Apple launched the Apply Pay e-wallet in 2014 to enable mobile payments. Since then, it has gained immense popularity in the digital payment industry. Online payments are convenient for users, as they no longer need to bring cash or credit cards to brick-and-mortar stores. All they need to do is hold the smartphone in front of the store’s QR code and enter the amount. So, what is Apple Pay, and how does it work?

What is Apple Pay?

Apple Pay is a payment app for Apple mobile users. It was designed to make digital transactions convenient and safer for customers. Now, people can pay using their Apple wallets without carrying cash and credit cards to every store. This e-wallet allows you to process multiple transactions using your device.

Considering the number of people who request online payment services, businesses have started integrating Apple Pay and other e-wallets into their payment ecosystem to increase sales.

How to Use Apple Pay on iPhones?

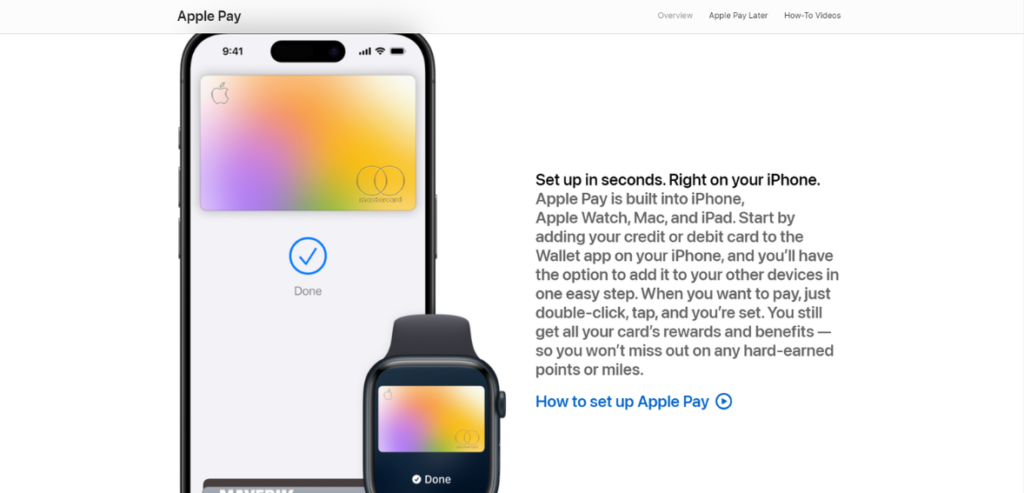

Apple Pay allows iPhone users to make payments using different options. It includes payment through messages, in-app stores, online payments, or payments at brick-and-mortar stores. To start using Apple Pay for digital transactions, the user needs to link their credit card or bank account to their Apple phone. The app works on Apple, iPhone, iPad, and Apple Watch. To start using any mobile device, you need to link your credit cards to Apple Pay.

As soon as you have added your card details, you can use a password or touch ID to pay with Apple Pay. Some users can integrate face ID for maximum security.

How to pay with Apple Pay.

- Open the Wallet app on your mobile and click on the ‘+’ icon

- You will be asked to enter your credit card information. If you have your cards added to other Apple devices already, you can select that card and send the security code.

- You might be asked to download the bank’s or credit card company’s official mobile app to complete the process.

- Wait for a few minutes for your bank or the credit card company to verify your card details.

- As soon as your card is accepted, you can start using Apple Pay on the websites and retail stores that accept this payment method. You will find the Apple logo on the websites and near the payment terminals at the retail stores that accept this e-wallet.

- Following the above steps, you can change your current credit card or add another card.

Where Does Apple Pay Work?

As mentioned earlier, Apple Pay has become one of the popular payment methods for customers and retailers. Businesses have started embracing Apple Pay since more and more customers now want the flexibility of making payments from their mobiles.

- For Buying Apps or In-app Services: Apple Pay can be used to buy paid apps or services within the apps. You only need your password or touch ID to process the payment in one tap. You can also use it to make payments for subscription-based models, especially services you have purchased from Apple. Once you set up your Apple Pay on your device, there isn’t an easier way to make payments than this e-wallet. You can buy digital services and in-app products with a single button tap.

