If you use Stripe dashboard you might have come across Stripe loan offers from Stripe Capital. You might have some doubts about it. Not many people know if Stripe offer loans or not. For all those who are new to Stripe, this article will guide them through the loans offered by Stripe and an in-depth analysis and review of Stripe Capital.

We will explore various aspects of Stripe’s offerings, discussing both its benefits and limitations. We will also understand the eligibility process and provide a thorough analysis to help you determine if Stripe Capital is suitable for your business or not.

Introduction To Stripe Capital

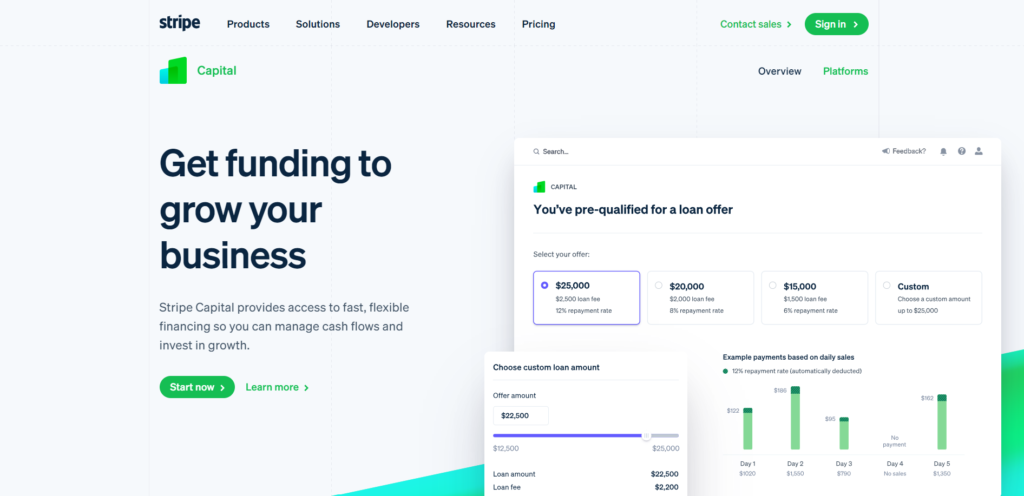

Stripe Capital, launched on September 5th, 2019, is a specialized loan service platform created by Stripe. Its primary aim is to provide swift and adaptable loans to businesses, particularly SMEs, giving them a chance to boost their growth. One of its standout features is the streamlined process, eliminating the need for credit checks or lengthy application procedures. Through a loan API, Stripe Capital offers businesses flexible access to dynamic loan terms, automatically adjusting repayments based on the users’ sales, thus enabling automated loan repayments. It means that Stripe Capital’s systems automatically sends the loan offers based on the business details.

Image source: Stripe Capital

This is possible because of the wealth of data available through Stripe’s main platform. As a leading payment processor online, Stripe has access to comprehensive transaction data and insights across diverse industries. By leveraging this data analytics and tailoring loan terms, Stripe Capital ensures that businesses can access the necessary capital customized to their specific circumstances.

This personalized approach guarantees that businesses receive an appropriate amount of capital with repayment terms that match with the needs of their cash flow patterns, financial performance and growth forecasts.

