Payment orchestration involves optimizing the payment process to boost conversions efficiently. This includes collaborating with various payment providers, acquirers, and banks to streamline the customer experience, improve conversions, ensure compliance with regulations, strengthen fraud prevention, and facilitate global payment coverage.

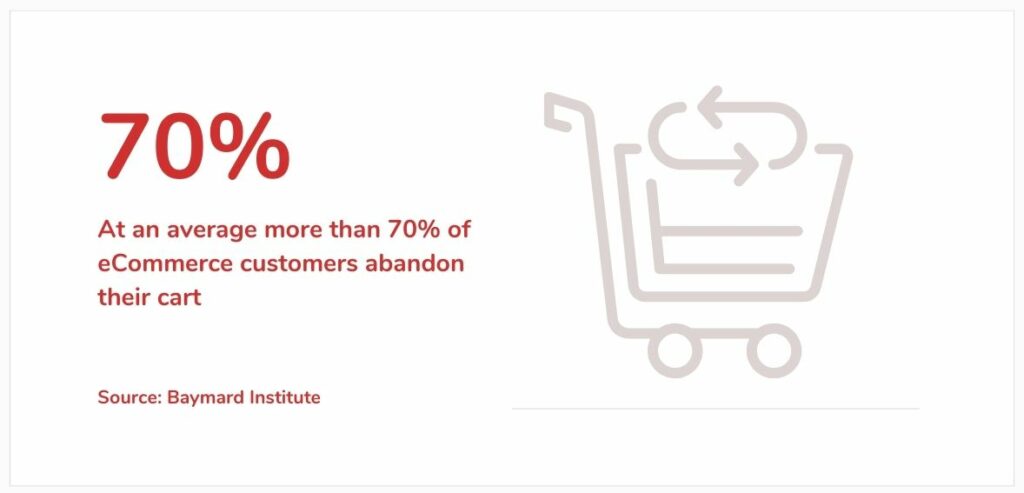

This approach is gaining traction, especially in the eCommerce sector. Recent reports indicate:

- 60% and more merchants prefer engaging with multiple vendors.

- One fourth of the merchants prioritize enhancing payment orchestration platforms.

Payment Orchestration Platforms (POPs), also referred to as Payment Orchestration Layers (POLs), simplify integration on both ends (front and back). But do merchants truly require them? Is there more to payment orchestration than what these top payment orchestration platforms currently offer? This article will discuss these queries and more.

Source: Baymard Institute

What Is Payment Orchestration- Understanding The Basics Of Payment Orchestration

As explained in our What is Payments Orchestration article, Payment orchestration platforms refer to software solutions that act as centralized hubs for handling payments. These platforms integrate with multiple PSPs, enabling retailers to provide customers with diverse payment options while streamlining the backend payment procedures. As a result, customers enjoy a smoother and quicker payment experience, leading to improved conversion rates for retailers.

Front-end orchestration involves selecting and linking the most suitable PSPs for a retailer’s specific requirements. This selection process takes into account aspects like transaction fees, customer location, and preferred payment methods. By integrating with multiple PSPs, front-end orchestration platforms enable retailers to offer customers a diverse range of payment choices.

On the other hand, back-end orchestration refers to the management and processing of payments across various PSPs. This includes tasks such as reconciling transactions, facilitating refunds, and monitoring customer information. Back-end orchestration platforms streamline these operations by providing a centralized hub for all payment-related activities.

