Payroc WorldAccess LLC, a leading name in payment processing, and DINGG, a trailblazer in salon and spa software, have joined forces to revolutionize the beauty and wellness industry.

This collaboration is big news for salon and spa owners. By combining Payroc’s strong payment solutions with DINGG’s innovative salon software, they’re offering a one-stop solution for businesses in the beauty and wellness sector. This means salon and spa owners can run their operations more smoothly and effectively, even in a competitive market.

Hot on the heels of this partnership, Payroc has also expanded its payment services to the US and Canada. Their new PayByBank feature allows Independent Software Vendors (ISVs) and merchants to accept various types of payments through a single system. This includes recurring payments and one-time transactions, all with top-notch security.

At the heart of Payroc’s expanded services are advanced payment features like a flexible API for custom payment pages, virtual terminals, and tailored payment systems. The real breakthrough with Payroc’s payment system is its simplicity. One integration allows partners to tap into a seamless payment network covering the US and Canada. This means less hassle with multiple setups or tricky solutions, letting partners concentrate more on what matters most: their business goals. With this expansion, partners in the US and Canada can now process secure payments more efficiently, whether one-time or recurring.

Image source

Key Takeaways:

- Strategic Partnership for Salon and Spa Excellence: Payroc and DINGG have formed a transformative alliance to redefine the beauty and wellness sector. By melding Payroc’s robust payment processing capabilities with DINGG’s innovative salon software, the collaboration offers a comprehensive solution, enabling salon and spa owners to manage operations more efficiently in a competitive market.

- Seamless Payment Solutions in North America: Payroc’s expansion into the US and Canada brings forth its PayByBank feature, a groundbreaking API that allows Independent Software Vendors and merchants to accept diverse payment types through a unified system. This simplifies transactions and boosts security, positioning Payroc as a leading payment solutions provider in both countries.

- Enhanced Security and Flexibility with PayByBank: The PayByBank feature introduces token-based card and account-to-account payments, enhancing security measures like tokenization for ACH in the US and PAD in Canada. This safeguards customer information and offers US and Canadian partners a streamlined, secure, and efficient payment processing experience.

- Growth Opportunities and Market Adaptation: With Payroc’s established presence in the US market and DINGG’s innovative software capabilities, the partnership is poised to support DINGG’s growth and adaptability. Furthermore, the collaboration serves as a platform for DINGG to leverage insights from the US market, contributing to advancing the beauty and wellness industry, particularly in India.

Payroc and DINGG Team Up to Transform Salon and Spa Services

Payroc WorldAccess and DINGG, an advanced software company specializing in the beauty and wellness sector, are thrilled to announce a strategic partnership set to redefine the Salon and Spa industry. This collaboration is a major milestone in the beauty and wellness realm, uniting Payroc’s strong payment processing solutions with DINGG’s groundbreaking salon software to provide seamless and efficient services to salon and spa businesses. Together, they present a unified solution, empowering salon and spa owners to thrive in an increasingly competitive market.

Annette Cristerna, Director of Inside Sales at Payroc, expressed the goal of providing salon and spa owners with a seamless, user-friendly, and efficient way to manage various business operations, from scheduling to payment processing and customer management. She further conveyed their excitement about teaming up with DINGG to bring innovation and efficiency to the Spa and Salon industry.

Through this collaboration, Payroc and DINGG are committed to boosting the Salon and Spa industry in today’s tough market. They’re rolling out a comprehensive “Business in the Box” package, designed to give business owners all the essentials and guidance they need to excel.

Akshay Poorey, co-founder of DINGG, pointed out that companies often need a solid marketing strategy to quickly impact a new market. When entering a new market, having a partner familiar with local dynamics can be invaluable. With Payroc’s established presence in the USA’s payment processing sector and a diverse range of businesses like salons and spas on its platform, they’re well-positioned to support DINGG’s growth as a tech partner.

He also noted that the US leads the way in technology. As DINGG learns and adapts from the US market, they can apply those insights back home in India, contributing to the growth of their industry there as well.

Apart from this announcement, Payroc also unveiled exciting news on its expansion with PayByBank. Let’s see what it is all about in the next section.

Payroc Widens Payment Services Across the US and Canada

Payroc LLC has introduced a game-changing API that enables clients to seamlessly offer its PayByBank solution for both the US and Canada through a single interface. This development eliminates the previous need for separate interfaces in each country, streamlining operations and reducing complexities. PayByBank empowers merchants and ISVs to receive token-based cards and account-to-account payments, providing a secure and efficient transaction process.

The introduction of this unified interface allows ISVs and merchants to tokenize banking information for transactions routed through the automated clearing house (ACH) in the US and for Preauthorized debits (PAD) in Canada. PAD permits merchants or billers to withdraw funds from a consumer’s bank account on a one-time or recurring basis. The API’s implementation is expected to open up new growth opportunities for merchants and ISVs operating in both countries.

Marcus Dagenais, managing director for Canada and corporate development at Payroc, highlighted the significant improvement in convenience and flexibility for partners. With this expansion, Payroc aims to provide unparalleled ease and security, unlocking substantial growth potential for partners in both the US and Canada. Dagenais emphasized that the API development now allows merchants and ISVs to connect once to the platform for access to both countries, simplifying their operations.