Repayment And Pricing Structure

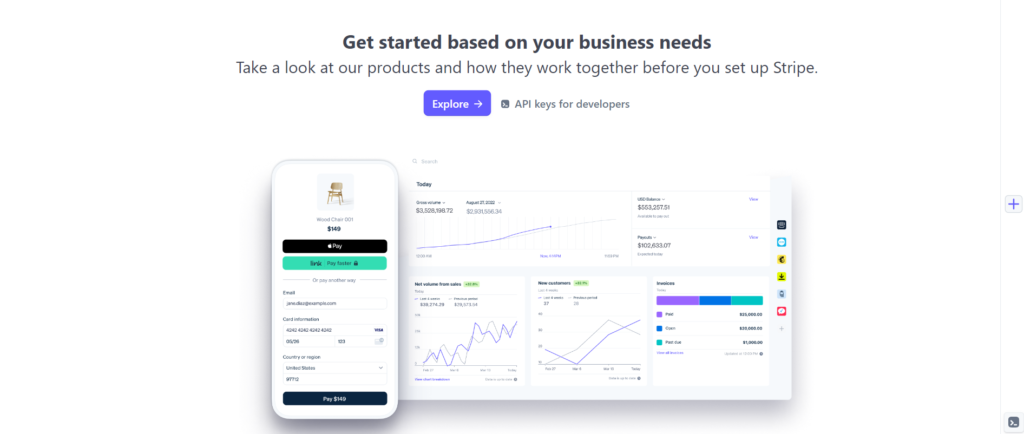

As discussed earlier, Stripe is cleverly using the technology to structure and distribute the loans tailored to individual merchant’s needs, capability, and the power to repay it back. This is the reason why the repayment structure and interest rate of this service is not transparent.

But individuals who gets access to this service is able to understand the pricing with a customizable slider in the dashboard of the Stripe Capital, that allows you to select a loan amount up to a predetermined maximum. Adjusting this amount will automatically modify the fee and repayment rate.

Image source: Stripe Capital

Stripe’s repayment structure is straightforward – the total repayment consists of the loan amount and a flat fee.

- Repayment is automated, with a percentage deducted from your Stripe sales.

- Consequently, you repay more during periods of high business activity and less during slower periods.

Stripe employs a repayment rate based on a percentage of your sales, ensuring a predetermined minimum is repaid within each payment cycle. Failure to meet this minimum results in the outstanding amount being charged from your bank account. Early repayment of the loan is possible without incurring any additional fees.

Some Features Of Stripe Capital

Image source: Stripe Capital

Stripe Capital offers a range of features and services designed to support businesses effectively.

- a) Flexible loan amounts: Businesses can access varying loan amounts, spanning from a few thousand dollars to substantial sum of $150,000, contingent upon their sales history, revenue, and financial standing.

- b) Tailored loan propositions: Leveraging sophisticated algorithms, Stripe evaluates a business’s transaction data to devise personalized loan offers that align with their specific financial requirements. This approach ensures that businesses receive loan terms and amounts that complement their growth strategies and revenue projections.

- c) Streamlined repayment process: Repaying Stripe Business Loans is simplified through automated deductions from daily sales. A fixed percentage or amount is subtracted until the loan is fully repaid. This easy repayment method enables businesses to manage their cash flow efficiently without any disruptions.

- d) Financial visibility and analysis: Stripe equips borrowers with valuable financial insights and reporting tools, enabling businesses to gain comprehensive visibility into their financial performance. These resources empower businesses to make informed decisions, optimize their operations, and foster sustainable growth.

How Does Stripe Capital Works?

Understanding how Stripe Capital operates is crucial for businesses considering their financing options. Stripe Capital advertises loans in varying amounts, from $15 to $25K, with the potential for multiple loans for eligible customers. The Stripe’s website, however, state that you could get loan up to $150,000.

Repayment flexibility is offered, allowing borrowers to clear the debt at any time. However, it’s important to note that early repayment doesn’t result in cost savings or reduced interest payments due to the fixed fee structure.

To be eligible for a Stripe working capital loan, certain criteria must be met, including a minimum of six months of history with Stripe payment processing, an annual processing volume of at least $5,000 through Stripe payments, consistent sales volume, a diverse customer base, and a growing number of payments. However, businesses can’t directly apply for Stripe working capital; instead, they must wait for Stripe to extend a loan offer through their Stripe dashboard.

This simple gives you the clear picture of the core of how the Stripe Capital loans work. Further exploration into the advantages and limitations of Stripe Capital, as well as a comparison with other loan providers, can offer a comprehensive understanding for businesses seeking the most suitable financing solutions.