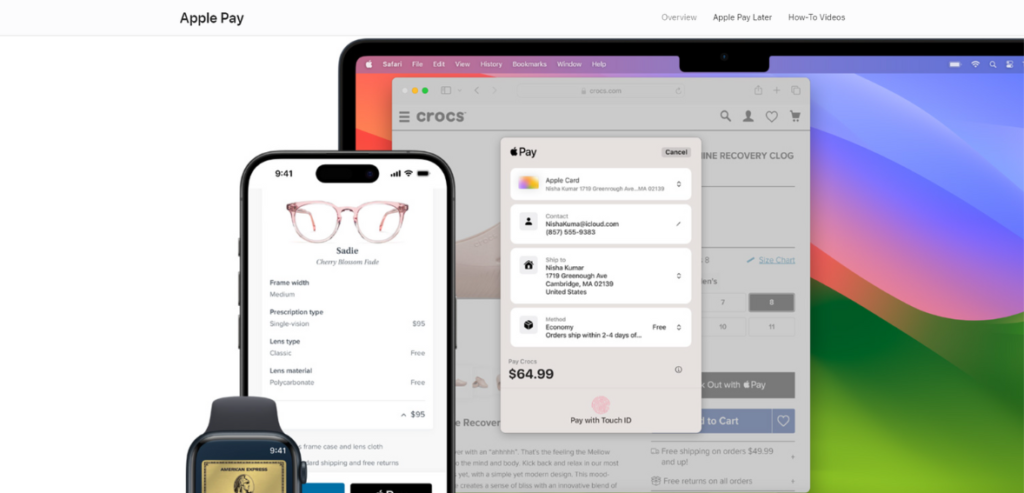

- Pay on the Web: Many website owners accept payments through Apple Pay. It works like credit and debit card payments; the only difference is that you no longer have to enter your card numbers manually. Instead of having to type your credit card number and other card details, you can enter your password for the Apple Pay app and pay through the cards linked to your Apple Pay account. Note that this works only on the websites that accept Apply Pay.

- In-Store Payments: Apple Pay is also accepted at restaurants, gas stations, grocery stores, supermarkets, and other retail stores. So, if you ever plan to visit these land-based stores, you can bring your iPhone or iPad to make the payment through Apple Pay. It is one of the safest ways to complete the transaction, as you only need to verify your identity by entering the passcode.

Why Use Apple Pay for In-store and Online Payments?

Customers prefer Apple Pay to send payments to retailers for a few reasons. For starters, they don’t have to fumble the cards or count cash to make the payment. Secondly, Apple Pay is considerably safer than any other payment method. There is no risk of losing money or paying extra cash when your credit card is linked to Apple Pay.

Besides, it is incredibly convenient for your customers. Retailers and online businesses must start accepting Apple Pay to ensure more completed transactions. You can use the POS terminal installed at your brick-and-mortar store to receive payments through Apple Pay. Ask the terminal provider whether it accepts Apple Pay before installation. Then, put the Apple Pay logo near the terminal.

A business owner must choose a payment gateway and processor to accept payments through this e-wallet. The payment processor is responsible for verifying the credit card details and validating the transaction. It also ensures secure transactions over an encrypted network. The payment gateway and processor validate in-store and online Apple Pay payments.

Bottom Line

This online e-wallet payment system in your store can save you a lot of time and money when processing payments manually. You no longer need a cashier to count cash and record the transaction in spreadsheets. If you have not integrated Apple Pay, now is the best time to add this payment method to your system and start accepting payment via the Apple Pay App.

Frequently Asked Questions

What is Apple Pay?

Apple Pay is a mobile payment and digital wallet service by Apple Inc. that allows users to make payments using their Apple devices, such as iPhones, Apple Watches, iPads, and Macs. It is designed to work with major credit, debit, and prepaid cards from participating banks, enabling secure and convenient transactions.

How does Apple Pay work?

Apple Pay uses Near Field Communication (NFC) technology for contactless payments. To make a payment, you simply hold your device near a payment terminal that supports contactless payments and authenticate the transaction using Touch ID, Face ID, or your device’s passcode.

Is Apple Pay secure?

Yes, Apple Pay is designed with security and privacy in mind. It uses a method known as tokenization to replace your card number with a unique, encrypted code for each transaction. Additionally, Apple Pay requires authentication (Touch ID, Face ID, or passcode) for every payment, and Apple does not store or have access to your original card numbers.

How do I set up Apple Pay?

To set up Apple Pay, open the Wallet app on your compatible Apple device, tap the “+” sign, and follow the instructions to add a credit or debit card. You can also add cards from within the Settings app under “Wallet & Apple Pay.”

Where can I use Apple Pay?

Apple Pay is accepted in millions of stores, restaurants, service providers, and more around the world. Look for the Apple Pay or contactless payment symbol at checkout to determine if a merchant accepts Apple Pay.

Can I use Apple Pay for online or in-app purchases?

Yes, Apple Pay can be used for online and in-app purchases on websites and in apps that accept Apple Pay. You’ll see an option to pay with Apple Pay at checkout, and you’ll need to authenticate the payment with Touch ID, Face ID, or your passcode.

Does Apple Pay work internationally?

Yes, Apple Pay works internationally, but you need to have a credit or debit card from a bank that supports Apple Pay in the country you’re attempting to use it. Be aware of any foreign transaction fees that your bank may charge.

What devices are compatible with Apple Pay?

Apple Pay is available on iPhone 6 and later, Apple Watch, iPad Pro, iPad Air 2, iPad mini 3 and later, and Mac (with macOS Sierra or later for online purchases and requires an iPhone or Apple Watch for in-store purchases).

Is there a fee for using Apple Pay?

No, Apple does not charge fees to use Apple Pay. However, your bank’s standard processing fees and any applicable card fees still apply to purchases.