When initiating a transaction, encountering a “Zelle payment failed” notification can be frustrating and confusing. This article explains why these Zelle payment failures occur, exploring the common reasons behind unsuccessful transactions and providing practical solutions to resolve them. From understanding the technical requirements to ensuring compliance with security measures, we will guide you through the steps to minimize the chances of a payment failure and provide a smoother Zelle experience.

Top Zelle Payment Failed Reasons and How to Fix It?

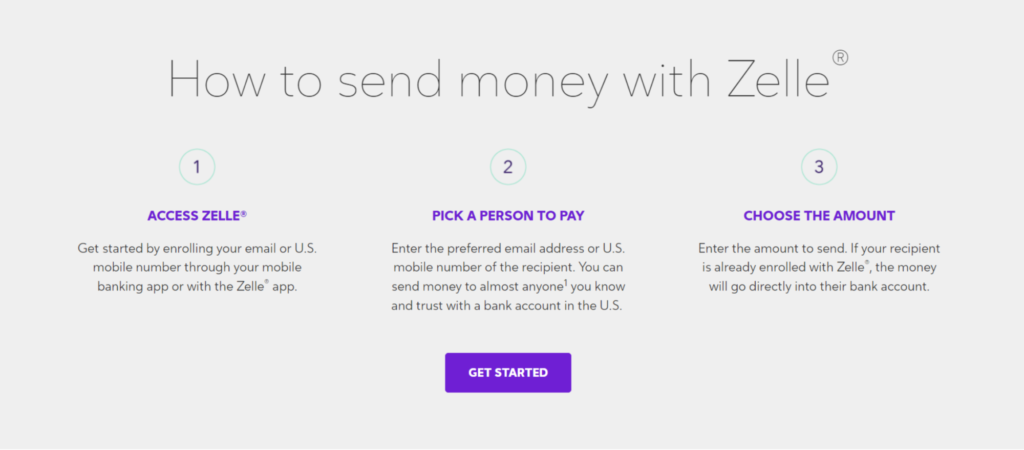

Zelle has gained popularity as a platform for peer-to-peer payments, providing users with a convenient method to send and receive money directly from their bank accounts. However, like any payment service, there are occasions where a Zelle payment might not process successfully. Here are some reasons why this could happen:

1. Incorrect Contact Information:

Incorrect contact information is a common reason for digital payments, including those made via Zelle, to fail. Even a single erroneous digit or character in the recipient’s contact details can cause a transaction to fail. If your Zelle payment doesn’t go through, you must verify that you have the correct information for the recipient.

Zelle identifies users by either an email address or a phone number, which acts like a username or contact point within their app. When someone sends you money, they use your registered email or phone number. Since Zelle accounts are linked to one email address or phone number at a time, using incorrect details will result in a failed transaction. Always double-check this information with your recipient before initiating a transfer. Similarly, if someone is sending money to you, ensure they have your correct details.

You can verify or update your contact details directly in the Zelle app or through the Zelle section of your banking app. You can toggle between your email address and phone number and add new contact information if necessary.

One effective way to ensure accuracy is to use Zelle’s payment request feature. By sending a payment request, the recipient can prompt the sender to authorize payment using the correct details, reducing the likelihood of entering incorrect information manually.

2. Insufficient Balance:

The transaction will not go through if funds are insufficient in your bank account to cover a Zelle payment. You will receive an automated error message explaining why the payment failed.

The solution to this issue is simple. You need to deposit more money into your bank account linked to Zelle to ensure adequate funds are available for the transaction. Once you have topped up your account, you can attempt the payment again.

3. Technical Issues:

Like any technology-driven service, Zelle payments can be disrupted by various technical issues, such as:

- Server Issues:

Many users occasionally experience difficulties connecting to Zelle’s servers. This is relatively common since the Zelle app relies on the company’s internal servers to facilitate communication between networked banks. If there is downtime on Zelle’s servers, the only option is to wait until Zelle resolves the issue.

While server downtime at Zelle usually resolves within a few hours, recognizing the significant impact such disruptions can have on users and their operations, it’s helpful to keep the Zelle customer support number handy, which is available 24/7 at 00 1 501-748-8506 for any assistance during these periods.

Remember that just as server issues with Zelle can prevent successful transactions, downtime on your bank’s servers can also hinder your ability to transfer funds through Zelle. Unfortunately, like with Zelle server issues, the only solution is waiting until your bank’s servers are operational. However, you can contact your bank directly for an update on the extent of the issue and an estimated time for their services to be restored. Typically, such downtimes are resolved within an hour or two.

- Poor Internet Connection:

If your Zelle payment fails, the first thing to check should be the quality of your internet connection. Zelle requires a connection through its servers and those of your financial institution to process transactions. If your connection is unstable or slow, it might hinder the app’s ability to complete the transaction. To address this, try connecting to a more reliable network. Ideally, connecting your device to a WiFi network and staying close to the router can improve your connection stability and speed, enhancing the transaction process with Zelle.