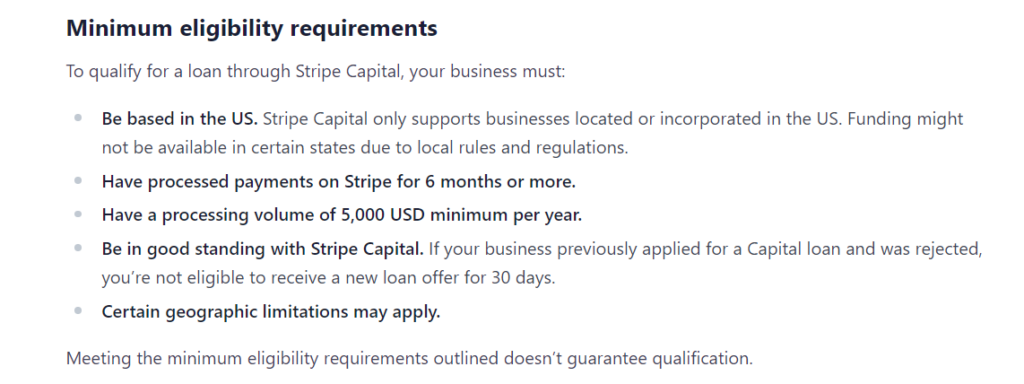

Understanding Stripe Capital’s Eligibility Criteria

Image source: Stripe Capital eligibility

Stripe Capital’s eligibility criteria are currently undergoing development, with funding opportunities being offered to specific merchants. Although the criteria are subject to change, some common factors are typically considered during the assessment process:

- Sales History: Stripe evaluates a business’s sales history, including transaction volume and revenue trends, to assess its financial performance and growth potential. A robust and consistent sales record indicates the business’s capacity to generate revenue, a vital aspect in determining eligibility.

- Time in Business: The duration of a business’s operation is often taken into account, with established businesses having a more solid financial track record. While specific requirements may vary, a more extended business history generally enhances the likelihood of meeting eligibility criteria.

- Stripe Account Usage: Active usage and transaction activity on the Stripe platform are pivotal factors for businesses seeking Stripe Capital Loans. As we mentioned earlier that Stripe is favoring customers with atleast $5,000 processing volume (annually). Maintaining an active and engaged Stripe account demonstrates a business’s commitment to utilizing the platform effectively, contributing to its eligibility for the loan.

- Creditworthiness: Although Stripe Capital primarily relies on a business’s sales history for evaluation, creditworthiness is a consideration that it’s system will look at. This could involve an assessment of the business owner’s personal credit history, with an ideal score of 600, or an evaluation of any existing credit relationships associated with the business.

Advantages of Stripe Capital

The Stripe Capital program presents several advantageous features that can benefit businesses looking for flexible financing options.

- Payment Cycles of 60 Day:

The extended 60-day payment cycles offered by Stripe Capital provide businesses with a comfortable repayment timeline. This extended period allows businesses to manage their cash flow more effectively, alleviating the potential strain that short repayment windows might cause.

- Daily Repayments:

The daily repayment structure based on Stripe sales ensures that businesses can repay their loans seamlessly. By aligning repayments with daily sales, businesses can efficiently manage their finances without facing overwhelming lump-sum payments, promoting a smoother and more sustainable cash flow management process.

- Flat Fees Structure:

One of the standout benefits of Stripe Capital is the absence of interest. Instead, the platform charges businesses a straightforward flat fee, eliminating the complexities associated with calculating interest rates. This transparent fee structure allows businesses to accurately forecast their repayment obligations, promoting better financial planning and reducing uncertainties related to fluctuating interest rates.

Drawbacks of Stripe Capital

While discussing Stripe Capital, it’s essential to revisit some of the issues you may face with the platform.

