The process of handling chargebacks by different card networks are generally the same. When dealing with Stripe chargebacks the platform acts as an intermediary during the dispute resolution process. They pass on your evidence to their partners who then forward it to the card issuers if needed. This entire process can take from 60 to 75 days. It’s important to note that Stripe takes responsibility for evaluating your evidence related to your disputes. Their role includes assessing whether your evidence meets the requirements set by the card company for a chargeback resolution.

If your evidence does not meet their standards, you will automatically lose the dispute. Stripe will rule in favor of the cardholder and award them the chargeback. Stripe will also close the case. Remember that ultimately it is up to the card issuer to make the decision on the dispute. The fact that Stripe relays your evidence does not guarantee any outcome in your case.

Your main goal should be to minimize Stripe chargebacks as much as possible. However, it is equally important to be prepared and ready to contest them if they do occur. In the following sections of this article, we will discuss strategies that can help you succeed in resolving disputes related to Stripe chargebacks.

We will also explore the reasons that could result in chargebacks that cannot be won the consequences of disputes and the recommended approaches to steer clear of these challenges.

What is a Stripe Chargeback?

A Stripe chargeback occurs when a customer encounters a problem with a transaction and contacts their bank to request a refund. Just like with any other payment processor, Stripe chargebacks can arise from transactions conducted over the Stripe payment network.

When a customer initiates a dispute, their bank assesses the evidence and, if warranted, retrieves the funds from your Stripe account. In addition to this, you may also incur an additional chargeback fee.

How Does Stripe Manage Chargebacks?

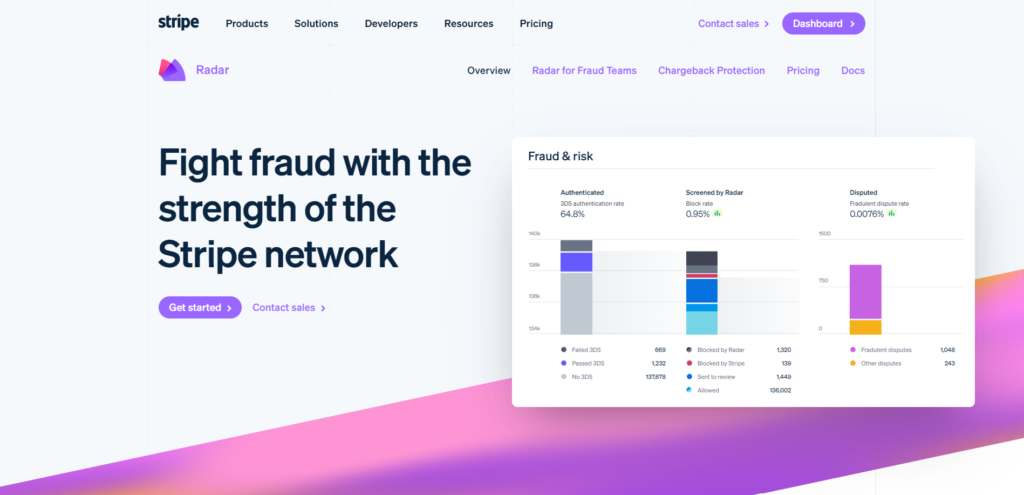

Stripe’s approach to chargebacks involves leveraging Stripe Radar, the company’s advanced AI-based fraud detection system. This comprehensive tool not only aids in proactively preventing fraud but also encompasses Stripe Chargeback Protection, which serves to shield merchants from the adverse impact of chargebacks. The system actively detects and obstructs fraudulent activities by employing sophisticated algorithms and machine learning techniques that draw insights from data across numerous global companies.

Image source: Stripe Radar

During the course of e-commerce transactions, the platform identifies buyers deemed to be of high risk. While low-risk buyers can seamlessly proceed through the checkout process, transactions flagged as potentially fraudulent prompt customers to provide additional information and may even be rejected. Notably, Radar is seamlessly integrated into the Stripe platform and requires no supplementary setup.

However, in the event that some fraudulent activities manage to slip through, you may find yourself facing chargebacks. In the absence of protective measures, you will need to respond to Stripe chargebacks in the conventional manner: gather evidence, such as receipts, copies of your return policies, and proof of delivery, and submit them through the Stripe Dashboard. It is important to be aware that a fee of $15 will be incurred for this process.

