Running an online business requires an effective method for receiving payments, and payment gateways serve as financial tools that facilitate the collection of payments through credit or debit cards. Nowadays, where online shopping is prevalent, and physical cash is less common, having an accessible and user-friendly payment gateway is essential for engaging both consumer and business clientele.

To make an informed choice for your business, it’s crucial to evaluate factors such as cost, features, and supported payment methods. Read on to discover the best payment gateways in 2024 suitable for businesses that rely on card-based transactions.

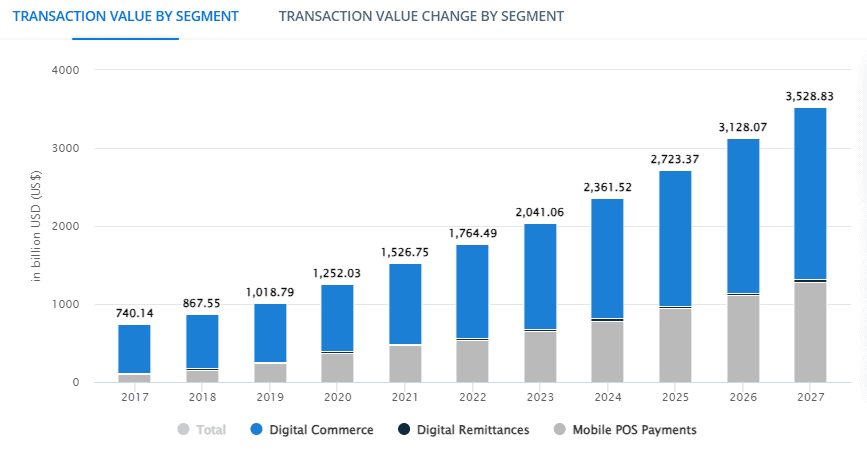

Source: Statista – Digital Payments in the US

Understanding Payment Gateways

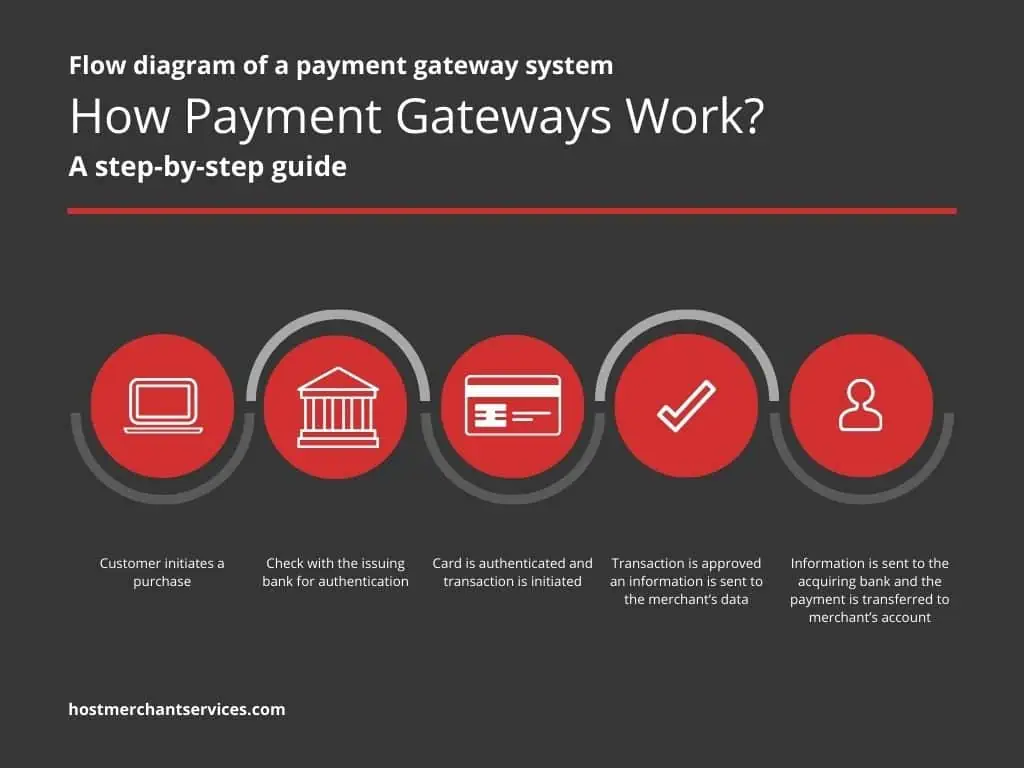

A payment gateway is a software application utilized by merchants to facilitate the acceptance of various electronic payments, including credit cards. Functioning as encryption systems, these gateways play a crucial role in safeguarding sensitive information like credit card numbers during the transfer from customers to merchants. Following this secure exchange, the gateways transmit transaction details to both the customer’s bank and the merchant’s acquiring bank, responsible for credit card processing services.

The payment gateway assumes the responsibility of authorizing credit card transactions and ensuring the seamless transfer of funds from the customer’s account to the merchant’s account. It’s common for payment gateways to impose a monthly fee along with a per-transaction fee for their services.

How Payment Gateway Works?

The structure of a payment gateway can be divided based on its use in either an online payment portal or an in-store setting. For online payments, the gateway must be hosted on the website. This can be done through a third-party service provider or directly by the merchant using an API. This integration enables the website to interact with the payment processing network and receive a response from the issuing bank.

In an in-store setting, a payment gateway is utilized through a physical card reading device or a POS terminal. These devices connect to the processing network via a secure internet connection, ensuring a seamless transaction process.

Key Players In The Payment Gateway Ecosystem

- Merchant:

The merchant is the individual or business conducting online sales of goods or services. To enable online transactions, a merchant requires a merchant account, essentially a bank account tailored for online transactions. Integrated with the payment gateway, this account ensures secure transaction processing, serving as the destination for incoming funds after settlement.

