Step Four: The card reader recognizes who the customer is and contacts the bank that issued the credit card.

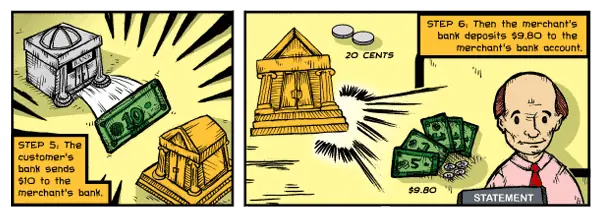

Step Five: The customer’s bank sends $10 to the merchant’s bank.

Step Six: Then the merchant’s bank deposits $9.80 to the merchant’s bank account.

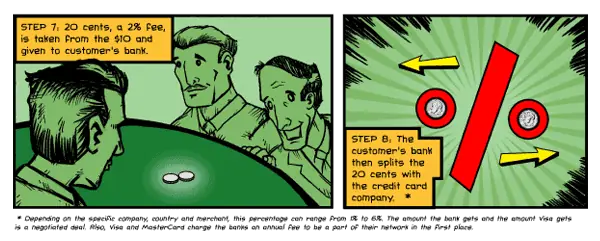

Step Seven: That remaining 20 cents, a 2% fee, is taken from the $10 and given to the customer’s bank.

Step Eight: The customer’s bank then splits the 20 cents with the credit card company.*

* Depending on the specific company, country and merchant, the percentage can range from 1% to 6%. The amount the bank gets and the amount Visa gets is a negotiated deal. Also, Visa and MasterCard charge the banks an annual fee to be a part of their network in the first place.

Where The Money Gets Made

Credit Card processing Companies make money in a variety of ways. Here are the four most common:

One: The most common way credit card companies make money is through fees, such as the annual fee, over-limit fee, and past due fees.

Two: Another way credit card companies make money is through interest on revolving loans if the card balance is not paid in full each month.

Three: As explained above, the card issuer (the bank that issued the card and/or the issuer network, be it Visa, MasterCard, Discover) makes a percentage of each item you purchase from a merchant who accepts your credit card. The rates range from 1% to 6% for each purchase.

Four: The card issuer can also make money through ancillary avenues, such as selling your name to a mailing list or selling advertisements along with your monthly billing statement.

SOURCE: Information for this article was gathered from www.creditscore.net, the movie Superman III, Wikipedia, and Authorize.net.