The term “Financial responsibility” might sound heavy, perhaps mimicking your dad’s or mom’s voice in your head. However, being financially responsible is simply about maintaining control over your money instead of letting it control you. It’s a crucial aspect of shaping your path to adulthood.

When you exhibit financial responsibility, you cultivate healthy spending habits that prevent you from overspending. This approach allows you to enjoy your money and the sense of security it provides, eliminating the monthly worry of struggling to pay your bills.

Integrating financial management into your life’s essential processes and incorporating it into your ongoing plans or aspirations is crucial. Even if your finances seem intricate and perplexing, the ten valuable tips in this article should assist you in taking command and gaining control over them.

What Exactly Is Being Financially Responsible?

Practicing financial responsibility entails managing your money wisely and making informed decisions. It involves the skillful handling of saving, budgeting, and investing. Additionally, it means being mindful of spending habits and preventing the escalation of debt.

Financial responsibility is significant as it empowers you to steer your finances effectively and make choices aligned with your best interests. When you exhibit financial responsibility, the likelihood of falling into debt or bad financial choices is on the list. It serves as a cornerstone for realizing long-term financial objectives and establishing a robust foundation for your future.

Top 10 Tips For A Financially Responsible Future

1. Pay Yourself What You Are Worth and Cut Your Expenses

The first step is to ensure you’re compensated fairly by understanding your job’s market value. Evaluate your productivity, contributions, and skills to determine your worth. Research both external and internal salary rates for your role. Advocating for your deserved salary showcases market awareness.

List your degrees, qualifications & skills, certifications, and achievements when negotiating pay. This demonstrates your alignment with job requirements and helps in salary research.

However, financial stability requires spending less than you earn regardless of income. Cost-cutting efforts in various areas can lead to significant savings. Small adjustments can make a difference without major sacrifices.

2. Controlling Credit Card Debt

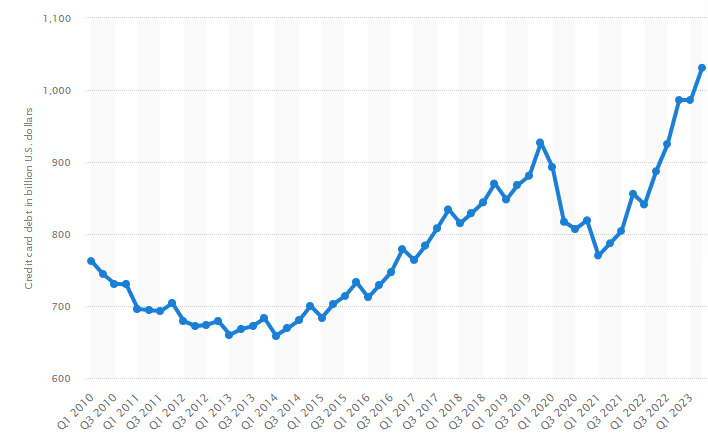

Credit cards serve as a valuable tool for significant purchases and establishing a positive credit history. Many credit cards offer enticing rewards like cash back or airline miles, enhancing their appeal. However, the convenience of credit cards may lead to the swift accumulation of debt. This holds as an American’s average credit card debt is $6,365. Fortunately, there are practical steps to prevent the accrual of substantial debt.

Source: Statista – Credit card debt in the United States from 2nd quarter 2010 to 2nd quarter 2023

To maintain a healthy credit profile, consider the following tips:

- Ensure to settle your balance entirely every month.

- Make on-time payments consistently.

- Aim for a low utilization ratio, ideally below 30%.

- Familiarize yourself with the details of your credit card agreement.

- Avoid opening too many accounts in a short timeframe.

Using credit cards wisely contributes to improved financial well-being. Monitoring your credit score is equally crucial. Experian and many other online services offer free credit monitoring services, which provide access to your credit report and FICO Score, along with real-time alerts about changes in your credit report, allowing you to address potential issues promptly.

If your credit score falls below your desired level, bringing overdue accounts up to date and consistently paying bills on time can be instrumental in enhancing it.

3. Tackle Your Debt

Just as we discussed earlier in relation to credit cards, carrying debt can pose challenges in managing your monthly expenses. Additionally, it can elevate your debt-to-income ratio, potentially hindering progress toward your financial objectives. If you’re grappling with high-interest debt, incorporating debt repayment into your financial routine can be a smart move.

Consider setting “debt payoff” as one of your financial goals and review your budget to determine the amount you can allocate each month to reduce your debt. Explore various debt payoff strategies, such as the debt avalanche method or the debt snowball method, to find an approach that aligns with your financial circumstances and objectives.

4. Budgeting for Responsible Financial Well-Being

Establishing a budget isn’t exclusive to business owners or finance experts; it’s a crucial practice for everyone. It serves as a foundational financial habit that complements other financial planning strategies, applicable regardless of your financial situation.