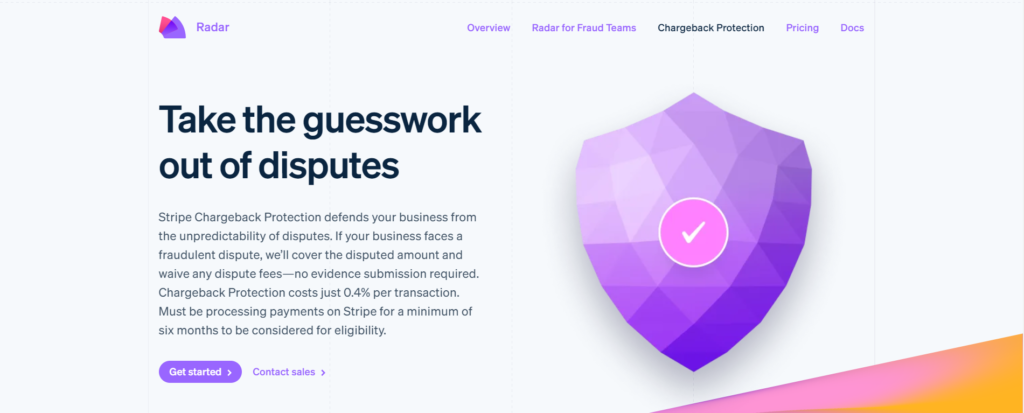

Understanding Chargebacks Protection of Stripe

Under this plan, the merchant’s sales receive robust protection against fraudulent disputes. Stripe takes the responsibility of reimbursing you for the disputed amount and waiving any associated dispute fees for qualifying transactions. Upon a chargeback being filed against a protected charge, you, as the merchant, are not obligated to assemble evidence validating the legitimacy of the transaction. As long as your account is in good standing and falls within Stripe’s “protection limit,” Stripe will directly handle the costs for you.

In this process, you remain uninvolved in the dispute resolution entirely. Stripe takes the initiative to reimburse you for the disputed transaction, exempts you from any chargeback fees, and makes the decision on whether to contest the chargeback. By opting for this protection, you authorize Stripe to challenge any fraudulent disputes on your behalf. Your active participation beyond this step is not required.

Disputes and chargebacks don’t follow a one-size-fits-all pattern, but they typically involve several key players in the process:

- The customer or cardholder

- The issuing bank

- The merchant

- The acquiring bank

- The credit card network

While Stripe does not have the ultimate authority in resolving disputes, it plays a vital role by submitting your evidence to their financial partners. These partners then pass on the information to the issuing bank if the evidence meets specific criteria. However, if the evidence does not meet the review board’s standards, the dispute is closed. Stripe ensures that merchants are kept updated on the final decision made by the issuer through various communication channels like the Stripe Dashboard, webhooks, and API.

Understanding How the Stripe Chargeback Protection Benefits Merchants

When you opt for Stripe Chargeback Protection, your business receives valuable safeguards against fraudulent disputes. Stripe takes on the responsibility of reimbursing you for the disputed amount and waiving any associated dispute fees for qualifying transactions. Under this plan, if a chargeback is filed against a protected charge, you aren’t required to gather evidence to validate the transaction’s authenticity. As long as your account remains in good standing and falls within Stripe’s designated “protection limit,” Stripe will handle the costs on your behalf.

In essence, you’re removed from the dispute process entirely. Stripe handles the reimbursement for the disputed transaction, waives chargeback fees, and makes the decision whether or not to contest the chargeback. By granting Stripe the authority to challenge fraudulent disputes on your behalf, your active involvement in the process becomes unnecessary.

A Look at Retrievals and Inquries in Credit Card Transactions

Sometimes, credit card issuers might initiate an investigation into a transaction before initiating a chargeback. While American Express refers to this as an “inquiry,” other credit card networks term it a “retrieval.” Merchants must promptly provide the necessary information within the specified time frame to prevent an inquiry from escalating into a chargeback. Alternatively, issuing a full refund can mark the inquiry as resolved, saving you from incurring any dispute fees.

Inquiries and retrievals typically arise when customers question a transaction. While providing adequate evidence often resolves the matter, there are instances where a cardholder disputes the evidence provided, or the credit card issuer deems the evidence insufficient.

Timeframes for Stripe Chargebacks

When it comes to Stripe chargebacks, it’s essential to be aware of the time limitations set by card networks. Typically, customers can initiate chargebacks within 120 days from the transaction date. However, specific industries such as travel may allow for an extended chargeback initiation window due to the intricacies of advanced bookings.

When a customer initiates a chargeback, you have a time frame of 7 to 21 days to respond to the card issuer, which varies depending on the policies of the specific card network. If you choose to contest the chargeback and present evidence, the issuer then has 60 to 75 days to review the evidence and make a decision.

The entire process, from the initial chargeback filing to the issuer’s final verdict, can span a period of 2 to 3 months. Aside from accepting the dispute without challenging it, there’s little a business can do to expedite this timeline.