- Limited Information

Stripe Capital’s lack of transparency regarding loan specifics is a concern for many. Detailed information about loan amounts, fees, retrieval rates, and other pertinent details is crucial for informed decision making. Having this information readily available would enable businesses to assess their interest in Stripe Capital before receiving a loan offer, eliminating the pressure to make rushed decisions.

- Similarities to Cash Advances

The resemblance between Stripe Capital’s short-term loans and merchant cash advances is a notable drawback. These loans often come with high fees and irregular payment structures, potentially causing disruptions to a business’s cash flow, particularly if payment volumes don’t meet expectations. As a result, careful consideration is advised when considering these borrowing options.

- Automated Process

Stripe’s lack of a manual application process for loans is another issue. While the automated decision-making process can save time by preventing rejected applications, it leaves businesses unable to plan for a Stripe loan. The absence of a proactive approach to loan applications may not align with the preference for deliberate, weighed borrowing decisions.

Having the option to apply for a Stripe loan as needed would be preferable to receiving unexpected loan offers, reducing the pressure associated with impromptu borrowing decisions.

Alternatives To Stripe Capital

Here are the best alternatives of Stripe right now:

1. Square Loans

Securing a Square loans isn’t a matter of application; rather, if you meet the criteria, Square will notify you through your Square dashboard promptly. Luckily, Square assesses your eligibility daily, ensuring quick communication if you qualify.

Image source: Square loans

While Square doesn’t publicly disclose its specific eligibility algorithm, it does provide some general prerequisites. For instance, you should process a minimum of $10,000 in Square payments annually, maintain a consistent payment flow, and cater to both new and existing customers. Additionally, the offer can improve if your payment processing increases over time.

Details of Square Capital Financing:

- Loan Range: $500 to $250,000

- Minimum Annual Revenue: $10,000 from Square sales

- Minimum Rate Listed: 10%

2. PayPal Working Capital (PWC)

To be eligible for financing through PWC, it’s necessary to have used either PayPal Business or PayPal Premier for a minimum of three months. Once this criterion is met, you can proceed with the application.

Image source: Paypal Working Capital

It’s important to note that PayPal has distinct revenue prerequisites, which vary depending on your account type.

Key Details of PWC:

- Loan Range: Upto 35% of your PayPal sales

- Minimum Annual Revenue: $15,000 to 20,000/yr

- Minimum Rate Listed: 2 to 25% (Expected)

Conclusion

Stripe Capital, a loan service platform offered by Stripe, provides businesses with swift and adaptable loans tailored to their specific circumstances. With features such as flexible loan amounts, streamlined repayment, and comprehensive financial insights, it offers an attractive financing solution.

However, the lack of transparency and automated application process may pose challenges. Consider exploring alternatives like Square Capital or PayPal Working Capital for diverse financing options.

As this service is still in a development phase and very little information about the service is out in open to compare it with, so it’s not possible, right now, to give rating to each aspect of it. But overall if measure all the pros and cons, it boils down to a 3.9/5 stars.

Frequently Asked Questions

Q: How does Stripe Capital function?

Stripe Capital automatically deducts a percentage of funds, known as the repayment rate, from your sales. This amount contributes to your minimum. If you haven't met the minimum by the end of each payment period, Stripe deducts the balance required to meet your minimum from your bank account.

Q: Do I have to pay interest with Stripe Capital?

No, Stripe Capital does not impose interest on your loan. Instead, a fixed fee from your Online Payments transactions is allocated to repay the loan. This fee is clearly outlined in your loan offer, which you need to agree to before taking out the loan.

Q: How is eligibility assessed for a loan offer with Stripe Capital?

Eligibility is determined by Stripe Capital, considering your transaction history and the duration of your Online Payments account.

Q: Does Stripe conduct a credit check?

Stripe reviews a business credit report that includes any past and current credit products your business has obtained from other SBFE lenders and your performance on those products. This evaluation does not constitute a personal credit check and has no impact on your personal credit score.