Imagine a raging river, its turbulent waters rushing downstream, sweeping everything in its path. Now, replace that river with your hard-earned money, flowing out of your pockets faster than it trickles in. This relentless torrent of expenses exceeding income is known as negative cash flow, a financial predicament that can leave even the most astute individuals feeling like they’re drowning. But fear not, for in the face of adversity lies opportunity. In this article, we’ll explore the concept of negative cash flow, dissect its causes, and equip you with a life vest of strategies to navigate these treacherous waters. So, grab hold of your fiscal compass, and let’s chart a course toward financial stability and success!

What is a Negative Cash Flow?

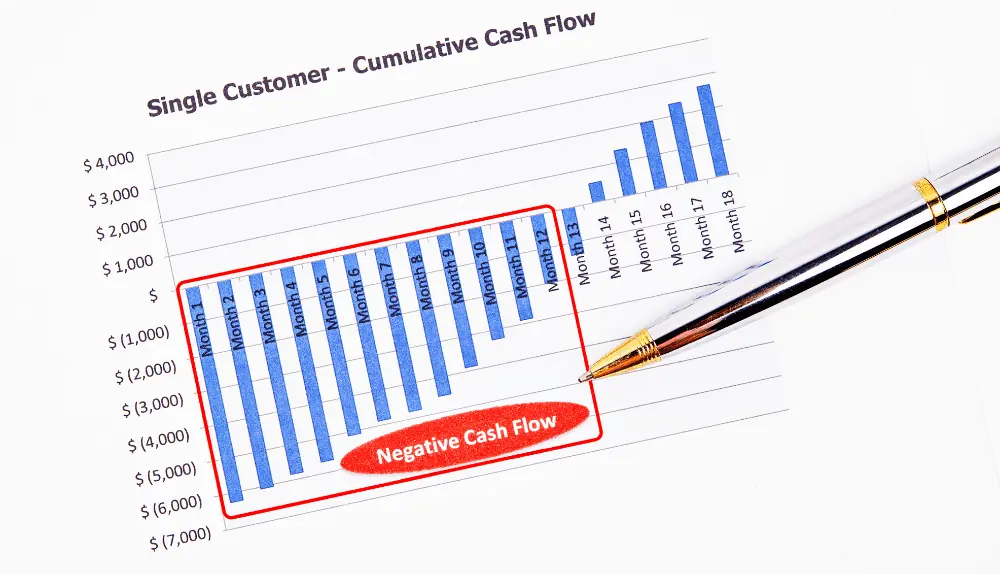

Negative cash flow is a financial condition where the outgoing cash from a business or individual exceeds the incoming cash. It is akin to a leaky bucket, with money pouring out faster than it can be replenished. In simpler terms, it means spending more money than what is being earned or generated. This can occur due to various factors such as high expenses, low sales or income, excessive debt payments, or poor financial management.

Negative cash flow can be a temporary setback or a chronic problem, but either way, it can have detrimental consequences. It can strain the ability to pay bills, meet financial obligations, or invest in growth opportunities. Without intervention, negative cash flow can lead to accumulating debt, cash shortages, and even bankruptcy.

However, it’s important to note that negative cash flow is not always a sign of impending doom. With effective financial planning, budgeting, expense control, and strategic decision-making, it is possible to reverse the tide and restore financial stability.

What Causes Negative Cash Flow?

Negative cash flow can be a formidable financial challenge, capable of throwing individuals and businesses into disarray. Understanding the causes behind this cash crunch is crucial in order to tackle the problem head-on. From high expenses and low sales to inefficient inventory management and inadequate financial planning, there are various factors that can contribute to negative cash flow.

By identifying these causes and implementing strategic measures, one can regain control and steer towards a positive cash flow trajectory. Let’s delve deeper into the root causes of negative cash flow and explore effective solutions to handle this financial predicament.

High Expenses

One of the primary causes of negative cash flow is excessive expenses. When expenses outweigh income, it creates a deficit. This can result from high operating costs, such as rent, utilities, salaries, or inventory expenses. Uncontrolled spending, extravagant purchases, or poor cost management can also contribute to high expenses.

Low Sales or Income

Insufficient revenue or low sales can lead to negative cash flow. When businesses fail to generate enough income to cover their expenses, it results in a cash shortfall. Factors such as economic downturns, market competition, pricing issues, or declining customer demand can all contribute to lower sales or income.

Excessive Debt Payments

Heavy debt burdens, including loan repayments or interest payments, can consume a significant portion of cash flow. If debt obligations are high and not adequately managed, it can drain cash reserves and create a negative cash flow situation.

