In 2023, the United States witnessed more bankrupt companies than in the entire year of 2022 or 2021. Companies are facing difficulties due to the impact of high interest rates and a competitive job market.

As per the reports, there have been 459 instances of companies filing for bankruptcy until August 31, surpassing the figures from both 2022 (373 filings) and 2021 (408 filings). While this number is still lower than the peak of 639 filings recorded in 2020 during the downturn caused by the pandemic, this increase deserves attention. In August 2023, as many as 57 companies filed for bankruptcy, highlighting the ongoing economic challenges that businesses are grappling with. Today we will understand and analyze the notable recent bankruptcies.

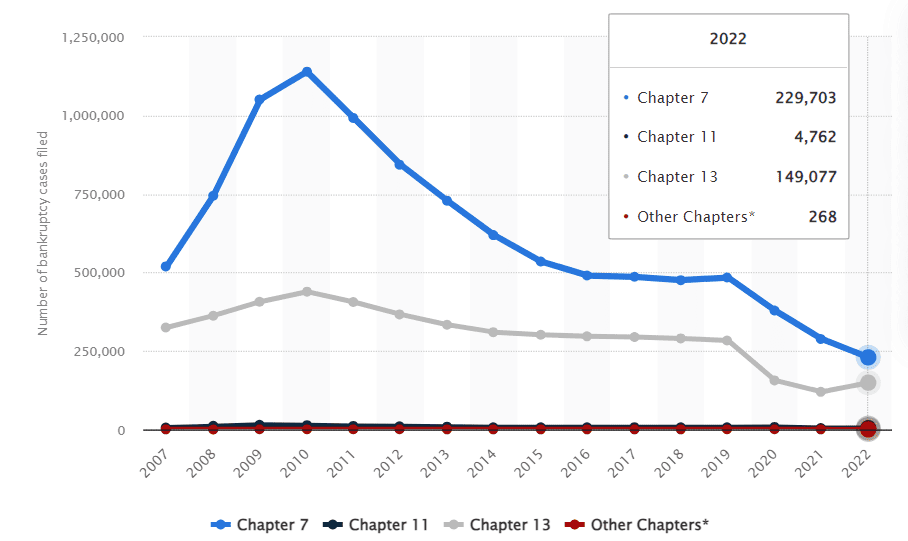

Source: Statista – Bankruptcy filed in the United States(2007 to 2022), by chapter

Notable Recent Bankruptcies Key Highlights:

Surge in Corporate Bankruptcies: In 2023, the United States experienced a significant increase in bankruptcy companies, surpassing the totals of both 2021 and 2022. As of August 31st, there have been a total of 459 reported cases of bankruptcy, surpassing the numbers seen in the last decade.

Monthly Trends: Looking at the trends during August, the market witnessed 57 companies filing for Chapter 11 protection, which indicates the persisting economic difficulties. Although this number is lower than the figures in July, it still remains significantly higher compared to the majority of months in the two years.

Notable Cases:

- Proterra Inc.: Filed for bankruptcy to optimize its value amid macroeconomic challenges and market headwinds.

- Yellow Corp.: Bankruptcy resulted from a prolonged conflict with the International Brotherhood over a business modernization plan.

- Bed Bath and Beyond: Filed for Chapter 11, with Overstock.com playing a crucial role in its partial revival.

- Sectoral Trends: While healthcare recorded the highest number of bankruptcies in August, the consumer discretionary and industrial sectors surpassed it in the total number of bankruptcies filed throughout 2023.

Other Notable Bankruptcies:

- WeWork: WeWork encountered difficulties due to its “ambitious” growth and internal leadership issues, resulting in the company filing for Chapter 11 bankruptcy protection in November 2023

- Amyris Inc.: Amyris Inc. faced various challenges and chose to file for Chapter 11 bankruptcy in August with a strategic plan to sell some of its consumer brands to improve their financial standing

- Western Global Airlines: Western Global Airlines sought bankruptcy protection as a means to manage their debt and maintain operations while working towards implementing a restructuring plan.

Surge in Corporate Bankruptcies in 2023

This year, the United States has seen a large number of corporate bankruptcies compared to the total filings in both FY 2021 and FY 2022. This reflects the challenges caused by high interest rates and a tight job market. According to reports from S&P Global, until August 31, there have been 459 bankruptcy filings in 2023 surpassing the numbers for both 2021 and 2022. It’s worth noting that this year-to-date figure is also higher than most of the preceding 13 years, with two exceptions.

Until August this year alone, 57 companies sought Chapter 11 protection. Although this bankrupt company’s figure was lower than the 64 filings in July, it remained significantly higher than the majority of months in the preceding two calendar years.