Once you’ve crafted a budget, you gain clarity on your investment capacity, determine reasonable contributions to your emergency fund, and identify the amount available for monthly debt repayment. Here are some tips to start by:

- Determine your net income: Your gross income, or take-home pay, is the foundation of a successful budget. It is all of your earnings less the costs of taxes and employer-sponsored benefits like medical coverage and plans for retirement.

- Monitor your spending: List your fixed expenses to start the budgeting process. These are regular monthly expenses like utilities, lease or mortgage, and auto payments. Next, list your variable expenses, which include things like gas, groceries, and pleasure that could change on a monthly basis. There are chances for possible savings in this area.

- Establish achievable goals: Prior to scathing into the details you’ve tracked, outline a list of your short-term and long-term financial goals. Possibly in a year or three, short-term objectives could include things like setting up an emergency fund or paying off credit card debt. Conversely, long-term objectives, like funding your child’s education or retirement, might take longer than five years to complete.

- Create a strategy: This is the phase where all the elements converge: your actual spending versus your intended expenditure. Utilize the compiled list of fixed and variable expenses to project your upcoming monthly outlays. Then, align this with your priorities and net income. Contemplate establishing precise—and achievable—spending limitations for each expense category. You may opt to categorize your expenses further, distinguishing between necessities and luxuries. Consider adopting the 50-30-20 plan—allocating 50% to needs, 30% to wants, and 20% to savings.

- Modify your spending to adhere to the budget: Having established your expenses and income, you can now make any required adjustments to prevent overspending and allocate funds toward your objectives. Prioritize trimming your discretionary “desires” as the initial area for potential reductions.

5. Prioritize Your Financial Well-being

Taking control of your interest and borrowing expenses may seem challenging, but in reality, it boils down to discerning between necessities and luxuries. For instance, while having a car may be a necessity, owning a high-end model is a luxury. If you can’t afford to pay for it outright, it’s advisable to opt for a more budget-friendly option.

Similarly, having a place to live is a necessity, but residing in a mansion is a luxury. For most individuals, a mortgage is a necessary step to own a home, but it’s crucial to do so in a financially responsible manner. A general guideline is that the cost of your home shouldn’t exceed two to 2.5 times your annual income. Additionally, a healthy measure is ensuring that your monthly mortgage payment doesn’t surpass 30% of your monthly take-home pay.

Beyond steering clear of excessive spending on your home, it’s advisable to make a substantial down payment that eliminates the need for private mortgage insurance (PMI). If meeting these purchasing criteria proves challenging, consider renting until you’re financially ready to make a home purchase.

6. Build Your Emergency Fund

Regardless of your income or expenses, having an emergency fund is crucial for financial stability. The size of this fund should align with your lifestyle, with a common recommendation being enough to cover three to six months of expenses.

To ease into the habit of saving, start with a modest initial contribution. This ensures your cash flow isn’t strained, reducing the likelihood of abandoning your savings routine.

Opt for direct deposit to keep your savings out of sight and out of mind. Many employers offer this option, allowing you to allocate funds to multiple accounts.

While an emergency fund is essential, avoid allocating an excessive portion of your savings to it. Since it’s meant for quick access, it’s often stored in low-yield options like a savings account with minimal interest.

Once you reach your target for the emergency fund, redirect your contributions to an account that can generate returns, such as your retirement account. This strategic move allows your money to grow over time, maximizing its potential.

7. Buckling Up Your Investments

Starting your investment journey may feel overwhelming as a newcomer, but it can be easy with little knowledge. Questions about the required amount, how to initiate the process, and the best strategies for beginners can be daunting. However, investing early in your life can yield substantial returns, thanks to the power of compound earnings. This phenomenon allows your investment returns to generate their own returns, leading to significant growth over time.

Whether you’re committing $1,000 monthly or a more modest $50, establishing a regular contribution to your investments is key. This consistency ensures a steady influx of funds into your investment portfolio. To set you on the right path, here are some fundamental insights to consider before diving into the world of investing:

- Determining the right amount:

It is a crucial decision, influenced by your financial situation, investment goals, and the timeline for achieving them.

For retirement, a common investment objective, consider allocating 10% to 15% of your annual income. If you have a workplace retirement account, like a 401(k), that offers employer matching, prioritize contributing enough to receive the full match. This matching contribution is essentially free money, a valuable boost towards your retirement goals.

For other aspirations such as homeownership, travel, or education, evaluate your time horizon and financial needs. Break down the required amount into manageable monthly or weekly investments to stay on track.

- Opening an investment account:

If you lack access to an employer-sponsored retirement plan, an individual retirement account (IRA) is a viable option, offering both traditional and Roth IRAs. However, if your investment goals extend beyond retirement, explore taxable brokerage accounts. These accounts provide flexibility, allowing withdrawals without additional taxes or penalties, making them suitable for various financial objectives.

- Create an Investment Approach

Selecting the right investment strategy hinges on your specific saving objectives, the financial milestones you aim to achieve, and the time frame for reaching them.