Inefficient Inventory Management

Poor inventory management practices can tie up substantial amounts of capital, leading to negative cash flow. Excess inventory or slow inventory turnover can result in cash being tied up in unsold products, causing a strain on cash flow.

Seasonal or Cyclical Nature of Business

Some businesses experience fluctuations in their cash flow due to seasonal or cyclical factors. For instance, businesses heavily reliant on holiday sales may struggle during off-peak months. Such fluctuations can result in negative cash flow during certain periods.

Inadequate Financial Planning or Budgeting

Failure to develop realistic financial plans or budgets can contribute to negative cash flow. Without proper forecasting, businesses may underestimate expenses, overestimate sales, or fail to allocate sufficient funds for unforeseen circumstances, leading to a cash flow deficit.

Inefficient Accounts Receivable Management

Delayed or uncollected payments from customers can severely impact cash flow. Inefficient accounts receivable management, lax credit policies, or late payment collection procedures can all contribute to negative cash flow.

Economic Factors and External Events

Economic recessions, policy changes, market disruptions, or unexpected events like natural disasters can adversely affect cash flow. These external factors can reduce sales, increase costs, or create financial uncertainty, leading to negative cash flow.

Understanding the causes of negative cash flow is essential for businesses and individuals to identify areas for improvement and implement strategies to restore positive cash flow. By addressing these underlying causes and implementing effective cash management practices, it is possible to reverse the flow and regain financial stability.

How Negative Cash Flow Affects Businesses

Negative cash flow can have significant ramifications on businesses, affecting their financial health and overall operations. Here are some key ways in which negative cash flow can impact businesses:

Limited Working Capital

Negative cash flow limits the availability of working capital, which is essential for day-to-day operations, purchasing inventory, paying suppliers, and covering operational expenses. Insufficient working capital can lead to payment delays, compromised relationships with suppliers, and hindered business growth.

Inability to Meet Financial Obligations

Negative cash flow can make it difficult for businesses to meet their financial obligations, such as loan repayments, rent, utilities, and payroll. This can result in late payments, penalties, damaged credit ratings, and strained relationships with creditors or landlords.

Restricted Growth and Investment Opportunities

A lack of positive cash flow restricts a business’s ability to invest in growth opportunities, such as expanding operations, acquiring new assets, developing new products, or entering new markets. This can hinder the business’s competitiveness and limit its potential for long-term success.

Increased Reliance on Debt

Negative cash flow often forces businesses to rely on external financing, such as loans or lines of credit, to cover operational expenses and bridge the cash gap. This can lead to accumulating debt, higher interest payments, and increased financial risks.

Employee Morale and Retention Challenges

Cash flow issues can impact employee morale and job security. If a business struggles to pay salaries or provide regular compensation, it can lead to dissatisfaction, demotivation, and even higher employee turnover. This can disrupt productivity, hinder team cohesion, and increase recruitment and training costs.

Limited Financial Flexibility

Negative cash flow restricts a business’s ability to respond to unforeseen circumstances or take advantage of emerging opportunities. Without sufficient cash reserves, businesses may find it challenging to navigate economic downturns, invest in innovation, or adapt to changing market conditions.

Potential Business Failure

If negative cash flow persists over an extended period, it can ultimately lead to business failure. Inability to generate enough cash to sustain operations, meet financial obligations, or fund necessary investments can result in bankruptcy or closure.

It is crucial for businesses to proactively manage cash flow, monitor financial performance, and implement effective strategies to reverse negative cash flow. By improving revenue generation, reducing expenses, optimizing inventory management, and maintaining strong financial planning and budgeting practices, businesses can mitigate the impact of negative cash flow and work towards financial stability and growth.

How to Manage Negative Cash Flows

Managing negative cash flow requires a proactive and strategic approach to improve financial stability and restore positive cash flow. Here are some effective strategies to handle and manage negative cash flow:

Review and Reduce Expenses

Conduct a thorough review of your expenses to identify areas where costs can be reduced or eliminated. Look for non-essential expenditures, negotiate better deals with suppliers, explore cost-saving measures, and prioritize essential expenses.

Improve Cash Inflows

Focus on boosting your cash inflows by implementing strategies to increase sales and generate revenue. This can include exploring new marketing initiatives, targeting new customer segments, offering promotions or discounts, or diversifying your product or service offerings.

Tighten Credit and Collections Policies

Enhance your credit and collections policies to ensure timely payments from customers. Set clear payment terms, send timely reminders, incentivize early payments, and consider implementing stricter credit screening processes for new customers.

