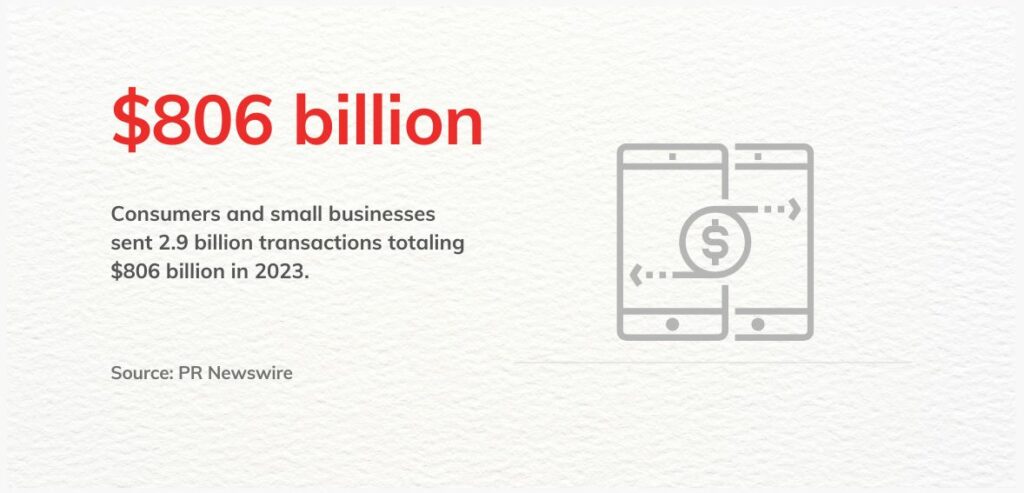

Zelle is a digital payment network owned by Early Warning Services. In 2023, consumers and small businesses used Zelle to make 2.9 billion transactions amounting to $806 billion, marking a significant 28% increase from the previous year. Given the dependency on Zelle for daily transactions, dealing with a frozen Zelle account can be an unpleasant surprise, especially for those who rely on it to make daily essential payments. This Zelle account suspension can happen for many reasons, from simple payment failure to more complex issues.

If your Zelle account is suspended, this article explains why and offers guidance on resolving the situation and preventing recurrence.

Source: PR Newswire

Why is My Zelle Account Frozen?

Here are some of the reasons why your Zelle account is frozen.

1. Too Many Failed Login Attempts

If you try to log in to your Zelle account three times without success, Zelle will automatically suspend your account. This precaution against unauthorized access is a common security measure used by many platforms, including Zelle. Mistakes such as typographical errors or forgetting your password are normal, which is why you’re allowed three attempts to log in.

However, failing to log in successfully after these attempts may lead the platform to suspect fraudulent activity, like someone trying to access another person’s account. Therefore, even if you’re the legitimate owner, Zelle might temporarily suspend your account to investigate the situation further. This is because the system’s automated processes sometimes cannot differentiate between suspicious and legitimate activities. To prevent account suspension, you can reset your Zelle password by following the steps below:

- Navigate to the Login page.

- Choose “Forgot your password?”

- Input the email tied to your Zelle account.

- Select “Reset.”

- An email will be sent to you to reset your password.

- In the email, click on “Reset your password.”

- Type in your new password, then confirm it.

- Click “Continue” after entering your new password.

Alternatively, contact Zelle Consumer Support at +1 (855) 428-8542, available Monday through Friday from 10 AM to 10 PM ET, except on federal holidays.

2. Violation of Terms and Conditions

Zelle enforces strict guidelines and policies for all users, which must be agreed upon when creating a Zelle account. Violating these policies can result in consequences. For instance, Zelle prohibits using its platform for selling, reselling, or offering content for sale and sending altered, deceptive, or false information. Phishing, spamming, collecting, intercepting, or storing personal information using Zelle is prohibited.

Suppose Zelle suspects a violation of these terms. In that case, it reserves the right to take action, including issuing warnings, suspending users, terminating accounts, or implementing other corrective measures as deemed necessary. If your Zelle account is suspended without explanation, reviewing the terms and conditions to identify any unintentional breaches of the rules is recommended.

3. Suspicious Activity

Zelle’s security system flags any suspicious activity on an account and might block it for security. This can happen for many reasons. For instance, an excessive number of transactions within a short period may trigger this suspension.

Your account can be considered suspicious even if your activities were unintentional. Alternatively, your profile could be frozen as a precautionary measure to safeguard your funds from potential scammers. To avoid such consequences, using the Zelle platform as intended is essential, thereby preventing red flags, temporary suspensions, or permanent bans on your account.