To open a merchant account, thorough research is necessary to select a provider that aligns with specific business requirements.

- Customer:

Customers constitute the primary participants in the payment gateway ecosystem. They utilize various online payment methods, including debit or credit cards, net banking, UPI, or online wallets, to make purchases online.

- Acquirer and Issuer Bank:

Two distinct types of banks operate within the payment gateway ecosystem. The acquirer bank manages payments on behalf of the merchant, housing the merchant account. This bank serves as the endpoint for financial transactions routed through the payment gateway, ultimately receiving the funds.

Conversely, the issuer bank is where the transaction originates. This account belongs to the customer initiating the payment for a product. The issuer bank represents the customer and supports diverse payment methods like credit cards, debit cards, or net banking.

- Payment Gateway:

Serving as the intermediary between the merchant’s website or app and the acquirer and issuer banks, the payment gateway plays a crucial role.

When a customer makes a purchase on the merchant’s platform, the payment gateway facilitates the smooth progression of the payment. It ensures the secure transfer of payment information and manages the authorization and settlement of transactions.

- Payment Processor:

The payment processor is responsible for overseeing the technical connections between the payment gateway, the acquiring bank, and the issuer bank. It validates and securely routes payment transactions. Both the payment gateway and the payment processor are essential components in effectively managing online payment transactions.

How To Select The Best Payment Gateway?

Selecting the appropriate payment gateway for your business is a crucial decision. Opting for a gateway that doesn’t align with your business model can potentially lead to significant financial losses and a decline in customer satisfaction.

Consider the following key factors:

- Cost:

The foremost consideration when choosing a payment gateway is the overall cost it incurs. The costs associated with payment gateways typically involve a set-up fee, a monthly fee, and a transaction fee.

To determine the most cost-effective option for your business, it’s essential to evaluate both the volume and value of your transactions. Many payment gateways offer competitive transaction fees, often around 2.9% + 30¢. Carefully assessing these costs ensures a financially prudent choice for your business.