Negotiate with Creditors and Suppliers

Engage in open communication with your creditors and suppliers to negotiate favorable payment terms. Request extended payment terms, discounts, or installment plans to manage your cash flow more effectively.

Improve Inventory Management

Optimize your inventory management practices to avoid tying up excess cash in unsold products. Regularly review and adjust your inventory levels, implement just-in-time inventory systems, and consider partnering with suppliers for consignment arrangements.

Seek Additional Funding or Financing

Explore financing options to bridge the cash flow gap. This may involve securing a short-term loan, line of credit or seeking investors. However, exercise caution and ensure that the cost of financing does not exacerbate your cash flow challenges.

Enhance Financial Planning and Budgeting

Develop a comprehensive financial plan and budget that aligns with your business goals. Regularly monitor and update your financial projections, track actual performance against the budget, and make adjustments as necessary to improve cash flow management.

Consider Cost-cutting Measures

Evaluate your business operations and identify areas where you can implement cost-cutting measures. This may involve reducing staffing levels, renegotiating leases, downsizing office space, or outsourcing non-core functions.

Prioritize Cash Flow Management

Make cash flow management a top priority within your organization. Assign someone responsible for monitoring and analyzing cash flow regularly and implement cash flow forecasting tools to anticipate and address potential cash flow gaps in advance.

Seek Professional Guidance

If you are struggling to manage negative cash flow, consider consulting with a financial advisor or seeking the expertise of a business consultant. They can provide valuable insights, guidance, and practical solutions tailored to your specific circumstances.

Managing negative cash flow requires a proactive and disciplined approach. By implementing these strategies and continuously monitoring and adjusting your financial practices, you can navigate through challenging times and work towards restoring positive cash flow and financial stability.

Consequences of Negative Cash Flow

Negative cash flow can have several consequences for businesses, impacting their financial health, operations, and overall sustainability. Here are some key consequences of negative cash flow:

Insufficient Working Capital

Negative cash flow limits the availability of working capital, which is necessary for day-to-day operations, purchasing inventory, paying suppliers, and covering operational expenses. Insufficient working capital can disrupt business operations, hinder growth opportunities, and lead to liquidity issues.

Difficulty Meeting Financial Obligations

Negative cash flow can make it challenging for businesses to meet their financial obligations. This includes paying creditors, suppliers, and lenders on time. Late or missed payments can strain relationships, result in penalties or fines, and damage the business’s credit rating.

Limited Growth and Investment Opportunities

Negative cash flow restricts a business’s ability to invest in growth opportunities. Lack of funds hampers expansion plans, research and development initiatives, marketing efforts, and technological advancements. It can impede a business’s competitiveness and hinder its ability to capitalize on emerging opportunities.

Increased Debt and Interest Payments

To bridge the cash flow gap, businesses may resort to borrowing funds, taking on additional debt, or relying on credit lines. This can result in increased interest payments and debt burdens, which can further strain cash flow and financial stability.

Damaged Supplier and Creditor Relationships

Consistently negative cash flow can strain relationships with suppliers and creditors. Late or incomplete payments may result in reduced credit terms, limited access to supplies, and strained partnerships. This can impact the business’s ability to operate efficiently and maintain crucial supplier relationships.

Reduced Employee Morale and Retention Challenges

Negative cash flow can affect employee morale and job security. The inability to meet payroll obligations or offer competitive compensation packages can lead to demotivation, increased turnover rates, and difficulties in attracting and retaining top talent.

Limited Financial Flexibility

Negative cash flow limits a business’s financial flexibility and ability to respond to unforeseen circumstances. It reduces the ability to weather economic downturns, adapt to market changes, or invest in innovation. This can make the business vulnerable to external risks and challenges.

Risk of Business Failure

Prolonged negative cash flow can ultimately lead to business failure. Inadequate cash reserves, inability to cover operational costs, and a lack of resources to invest in growth or recovery strategies can result in bankruptcy or closure.

Understanding the consequences of negative cash flow is crucial for businesses to take proactive measures to address and improve their cash flow situation. Implementing effective cash management practices, improving revenue generation, reducing expenses, and seeking professional guidance when needed can help mitigate the impact of negative cash flow and pave the way for financial stability and long-term success.

How to Create a Successful Business Budget

Creating a successful business budget is a critical step in effective financial management. It helps businesses plan and allocate resources, track expenses, and make informed financial decisions. Here are the key steps to create a successful business budget:

Set Clear Goals

Begin by defining your business goals and objectives. These goals will serve as the foundation for your budget and guide your financial planning. Identify specific targets such as revenue growth, expense reduction, or profit margins that you want to achieve.

