As Gen Z becomes the largest demographic in the workforce, they are reshaping the way we think about payments and financial technology. This generation has grown up with mobile devices and instant gratification, and they expect the same level of convenience in their financial transactions. This article will explore the gen Z focused payment options and technology trends that are most important to Gen Z and how financial services providers can meet their needs.

Gen Z Focused Payment Options and Technology Trends – 2023

Gen Z and Cash

Gen Z is the demographic cohort that follows the millennials, typically born between the mid-1990s and mid-2010s. This group has grown up in a digital age, and their relationship with cash is quite different from previous generations. Gen Z is less reliant on cash for everyday transactions, with many preferring to use digital payment options.

The rise of online shopping and e-commerce has also contributed to this trend, as many Gen Zers are more comfortable making purchases using their smartphones or computers rather than carrying cash. Additionally, the COVID-19 pandemic has accelerated the move away from cash as people are looking for contactless payment options to reduce the risk of infection. Overall, Gen Z is a generation that is driving the shift towards digital payments and the adoption of new payment technologies.

P2P Payments

P2P (peer-to-peer) payments refer to a type of digital payment that allows individuals to transfer money from one person to another using a mobile app or website. These payments can be made between friends, family members, or even strangers, and are often used to split bills, pay for goods and services, or simply send money to someone else.

P2P payments are becoming increasingly popular among younger generations, including Gen Z, as they offer a convenient and secure way to transfer funds without the need for cash or checks. In most cases, users can link their bank accounts or credit/debit cards to the P2P app, making it easy to send and receive money with just a few taps on their mobile device. Some popular P2P payment apps include Venmo, Zelle, PayPal, and Cash App.

BNPL

BNPL (Buy Now, Pay Later) is a type of payment option that allows customers to make purchases without having to pay for them upfront. With BNPL, customers can split their purchases into smaller, interest-free installments that are paid over a set period of time.

This option is becoming increasingly popular among Gen Z consumers who may not have access to traditional credit options, or who prefer not to use credit cards due to concerns about high-interest rates and debt. BNPL allows consumers to make purchases that they may not have been able to afford otherwise, and it also provides them with greater flexibility and control over their spending.

Some popular BNPL services include Afterpay, Klarna, and Affirm. While BNPL can be a convenient option for some consumers, it’s important to understand the terms and conditions of the service, as missed payments or late fees can have negative consequences, including damage to credit scores.

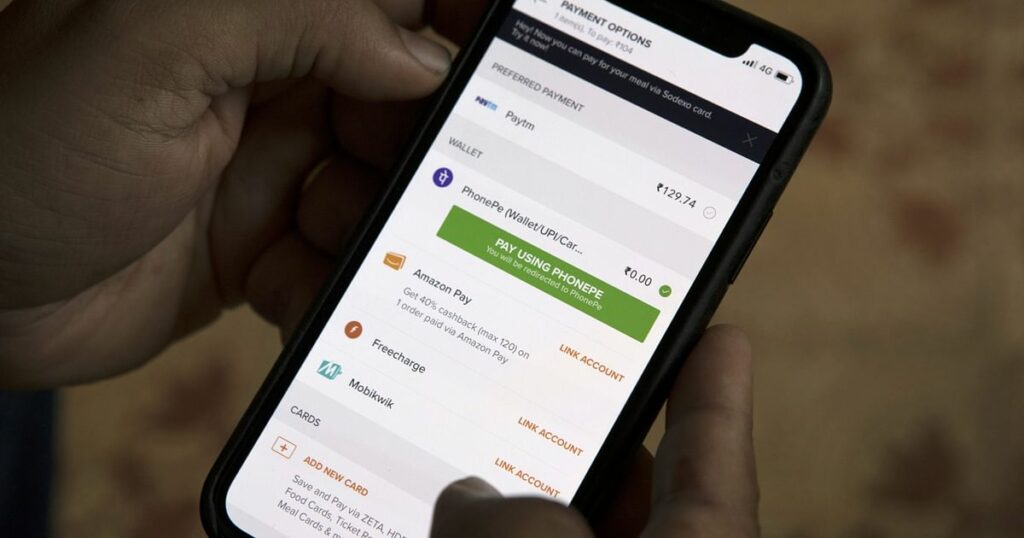

Mobile Wallets

Mobile wallets are a type of digital payment solution that allows users to store and manage their payment information on their smartphones. These wallets can be used to make purchases in stores, online, or within mobile apps, eliminating the need for physical cash or cards. Mobile wallets typically work by linking a user’s bank account or credit/debit card to their smartphone, allowing them to make transactions with just a few taps on their device. Popular mobile wallets include Apple Pay, Google Pay, and Samsung Pay.