- Accepted Card Types:

The widely utilized credit cards—Visa, MasterCard, and Amex—are typically supported by most payment gateways. However, if your customers commonly use alternative card types like debit cards or Diners Club cards, it’s crucial to ensure that your chosen payment gateway accommodates these variations.

- Holding Period:

While payments are generally swiftly approved, there is a brief holding period before the funds are settled into your account. This delay allows for the processing of refunds and handling chargebacks. Holding periods can range from 1-7 days, varying among payment service providers. Depending on your cash flow needs, you can opt to receive immediate payment or wait for the designated settlement period.

- Multiple Currency Support:

For businesses engaged in international transactions, verifying that your selected payment gateway can process payments in various currencies and from different countries is essential. Enabling customers to pay in their preferred currency is paramount. Additionally, it’s advisable to check for any associated fees related to foreign currency transactions.

- Seamless Integrations:

Ensure that your chosen payment gateway seamlessly integrates with your shopping cart, accounting software, and any other tools essential for your business operations. This integration capability enables automation in your accounting processes, ultimately saving valuable time.

- Customization Options:

Consider whether the payment gateway provides customization features. For instance, having the ability to incorporate your logo or modify the payment page’s color scheme can enhance your brand representation. Many gateways offer this through an API, though it’s worth noting that not all gateways provide such customization options.

- Emphasis on Security:

Prioritize security when making your payment gateway selection. It’s crucial to confirm that the gateway employs state-of-the-art encryption technology to safeguard your customers’ credit card details from potential theft.

- PCI Compliance:

Verify that the chosen payment gateway adheres to PCI compliance standards. This compliance involves following the PCI DSS standard, a set of security regulations mandatory for all businesses engaged in credit card payment processing. Choosing a PCI-compliant gateway ensures that your business meets the required security standards.

Top 10 Payment Gateways In 2024

There are many payment gateway options now with the rise of e-commerce and online payments, here is our best pick for the reliable payment gateway solution for 2024:

1. Authorize.Net

- Pricing: $25 monthly

- Processing Charges: 2.9% + an additional $0.30 for every transaction

Authorize.Net, affiliated with Visa, accommodates major credit cards like Mastercard, Visa, Discover, American Express, JCB, and Diner’s Club. It also supports digital payment services such as PayPal, Visa Checkout, and Apple Pay. While it caters to global transactions, your business must be registered in the US, Canada, UK, Australia, or Europe.

Starting with the gateway-only plan, which incurs no setup fee, it involves a monthly gateway fee, a per-transaction charge, and a daily batch fee. For larger business needs, enterprise solutions provide customized pricing.

Pros:

Tailored fraud prevention with AFDS

Offers both payment gateway and one-stop solution for flexibility

No setup charges, minimizing the initial costs

Cons:

Additional charges for specific features like e-check and

Account Updater Merchant account approval may take up to 5 business days, potentially delaying the setup.

2. PayPal

- Pricing: Free

- Processing Charges: 2 to 4% + an additional $0.49 for every transaction

A stalwart in online payments, PayPal facilitates quick registration and online payment acceptance. It extends its services to mobile and in-person transactions, among other financial solutions.

Online card payments typically incur a $0.49 fee plus an additional 3.49%. QR code payments reduce costs to 1.90% for transactions above $10 or 2.40% for transactions of $10 or less, plus the $0.49 fee. Businesses usually face no monthly recurring fees. In-person payments cost 2.70% for card-present transactions or 3.50% plus $0.15 for keyed transactions.

Pros:

Versatile payment solutions for diverse business needs

Strong global recognition instills customer trust

Efficient customer support post-sale

Transparent pricing with no monthly fee

Cons:

May not be cost-effective for high-volume sellers

Known for holding funds from sellers and occasional account closures with limited recourse.