4. Security Concerns

Zelle maintains a stringent security system due to the substantial volume of financial requests and user data it handles daily. If security concerns are associated with an account, Zelle may temporarily suspend it to safeguard the user’s sensitive information.

Your Zelle account can be compromised if someone gains access to your phone number or email address. While additional information like your Zelle PIN or password is typically required, scammers may acquire this data through phishing emails or smishing text messages. These fraudulent individuals often pose as trusted entities, such as Zelle, via email, texts, social media, or phone calls. They may request personal information like your Zelle PIN or password under the guise of a legitimate inquiry or claim that your account has been compromised, urging you to transfer funds to protect your remaining balance.

Suspending the account is a proactive measure to prevent unauthorized transactions and ensure the safety of the account holder. It’s crucial to remember that Zelle will never request money via email or phone calls, nor will it ask for your password. Here are some straightforward tips to shield yourself from Zelle scams:

- Ignore unsolicited text messages or emails.

- Confirm that the sender’s email address belongs to an official domain.

- Look for phishing signs, like poor grammar or an overly urgent tone.

5. Account Verification Issues

Your Zelle account may be suspended if you fail to provide additional information. Zelle requires every user to verify their identity accurately. Additionally, the platform might periodically ask for more documentation to confirm your identity or address, especially for business accounts.

A delay in providing the necessary information may also result in account suspension. Typically, you can restore access by furnishing the required details or documents. To verify your Zelle account, navigate to the Pending Activity section on the Activity screen and click “Verify.” Zelle will then send you a one-time code to input on the website. You can also select your preferred method for receiving the verification code on the activity screen.

Here are some steps you can take if you encounter difficulties verifying your Zelle account:

- Check Zelle’s official website or your bank’s notifications for service disruptions and understand the reason.

- Ensure your account is fully verified by providing updated documents.

- Double-check that the information you’re entering matches your bank or credit union’s records.

- Log in using the same mobile phone number you enrolled with.

6. Involvement in High-Risk or Illegal Business

To safeguard users from financial harm, Zelle suspends accounts linked to scams or fraudulent activities. Zelle prohibits using its service for certain businesses categorized as “high-risk” trades. Even if your business is lawful, Zelle will suspend your account if it’s associated with trades falling into this “high-risk category.” Like other digital payment platforms and banks, Zelle also restricts transactions for high-risk businesses.

Examples of high-risk and illegal businesses that Zelle prohibits include:

- Banned substances, including illicit drugs and CBD products;

- Items related to drug use, such as paraphernalia;

- All forms of weaponry, including ammunition and firearms;

- Materials and activities of a sexual nature;

- Pornographic content;

- Materials or actions that are considered offensive or obscene;

- Activities or content promoting intolerance, violence, or hate;

- Financial frauds, including pyramid or Ponzi schemes;

- Illicit betting, lotteries, sweepstakes, or gambling activities;

- Payments mandated by the court for child support or alimony;

- Financial instruments like traveler’s checks, stocks, money orders, annuities, or various currencies, including digital forms like cryptocurrencies;

- Fake or counterfeit materials;

- Violations against intellectual property rights, including patent, copyright, trade secret infringements or trademark concerning Zelle,;

- Financing of terrorism;

- Any fraudulent activities;

- Schemes designed to deceive or scam;

- Money Laundering;

- Any activities or purposes that are illegal or unlawful.

7. Prolonged Inactivity

Any Zelle account that remains inactive for 18 months will be deactivated. This measure allows Zelle to ensure updated verification of users, enhance security, and maintain compliance. However, deactivation doesn’t permanently bar you from using Zelle for peer-to-peer transactions or business purposes. If your account is deactivated due to inactivity, you can re-enroll with Zelle to resume using the service.

How to Deal With the Zelle Account Suspension?

Image source

Dealing with a suspended Zelle account can be frustrating and concerning, especially when access to your finances and sensitive information is at stake. However, there are steps you can take to address the issue. Here are some solutions to consider:

1. Contact Customer Support:

If your Zelle account is suspended, you can contact Zelle customer support for assistance. You can reach them at +1 (855) 428-8542. A Zelle representative will guide you through the process and provide specific instructions to resolve the issue.

OR

Alternatively, you can contact Zelle customer support through their website:

- Open your web browser and visit the official Zelle website.

- Navigate to the support page (zellepay.com/support/contact) and select it.

- Scroll down to find the complaint submission form.

- Fill in the required fields and provide detailed information about your account suspension.

By following these steps, you can communicate with Zelle customer support and work towards resolving the suspension of your account. Customer support is closed on New Year’s Day, Thanksgiving, Christmas, and Independence Day. However, they are available for assistance from 10 AM to 10 PM ET, seven days a week.

