The payment industry has undergone a significant transformation. From frantically combing through our pockets for spare change to just tapping our cards at POS terminals, the evolution has been marked by increased convenience. While payment methods have evolved to offer greater flexibility and enhanced security, our collective desire for convenience remains unwavering. As we look forward, it’s evident that payment trends will continue to evolve.

For businesses, staying abreast of these evolving payment trends is crucial. It ensures customer satisfaction and enables them to be ahead of these latest advancements and streamline processing errors. So, what lies ahead in payment trends for 2024? Let’s see what are the payment industry projections for 2024 and beyond.

Payment Industry Projections- Top 8 Trends Shaping The Industry In 2024

1. The Emergence of Micropayments as an Alternative to Subscriptions

Micropayments, known as microtransactions, are becoming a viable alternative to traditional subscription models. Defined as small online purchases for digital products, micropayments typically involve transactions under one dollar, occasionally extending up to $10. This payment method allows customers to make small, incremental payments for accessing online services or purchasing digital content. The charging model varies, with users either paying each time they use a service, making a content purchase, depositing a lump sum, or being charged as a bundled unit after a specified time period.

As a potential substitute for subscription models, micropayments are expected to address the challenges posed by rigid subscription plans, reducing cancellations. Major content providers are considering formally introducing micropayments in response to rising subscription cancellations. A 2023 survey revealed that one-fourth of US consumers canceled video streaming subscriptions due to pricing concerns, with a quarter citing budget constraints.

Micropayments offer numerous advantages for businesses, ranging from startups to large enterprises. Companies can attract a broader audience and boost sales by enabling customers to purchase individual movies, songs, or content selectively. Additionally, the post-payment option encourages impulse buying, especially among consumers interested in acquiring downloadable games and entertainment products at affordable prices.

2. The Dominance of Mobile Payments and Digital Wallets in 2024

A significant shift is underway in 2024, with mobile payments and digital wallets taking center stage. Projections indicate that mobile payment adoption is set to reach 4.8 billion by 2025, paving the way for substantial revenue growth, particularly for leaders in specific countries or regions. This surge is fueled by the extensive integration of many mobile apps into providers’ broader financial services. Notably, global digital payments recorded a transaction value of $9.46 trillion in 2023, showcasing the widespread embrace of digital wallets for their convenience and security.

Mobile payments have transformed how people conduct transactions, offering a swift and convenient method for paying for goods and services through smartphones. With the escalating prevalence of e-commerce, digital wallets have emerged as a favored payment choice for consumers. Beyond providing a secure means to store payment information, these wallets offer additional features like loyalty programs and rewards. The acceptance of mobile payments is expanding in offline retail, with businesses increasingly embracing platforms such as Samsung Pay, Google Pay, and Apple Pay. As technology advances, the prevalence of digital wallets is expected to grow, fundamentally reshaping how we manage our finances.

3. The Rise of Account-to-Account (A2A) Transactions

Account-to-account (A2A) payments mark a transformative shift by sidestepping intermediaries like credit cards and payment processors. This approach facilitates direct and instantaneous money transfers from one party’s account to another, offering a swifter, more convenient, and cost-effective alternative to traditional bank transfers.

While A2A payments aren’t novel, the convergence of API technology and the advent of open banking have propelled their widespread adoption. The momentum is poised to escalate globally as instant digital payment solutions gain further traction in retail and corporate realms. The successful implementation of payment innovation under PSD2 in Europe has shaped this trajectory. PSD2, the revised Payment Services Directive, governs payment systems in the European Union (EU), regulating access to payment data beyond banks and obliging banks to grant firms access to payment accounts with user consent.

Anticipating the future, the US is gearing up for new rules in the upcoming year. These rules are strategically designed to navigate the challenges observed in open banking strategies elsewhere, positioning the US market for accelerated adoption and increased innovation opportunities. Noteworthy initiatives like FedNow and providers leveraging “Pay by Bank” options are set to expand in 2024. By harnessing open banking technologies and A2A payments, these advancements promise real-time money flows and reduced processing costs for merchants, potentially reshaping payment solutions.

4. PCI DSS 4.0 will Create a New Paradigm Shift in Payment Security

The imminent arrival of PCI DSS 4.0 predicts a paradigm shift for payment professionals, introducing critical alterations that demand more attention. As a linchpin of payment security, this updated version brings forth revamped requirements and fortified guidelines to counter emerging threats. Vigilance is key for merchants and payment professionals as they track these changes, ensuring compliance and mitigating the risks of handling sensitive cardholder data.

