The era of struggling with cash and swiping cards for payments in the current landscape has faded into obscurity. Today, the prevailing practice for transactions, whether it’s purchasing your morning coffee, groceries, or even paying for your bus fare, revolves around the effortless act of tapping your phone or card. Touch to Pay or tap to pay is a convenient payment method that accepts contactless transactions from various sources, including contactless debit or credit cards, Google Pay, Apple Pay, Samsung Pay, and other digital wallets.

This means you can transform your smartphone into a payment terminal, eliminating the need for extra hardware or terminals. Contactless payment options are increasingly common in the U.S. This article will provide an overview of touch-to-pay, how it works, and the benefits of this innovative technology.

What Is Touch to Pay?

Touch to pay, or tap to pay, enables customers to make secure payments using contactless EMV NFC-enabled chip cards or devices like smartphones and wearables. Near-field communication (NFC) is a short-range technology that allows devices to transfer information without physical contact. It utilizes a short-range radio frequency to facilitate wireless communication between a payment terminal and a contactless card or device.

As per the latest reports, over half (51%) Americans currently utilize various contactless payment forms, including mobile wallets and tap-to-go credit cards.

This payment method makes the transactions fast, does not require entering the PIN, and allows customers to pay without physically handing over their cards. Apart from hygiene, contactless payments are renowned for their security features since customers don’t directly share billing or payment information with the vendor. Instead, all communication is encrypted, and each purchase is tokenized with a unique transaction number. In the event of interception of wireless transmission, the attacker would only obtain the one-time code used to identify a specific transaction.

How Does Contactless Payment Work?

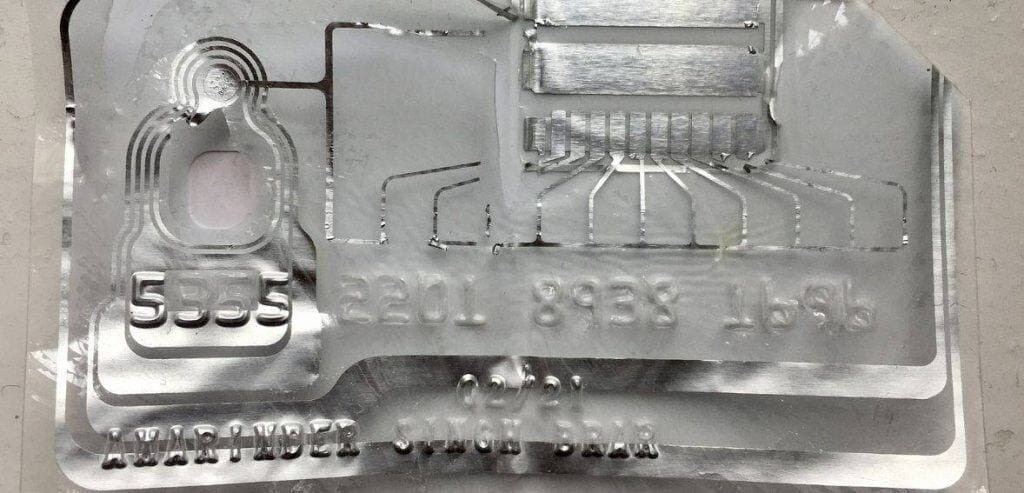

Image source- Wikipedia – Inside of a credit card

Contactless payment relies on near-field communication (NFC) and radio frequency identification (RFID). RFID includes tags and readers using radio waves to passively identify an object (such as your credit card). On the other hand, NFC is a short-range wireless technology connecting smartphones, wearables (like the Apple Watch), payment cards, and tablets. NFC technology is commonly used for coupon downloads, bill payments, and exchanging business cards.

As its popularity grows, more vendors will likely offer contactless payment. Stores, restaurants, bars, and even vending machines in the U.S. have already started integrating the technology. Here’s how a contactless payment transaction typically works:

- At the point of sale, you choose the mode of payment as “tap to pay.”

- The customer hovers their card/smartphone/wearable over the contactless sign at the payment terminal.

