High-end furniture brand Mitchell Gold, with 27 stores across 14 states and some Canadian provinces, decided to shut down all its stores over the weekend of August 27, 2023. This was due to difficulties in securing the funds for business operations it had expected. But in the turn of events, surprising everyone, on September 6, The Mitchell Gold Co., LLC filed for Chapter 11 bankruptcy in the United States Bankruptcy Court for the District of Delaware. Subsequently, they also filed for Chapter 7 liquidation. Here are some important updates about Mitchell Gold bankruptcy.

Over 2000 products ready for customer dispatch were held up with delivery partner Ryder due to “pending” payment issues. Mitchell Gold stores’ sudden closure left customers and employees surprised and uncertain about what would happen. The bankruptcy filings revealed challenges that had been brewing behind the scenes.

Key Takeaways

- Mitchell Gold, a top-brand furniture business, faced significant difficulties when shifting from Chapter 11 bankruptcy to Chapter 7. It moved from looking for ways to restructure to selling off all assets to clear existing debts.

- Surya, a company dealing in home goods, cleverly bought Mitchell Gold’s assets. They plan to bring back the brand as a business-only resource for interior designers and design-focused stores, hence stopping direct consumer sales.

- When the bankruptcy happened, many customer orders were not delivered, with over 2,000 Mitchell Gold items stuck at Ryder, the logistics firm. Legal and process issues began when Ryder demanded payment upfront and added daily storage fees.

- A new twist happened when Ryder got court approval to send paid-for items to customers. However, those customers will have to pay for extra storage and delivery costs.

Mitchell Gold Bankruptcy: Impact On Operations, Logistics, And Customer Orders

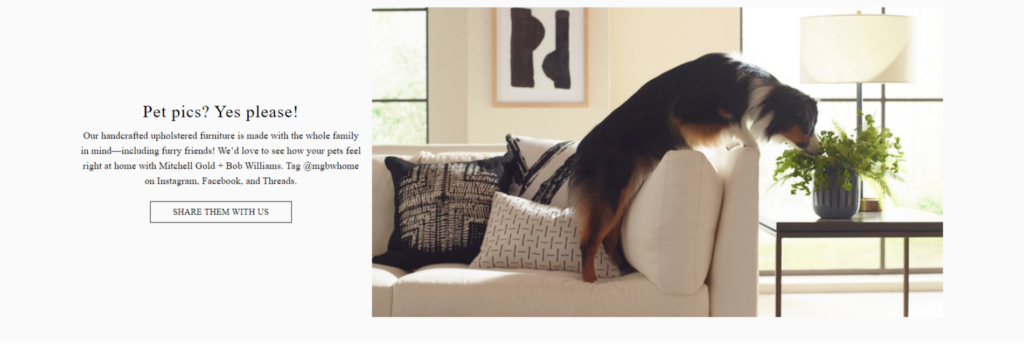

Image source Mitchell Gold Website(The website is now closed)

There had been logistical and financial difficulties following the unexpected closure and economic downturn of Mitchell Gold Co. This led to confusion over thousands of shipments ready to be shipped to the customers. After first filing under Chapter 11 bankruptcy, Mitchell Gold Co. is now under Chapter 7 liquidation. This move represents a departure from trying debt restructuring and reorganization in favor of a more thorough asset sale to pay off existing debts to creditors.

Selling non-exempt assets is a requirement in a Chapter 7 filing to pay back creditors. With the sale of its remaining assets to fulfill its debts, Mitchell Gold’s case signifies the end of the business’s operations.

Surya, a home furnishings company based in Cartersville, Georgia, specializing in textiles, rugs, decor, and lighting furniture, has successfully acquired Mitchell Gold’s assets. These assets include intellectual property, specific inventory, and manufacturing facilities. In an official statement, Surya intends to reintroduce Mitchell Gold as an exclusive trade partner, catering specifically to leading interior designers and design-focused retailers. Notably, this strategic shift means that direct shopping and purchasing from the “Mitchell” brand will no longer be available to consumers.

Image source

Many client orders remained unmet due to Mitchell Gold Co.’s abrupt liquidation and subsequent insolvency. Because these clients had previously paid for their purchases, a complicated situation arose in which logistics companies had thousands of goods in their warehouses. At the same time, they awaited payment from the now-defunct business.

One of the logistics companies impacted by Mitchell Gold’s insolvency was Ryder Last Mile, which was left in charge of keeping more than 2,000 Mitchell Gold items that were initially meant for customer delivery in its warehouses. A solution was required due to the regulatory and logistical issues that resulted from these unfulfilled products. Customers who have already made payments are impacted by this circumstance, which also presents difficulties for logistics companies like Ryder.