Gather Financial Data

Collect accurate and up-to-date financial data from your business records. This includes income statements, balance sheets, cash flow statements, and other relevant financial documents. Analyze this data to understand your historical financial performance and identify trends and patterns.

Determine Revenue Streams

Identify and project your revenue streams. This may include sales of products or services, subscription fees, royalties, or other income sources. Be realistic and consider factors such as market conditions, customer demand, and industry trends when estimating revenue.

Estimate Expenses

Categorize and estimate your business expenses. Common expense categories include personnel costs, rent, utilities, marketing, supplies, equipment, insurance, and taxes. Use historical data, industry benchmarks, and market research to ensure accurate estimation.

Consider Fixed and Variable Costs

Differentiate between fixed and variable costs. Fixed costs remain constant regardless of production or sales volume (e.g., rent), while variable costs fluctuate based on business activity (e.g., raw materials). This distinction helps you understand the impact of changes in business operations on expenses.

Allocate Resources

Allocate resources based on your business goals and priorities. Determine how much budget to allocate to each department or cost center. Consider factors such as growth opportunities, strategic initiatives, and areas that require additional investment or cost reduction.

Incorporate Contingency

Set aside a contingency or buffer amount to account for unexpected expenses or emergencies. This provides a safety net and helps manage unforeseen financial challenges without derailing your budget.

Track and Review

Implement a system to track your actual financial performance against your budget. Regularly review and compare your budgeted figures with actual results. This will help you identify any variances, assess your financial health, and make adjustments as necessary.

Involve Stakeholders

Engage key stakeholders such as department heads, managers, or financial advisors in the budgeting process. Seek their input and insights to ensure a comprehensive and realistic budget that considers all aspects of the business.

Revise and Update

Budgets are not static documents. Review and update your budget periodically to reflect changes in the business environment, market conditions, or strategic objectives. Adjustments may be required based on new opportunities, challenges, or shifts in business priorities.

Communicate and Monitor

Ensure effective communication of the budget to all relevant stakeholders within your organization. This creates awareness and accountability, encourages adherence to the budget, and fosters a shared understanding of financial goals and expectations.

Creating a successful business budget requires careful analysis, attention to detail, and a thorough understanding of your business operations. By following these steps and regularly reviewing and revising your budget, you can make informed financial decisions, optimize resource allocation, and work towards achieving your business goals.

Final Words

In conclusion, negative cash flow can have significant consequences for businesses, impacting their financial stability, operations, and growth potential. However, by understanding the causes and consequences of negative cash flow, businesses can take proactive steps to manage and recover from it. Implementing strategies such as improving cash flow management, cutting costs, increasing revenue streams, renegotiating terms with creditors, and seeking professional guidance can help businesses navigate through challenging times and restore positive cash flow.

Additionally, creating a successful business budget is a crucial tool for effective financial management. By setting clear goals, estimating revenues and expenses accurately, allocating resources strategically, and regularly monitoring and reviewing the budget, businesses can optimize their financial performance and make informed decisions.

By combining prudent financial management practices and a proactive approach to budgeting, businesses can minimize the risk of negative cash flow, maintain financial stability, and position themselves for long-term success.

Frequently Asked Questions (FAQs)

What are the common causes of negative cash flow?

Negative cash flow can be caused by various factors, including low sales or revenue, excessive operating expenses, high debt repayments, inventory management issues, economic downturns, or poor cash flow management practices.

How does negative cash flow affect a business?

Negative cash flow can have significant consequences for a business. It can lead to cash shortages, difficulties in meeting financial obligations, strained supplier relationships, limited growth opportunities, increased debt, reduced employee morale, and, in extreme cases, business failure.

How can businesses manage negative cash flow?

Managing negative cash flow requires a proactive approach. Businesses can take steps such as improving cash flow forecasting, reducing expenses, increasing sales and revenue, renegotiating payment terms with creditors, controlling inventory levels, seeking financing options, and implementing effective cash flow management practices.

How long does it take to recover from negative cash flow?

The time it takes to recover from negative cash flow varies depending on the specific circumstances of the business, the severity of the cash flow issues, and the effectiveness of the recovery strategies implemented. Recovery can take anywhere from a few months to several years.

When should a business seek professional assistance for managing negative cash flow?

If a business is struggling with negative cash flow and is unable to effectively address the issue internally, it may be beneficial to seek professional assistance. Financial advisors, accountants, or business consultants with expertise in cash flow management can provide guidance, identify areas for improvement, and offer tailored strategies to overcome cash flow challenges.