2. Provide Accurate Details

When facing a Zelle account suspension, promptly and accurately provide the requested personal and account information. This step ensures that Zelle or your bank can verify your identity and help determine the reasons behind the suspension.

Doing so, you help safeguard your account against unauthorized access or fraudulent activities.

3. Exercise Patience

Zelle accounts may automatically lift temporary suspensions after a few days. If you’ve submitted documents, Zelle might conduct security checks, address system bugs, or investigate any red flags. Typically, the situation resolves itself if there are no serious issues or violations on your account. It’s advisable to remain patient during this period, understanding that resolving such matters may take some time.

4. Follow Up

Following up is a crucial step in resolving a Zelle account suspension. After providing the necessary verification details, you must actively engage with Zelle or your bank. This may include checking the status of your suspension review, requesting updates, or providing additional information if needed.

Timely and persistent follow-up can expedite the resolution process, ensuring prompt and effective handling of your case. Additionally, it helps clarify any misunderstandings and determines any further actions required to regain access to your account.

Tips to Consider to Avoid Getting Your Zelle Account Suspended

To enhance the security of your Zelle account and reduce the likelihood of needing to recover it in the future, consider the following upgraded and informative steps based on current best practices for online payment security:

- Never Share Login Information: Keep all your account login details private to avoid identity theft. Sharing this sensitive information can lead to unauthorized access and misuse of your account.

- Enable Two-Factor Authentication (2FA): Adding an extra layer of security, such as 2FA, significantly increases your account’s protection. This method requires you to verify your identity with a second piece of evidence beyond just the password, making unauthorized access much more challenging.

- Regularly Update Your Password: Change your password periodically, even if it is strong. Using a password manager can help you generate and store complex passwords, ensuring each account has a unique and robust password. This practice helps in minimizing the risk of brute-force attacks.

- Monitor Account Activity: Monitor your Zelle account transaction history to spot any unusual or suspicious activities early. Limiting the number of transactions in a short period helps prevent your account from being flagged for suspicious behavior.

- Educate Yourself and Others: Be informed about the latest phishing scams and educate those around you. Knowing how to spot fraudulent emails or texts can protect you and your contacts from scams.

- Secure Your Internet Connection: Always opt for a secure internet connection, especially when making financial transactions. Avoid using public Wi-Fi for any banking or payment activities. Use a VPN to encrypt your data on public networks to prevent data theft.

- Consider Using a Dedicated Payment Account for Online Purchases: A separate account for online transactions can act as a buffer to protect your primary bank account from unauthorized access and potential fraud.

- Partner with High-risk Merchant Account: A high-risk merchant account provides a critical advantage for businesses operating within high-risk industries, as it enables them to process credit card transactions despite the increased risk of chargebacks and fraud associated with their sector. This specialized type of account is tailored to meet the unique needs of high-risk businesses, ensuring they can securely accept payments and manage their financial transactions effectively, which is essential for maintaining cash flow and operational stability.

Conclusion

Dealing with a suspended Zelle account can be stressful, especially affecting your daily financial transactions. It’s important to know the reasons for account freezes, including failed login attempts, policy violations, suspicious activity, security concerns, commercial use, verification problems, involvement in high-risk or illegal businesses, or prolonged inactivity. Understanding the underlying cause of the issue is essential for finding the appropriate solution.

By following the outlined steps, including contacting customer support, providing accurate details, exercising patience, and following up diligently, you can work towards resolving the suspension and regaining access to your account. Additionally, implementing preventive measures, like securing your login information, enabling two-factor authentication, updating passwords regularly, monitoring account activity, educating yourself and others about scams, securing your internet connection, considering a dedicated payment account, and partnering with high-risk merchant accounts for businesses, can help mitigate the risk of future suspensions and enhance the security of your Zelle account.

Frequently Asked Questions

Why would my account be suspended in Zelle?

Your Zelle account may be suspended if you fail to provide the necessary information for enrollment, if your identity cannot be verified, or if there are concerns about fraud or security.

Can you reactivate an inactive Zelle account?

Your account will be deactivated if you haven't used Zelle for 18 months or longer. You'll need to re-enroll to reactivate it.

How can I unsuspend my Zelle account?

To lift the suspension on your Zelle account, you can appeal by visiting this link: Zelle Support Page. Fill out the form provided with the details of your issue.

Can I make a second Zelle account?

Yes, you can create additional Zelle accounts, but you must use a different email address or U.S. mobile number for each bank account you enroll with Zelle. This ensures each account has a unique identifier for fund transfers and deposits.