In keeping with their goal to transform the digital economy by implementing real-time payments (RTP) on the RTP network, Mastercard and TCH, or The Clearing House, have decided to prolong their multi-year relationship. With the help of this Mastercard TCH partnership, businesses, governments, and consumers will be able to navigate and prosper in the quickly changing digital landscape by utilizing cutting-edge instant payment use cases for various payment procedures.

Notably, Mastercard will continue to serve as TCH’s exclusive supplier of immediate payment software for its RTP network, allowing the integration of new instant payments for various uses across different entities. In 2017, both companies joined forces to introduce the RTP Network, marking the first new payments rail framed by Mastercard in four decades. Presently, the ongoing collaboration focuses on advancing real-time account-to-account technologies. These innovations facilitate the seamless transmission of data within the network, not only across the US but also on a global scale.

Key Takeaways

- Enhanced Digital Economy Commitment: The extended partnership between Mastercard and The Clearing House reaffirms their dedication to transforming the digital economy by implementing real-time payment systems. This collaboration aims to introduce innovative instant payment use cases, providing advanced capabilities for businesses, governments, and consumers in the fast-moving world of payments.

- Mastercard’s Exclusive Role: Mastercard continues to serve as the exclusive instant payments software provider for TCH’s RTP network, solidifying its position in advancing real-time account-to-account technologies. The collaboration focuses on integrating new instant payment not only within the US but also globally.

- Real-Time Payments Impact Across Sectors: The partnership highlights the critical role of instant payments in elevating the value and efficiency of financial transactions across diverse sectors. RTP ensures immediate access and confidence in payment receipt for consumers, streamlines process for businesses, and activates local economies for governments through efficient disbursement and settlement processes.

- Competition and Industry Recognition: The collaboration builds upon TCH’s efforts to expand its RTP network amidst competition from FedNow. The RTP network’s significant milestones, such as surpassing one million daily payments, reflect industry recognition of the advantages offered by real-time transactions. Financial institutions’ increasing usage of the RTP network demonstrates its effectiveness in addressing real-world challenges and innovation in payment processes.

Mastercard TCH Partnership – Driving Next-Gen Instant Payment Capabilities

Mastercard has recently declared the extension of its partnership with TCH, emphasizing the enhancement of user capabilities. In a multi-year collaboration initiated by Mastercard and TCH, the two entities are working jointly to introduce improved features for businesses, governments, and consumers. The primary goal is to facilitate the adoption of the digital economy through the implementation of RTP on the RTP network. Additionally, this partnership solidifies Mastercard’s exclusive role as the provider of instant payment software for TCH’s RTP network, enabling both entities to integrate additional instant payment.

RTP guarantees customers instant access and assurance that their payments will always be received. It promotes timely wage disbursements, optimizes capital workflows, improves liquidity management, and streamlines payment operations for enterprises. Governments might also gain from stimulating local economies by ensuring that settlement and distribution procedures are effective. The expanded collaboration emphasizes how important real-time payments are to improving the effectiveness and value of financial transactions in a variety of industries.

The Federal Reserve’s immediate payments system, FedNow, introduced last year, is a competitor to TCH’s RTP network expansion efforts. This partnership with Mastercard strengthens TCH’s present efforts in this regard. The year 2017 saw TCH, which is owned by significant US banks, launch its instant payment network services, RTP. In the United States, financial institutions that hold around 90% of the demand deposit accounts have access to the RTP network.

Linda Kirkpatrick, who is the President, of North America at Mastercard, highlighted the key role of advanced technology in offering businesses and consumers increased flexibility in payment methods. The enduring collaboration with TCH contributes to expanding payment options by enabling contemporary and widely accessible real-time channels for bank transactions. Kirkpatrick expressed satisfaction in extending and reinforcing their commitment to TCH and its owner banks, emphasizing the shared objectives of ensuring the dependability, efficiency, and security of instant payments.

The RTP network, TCH’s instant payments system accessible to all insured depository financial institutions in the US, achieved a significant milestone last September by surpassing one million daily payments. This milestone reflects the growing recognition among the institutions and their customers of the advantages offered by real-time transactions, such as payment confirmation, enhanced control over payment schedules, and immediate fund availability.

With over 60 million transactions processed each quarter, the RTP network is experiencing increased usage as financial institutions leverage its real-time payment capabilities to address real-world challenges in innovative ways.

FedNow is a real-time payment system that competes with the growing RTP network. Interest in the RTP network appears to have increased with the release of FedNow. FedNow and RTP are competing with each other for the business of financial institutions. Regarding the Fed’s fast payments system, Mastercard has taken a cautious position. Previously, despite the FedNow system’s early acceptance by significant corporations like Fiserv and JPMorgan Chase, Mastercard CEO Michael Miebach noted that it lacks capabilities and a consumer platform.