PayByBank’s Tokenization and PAD Features Benefit US and Canadian Partners

PayByBank helps merchants enhance the security of their customers’ banking information. This is achieved through tokenization, providing an additional layer of protection for transactions ACH (for US) and PAD (for Canada). Businesses can obtain payments straight from customers’ banking accounts by using the PAD option, ensuring the safety of sensitive data, thereby fostering trust and bolstering customer confidence in the payment processing system, be it for single or recurring transactions.

For Canadian collaborators, PayByBank’s PAD processing is among them, offering a substantial advantage. Since PADs are widely accepted as forms of payment in Canada, incorporating PAD processes into the payment network enables their Canadian businesses to take advantage of a tried-and-true payment option, improving consumer convenience and giving them a competitive advantage in the market.

Chief Product Officer Casey Conley was excited about this most recent expansion, which allows partners to expand their reach and simplify transactions throughout the US and Canada with a single connection. Conley underlined that partners receive unparalleled ease, flexibility, and security with the latest release combined with PayByBank. According to the corporation, partners in each country will have substantial growth prospects due to this release.

Partners that use Payroc can take advantage of a streamlined payment environment that covers every step of the process, from settlement to authorization and is backed by specialized customer service from start to finish.

About Payroc

Payroc WorldAccess LLC is a rapidly growing player in the world of payment processing. Handling above $80 billion in payments annually across 40+ countries for 151,000 plus merchants, Payroc WorldAccess is a force to be reckoned with.

What sets Payroc apart is its top-notch sales support and cutting-edge payment processing technology, which are available globally. The company provides comprehensive merchant acquiring solutions, incorporating necessary services such as sponsorship registrations for card brand networks and payments. Notably, Payroc (and its subsidiaries) is a registered third-party servicer for Mastercard and Visa, offering encryption support and serving as a payment facilitator for Fifth Third Bank. In Canada, Payroc is registered with People’s Trust Company, solidifying its presence and reliability on an international scale.

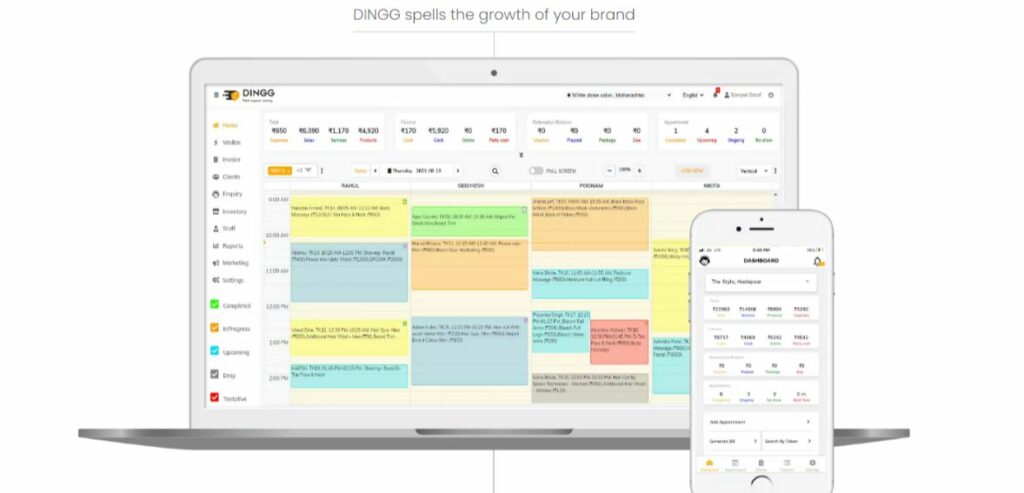

About Dingg

DINGG is a software company that’s revolutionizing how salons and spas manage their business. Their platform is designed to streamline daily tasks, from handling clients and bookings to tracking inventory and managing finances.

With DINGG, salon and spa owners have everything they need in one place. They can manage client appointments, track expenses, handle invoicing, and even monitor employee attendance and commissions. Plus, there’s no need to call or visit vendors to book services. Users can do it all through the app from their phones and stay updated on wait times. What’s more, DINGG offers users real reviews from verified customers and special deals from vendors, rewarding loyal customers with exclusive offers. Founded on October 29, 2018, in Pune, Maharashtra, by Akshay Poorey and Santosh Patidar, DINGG is changing the game for salon and spa businesses.

Conclusion

The partnership between Payroc and DINGG marks a significant advancement in the beauty and wellness industry, particularly for salon and spa businesses. By integrating Payroc’s robust payment solutions with DINGG’s cutting-edge software, they have created a unified platform that simplifies operations and enhances efficiency.

The introduction of PayByBank’s new API further amplifies this by providing a seamless payment experience across the US and Canada. This streamlines transactions and elevates security measures, fostering greater trust among customers. Overall, this collaboration sets a new salon and spa management standard, offering owners a comprehensive solution to thrive in an increasingly competitive market.