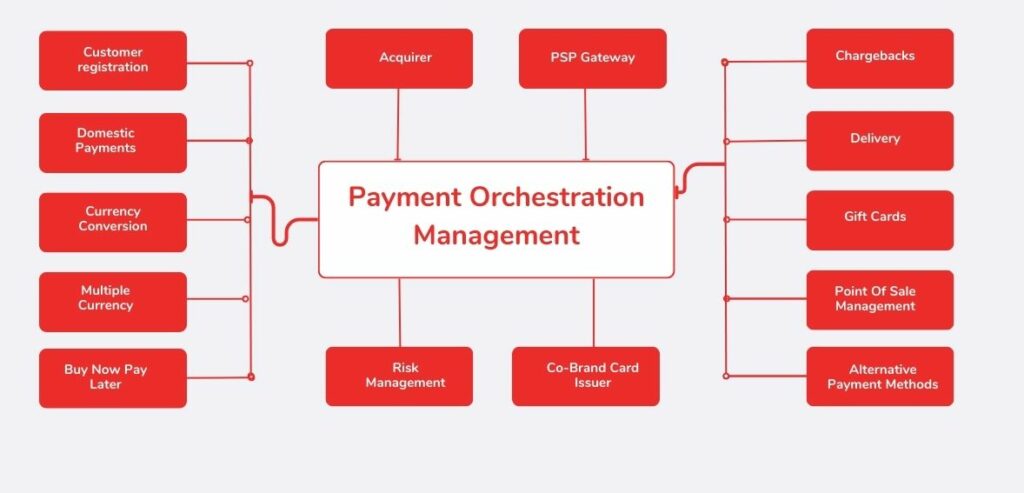

Components of Payment Orchestration

The payment orchestration process involves several key components that contribute to its smooth functioning. Let’s take a closer look at these elements.

- Payment Solution Aggregation

Payment orchestration companies consolidate diverse payment methods into a unified interface. This integration allows businesses to accept payments from multiple sources seamlessly, providing customers with a wide array of options suited to their needs. If you want to know more about how Aggregators are Using Payments Orchestration, this article will help.

- Transaction Routing

Intelligent routing mechanisms within orchestration platforms help identify the most efficient and cost-effective payment orchestration providers for each transaction. Think of these mechanisms as a GPS, guiding transactions along the optimal route, enhancing the likelihood of successful payments while minimizing costs.

- Robust Security Measures

With the escalating risk of e-commerce transaction fraud, ensuring the security of financial transactions remains paramount. Modern payment orchestration platforms prioritize compliance with industry standards and implement advanced security protocols, including fraud detection, risk orchestration solutions, encryption, and tokenization services. Through this multi-layered approach, these platforms safeguard data and funds for both businesses and their customers.

- Insightful Analytics

To refine products and optimize marketing strategies, businesses require comprehensive insights into customer behavior. Payment orchestration platforms feature transaction analytics modules that offer valuable information on customer payment preferences and behavioral patterns. Leveraging these insights, businesses can anticipate future trends and tailor their offerings to meet evolving customer needs effectively.

The Role of Payment Orchestration in Reshaping Modern Transactions

The modern cloud infrastructure serves as the missing link that has propelled Payment Orchestration toward widespread adoption. However, despite being on the cusp of a breakthrough, the concept is not yet fully realized. Companies of all sizes in e-commerce and various service sectors can gain a competitive advantage by spearheading the in-house development of Payment Orchestration Layers. According to experts, a few years down the line, customers and merchants will come to view orchestrated payments as the standard operating procedure.

A well-planned Payment Orchestration Layer also facilitates the integration of highly sought-after payment methods, such as the increasingly popular Buy Now and Pay Later options. Having a flexible payment system that can swiftly respond to market demands is crucial. Implementing a Payment Orchestration represents a vital step in this direction.

Benefits of Payment Orchestration Platforms

Here’s a breakdown of the key advantages associated with utilizing Payment Orchestration Platforms:

- Simplified Integration

By leveraging Payment Orchestration, merchants can collaborate with multiple payment service providers, streamlining the process by utilizing a unified API instead of managing multiple third-party integrations.

- Seamless Adaptation to Customer Preferences

Payment orchestration platforms offer access to an extensive range of payment service providers, facilitating the integration of additional payment methods into e-commerce websites through a single API integration, thus catering to diverse customer preferences more efficiently.

- Facilitates Business Scalability

With Payment Orchestration, businesses can swiftly set up numerous payment methods and features, expediting the speed-to-market process. By providing an array of payment options, businesses can expand their customer reach, enhance the overall customer experience, and bolster cross-border sales capabilities.

- Improved Payment Approval Rates

Payment Orchestration Platforms can effectively mitigate potential sales losses resulting from technical glitches by intelligently routing transactions to the most reliable payment processors. This approach significantly reduces the incidence of declined payments and results in higher authorized transactions at the checkout stage.

- Decreased Payment Processing Expenses

Payment Orchestration streamlines the entire payment stack, leading to reduced costs across the board. This includes minimizing setup fees associated with multiple integrations and cutting down on additional charges imposed by standalone payment service providers for automated transaction routing.

