When you pay online, you have to manually enter the credit or debit card details. This process takes a lot of time and is frustrating when you want to complete the buying process quickly. And this is one of the hurdles where most buyers leave or abandon the cart. This is one of the key factors that troubles eCommerce businesses. This revenue loss can be prevented with a click-to-pay option.

Click to Pay was developed by Visa, Mastercard, American Express, and Discover. As a user, you get one Click to Pay account, and you can easily use any of the mentioned card brands to purchase online or in person. Today we will understand the benefits of Click to Pay and also know if it is safe to use for online payments.

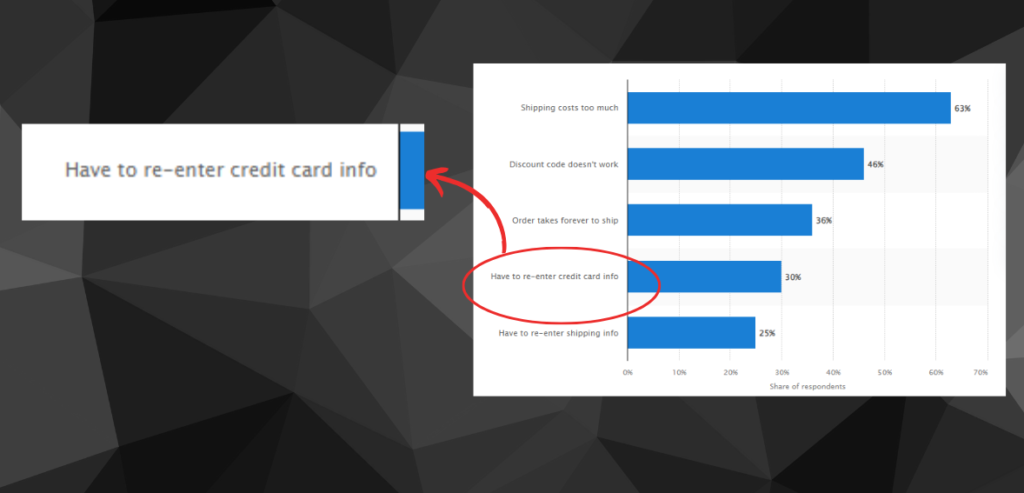

Abandoning the cart during online payment is a major disadvantage. Almost 30% of users abandon the cart because they do not want to spend time re-entering the credit card info. For merchants, this is a frustrating experience.

Source: Statista

To avoid cart abandonment, online merchants nowadays offer the option to click and pay. The user has to enter the details of their card only once. After that, they can easily pay with a single click whenever they want. This improves customer experience and also reduces the chances of abandoned carts. Click to pay simplifies the online payment process and is faster than any other method. But is it safe for customers and merchants?

What Is Click & Pay?

Click & Pay is one of the best and easiest options today available for customers. It streamlines and simplifies the e-commerce payment process for customers and helps them to complete the purchase with just one click. The user is allowed to add their card details, which is a one-time process. The user can add multiple cards irrespective of the brand. During checkout, the customer is asked to choose the card for payment, and the checkout is completed by processing the payment from the selected card. The process is swift and improves the customers’ payment experience on the online site.

Many popular retailers in the United States now use Click to Pay for payment because click & pay is one of the fastest options for payment and is also secure. Some known names that have opted for it include Expedia, Cinemark, Lowes, Fresh Direct, Papa Johns, Marriott, SHOP.com, and Rakuten. Internationally, various merchants have also embraced this technology. Examples include Mitrе 10, Emirates, 1 Day, Noel Leeming, The Warehouse, Pizza Hut, etc.

How Do Click To Pay Functions?

Major credit card companies, like Mastercard, Visa, Discover, and Amex, had similar systems in place. However, they had a drawback because each worked with its card brand and not others. But with their joint efforts, Click to Pay eliminated this barrier.

Image source: Mastercard

Payment with Click to Pay can be made with any card brand out of the four. There is no limitation. Remember, this system was developed to give a positive payment experience to online buyers. The buyer has to add the card details only once. After that, every payment can be easily made by the buyer with click to pay option. Due to this, the buyer doesn’t leave the purchase mid-way. The reason for abandoning the purchase can be many things, like missing the card at the time of purchase or being unwilling to enter the card details again when purchasing online. The Click to Pay option is highly secure, and the user can use it seamlessly on different platforms.

One-click solutions are incredibly important in reducing the number of abandoned shopping carts. Click & pay has become a major challenger to other payment processors offering one-click services and digital wallets such as PayPal, Google Pay, and Apple Pay.

How Does CTP Work For Consumers?

The first step for the customer who wants to use Click to Pay is to register. The customer can register and create a CTP profile. Visa and Mastercard give this option on their websites. The issuing bank of these cards also gives the option to register for their consumers.

