Launching a new venture is a difficult process, primarily due to the financial hurdles. Many promising entrepreneurs find themselves at a crossroads, holding back from pursuing their business dreams because they do not have enough funds for their venture. Interest rates are high, and nobody wants to invest in new ideas. Crowdfunding is the solution.

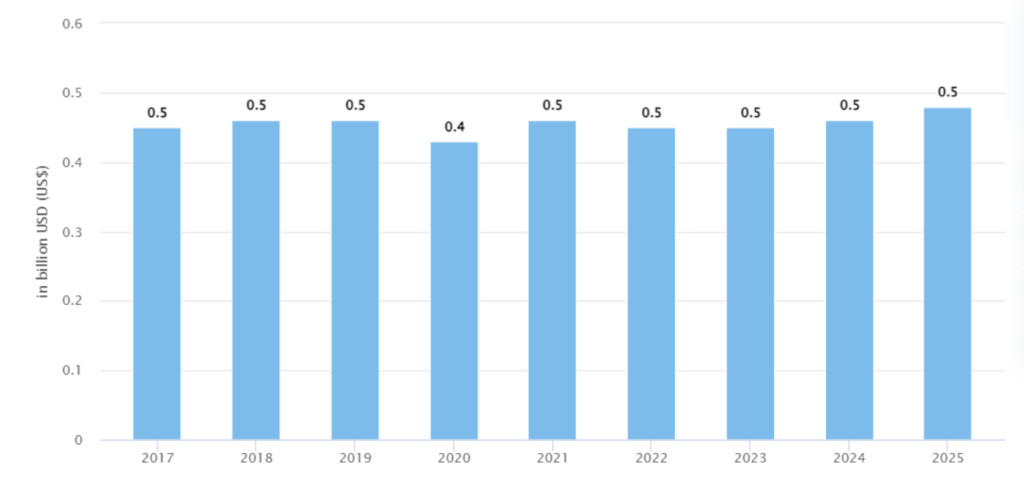

Source: Statista – The total transaction value in the Crowdfunding market is expected to reach US$0.5bn in 2024.

Crowdfunding has become popular with startups and individuals wanting to raise capital. More than just a funding mechanism, it offers the invaluable benefit of building a community around a business or an idea. Entrepreneurs secure financial backing and engage with a crowd that provides market insights and opens doors to potential customers. So, what is crowdfunding? How can a business or an individual raise finance with the help of crowdfunding? Let us find out.

What is Crowdfunding?

Crowdfunding is an alternative to traditional bank loans that pools money from several individuals to fund new ideas and projects. It is an online tool where the startup manager sets a fundraising timeline and financial goals. The funds can be in the form of donations for charity goals or an investment in a startup.

People from different backgrounds then fund the campaign. They can be friends, family, investment groups, individual investors, and people attracted to the business idea. The aim is to secure the investment commitment of as many individual investors as possible until the fund target is achieved.

How does Crowdfunding Work?

Capital is the most crucial part of any new startup or business that wants to expand. Established corporations often need help raising funds from investors or obtaining additional loans. However, smaller companies and startups find fundraising challenging. This is where crowdfunding proves invaluable. Crowdfunding platforms are websites that facilitate smooth interaction between fundraisers and the public. Depending on the platform used, people can contribute funds for the idea, or they can become an investor in the company seeking funds.

Through crowdfunding, business owners have a unique opportunity to collect significant amounts of money, which sometimes exceeds millions of dollars, from people who want to support a business and invest their funds. It serves as a field where everyone can present an idea to investors who may support it. Generally, a platform will charge a fee to your fundraiser when your campaign raises money.

Many platforms operate on an all-or-nothing funding model. This means that if the fundraiser reaches its target, it receives the pledged funds, but if it doesn’t, all pledged funds are returned to the contributors without any financial loss. Different types of crowdfunding exist, including peer-to-peer, equity, and rewards. Some crowdfunding platforms like Patreon offer a subscription-based model where the fundraiser gets funds regularly.

Benefits of Crowdfunding

Here are some of the benefits of crowdfunding:

- No credit score required

To get a loan from a bank or financial institution, you will require a good credit score. However, with crowdfunding, a credit score is irrelevant. It is the idea that matters the most. This is significant for startups and small businesses as they have limited opportunities to get their finances from traditional institutions. Crowdfunding gives them a platform to share their ideas with the world, and people can contribute to their ideas. Similarly, if a person is required to raise money for charity, they can easily use a platform like GoFundMe.