This evolution may prompt merchants to shift the responsibility of PCI requirements onto third-party tokenization platforms, offering respite from compliance-related challenges. Adapting to and comprehending these changes becomes paramount for businesses seeking to streamline payment processes while upholding data security standards. While the implementation date of PCI DSS 4.0, slated for March 31, 2024, for the first phase, is close, proactive preparation is imperative for IT security professionals, compliance officials, and executives.

Assessing current compliance status, identifying potential hurdles, and communicating the PCI DSS 4.0 revisions, especially to key stakeholders, are essential steps. The significant shift lies in the heightened emphasis on security within PCI DSS 4.0, enabling adaptable data practices seamlessly integrated into an organization’s security framework. This updated standard prioritizes flexibility by acknowledging that new technologies must neatly fit into rigid, prescriptive control structures.

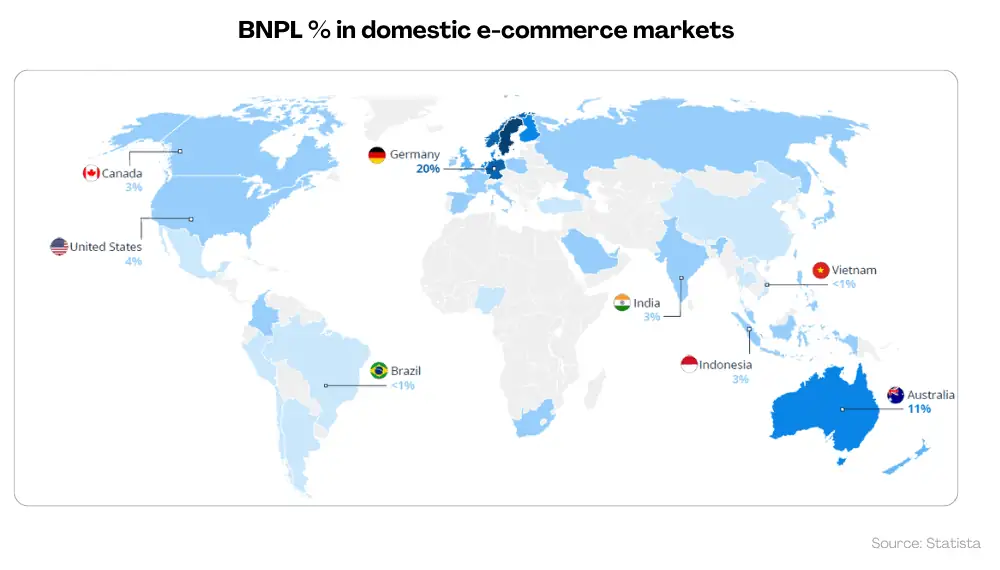

5. More People Adopting BNPL for High-Value Items

In an era of higher living costs, the BNPL financing method has become an enticing option for consumers. True to its name, this loan type divides the purchase price into equal installments, with the initial payment due at checkout. This approach allows buyers to make immediate purchases while spreading the remaining balance over time. Notably, the model often features minimal or 0% financing and does not necessitate an initial credit check.

The appeal of BNPL is steadily growing among North Americans, particularly for high-value purchases. Consumers find it easier to justify these buying decisions when they can opt for a phased payment approach rather than a lump sum. However, the landscape for BNPL companies may transform in 2024 as traditional financial institutions enter the arena with similar services.

The global buy now, pay later market, valued at $256.54 billion in 2022, is projected to surge to an estimated $3.8 trillion by 2031, reflecting a CAGR of 30.5%.

6. Using Consumer Insights for Strategic Growth

In the payments industry, the ability to decipher crucial payment data emerges as a linchpin for informed decision-making. As businesses traverse diverse payment channels, establishing a singular, authoritative repository for payment data gains paramount significance. Taking ownership of this data marks the initial stride toward unleashing its potential, strategically leveraging it to glean valuable insights into consumer behavior and market trends.

The judicious utilization of these consumer insights empowers businesses to tune their marketing and promotional campaigns finely. This tailored approach resonates more effectively with the target audience, building customer engagement and fortifying brand loyalty. This, in turn, becomes a linchpin for achieving sustainable and organic growth within the competitive marketplace.

