Transactions worth 5.66 billion were processed through American Express credit cards in the US alone in 2019, according to a report by Cardrates. As the popularity of online shopping is growing exponentially, people have started relying more on credit and debit cards to ensure safe transactions. These payment cards are extensively used to process a large volume of transactions annually. You need to keep them secured and so you should know how to find the CVV Security Code on an American Express (Amex) Credit Card.

Safety and convenience are two of the main elements that make credit cards an ideal option for payments. Now, each credit card company has a unique pricing policy. Visa and MasterCard charge a reasonable fee per transaction, while American Express charges it’s own pricing structure, known as OptBlue, to most merchants. Still, many retailers accept Amex cards since many customers use American Express to make online purchases.

What is Amex Card CVV? Why is it Needed?

If you have used one of these credit cards for shopping, you might have noticed the 3 or 4 digit CVV number printed either on the front or back of these cards. What is the purpose of these numbers? And, why do you need to enter the card number every time you are shopping online? In this post, we will show you what Amex security code is, where you can find the CVV security code on American Express, and why you need it.

CVV stands for the Card Verification Value and is a 4-digit number printed on all American Express credit cards. It is a 3-digit security number for Visa, MasterCard, and Discover. The number is printed on your credit card and is often used for security purposes. If you have used your American Express for shopping online or at any online store, the retailer might have asked you to enter the 4 digit CVV number to prove that you own this card.

Thus CVV security code on an AMEX credit card is an extremely important number that you should keep safe and not share it with others. It is printed on the card but not stored as part of the magnetic stripe or in the EMV chip data. This allows it to act as an additional verification value to provide increased transaction security.

CVV Security Code on an AMEX Credit Card – Easy To Find

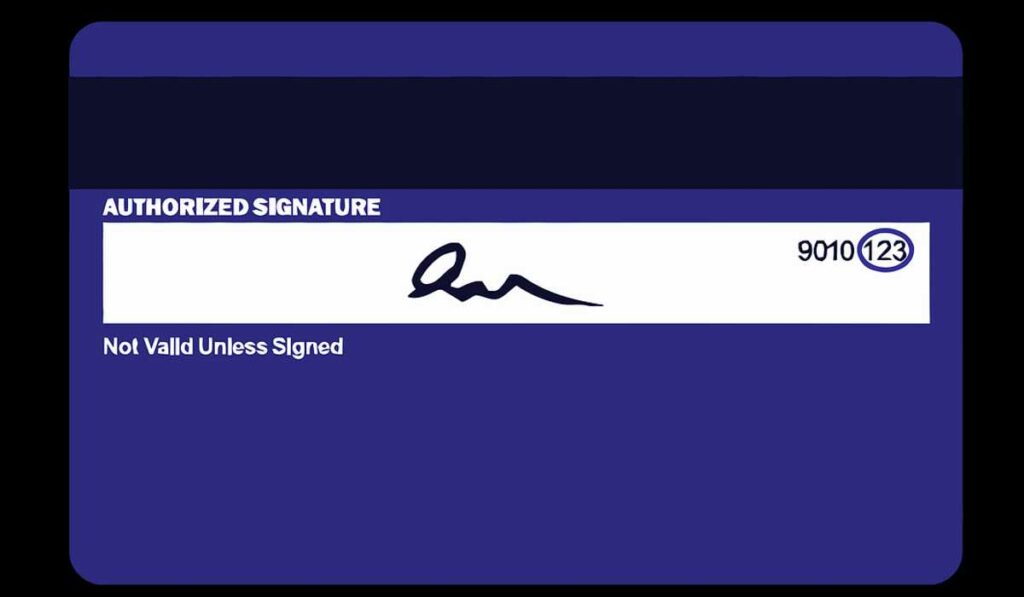

The American Express CVV (Amex CVV) is totally different from Visa and MasterCard in terms of location. Unlike other cards, Amex has a 4-digit CVV security code along with the CID (Card Identification Number). Usually, a CVV number is the three-digit number found on the back of the credit card, but on the Amex card, it is a 4 digit value printed on the front.

On the back of this card, there is the CID number where the CVV usually appears on Visa and MasterCard. Be careful not to confuse the CID value on the back of your American Express card with the 4 digit CVV number located on the front. Your payment will be declined if you use the CID number instead of the CVV.

It is easy to find the CVV security code on an AMEX credit card. You can find this number on the front of the card right above the last four digits of your credit card number. For Visa, MasterCard, and Discover users, this 3 digit number can be found on the signature panel on the back of the card. Even though much has changed in the credit card industry, if one thing has remained unchanged, it is the American Express credit card.

The card still has the same format, structure, and number system. There are a few questions that customers often ask when it comes to the American Express CVV code. Here’s a look at a few of these questions.

Why Has Amex not Embossed the CVV Number?

If you have noticed the American Credit card format, you may have noticed that the card number is embossed while the CVV security code on an AMEX credit card digits is not. The company has not embossed the number for safety purposes.

If someone takes an imprint of your card, which is admittedly rare these days, the non-embossed CVV number will not be recorded. By avoiding embossing the CVV number, American Express is helping to secure it from being inadvertently recorded or stolen.

The CVV security code on an American Express (AMEX) credit card is usually required when you are shopping online. This information serves as proof that you have the card physically present and you are the owner of the Amex card. Similarly, if you are making a purchase by phone, the retailer might ask you to share the 4-digit CVV code for security reasons. This is done to help authenticate the transaction.

Where are These Codes Used?

When there’s a physical transaction, the merchant can verify the information easily by matching your signature with the same on your credit card. If a fraudster gets access to your credit card number, you can rest easy knowing that they cannot use it for online transactions unless they have access to the CVV number. Since it is prohibited for merchants to store CVV numbers, it is less likely that this data will be exposed in the event of a breach. That’s the reason why Card Verification Values are used to authorize and secure your transactions.

In simple terms, the Amex CVV code is used to protect your information. Even though the number is now extensively used for making online payments or by telephone, it is usually safe to provide your CVV code to the merchant so long as you trust the merchant and you are certain they will not store or misuse this information.

When you are making an online transaction using the American Express card CVV, double-check the security protocols of the website. You must purchase from a website that is secured by SSL, indicated by HTTPS in the URL instead of HTTP (and often a lock icon). These websites encrypt your personal and financial information, thus offering maximum protection.

How Can You Find the CVV Code on an Amex Credit Card?

The 4-digit CVV number is located on the front of the credit card, at the right side above the last four digits of the card number. As mentioned previously, the CVV number on your American Express is not embossed like the credit card number. There is also a 3 digit number printed on the back of the card near the signature panel. This is the CID number.

Make sure you do not confuse the CID for CVV. Your transaction will be considered valid only after you submit the card number, expiry date, and the correct 4 digit CVV code.

This should be everything needed to help determine the location of the CVV on Amex and to understand what it is used for. Find your Amex card CVV and use it for all your future transactions.