Whether you are deemed “credit invisible” with no credit history, crowdfunding offers an alternative means of financing to launch or expand your business.

- No obligation to repay

One of the primary benefits of equity, reward, and donation-based crowdfunding is the absence of monthly loan payments. Although you may need to give them some equity in your company to attract crowdfunding contributions, there is no repayment obligation.

Businesses may choose to crowdfund over loans to avoid concerns about defaulting. Nonetheless, if they choose debt-based crowdfunding, they must reimburse their supporters.

- Validates your concept

Crowdfunding platforms are the best place to validate your concept or ideas. The enthusiasm of donors’ contributions to a campaign often indicates the project’s potential success and market demand. Achieving the campaign goal before the deadline or surpassing the fundraising target substantially are positive signs of concept validation. This not only enhances your credibility but also imparts trust among potential investors.

These platforms allow you to experiment and gauge public interest in your ideas. It provides insights into the marketability of your concept and helps you determine if it’s worth pursuing further. Failure to succeed in a crowdfunding campaign encourages a reassessment of your idea and improve it further.

- A quick way to raise funds

Crowdfunding campaigns typically run for one to two months, including preparation time. This makes it quicker for entrepreneurs to gather funds than traditional routes like bank loans or VC pitches. Moreover, you have complete control throughout your crowdfunding campaign.

Securing a small business loan can be lengthy, involving several months of preparation, approval, and fund disbursement. Similarly, pitching to VC firms and finalizing a deal may take months, assuming you have access to such networks. Crowdfunding offers a solution to these challenges by providing a more accessible funding option.

- Best place for marketing

A successful crowdfunding campaign can also be a powerful marketing campaign. Supported by a remarkable business idea and a compelling campaign page, you can effectively use it to promote your ideas to the world. It is free publicity across the internet and social media, ranging from viral social media posts to media coverage. Additionally, buzzworthy campaigns can attract potential investors.

List of Top Crowdfunding Platforms

Kickstarter: Kickstarter mainly focuses on creative projects like music, art, film, and technology. Its model is “all-or-nothing,” which means that you get the funds only if the funding achieves its goals. Otherwise, the money is paid back to the donors.

Indiegogo: Indiegogo is more flexible than Kickstarter. It offers fixed and flexible funding options. Indiegogo supports a wide range of campaigns that include inventions, gadgets, and community projects.

GoFundMe: This platform is best known for personal and charitable crowdfunding. GoFundMe allows individuals to raise funds for emergencies, medical expenses, education costs, etc.

Patreon: This crowdfunding platform is different from others in many ways. Patreon operates on a subscription model, allowing creators to receive funding from their fans or patrons regularly.

Crowdfunder: Crowdfunder focuses primarily on the business side. It connects startups and growing businesses with investors, offering equity crowdfunding where backers receive a stake in the business.

SeedInvest: This platform, like Crowfunder, offers equity crowdfunding. SeedInvest is aimed at tech startups and provides a platform for them to raise funds from accredited investors.

StartEngine: This platform helps entrepreneurs achieve their dreams of raising capital through equity crowdfunding, allowing the public to invest in startups and early-stage companies.

Fundable: Fundable is tailored for small businesses. It offers rewards-based options and equity crowdfunding options. Depending on your campaign’s requirements, you can choose any option.

Crowdcube: This platform is based in the UK. Crowdcube is an equity crowdfunding platform that allows anyone to invest in startups and growing businesses.

Kiva: Kiva is the best place to get microfinancing. It allows people to lend money to entrepreneurs worldwide, supporting small businesses and communities with loans rather than donations.

Different Types of Crowdfunding Platforms

Crowdfunding comes in various forms, each tailored to different needs and objectives:

- Donation-Based Crowdfunding: This type raises funds for social projects, often through social media platforms and other awareness campaigns.

- Reward-Based Crowdfunding: Investors receive rewards corresponding to their investment. Many startups prefer this approach, offering gifts, coupons, goods, services, and more as incentives.

- Equity Crowdfunding: Investors acquire equity in the company in exchange for their investment, effectively becoming partial owners.

- Debt Crowdfunding: Companies promise to repay the invested amount and interest, making this akin to a loan.

- Real Estate Crowdfunding: This form supports fundraising in the real estate sector, offering the potential for substantial returns once the project generates revenue.

What are the Real-Life Examples of Crowdfunding Success Stories?