For long-term goals extending beyond 20 years, such as retirement, a significant portion of your funds can be allocated to stocks. However, delving into individual stock selection can be intricate and time-intensive. For most individuals, a prudent approach is to invest in low-cost stock mutual funds, index funds, or ETFs, providing diversified exposure to the stock market.

Conversely, if you are saving for a short-term goal with a horizon of less than five years, the inherent risk associated with stocks suggests a more conservative approach. Safeguard your funds in secure avenues such as online savings accounts, cash management accounts, or low-risk investment portfolios to preserve capital and liquidity.

- A Primer on Investment Choices

Upon determining your preferred investment strategy, the next step involves selecting specific assets for your portfolio. Every investment comes with its own set of risks, and comprehending the characteristics of each instrument, evaluating its risk profile, and ensuring alignment with your financial objectives is crucial. Here are some popular investment options, particularly suitable for beginners:

- Stocks

- Bonds

- Mutual Funds

- Exchange-traded funds (ETFs)

Understanding the nature of these investments will empower you to make informed decisions that align with your financial goals and risk tolerance.

8. Prepare for the Unforeseen

Contemplating mortality may not be pleasant, but ensuring the well-being of your loved ones in the event of your demise is a responsible step. Even if you’re presently unattached with no dependents, securing an affordable life insurance policy while you’re younger is a prudent financial move.

The process of obtaining life insurance is straightforward, and it doesn’t have to strain your monthly budget. Although there is a multitude of life insurance products available, opting for a term insurance policy is often considered a clear-cut choice for many individuals seeking the coverage they require.

As you navigate significant milestones like marriage, homeownership, or parenthood, a term insurance policy becomes a valuable asset, offering financial protection in the event of your absence.

9. Update Your Will

You might be wondering about the relevance of a will in the realm of financial responsibility. A will, formally known as a last will and testament, is a legal document that outlines your preferences concerning the distribution of your assets and finances after your passing. It stands as a crucial element of financial responsibility, ensuring that your wishes are upheld. Without a will, the execution of these wishes may be uncertain, leading to additional time, costs, and emotional strain for your heirs.

While no single document can anticipate every posthumous issue, a well-crafted will can address a significant portion of them. Surprisingly, only 33% of Americans had a will in 2021. Whether you have dependents or varying degrees of assets, having a will is essential. While you can create a basic will on your own, seeking guidance from a legal professional is advisable for added assurance. To enhance the protection of your loved ones and streamline the posthumous process, it’s wise to consider updating your will.

10. Maintain Accurate Tax Records

Last but not least, neglecting to keep meticulous records may result in missing out on potential income tax deductions and credits.

Establish a systematic approach and maintain it throughout the year. This proactive strategy is far more efficient than the last-minute scramble during tax season, preventing oversights that could have otherwise contributed to savings.

Conclusion

Embracing financial responsibility is not just a distant goal but a practical and achievable path to securing your financial well-being. By incorporating the ten essential tips provided, you can navigate the realm of personal finance with confidence and control.

Understanding the fundamentals of financial responsibility involves more than just budgeting; it requires a holistic approach to managing your money wisely. From addressing credit card debt to strategically investing for the future, each tip contributes to a comprehensive strategy for long-term financial success.

Take the time to pay yourself what you’re worth, control credit card debt, tackle existing debts, and establish a realistic budget. Prioritize your financial well-being by distinguishing between necessities and luxuries, building an emergency fund, and initiating a well-thought-out investment journey.

Remember, your financial journey is not complete without preparing for the unforeseen. Securing life insurance, updating your will, and maintaining accurate tax records are integral components of a responsible financial plan.

In essence, being financially responsible is about taking charge of your financial destiny, making informed decisions, and cultivating habits that lead to a secure and prosperous future. As you embark on this journey, keep in mind that financial responsibility is not a destination but a continuous process of learning, adapting, and thriving in the ever-changing landscape of personal finance.

Frequently Asked Questions

What's a good financial tip?

A practical money management tip is to embrace the 50-30-20 rule, allocating 50% of your income to essentials like housing, food, transportation, and utilities, while dedicating 30% to your wants, such as entertainment and travel.

What are the 5 pillars of financial freedom?

Building wealth requires time, effort, and a solid financial plan. Focus on five key pillars to achieve financial freedom: budgeting, saving, investing, debt repayment, and insurance.

What are financial habits?

Financial habits encompass the values, standards, routine practices, and rules guiding day-to-day financial decisions. These habits support effective money management, enabling individuals to navigate their financial lives adeptly and respond swiftly to financial challenges.

How can I improve my money mindset?

Enhance your money mindset by:

-Forgiving past financial mistakes.

-Understanding your thoughts and emotions about money.

-Recognizing that comparing yourself to others is counterproductive.

-Working on forming good financial habits.

-Creating a budget that brings you joy.

-Remember to be thankful for your financial situation.

Q:

Q:

Q:

Q: