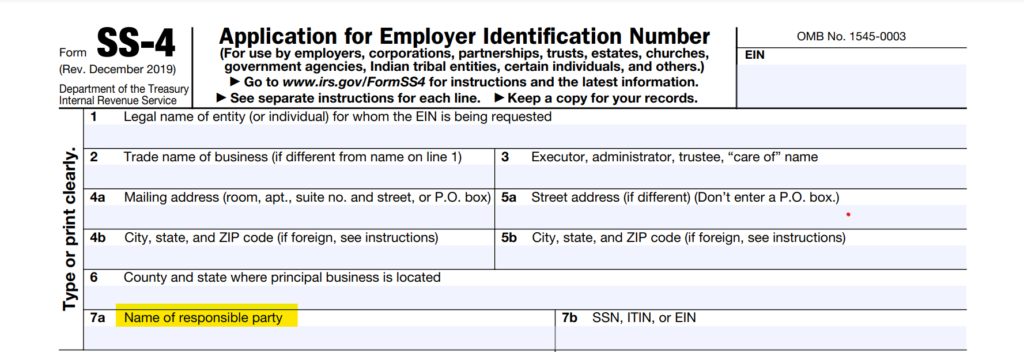

When your business applies for an EIN using Form SS4, you’re required to identify a responsible party on line 7a and provide their tax ID number on Line 7b. This taxpayer ID can be the individual’s Social Security, ITIN, or EIN.

But what is the difference between a Responsible party and a nominee?

A “nominee” typically does not hold much of a power to act in regard to the company when the time calls for it. The “general partner or principal officer,” serves as the right “responsible party”, as opposed to a nominee. Responsible party, however, is a person or sometimes an entity that manages, directs, and controls the company and its funds and assets. On the other hand, a nominee is granted minimal or, for most of the time, no authority whatsoever.

The IRS currently doesn’t permit nominees to be designated as responsible parties when applying for an EIN. The IRS aims to ensure that the designated contact person for the company is someone with the authority to make all decisions in regard to the business.

Who Is Responsible Party In Your Business?

Although your business can only have one responsible party, this designation doesn’t impact the business’s ownership or its taxation method. Ownership details for your business are typically recorded through membership or stock certificates, along with the relevant LLC operating agreement or corporate bylaws. Here’s what you should understand about how LLCs and corporations are taxed:

LLCs are typically taxed as disregarded entities or partnerships. This means that the business’s income flows through the company and is allocated to each member as income, which they then report on their personal tax returns. Therefore, in a multi-member LLC, designating one member as the responsible party should not impact the taxes of either member, as each member files their taxes separately.

Many corporations are taxed as C-corporations, which means they face “double taxation.” This means that the business itself pays corporate income tax on its profits, and then shareholders must also pay personal income tax on the profits they receive. However, some corporations choose to be taxed as S-corps instead. Here, they are treated as pass-through entities and do not face double taxation.

Are You Liable As “Responsible Party” If Company Defaults?

The Simple answer to this is that being a business’s responsible party doesn’t automatically make you personally liable for the business’s debts or legal matters. Each LLC member or corporate shareholder is equally responsible for paying taxes on their share of the business profits. LLCs and corporates benefit from liability protection, safeguarding the owners from personal liability for the business’s legal or financial concerns, as long as they maintain the legal separation between the business and its owners.

Many readers often question whether designating themselves as a Responsible Party would automatically render them to be completely liable if or when the LLC faces tax issues with IRS due to the actions of another member of the LLC in a company with more than one owner or partners.

Simply being titled a Responsible Party doesn’t automatically imply personal liability for the LLC’s tax debts to IRS.

However, this doesn’t exempt you from potentially receiving correspondences from IRS or having to appear in court, especially in more severe cases, to establish that you aren’t liable personally for the company’s tax debts.

It’s important to distinguish between the following terms:

- Responsible Party

- Responsible person

It may be decided in a tax court that the person entitled as the Responsible Party is not personally liable for the LLC’s tax bills, especially if some other member intentionally misrepresented information or evaded in taxes with IRS.

In essence, a responsible party serves as the primary point of contact between IRS and LLC.

When it comes to Multi-Member company, the person designated as the Responsible Party must be willing to assume the role and responsibility of ensuring all the taxes are accurately filed and deposited on time.

And when it comes to Single-Member company, as the head, you should serve as Responsible Party. Same as Multi-Member company, you aren’t personally responsible for the LLC’s tax debts. But, if you deliberately provide false information or worst avoid filing/paying the taxes, you may personally face repercussions from the IRS.

How Can You Change/Update A Responsible Party?