Proterra Inc. filed for bankruptcy on August 7th stating that this step would help the company maximize its value by segregating its various product lines. Proterra focuses on manufacturing vehicles for use and providing EV technology solutions. They cited difficulties and challenging market conditions as the reasons that affected their ability to expand all of their product lines effectively.

Another notable bankruptcy filing occurred on August 6th, involving Yellow Corp., a trucking company that employed 30,000 freight professionals. The primary reason cited for the bankruptcy was an extended conflict with the International Brotherhood over a business modernization plan.

In its official statement, Yellow Corp. also revealed a pending lawsuit against the union, filed on June 26. The lawsuit alleged a breach of contract and claimed a loss of enterprise value exceeding $137 million in damages. The union responded on June 27, refuting the allegations and expressing its intent to employ all available legal resources to contest what it deemed meritless accusations from Yellow Corp.

Other significant bankrupt companies include Bed Bath and Beyond, which filed for Chapter 11 in April. Overstock.com, Inc. played a pivotal role in the company’s partial revival by acquiring a substantial portion of its assets, including the intellectual property, online platform, and brand name. Overstock.com recently completed the rebranding process, launching the “new” Bed Bath and Beyond website, bedbathandbeyond.com, in the US at the start of September.

While healthcare recorded the highest number of bankruptcies in August, the consumer discretionary and industrial sectors surpassed it in the total number of bankruptcies filed throughout 2023. The consumer discretionary sector saw 57 bankruptcy filings in the first eight months of the year, followed by the industrials sector with 54 filings, and healthcare with 51.

Other Notable Companies That Filed Bankruptcies

WeWork: One of the most recent companies that filed for bankruptcy in November 2023, WeWork has taken a significant step by filing for Chapter 11 bankruptcy protection, marking a remarkable downfall for the office-sharing giant that once promised to revolutionize global workspaces. This move unfolds amid a period of tremendous upheaval in the commercial real estate market, fueled by the aftermath of the COVID-19 pandemic causing a surge in vacancies.

The primary catalyst for WeWork’s current challenges traces back to its ambitious expansion during its early years. Despite an attempt to go public in October 2021, a venture that followed a spectacular collapse two years prior, the company found itself entangled in a web of difficulties. The aftermath of this debacle resulted in the removal of Adam Neumann who was the founder and the CEO of the company at that time. Neumann’s erratic behavior and extravagant spending had unsettled early investors, contributing to WeWork’s tumultuous journey.

Amyris: In August, Amyris Inc. announced its Chapter 11 bankruptcy filing in a U.S. court, revealing plans to sell its consumer brands to enhance the company’s financial position. To support day-to-day operations during this process, Amyris secured a $190 million financing commitment. Importantly, the bankruptcy proceedings do not involve the company’s entities outside the U.S.

In its filing with the Delaware bankruptcy court, Amyris listed estimated assets in the range of $500 million to $1 billion and liabilities in the range of $1 billion to $10 billion.

Western Global Airlines: WGA has sought bankruptcy protection to reduce its debt following a financial strain on the cargo airline.

In the petition filed under Chapter 11 in Delaware, the airline disclosed assets of up to $500 million and debts of up to $1 billion. This filing enables Western Global to continue its operations as it pursues court approval for a restructuring plan, intending to alleviate its debt burden by over $450 million.

Reasons For An Increasing Number Of Bankruptcies 2023

The market in 2023 has experienced unexpected turbulence amid lingering uncertainty leading to companies that filed for bankruptcy. What sets this apart from last year is that the anticipated turbulence in 2022 was largely attributed to pandemic-related factors. The comprehensive federal relief provided during the peak of the pandemic brought solace to both corporations and individuals. While the economy was significantly impacted by widespread shutdowns, 2023 has witnessed a rebound marked by higher employment rates, stable or increased home values, and relief in the supply chain.

Nevertheless, there’s a prevailing belief among many observers that a looming recession is on the horizon, primarily due to the substantial debt accumulated during the pandemic. Although the economy appears to be stabilizing, the substantial amount of corporate debt with impending maturities cannot be overlooked. Given the impending debt maturity wall, organizations might encounter significant challenges in raising funds in the current high-interest-rate environment. Moreover, uncertainty persists in various industry sectors such as cryptocurrency, commercial real estate, and retail. The impact of student loan repayments could potentially lead to an increase in nationwide filings by individuals.

Conclusion

In 2023, the surge in companies that filed for bankruptcy in the United States signals a concerning economic landscape, surpassing the totals of 2021 and 2022. With 459 filings as of August 31, the challenges posed by high interest rates and a competitive labor market are evident. Notable cases like Proterra Inc., Yellow Corp., and Bed Bath and Beyond underscore the diverse factors contributing to this trend. The unexpected turbulence in 2023, coupled with the looming recession concerns, highlights the complex dynamics influencing corporate financial stability.