- Zelle App Bugs:

If you’re facing payment failures and suspect issues with the Zelle app, there are several steps you can take to resolve these glitches. First, try simply closing and reopening the app, as this can often clear up minor glitches. If the issue persists, consider rebooting your device, which can help resolve deeper system issues affecting the app’s performance.

Additionally, make sure your Zelle app is up to date. Updates typically include fixes for known bugs and app stability improvements. These straightforward actions can help get your Zelle app running smoothly again.

4. Account Status ‘Suspended’ or ‘Closed’

Your bank account needs to be active and open to send and receive funds through Zelle. An account in any other status may encounter difficulties when transacting through Zelle.

If your Zelle transfers are consistently failing, the first step is to check the status of your account. Ensure that your account is active, in good standing without any negative balances, and free from any legal holds. If all these conditions are met and you still face issues, the problem may lie with the person you are trying to transfer funds to.

Advise the other party to check the status of their account activation as well. Sometimes, issues arise because individuals link their Zelle to a checking account. In this situation, the recipient must restore their account to receive payments. Typically, this involves contacting Zelle support directly to resolve the issue. If they registered their Zelle through their bank’s app, they should also contact their bank to have the account unblocked. Once Zelle or the bank reinstates their account, attempt the payment again. It should process successfully this time.

5. You are a ‘High-Risk’ Merchant

Zelle restricts the use of its services for certain types of businesses, typically those classified as high-risk. A high-risk merchant is often a business seen as having a greater likelihood of financial losses or chargebacks, which could be due to the nature of their products or services, their industry, or their track record with credit card transactions. Merchant service providers view these businesses as riskier, leading to potentially higher fees or more stringent restrictions on their credit card processing capabilities.

If you are found to be using Zelle for activities related to any prohibited industry, even if your business operations are legitimate, Zelle may suspend, freeze, or terminate your account. This is a common policy across many digital payment platforms and wallets, including PayPal, Venmo, Apple Pay, Google Pay, and Cash App, which all avoid facilitating transactions for high-risk businesses.

However, there are still viable options for high-risk merchants. Merchant services providers specialize in offering safe and flexible payment processing solutions tailored to high-risk businesses. These providers accommodate various payment methods, catering to the preferences of different customers, and typically do not freeze client accounts due to their capability to handle the demands of high-risk industries.

6. You’ve Reached Transaction Limit

The transfer limits for Zelle vary depending on the bank and can range from $500 to $2,500 daily, with weekly limits varying from $1,000 to $5,000. Zelle limits the daily and weekly transfers and the amount per transaction over a month. When setting up your Zelle business account, it’s crucial to confirm these transaction limits with your financial institution to ensure smooth payment processes and to avoid any failed transactions.

Zelle will decline the transaction if you attempt to make a payment that exceeds these limits. In such cases, you must wait until the next limit period begins to make further transfers. For example, if you reach your daily limit of $500, you must wait until the following day to initiate any additional transfers.

What if the Payment is Deducted But the Transaction is ‘Failed’?

If your Zelle payment fails but the funds have been debited from your account, checking the payment status is important. If the status shows as “pending,” it could mean that the recipient hasn’t yet signed up with Zelle. They should receive a notification with instructions on enrolling, and once they do, the funds will be transferred to their account.

Suppose the funds have been taken from your account, and the transaction failed for reasons other than enrollment issues. According to your bank’s policies, your account will automatically be credited within 3-5 working days since Zelle acts merely as an intermediary. It’s advisable to inform both your bank and Zelle’s customer support about the issue and wait for at least five working days from the transaction date. Check your bank statement after this period to confirm the reversal.

Conclusion

Dealing with Zelle payment failures can be frustrating, especially when you have time-sensitive transactions. However, understanding the reasons behind these failures is the first step toward resolving them effectively. Whether the cause is incorrect contact information, insufficient funds, technical issues, account status, merchant classification, or transaction limits, practical solutions are available to help fix the problem.

Users can mitigate the risk of failed transactions by verifying recipient details, ensuring adequate funds, addressing technical glitches, checking account status, exploring alternative payment solutions for high-risk merchants, and staying within transaction limits.

In addition, it’s recommended to communicate promptly with both the receiver and Zelle’s customer support in case of any issues, to speed up problem resolution and ensure a hassle-free payment experience. By being diligent and aware of these possible drawbacks, users can make use of Zelle’s payment platform for seamless and efficient online transactions.

Frequently Asked Questions

What should I do if my Zelle payment fails but the funds have been deducted from my account?

If the payment is pending, it may be because the recipient isn’t enrolled with Zelle. Contact your bank or Zelle’s customer support for resolution.

How can I prevent Zelle payment failures?

Ensure stable internet connectivity, verify recipient information, and check your account balance against transaction limits to prevent failures.

What are Zelle’s transaction limits?

Zelle’s limits vary by bank, ranging from $1,000 to $5,000 weekly and monthly limits from $4,000 to $20,000. Check with your bank for specific limits.

How long does it take to receive money with Zelle?

Zelle transactions typically occur within minutes for enrolled users, but timing may vary based on the recipient’s bank processing speed.