When wielded adeptly, consumer insight opens avenues for businesses to personalize products, aligning them with the unique needs, desires, and demands of their customer base. Microsoft’s research indicates that organizations leveraging customer behavior to extract insights surpass their peers by an impressive 85% sales growth.

These insights serve as a catalyst for expanding services and product portfolios, devising innovative marketing strategies, preparing detailed customer personas and journey maps, and enhancing existing offerings. The strategic deployment of customer insights elevates the overall customer experience and translates into enhanced revenue streams.

7. Payment Expectations with Digital Wallets are Still High!

Digital wallets are ushering in a new era, steering away from traditional payment methods. In 2024, businesses keen on meeting consumer demands must closely track this transformative trend. The widespread adoption of these secure and convenient digital solutions promises streamlined transactions and a redefined set of user expectations. The projected growth is staggering, with digital wallets expected to encompass over 5 billion users by 2026.

To stay in sync with evolving consumer preferences, businesses must adopt digital wallet functionality and align with the redefined standards for seamless and secure payment experiences. This shift will fundamentally transform how individuals interact with money and financial services. Understanding and embracing these developments will be imperative for businesses striving to stay ahead, adding significant user value and setting their platform apart in a competitive market.

8. Importance of Cybersecurity in 2024

As digital transformation continues to reshape various sectors, the specter of cybercrime looms larger, particularly within enterprises. The expansion of the attack surface, propelled by near-field communication technology in the payments realm, has ushered in new cyber risks for digital transactions. Cybercriminals, focusing on exploiting vulnerabilities in digital payment systems, actively seek to pilfer credit card details and other sensitive customer information. Recent developments have cleared that businesses urgently need to review their cybersecurity plans. It is clear from the rising wave of cyber attacks that the old methods of fending off these constantly changing threats are insufficient. Companies must future-proof the security of the data measures in this situation.

To address the mounting cyber risks, companies are intensifying their cybersecurity investments by 7% this year and projecting a 14% increase for the next. On average, companies with revenues ranging from $250 million to $1 billion will allocate $2.9 million next year.

In the face of escalating cybercrime, safeguarding digital payments becomes paramount for companies in 2024 and beyond. This imperative stems from the need to protect customer data and uphold trust and loyalty. Payment processing solutions equipped with robust security features, encompassing advanced encryption technologies, tokenization, and machine learning algorithms designed to identify unusual credit card transactions, stand as essential tools to thwart data leakage and fraud.

Conclusion

The payments industry in 2024 reflects a dynamic market of evolving trends and transformative shifts. The emergence of micropayments as a subscription alternative addresses consumer concerns, offering a flexible payment model. Mobile payments and digital wallets take center stage, reshaping how transactions occur and highlighting the importance of adaptability. Account-to-account transactions significantly move away from intermediaries, promising swifter and cost-effective transfers.

The impending PCI DSS 4.0 signals a paradigm shift in payment security, necessitating proactive measures for compliance. Buy now, pay later options gain traction, especially for high-value items, while consumer insights become pivotal for strategic growth. The ascent of digital wallets underscores the need for businesses to align with changing user expectations, emphasizing the crucial role of cybersecurity in safeguarding digital transactions. Staying informed and agile is important for businesses seeking success in the ever-evolving payments industry.

Frequently Asked Questions

Q: What does the future hold for payments?

Fueled by the rise of mobile commerce, global online payments are poised to witness mobile wallets as the predominant method, constituting over a third of all transactions by 2024. In the U.S., mobile wallets are anticipated to surpass physical cards as the primary online payment choice within the next three years.

Q: How rapidly is the payments industry expanding?

The Digital Payments market is projected to achieve a total transaction value of US$10.64 trillion by 2024.

Q: What trends are shaping the payment industry?

In our journey through the digital era, key trends transforming the payment processing landscape include mobile payments, cashless transactions, and AI-driven fraud detection. Blockchain technology promises heightened security and transparency, potentially reshaping the industry.

Q: How will technological advancements impact payment systems in the upcoming year?

Technological progress is enhancing the efficiency and user-friendliness of digital payments. Biometrics, blockchain, and AI advancements are pivotal in securing, streamlining, and making digital payments more accessible to consumers, playing a vital role in the future of this industry.

Q: What regulatory shifts will influence the payment industry in 2024?

Anticipated regulatory changes in 2024 are likely to focus on consumer protection. Regulators are expected to closely examine the potential impact of banks' innovative products, services, and technologies on consumers, emphasizing the need for careful scrutiny and safeguards.