- Information is transmitted via a microchip to the customer’s bank.

- The system accepts or denies the transmission.

- Acceptance confirmation is usually indicated with a green light, checkmark, or noise.

Contactless chip cards are considered more secure than traditional payment methods. These cards generate a unique one-time code for each transaction, making it extremely difficult for hackers to replicate or steal data using skimming devices, as they can with magnetic stripe cards.

However, since contactless payment doesn’t require a PIN, users are most concerned about the risk of their card being lost or stolen. To address this, most banks have robust fraud protection programs. Additionally, some cards impose conservative limits, such as $30, on individual purchases made through contactless payment for added security.

Contactless Cards and Smartphone Touch to Pay

Contactless cards, such as those issued by AMEX, Visa, Mastercard, or Discover, feature a wireless symbol and utilize RFID (Radio Frequency Identification) technology. You can hover or tap these cards over a card terminal to initiate a transaction. The card emits short-range electromagnetic waves containing your card information, which are captured by the POS system and processed to complete the transaction.

While many credit cards now incorporate chips, the chip used for inserting into card readers differs from the technology in contactless cards. Visually, a contactless card appears similar to other cards, regardless of additional technologies. Typically, every card includes a magnetic strip on the back and printed credit card information.

Plus, cards linked to devices like smartphones or smartwatches offer an alternative method of contactless payment using the same technology found in contactless cards. Apple Pay or Google Pay securely stores personal and card information on an iPhone or Apple Watch. Users can then tap their devices at participating stores to complete transactions, eliminating the need to place the card at the POS.

Is Touch to Pay Secure?

As we said before, touch-to-pay is a secure payment method with several security measures in place. Unlike traditional payment options, touch-to-pay transactions do not transmit sensitive personal information like names, card numbers, expiry dates, or security codes. The contactless touch-to-pay method offers enhanced security compared to chip cards or magstripe, which are more vulnerable to account information fraud. When customers use touch-to-pay, their card and personal information are protected by various measures, ensuring their security.

- Encryption: Each transaction is encrypted with a unique code.

- Tokenization: Bank or credit card information is replaced with random, unique characters.

- Two-factor authentication: While not universally applied, most touch-to-pay methods require additional identity verification through a PIN or face ID before authorizing a transaction.

Benefits of Touch to Pay to the Businesses

In addition to the significant advantage of fraud protection, there are numerous reasons to embrace tap-to-pay payment methods.

- Accelerating the Checkout Process

Touch-to-pay streamlines the checkout experience, allowing customers to enter your store, select their items, and complete payment at the self-checkout in less than 10 minutes. With a swift and seamless payment process, you and your team can allocate more time to assisting shoppers. Touch-to-pay transactions can be up to 10 times quicker than other payment methods.

- Rising Demand

Retailers are increasingly facing customers who anticipate the convenience of tap-to-pay options. Research indicates that 67% of millennials utilize digital wallets, leading to declining cash and credit card usage.

Recent research reveals that 41% of consumers would avoid shopping at stores that lack contactless payment options, as consumers prioritize convenience and speed when selecting payment methods.

- Durability Benefits

Unlike magnetic strips and EMV chips, which can deteriorate over time due to frequent contact with payment terminals, contactless chips inherently avoid this issue. A contactless card chip is designed to last for many years, providing reliability and longevity.

- Travel Convenience

Contactless payment technology has become widely prevalent overseas, particularly in Canada, Australia, and Europe, where it is virtually the standard. Many self-service ticket machines necessitate a chip and PIN-enabled card or contactless payment. If you lack a card with chip and PIN technology, the contactless payment becomes indispensable for transactions with certain vendors.

- No Additional Fees

Contactless payments have no extra processing fees or undisclosed charges, even if the transaction is done via a smartphone. The sole charges are associated with the processing fee of the credit or debit card linked to the phone. This aspect makes contactless payment particularly appealing due to its minimal operational costs.

Should You Incorporate Touch-to-Pay at Your Establishment?