Reducing Stripe Chargebacks through Effective Strategies

One of the key ways to minimize the occurrence of Stripe chargebacks is by prioritizing top-notch customer support. Establishing a reliable support system ensures that customers can easily reach out to you, decreasing the likelihood of disputes. Simplified access to site owner’s contact details or an informative FAQ page significantly reduces the chance of Stripe disputes. Proactive messaging such as ‘Contact me’ or ‘Message me on social media’ can deter potential disputes.

Furthermore, ensuring transparency throughout the purchase process is crucial. For online businesses, this involves providing comprehensive product descriptions, clear pricing information, and transparent billing procedures. A secure and user-friendly website, along with concise and informative communication, can enhance the customer experience and minimize the potential for misunderstandings that might lead to chargebacks. Additionally, including a visible contact email address in purchase confirmation emails can encourage direct communication and help build customer trust.

Addressing Stripe Chargebacks Effectively

In the event of a Stripe chargeback, it is crucial to respond promptly with compelling evidence to increase your chances of resolving the dispute in your favor. Time is of the essence, as Stripe temporarily withholds the customer’s funds, and a delayed response may potentially jeopardize more than just the single transaction. Besides harming your business’s reputation, excessive chargebacks might lead to account closure. For Stripe, the proportion of disputes filed against the account matters more than the proportion won.

To gain a comprehensive understanding of the dispute, review the customer’s account history in your Stripe dashboard. If necessary, reach out to the customer via the provided email address to resolve any underlying issues. In case of non-response, consider a follow-up after a few days.

If the customer remains unresponsive or unwilling to withdraw the chargeback, utilize the ‘Counter Dispute’ feature in your Stripe account. Provide thorough evidence of the transaction, including order confirmations, receipts, and any communication records with the customer. For tangible products, demonstrate proof of delivery. In scenarios involving online products, email exchanges and usage records, such as those accessible through the integration with Discord, serve as valuable evidence.

Present Convincing Evidence of Customer Authorization

In addressing Stripe chargebacks, it’s vital to provide compelling evidence of customer consent, particularly in cases involving fraudulent disputes, which are commonly encountered. Including data that verifies the cardholder’s awareness and approval of the disputed transaction is a critical component of a successful response. Some typical pieces of evidence include:

- AVS confirmations

- CVC validations

- Signed receipts or contracts

The IP address aligning with the cardholder’s verified billing address. Stripe typically has AVS/CVC results and the purchase IP (if accessible from your Stripe integration), but if you possess additional evidence of authorization, ensure its inclusion in your response.

Additionally, ensure compliance with the specific requirements outlined by the financial operator, such as Visa or Mastercard, to strengthen your case. Most of this information is readily available on the respective websites under their ‘chargeback’ sections. By meticulously presenting a well-documented and compelling case, you can significantly bolster your chances of successfully resolving the Stripe chargeback.

Key Takeaways:

- Gather Relevant Information

- Maintain Open Communication

- Choose a Carrier with Online Tracking

- Clearly Define Terms of Service

Conclusion

To minimize the occurrence of future chargebacks and disputes, it is important to learn from past experiences and improve your practices. Take time to analyze data and feedback obtained from your payment systems and customers, with the aim of identifying any recurring patterns or areas that need improvement. It is crucial to regularly update your information, policies, and procedures in order to align with industry best practices and meet market expectations.

Furthermore, make sure to actively seek feedback from your customers to understand their satisfaction and loyalty. Be prompt and efficient in addressing any concerns or complaints that may arise, showing your dedication to delivering exceptional service.

Frequently Asked Questions

Q: Does Stripe permit chargebacks?

To initiate a chargeback, the card issuer files a formal dispute on the card network, which promptly reverses the payment, withdrawing the payment amount and one or more network dispute fees from Stripe. Subsequently, Stripe deducts the payment amount and dispute fee from your balance.

Q: What is the chargeback threshold for Stripe?

The current threshold for dispute coverage is $25,300, exceeding the annual limit of $25,000 for Chargeback Protection. Therefore, this dispute will not be eligible for coverage by Stripe. Once you have reached the maximum number of protected disputes in a calendar year, any additional disputes filed against your account within that same year will not be covered by Stripe.

Q: Who typically prevails in chargebacks?

Generally, cardholders tend to win roughly 7 out of 8 chargebacks filed. In contrast, merchants have less than a 50/50 chance of winning their representment cases.

Q: What are the consequences if a merchant accepts a chargeback?

Once the merchant accepts the chargeback, the cardholder's temporary credit becomes permanent, and the case is closed. On the other hand, if the merchant fails to respond within the given deadline, they automatically accept the chargeback. Merchants may choose to accept chargebacks for different reasons.