These wallets use Near Field Communication (NFC) technology, allowing users to tap their phone against a compatible payment terminal to complete a transaction. Mobile wallets offer several advantages over traditional payment methods, including faster checkout times, enhanced security features, and the ability to track and manage to spend more easily. Additionally, some mobile wallets offer rewards or cashback programs for using their services, making them an attractive option for many consumers, including Gen Z.

Cryptocurrency

Cryptocurrency refers to a digital or virtual currency that uses encryption techniques to secure and verify transactions and control the creation of new units. Unlike traditional currencies, which are backed by governments or central authorities, cryptocurrencies operate on decentralized networks that are managed by a community of users.

This means that they are not subject to the same regulations or controls as traditional currencies, and their value can fluctuate rapidly based on market demand and other factors. Some popular cryptocurrencies include Bitcoin, Ethereum, and Litecoin. Cryptocurrencies are becoming increasingly popular among Gen Z consumers who value privacy, decentralization, and the ability to conduct transactions without the need for intermediaries like banks or payment processors.

Cryptocurrencies can be bought and sold on exchanges, and can also be used to make purchases with merchants who accept them as payment. While the adoption of cryptocurrencies is still relatively low compared to traditional currencies, many experts believe that they have the potential to transform the way we think about money and finance in the future.

Financial Education

Financial education refers to the process of teaching individuals the skills and knowledge needed to manage their finances effectively. This can include topics such as budgeting, saving, investing, debt management, and understanding financial products and services.

Financial education is important for individuals of all ages, but it is particularly critical for Gen Z consumers who are just entering the workforce and starting to make financial decisions that will impact their long-term financial well-being. Many Gen Z consumers have grown up in a world of economic uncertainty and financial instability, and may not have had access to the same level of financial education and resources as previous generations.

As a result, there is a growing need for financial education programs that can help Gen Z consumers develop the skills and knowledge they need to make informed financial decisions and achieve their financial goals.

Some organizations and initiatives that offer financial education programs and resources include government agencies, non-profit organizations, and financial institutions. By investing in financial education, Gen Z consumers can take control of their financial futures and build a foundation for long-term financial success.

Sustainable Finance

Sustainable finance refers to financial products and services that promote sustainable development and environmental responsibility. This includes investments in renewable energy, clean technologies, and other environmentally friendly projects, as well as loans and other financial products that support sustainable businesses and practices.

Sustainable finance is becoming increasingly important as individuals and organizations seek to address the challenges of climate change and other environmental issues. For Gen Z consumers, who are often passionate about social and environmental causes, sustainable finance represents an opportunity to align their financial goals with their values and make a positive impact on the world.

Some examples of sustainable finance products and services include green bonds, which fund environmentally sustainable projects and impact investing, which seeks to generate both financial returns and positive social or environmental outcomes. As sustainable finance continues to gain momentum, it has the potential to drive positive change and encourage more sustainable practices in the financial industry and beyond.

Personalization

Personalization refers to the process of tailoring products, services, or experiences to meet the specific needs and preferences of individual consumers. In the context of finance, personalization can include everything from customized investment portfolios to personalized marketing messages and offers. Personalization is becoming increasingly important as consumers, including Gen Z consumers, seek more personalized and relevant experiences from the brands and companies they interact with.

Personalization can help financial institutions build stronger relationships with their customers and provide a more engaging and satisfying experience. Some examples of personalization in finance include personalized investment recommendations based on an individual’s risk tolerance and financial goals, targeted marketing messages and offers based on an individual’s spending habits and preferences, and customized user interfaces that make it easier for individuals to manage their finances.

As technology continues to evolve, the potential for personalization in finance is only expected to grow, providing opportunities for financial institutions to differentiate themselves and better serve their customers.

Conclusion

To conclude, Gen Z is reshaping the payments and financial technology landscape with their demand for convenience, digital options, and personalized experiences. Financial services providers that can meet these needs will be well-positioned to capture the loyalty of this influential demographic. By offering P2P payments, BNPL, mobile wallets, cryptocurrency, financial education, sustainable finance, and personalization, financial services providers can stay ahead of the curve and meet the needs of this important demographic.