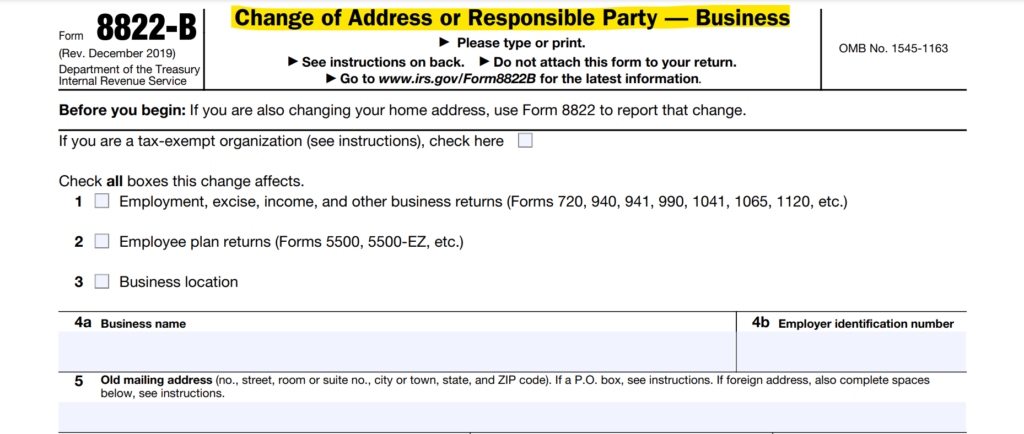

To change your existing Responsible Party with a new one, you have to submit the Form 8822B. Follow these step-by-step instructions for filling out the form:

- Business name (4a): Please enter your company’s name in this section.

- EIN (4b): Provide your LLC’s EIN Number in this section.

- Addresses (5, 6, & 7): You can leave these fields empty if you are not changing your LLC’s address with the IRS.

- Updated/Changed Responsible Party (8): Fill in the name of the new Responsible Party. Remember, this should be an individual’s name, not another company’s name like an LLC or Corporation.

- Changed responsible party’s ITIN, EIN, or SSN (9): Fill in the new Responsible Party’s SSN (social security number) or ITIN (Individual Taxpayer Identification Number) in this section.

| Note: While the form mentions “EIN,” you cannot enter the EIN of a company unless you are a government entity. The EIN Responsible Party for your LLC must be a person, and you must use their SSN or ITIN.If the EIN Responsible Party is a non-U.S. resident or non-U.S. citizen without an SSN or ITIN, you can enter “Foreign” on line 9. |

- Signature (10): Enter your phone number, sign the form, and provide today’s date and your title.

- If you are single-member taxed as the Sole proprietor, you should use the term “owner.”

- If you are Multi-Member taxed under a Partnership, you should use the term “partner.”

- If the LLC is taxed as C or S Corporation, use your officer title.

Make sure to attach any necessary supporting documentation, such as the partnership agreement, to validate the change. Mail the completed form and all supporting documents to IRS address provided in the instructions on the form. Please note that electronic submissions are not currently accepted.

The IRS will then process your request and send a confirmation once the change has been successfully recorded.

Key Takeaways –

- A responsible party is the person in charge of overseeing and managing the assets and funds of a business entity.

- When it comes to obtaining an employer identification number (EIN) from the IRS, they differentiate a responsible party from other individuals.

- In cases where multiple individuals are involved in controlling and managing the business, such as in partnerships, the business entity can choose who will serve as responsible party.

- If there is a change in responsible party for your business, it’s essential to inform the IRS within sixty days.

Frequently Asked Questions

Q: Need a New EIN Confirmation Letter?

It usually takes approximately 30 days to receive an EIN confirmation letter from the IRS, although it's advisable to allow 45 to 60 days for the process.

If the time crosses this limit, you can contact the IRS by phone (details provided below) and request a Verification Letter (147C) for EIN. This letter confirms your EIN and displays the updated Responsible Party information.Q: Can the EIN Responsible Party be an entity?

Since January 1st, 2018, the EIN Application has mandated that Responsible Party must be sole person, not an entity or company.

Q: Can a Responsible Party be an LLC Manager?

For Manager-Managed LLCs, whether the Manager can serve as a Responsible Party depends on whether they are also a Member of the LLC.

If the LLC Manager is an LLC Member, they can be a Responsible Party, but if not, then they can’t take the part. When filing the application for a Responsible Party, simply list them (or any other LLC Member) as a “Member.”

For LLCs with more than one member, you can designate the manager either way.Q: Who can be a Responsible Party for an LLC if the Member is a Trust?

– If the Grantor is alive, they can be a Responsible Party for the company. If there are multiple Grantors, you can select any one of them.

– In the event of the Grantor(s) being passed away, the Trustee (or the Successor) can assume the role of a Responsible Party.