Discover, and American Express don’t offer dedicated sign-up pages at the moment. Instead, you can create your CTP profile using the service during your initial purchase. During checkout, you can select the CTP option and choose the credit card you want to use for the payment.

If you want to create a Click to Pay account, then follow these steps.

- The first step is to enter your email address. This will also serve as your CTP Usеr ID.

- The next step is to enter your phone number.

- The system will then ask for your credit card details. You will have to enter the card number, expiration date, and the CVV number.

- The next step is to enter your address (that is associated with the card you are adding).

- Once all details are entered, you can submit the information. You will then get a verification code on the email that you entered. Use this code to complete the verification and the registration in Click to Pay.

How Does CTP Work For Merchants?

As an e-commerce store owner, you can consider adding and integrating the CTP functionality into the existing payment system. However, the setup process isn’t straightforward for merchants, although this might become more streamlined soon.

To add Click to Pay, you will have to use the API to connect your online store to the system.

Currently, the setup necessitates adding a CTP API integration to your online store. This certainly requires technical knowledge. You might have to hire a technical resource if you do not already have one on your team. Once the API is integrated successfully, your customers will see the option to Click to Pay.

Is It Safe To Use For Online Payments?

CTP ensures that your transactions are secure by using tokenization. When you use the CTP feature your credit card details are converted into an encrypted virtual card number for that transaction. This makes it more difficult for fraudsters to decode your card number. Another important aspect of Click to Pay is that when you purchase through CTP merchants never get the details of your credit/debit card number. This provides additional security.

Click to Pay also uses 2-factor authentication for a higher level of security. When you use it you get a verification code. Without the verification code, the payment will not be processed.

The only drawback that we found was impulsive behavior by the customers. The payment is made simple and the customer can buy anything with just one click. This might impact customers’ purchasing behavior. They tend to buy more than required.

Benefits Of CTP For Consumers

- Efficient, Hassle-Free Online Shopping

Whether you’re shopping for things you need for your business or treating yourself to something, having an experience is always better. With CTP, customers do no need to manually enter their card details, billing addresses, and shipping preferences every time they make a purchase. This convenient feature makes online shopping quicker and more enjoyable for customers by streamlining the process.

- Shop Anywhere

Customers can now shop from any device with an internet connection. Traditional checkout forms required all the details to be entered manually whenever a purchase was made. But with Click to Pay, the manual work is eliminated. A physical credit card is not required to complete the payment, and therefore, the user can purchase anywhere without any restrictions.

CPT is mobile-friendly, and therefore, it enhances the shopping experience on mobile devices.

- Use Any Card

Click to Pay supports any card from all the brands. Therefore, the limitation for using only one card brand for payment processing has been removed.

- Secure

Tokenization and 2-factor authentication have made this system highly secure and robust.

Benefits Of CTP For Merchants

Merchants get many benefits when using the Click to Pay facility. We have listed some of them below.

- Improved Sales

Customers abandon the cart because they do not want to enter all the details about the card again. As mentioned earlier 30% of the customers abandon the cart due to this reason. With Click to Pay, this issue has been successfully addressed. The payment is simple and takes a few seconds to complete. Therefore, the chances of abandoning the card during online purchases have been minimized.

The consumer doesn’t have to carry a physical card during payment. They can easily pay through their smartphone. Due to this, customers do not leave the purchase mid-way. This has helped online as well as brick-and-mortar merchants alike.

- Security

CTP uses the best security measures available today. Therefore, it is easy for the consumer to pay due to high trust in the system.

- Mitigates Chargeback Risk

As Click to Pay is a highly secured system using tokenization and 2-factor authentication, the chances for fraudulent activities have been minimized. Therefore, it has become easy for companies to address chargebacks quickly and efficiently for merchants. Payment disputes will be reduced substantially in the future with the increase in the use of Click to Pay as a payment option.

Conclusion

Whether your business provides subscription services or retail purchases, ensuring a smooth and unified payment experience for your customers is essential. Click to Pay effectively diminishes payment risks, enabling your business to deliver exceptional customer service.

Establishing yourself as a reliable brand can significantly enhance your sales and revenue potential.

Frequently Asked Questions

Q: What is Click to Pay?

Click to Pay was created under a cumulative effort by Mastercard, Visa, American Express, and Discover to give one unified and simple system for consumers. It was developed to enhance the buying experience for the customers where they can pay with a single click from their card.

Q: Is it safe to use Click to Pay?

Click for pay offers a secure payment method, making it challenging for scammers to access your credit card details. Therefore, it can be considered as safe.

Q: Is Click to Pay Mastercard/Visa safe?

Certainly, Mastercard/Visa CTP incorporates top-notch security technology provided by Mastercard, ensuring a secure and protected payment experience with your preferred merchants.