Lee Alexander, Executive Vice President and CIO at TCH mentioned that TCH and Mastercard collaborated on the creation of the RTP network, recognized as the leading instant payment platform in the US. With a robust history of successful collaboration in delivering scalable, secure, and innovative products, the extended partnership aims to facilitate the development of the next generation of real-time payment capabilities for financial institutions and their customers.

All in all, the RTP network was designed to cater to institutions of various sizes, providing a stage for innovation that enables them to introduce new services and products to their customers. Financial institutions have the flexibility to connect to the RTP network directly, utilize third-party providers, and collaborate with corporate credit unions and bankers’ banks.

About MasterCard

Mastercard, Inc. is a technology company deeply involved in the payments industry, serving as a vital link connecting consumers, financial institutions, merchants, governments, and businesses. Established in November 1966 and headquartered in Purchase, NY, Mastercard provides innovative payment solutions encompassing credit, debit, prepaid, commercial, and payment programs.

The company acts as a crucial network, facilitating transactions between issuing banks and acquiring banks to ensure authentication and fund transfers. Its role extends to enabling payments for various purposes, including shopping, travel, business operations, financial management, and more. Mastercard specializes in global digital payments and commerce, offering cutting-edge mobile payment processing solutions.

In the fiscal year 2022, Mastercard achieved notable financial success, recording annual revenues of $22.23 billion and a net profit of $9.93 billion. As a technology-driven entity, Mastercard continues to play a significant role in shaping the face of modern payment solutions.

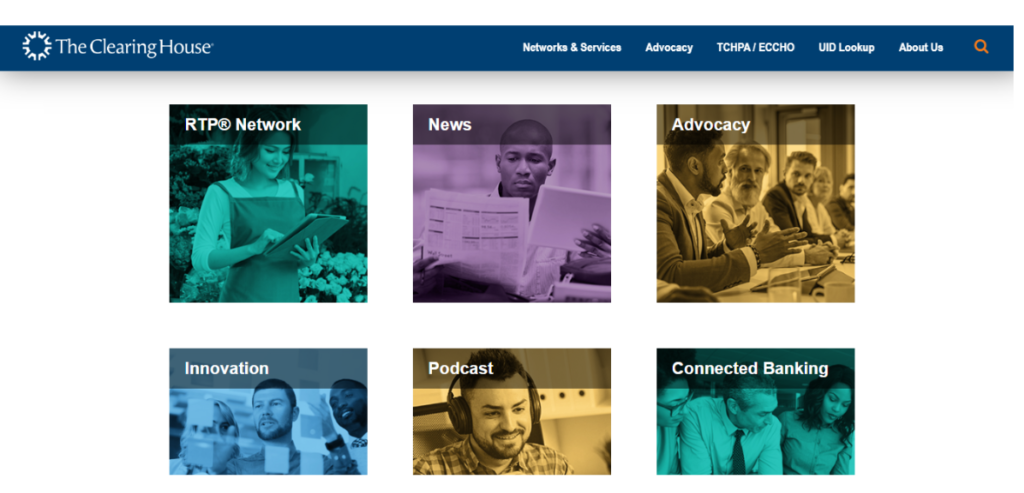

About The Clearing House

Founded in 1853, TCH stands as the oldest banking association and payments company in the United States. It is collectively owned by the world’s largest commercial banks, employing over two million individuals and holding more than half of all US deposits.

TCH Payments Company LLC plays a pivotal role by providing payment, clearing, and settlement services to its member banks and other financial institutions. Daily, it handles the clearing of almost $2 trillion, representing nearly half of the funds-transfer, ACH payments, and check-image payments made in the US.

Image source

On the advocacy front, TCH Association LLC operates as a nonpartisan organization, championing the interests of its owner banks. This is accomplished through regulatory comment letters, amicus briefs, and white papers, addressing a spectrum of systemically important banking issues.

Conclusion

The extended collaboration between Mastercard and The Clearing House marks a significant stride towards enhancing digital economy capabilities. Their commitment to RTP underscores a shared objective to propel businesses, governments, and consumers into a dynamic digital era. Mastercard’s role as the exclusive instant payments software provider for TCH’s RTP network positions them at the forefront of advancing real-time A2A technologies.

This partnership not only ensures immediate access for consumers and streamlined processes for businesses but also holds promise for efficient disbursement and settlement processes for governments. Amidst growing competition in the real-time payments realm, the enduring collaboration between Mastercard and TCH exemplifies a commitment to reliability, efficiency, and security in the evolving world of financial transactions.