Several factors should be considered when integrating touch-to-pay technology into your business. If you value the convenience of contactless payments, you’ll probably appreciate its benefits to your customers when they see the NFC symbol at your entrance. However, it’s important to note that implementing this technology is not always necessary for all businesses.

If you want to evaluate your decision effectively, here are some things you should consider:

- What is the standard practice among your competitors? If you’re the first to introduce contactless payments in your area, this could set you apart. However, if your rivals already offer this option, its importance becomes even more significant. While it may not be the only factor influencing where customers choose to shop, staying competitive is essential.

- Have you considered improving other aspects of the customer experience? Contactless payments are just one part of a more significant trend toward more sophisticated, personalized, and contemporary customer interactions. Simply adding this feature without considering the overall customer experience may not significantly impact.

- If you are updating your equipment, this is a great opportunity to consider acquiring an NFC-capable terminal. Upgrading your payment systems or transitioning to a new merchant service provider can also be a good time to make this move. With many options available, finding a suitable solution should be relatively easy.

How to Integrate Touch to Pay in Your Business?

Follow these straightforward steps to incorporate contactless payment methods into your business seamlessly:

- Assess Your Business’s Requirements

Before embracing touchless payment technologies, engage with your customers to understand their preferences regarding contactless payments and their openness to adopting such methods. Additionally, evaluate your average transaction volume and the nature of your offerings to determine the feasibility of adding NFC payment options.

- Evaluate Your Existing Equipment

Your current smartphone or POS system may already be equipped to handle contactless transactions. Check for the presence of the wireless symbol as an indicator. If available, consult with your payment provider for activation details or explore how to integrate contactless capabilities into your existing setup.

- Conduct Tests and Gather Feedback

Before officially launching, thoroughly test your new contactless payment setup. Solicit feedback from your team and a select group of customers to address any issues and ensure a seamless experience.

- Train Your Team

Ensure your staff is well informed about the workings of contactless payments, including security protocols and handling customer inquiries effectively.

For those new to contactless payments, have your staff ready to assist in using touch-to-pay services. Highlight the convenience, speed, and security benefits to encourage adoption.

- Promote Contactless Payment to Your Customers

Make sure your customers are aware of the touch-free payment options at your establishment. Use contactless payment symbols and clear signage within your premises, and consider utilizing social media or your website for broader outreach. Also, arrange your store layout to support a smooth, contactless transaction flow.

Conclusion

Tap-to-pay is transforming how we make payments by offering convenience, speed, and security. This payment method leverages contactless EMV NFC-enabled chip cards or devices like smartphones, ensuring secure transactions through encryption, tokenization, and two-factor authentication. Businesses that adopt touch-to-pay benefit from streamlined checkout processes, increased demand, enhanced durability, travel convenience, and reduced operational costs.

While businesses should consider customer preferences and competitive factors before integrating touch-to-pay, doing so offers a competitive edge and improves the overall customer experience. By following simple steps to incorporate touch-to-pay, businesses can seamlessly transition and capitalize on this innovative payment technology, driving growth and success in today’s digital economy.

Frequently Asked Questions

How does touch-to-pay work?

Touch-to-pay operates similarly to chip payment cards at POS terminals. Using NFC technology, the card or device sends a secure, one-time token to the payment terminal unique to that specific transaction.

Is touch to pay safe?

Yes, touch-to-pay employs dynamic authentication, significantly lowering the risk of card fraud and unauthorized access to your financial data. Embracing contactless payments ensures advanced security features safeguard your transactions.

Do you need a PIN to tap to pay?

Typically, no PIN or signature is required for contactless payments. Therefore, if your card is lost or stolen, it could potentially be used by someone else without easy detection.

How do I use my tap card on Apple Pay?

Go to the Cards section and choose “Add a TAP Card to Apple Wallet” or press the “Add card” symbol to add a TAP card to Apple Wallet. To add a pass or stored value to your card, simply follow the instructions. After purchasing, choose “Add to Apple Wallet” and pick the Apple device (iPhone or Apple Watch) to use your new card.