What Are Enterprises Focusing On?

Enterprises are increasingly favoring provider-agnostic orchestration platforms. Payment orchestration operates at a broader level, building seamless connectivity among a diverse array of independent payment-related services. Through these platforms, merchants and aggregators establish a single point of contact, enabling them to tap into an expanding spectrum of independent payment-related services that can be customized or adjusted on a market-specific basis.

By adopting such platforms, merchants can bypass the intricate technicalities involved in establishing direct relationships at every stage of the transaction flow, thus facilitating smoother and more efficient payment processing.

Merchants have come to recognize the importance of maintaining comprehensive control over their payment infrastructure, necessitating a provider-agnostic approach that allows them to channel transactions through various providers. This approach helps optimize transaction costs, success rates, and authorization rates.

Furthermore, payment orchestration empowers eCommerce firms to independently manage transaction processes, enabling them to fine-tune strategies tailored to specific markets. By promoting cost-effective payment options based on the average ticket size within a particular location, businesses can optimize their operations accordingly. For instance, a higher average ticket size might prompt enterprises to endorse a fixed-fee product, mitigating the need to pay a percentage of the transaction to a card provider.

To fortify defense mechanisms against fraud, payment orchestration platforms can implement advanced security measures such as tokenization, ensuring comprehensive protection for all stakeholders involved in the transaction process.

How Can You Take Advantage Of Payment Orchestration?

- Improving the Checkout Experience

Utilizing global payment orchestration enables businesses to enhance customer conversions by providing localized payment options and currencies tailored to specific regions. By allowing customers to pay in their local currency and offering familiar payment methods, businesses can streamline the payment process, minimizing potential confusion and friction during checkout. This ultimately boosts the likelihood of completing transactions and increasing overall conversions.

To initiate this process, it is crucial to evaluate the rates of checkout abandonment. This can be achieved by examining internal or Google analytics to identify the percentage of customers abandoning transactions during the checkout phase.

Moreover, businesses should consider the geographical locations of their customers and prioritize popular payment options and currencies in those areas. Incorporating a diverse range of payment methods, including the increasingly popular BNPL option, is essential for ensuring a seamless transaction process. Finally, it’s important to verify that payment providers possess the necessary capabilities to support various currencies and payment types.

- Minimizing Payment Costs

In the absence of global payment orchestration, businesses often face elevated fees and less favorable exchange rates. In some cases, when customers use cards issued in different countries or regions from where the payment is processed, they may encounter additional charges in the form of cross-border interchange fees, which are added to standard interchange fees.

To evaluate cross-border fees, businesses should thoroughly examine their processing statements, paying close attention to customer locations and the percentage of those situated outside the region where card payments are handled.

- Improving Approval Rates

Implementing global payment orchestration can significantly enhance businesses’ approval rates by facilitating a more efficient and streamlined process. By utilizing intelligent routing technology to direct each transaction through the most suitable local bank according to card brand regulations, businesses have observed an increase in approval rates from 3% – 6%.

To enhance approval rates, there are several controllable factors to consider. Transactions initiated from outside a bank’s local area are often perceived as riskier and more prone to being rejected. Hence, it’s vital to align the customer’s card currency with the transaction currency and adhere to local regulations, such as strong customer authentication (SCA).

Accurate transaction meta-tagging is equally vital as it provides the processor with crucial information about the nature of the transaction.

- Expanding Globally

A suitable global payment orchestration platform offers a range of local, preferred payment methods, enabling businesses to thrive in diverse regions. However, venturing into new markets also entails navigating different regulatory environments, which can be intricate and time-consuming.

To guarantee a successful international expansion, it’s crucial to comprehend the specific compliance and taxation requisites in each region. Failure to meet these obligations can lead to penalties, tarnished reputation, revenue loss, and business disruption. Effective global payment orchestration platforms furnish businesses with automated tools and integrated solutions to ensure compliance with local regulations, thereby ensuring secure payment processes aligned with industry standards.

Conclusion

The strategic implementation of payment orchestration is essential in optimizing the global commerce landscape. By facilitating diverse payment options, streamlining transactions, ensuring robust security measures, and providing insightful analytics, this approach significantly enhances customer experiences and business scalability.