Ryder and Mitchell Gold have come to an arrangement regarding the issue related to undelivered merchandise. The logistics provider’s strategy for handling the current Mitchell Gold product inventory is described in this agreement, which also guarantees a dedication to completing customer requests as accurately as feasible.

The Tale Of 2000 “Undelivered” Products

Many furniture businesses faced supply problems, stopping sales that people had already paid for. The main issue was Mitchell Gold’s delivery partner, Ryder. Ryder says it has the right over the Mitchell Gold goods in its warehouses. They want to be paid before they send anything out. According to some reports, Ryder estimates it is awaiting $200,000 in delivery costs for all the merchandise from Mitchell Gold Co. currently in its possession.

Ryder is billing Mitchell Gold Co. a daily fee of $4,140 for storage. This is happening while the furniture company is undergoing bankruptcy and insolvency. The storage fees have accumulated to past $80,000, as per the reports. Ryder also claims that the furniture company owes them $1 million. This debt is for past services such as delivery and storage. This big expense is causing a lot of worry for Mitchell Gold. Their finances are already shaky. Also, the rising storage costs are making things worse for them. They are finding it harder to deal with their problems during this period of uncertainty.

In a recent development within the bankruptcy proceedings, Ryder Last Mile Inc. has received court approval to initiate the shipment of stored items to customers. According to court documents, Ryder was storing over 2,000 distinct furniture items manufactured by MG+BW in various warehouses across the United States. However, customers who have fully paid for their undelivered items and have not sought a refund or credit are expected to cover additional storage and delivery charges incurred by the shipping firm.

As Ryder explained in court papers, customers typically pay shipping fees upfront to the retailers they purchase from, in this case, Mitchell Gold. Many purchases were made months before the bankruptcy filing, meaning Mitchell Gold had to pay Ryder for shipping services. However, the company filed for insolvency between receiving payment for shipping from customers and paying Ryder for delivery.

Despite already making payments to Mitchell Gold, customers must bill Ryder directly for delivery services. Ryder explicitly acknowledges this in its proposed letter, outlining the process for customers to reclaim the advance shipping fees paid to Mitchell Gold within the bankruptcy case.

The arrangement with Ryder and Mitchell Gold makes similar agreements with various third-party carriers possible. In addition to the $17 million kept at its own facilities, Mitchell Gold had around $6.5 million of goods stored at other 3PL sites, awaiting delivery to consumers.

This agreement may result in customers having to pay shipping charges twice. While they can file a claim for these charges with the bankruptcy court, the likelihood of receiving a refund is uncertain. The court may decide to refund some or all of these payments, but the outcome remains uncertain. Upon receiving the delivery, the purchased items become the customers’ property, exempt from any additional bankruptcy proceedings.

Amid Mitchell Gold’s challenges, other furniture companies are finding opportunities. Haynes Furniture, the owner of The Dump Luxe Furniture Outlets, a retail chain specializing in overstocks, home goods closeouts, and samples, has recently acquired unsold Mitchell Gold inventory.

The Dump’s six stores in Chicago, Atlanta, Houston, Dallas, Virginia, and Phoenix will feature Mitchell Gold rugs, furniture, lighting, home accents, and mattresses at discounts of up to 80% off the original MSRPs. It is anticipated that the merchandise will be available in “most” of the stores in time for Black Friday. Additionally, Haynes Furniture, based in Virginia, will include Mitchell Gold inventory in its Newport News, Richmond, and Virginia Beach stores.

About Mitchell Gold

Mitchell Gold & Bob Williams, also known as The Mitchell Gold Co., became famous in the furniture world. They focused on quality and clever creation. This brand made many different types of home furniture that were attractive and popular.

The company’s drive for high standards shined in everything it made. Details and designs are what set them apart from others. They’ve earned a name globally for their extraordinary furniture. The furniture is not only beautiful but also strong enough to last.

Conclusion

The sudden shutdown and ensuing bankruptcy of Mitchell Gold posed big problems for both shoppers and employees. Shifting from Chapter 11 to Chapter 7, bankruptcy signaled a sweeping sell-off of assets to pay off debt, not just a restructuring effort. Surya’s purchase of Mitchell Gold’s property and factories shows a change in tactics, as this move restricts customers’ direct access to the Mitchell brand.

The unsolved problem of products not yet delivered, involving Ryder and Mitchell Gold, created legal and delivery messes. Ryder agreed to handle the present stock and do their best to complete customer orders. But, the fix might mean extra charges for customers who have already handed over shipping payments to Mitchell Gold.

While Mitchell Gold grapples with issues, other furniture companies like Haynes Furniture spot chances. They’re scooping up unsold stock to sell at cut-rate prices. Mitchell Gold’s bankruptcy leaves a changed scene, affecting shoppers, delivery services, and rival firms.