There are many examples of companies reaching the skies after getting their initial crowdfunding. Here are some of the most successful (and some unsuccessful) examples:

- Brewdog’s

BrewDog, a Scottish brewery now recognized globally, owes much of its growth to crowdfunding. Dubbed ‘Equity for punks,’ Brewdog’s early fundraising efforts transformed it from a small-batch craft beer producer into a company that raised a remarkable $126 million over the campaign’s duration. This substantial funding provided a solid foundation for the company, enabling it to expand its marketing strategy beyond crowdfunding and into the broader retail market.

Another significant aspect of Brewdog’s evolution is its commitment to non-profit and environmental initiatives. At the time of writing, Brewdog proudly promotes itself as ‘The world’s first carbon-negative brewery,’ positioning it as an environmentally conscious choice for investors seeking alignment with their values. This strategic move has effectively positioned Brewdog in a league of its own as an environmentally active brewery.

- Oculus Rift

In 2012, Palmer Luckey, the visionary behind Oculus Rift, embarked on a crowdfunding journey at the age of 20. Little did he know that his campaign would become one of the biggest success stories of its time, with over 9,500 backers rallying behind his vision and raising over $2.4 million.

Fast-forward to 2014, Facebook swooped in to acquire Oculus VR for a staggering $2 billion. Today, Oculus Rift proudly stands as a member of the Facebook Family, with its revenue forecasted to reach a whopping $4.95 billion worldwide in 2019 solely from hardware sales.

But the story doesn’t end there. In October 2021, Meta, formerly known as Facebook, announced plans to retire the Oculus brand and rebrand its line of VR headsets as Meta Quest. Additionally, the company’s VR and AR segment, now under the umbrella of Reality Labs, experienced exponential growth, generating $2.2 billion in revenue in 2021, compared to $1.1 billion the previous year.

- OUYA

Let’s take a closer look at the OUYA gaming console, a prime example of the highs and lows of crowdfunding ventures. Initially, OUYA captured the attention of investors worldwide, raking in a staggering $8 million during its crowdfunding phase. The allure of merging mobile gaming with a cinematic, large-screen experience and its sleek branding proved irresistible to many.

However, despite its promising start, OUYA’s journey was fraught with challenges. While the crowdfunding campaign soared, the project’s execution stumbled. Technical glitches marred the user experience, as the console’s sales peaked at 200,000 units.

Successful crowdfunding is just one part of the entire process. Ultimately, customer experience is what matters.

- Glowforge

Glowforge made headlines by smashing Pebble’s crowdfunding record, pulling in an impressive $27.9 million within just one month. This innovative 3D laser printer empowers users to create a wide array of products using materials ranging from leather to plastic. Moreover, during its crowdfunding campaign, the company sweetened the deal by offering the product at a significant discount. Building on this momentum, Glowforge secured another $10 million in funding from other investors in 2018.

Conclusion

Crowdfunding offers one of the easiest ways to fund innovative ideas and projects. It empowers entrepreneurs to realize their dreams while engaging directly with their target audience. Through various crowdfunding models, such as equity, rewards, and donation-based platforms, individuals can access capital without the constraints of traditional financial institutions. This can help startups like Glowforge to become successful or accelerate the growth of small businesses.

Crowdfunding serves as a validation tool, gauging market interest and providing invaluable feedback for entrepreneurs. Real-life success stories such as Brewdog, Oculus Rift, and Glowforge underscore the potential of crowdfunding to catalyze remarkable achievements. However, cautionary tales like OUYA remind us of the importance of execution and product viability beyond fundraising efforts.

Frequently Asked Questions

What is crowdfunding?

Crowdfunding is gathering funds for a specific cause or project by soliciting contributions from many individuals, typically in small amounts, over a relatively short period, such as a few months.

What is the use of crowdfunding?

Crowdfunding involves raising capital from numerous individuals to support endeavors like projects, business ventures, product launches, or charitable causes. These campaigns are usually conducted online via crowdfunding platforms to get support and reach a predetermined fundraising target.

What's an example of a crowdfunding model?

One example of donation-based crowdfunding is raising funds for medical expenses or unexpected financial emergencies. Additionally, crowdfunding can support local initiatives such as community gardens or new park developments.

How to Begin Crowdfunding?

1- Assess if your idea is suitable for crowdfunding.

2- Choose the type of crowdfunding

3- Select a crowdfunding platform

4- Create an attractive crowdfunding campaign page.

5- Formulate your promotion strategy

6- Stay engaged throughout your campaign

7- Fulfill your commitments.