3. Stripe

- Pricing: Free

- Processing Charges: 2.9% + an additional $0.30 for every transaction

For companies of any kind, Stripe offers outstanding adaptability with over 660 integrations. Because of its highly configurable nature and application programming interfaces, it can be easily integrated into applications for smartphones and other software, catering to both startups as well as big corporations. Robust identification of fraud and tools for risk management, a flexible checkout procedure, the capacity to process payments via the Internet in over 135 currencies, and low-cost, programmed clearinghouse processing are some of the key features. Stripe offers flexible monthly agreements and reasonable fees when compared to different payment gateway service providers.

Pros:

Zero monthly charges

Zero setup charges

Developer-friendly

Highly versatile with many integrations and customizations

Cons:

Instant deposits cost 1% of the transaction

No native inventory management

4. Square:

- Pricing: Free

- Processing Charges: 2.6% + an additional $0.10 for every transaction

Founded in 2009, Square has become a prominent financial services and mobile payment provider, generating over $3 billion annually. Offering an intuitive and user-friendly experience, Square gained popularity in online payment gateways. Without needing to know programming or other specialized technical abilities, consumers can create an effective online presence with its tools.

Square offers several more sophisticated plans with recurring costs in addition to a starter package at no cost. Dispute resolution and live mobile assistance are included with all plans. On a device you own, Square’s standard POS is free to use through a mobile app. Advanced attributes, such as shortage in inventory alerts, are only available with a monthly POS plan.

Pros:

Zero monthly charges

Clear pricing on a per-transaction basis

Cheap and best hardware

BNPL options for online and in-person transactions

Numerous add-ons and integrations are available

Cons:

Loyalty programs for customers cost extra

No additional phone supportInflexible support hours for customers

5. Braintree:

- Pricing: Free

- Processing Charges: 2.59% + an additional $0.49 for every transaction

Since its acquisition by PayPal in 2013, Braintree has become closely associated with the renowned payment service provider. What sets Braintree apart is its provision of dedicated merchant accounts, a rarity among payment service providers. Some notable users of Braintree’s payment solutions include Uber, Airbnb, and GitHub.

Pros:

Drop-in payment widget with a best-in-class UI

Accept multiple payment methods with a single implementation

Single dashboard to manage all user subscriptions

Cons:

Coupon management is not very robust

Setup is challenging, lacking seamless migration from existing payment systems

Slow response from customer support

6. Stax:

- Pricing: $99 per month (no transaction fees)

Stax distinguishes itself with comprehensive customization tools that make branding tailored to your business easier than with other payment gateways. Its custom branding options allow you to tailor invoices, receipts, and website payments to align with your brand. Stax integrates seamlessly with popular business software programs like Xero, QuickBooks, MS Teams, Hubspot, Slack, Zoho, Google Docs, and Calendly.

Unlike most payment gateways, Stax adopts a flat monthly fee model instead of charging a percentage of each transaction, though there are still flat per-transaction fees.

Pros:

No charges for transactions; pay one flat-rate monthly subscription fee.

Free mobile or terminal reader

Scheduled payments and Recurring invoices option

Digital invoicingOption for ACH processing

Cons:

Additional fees per terminal1% charge for same-day access to funds

7. Payment Depot

- Pricing: $79 flat fee monthly

- Processing Charges: 2% + an additional $0.10 or $0.22 for every transaction

Image source: Payment Depot

Distinguishing itself from other payment processor companies, Payment Depot employs a subscription pricing model based on a merchant’s month-on-month transaction volume. Merchants pay a flat fee per transaction along with the interchange rate, irrespective of the transaction type.

Notably, Payment Depot doesn’t impose hidden fees or cancellations and ensures swift access to funds within 48 hours of a transaction. The company offers various card readers, terminals, and POS systems, complemented by 24/7 customer support.

Pros:

Significant savings for merchants in fees

Top-notch customer care and support

Flexible month-to-month billing

Cons:

Limited hardware options

Relatively costly for businesses with lower transaction volumes

8. Clover

- Pricing: $14.95 monthly

- Processing Charges: 2.6% + $0.10 for every transaction

Clover stands out as one of the premier payment gateways for small, brick-and-mortar businesses due to its user-friendly interface suitable for non-technical users. Its features encompass reporting tools for aggregated sales across multiple locations, revenue tracking, end-of-the-day reports, sales tracking, and analysis of peak business hours. Clover facilitates rapid deposits, allowing access to sales transaction funds within minutes (with a 1% fee).

Additionally, it supports the creation of digital and physical gift cards and accepts payments via Google Pay, Apple Pay, PayPal, and Venmo.

Pros:

Well-structured and transparent pricing plans

Comprehensive feature set, including tracking, loyalty programs, and order management.

Acceptance of a wide variety of payment methods

Cons:

Longer learning curve for users with limited technical expertise

9. Adyen

- Pricing: Free

- Processing Charges: $0.13 plus different interchange

Adyen stands as an international payment processor facilitating transactions across diverse payment channels, such as in-app orders with in-person pickup, self-scan and pay, in-store purchases, home shipping, QR code payments, and self-service kiosks.

For businesses in the US, Adyen imposes a $0.13 processing fee along with a variable interchange fee determined by the customer’s payment method. Interchange typically ranges between 2% to 4%, varying based on the chosen payment method. As a global processor, Adyen supports nearly every card or payment platform, including Alipay, Affirm, Apple Pay, Amazon Pay, Diners Club, and Cash App Pay.

Pros:

Zero setup or monthly charges

Round-the-clock mobile support

A comprehensive knowledge base available on its site

Cons:

Requires two months’ written notice for contract termination

Minimum sales volume requirement of $120

Not as user-friendly for individuals without a technical background

10. Helcim:

- Pricing: Free

- Processing Charges: 1.92% + an additional $0.8 for every transaction

Image source: Helcim

Helcim is renowned for its cost-effective payment gateway, offering an array of features, including invoice creation, subscription setup, and international payment processing. The platform provides numerous APIs, enabling customization of the payment gateway to align with specific business needs.

For businesses with high transaction volumes, Helcim offers automatic volume discounts, eliminating the need to contact their sales team for negotiation.

Pros:

Zero monthly charges—transaction fees only

Below the average rates for processing payments

No need of long contracts, you can pay as you go

API allows for extensive customization

Cons:

Flat charges of $10 monthly for instant deposits

Additional cost associated for hardware

Conclusion

Selecting the right payment gateway is a pivotal decision for any online business, influencing both customer satisfaction and financial outcomes. Evaluating factors such as cost, features, and supported payment methods is crucial. Among the top 10 payment gateways in 2024, each option offers unique advantages and considerations.

Whether it’s the cost-effective model of Helcim, the user-friendly interface of Clover, or the international capabilities of Adyen, understanding your business needs is key. Ultimately, a well-informed choice ensures not only smooth transactions but also sets the foundation for sustained growth and success in the competitive online marketplace.

Frequently Asked Questions

What are the most used payment gateway in the US?

The top three widely used payment gateways in the US are:

-PayPal

-Authorize.Net

-StripeWhich is better, Stripe or PayPal?

Choosing between Stripe and PayPal depends on your business needs. If your business handles a high volume of sales and requires flexibility in accepting various payment methods, Stripe may be the better choice. On the other hand, if you already use PayPal for invoicing and payments and operate a small business, sticking with PayPal might be more convenient.

Which payment gateway has no monthly fee?

Among others from the list, Adyen stands out as one of the best options with low prices and no monthly fees. Additionally, it provides support for in-person payments. For merchants operating across various channels, Adyen offers tools to seamlessly connect your sales data without imposing monthly, setup, integration, or closure fees.